Illinois Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

If you want to finalize, obtain, or produce sanctioned document templates, utilize US Legal Forms, the most extensive collection of official forms available online.

Employ the site's straightforward and convenient search function to locate the documents you require. A variety of templates for business and personal purposes are categorized by types and states, or keywords.

Utilize US Legal Forms to find the Illinois Personal Guaranty - Guarantee of Agreement for the Lease and Acquisition of Real Estate in just a few clicks.

Every legal document template you purchase is yours forever. You have access to every form you acquired within your account. Click on the My documents section and choose a form to print or download again.

Participate and obtain, and print the Illinois Personal Guaranty - Guarantee of Agreement for the Lease and Acquisition of Real Estate with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms member, Log In to your account and click on the Download button to access the Illinois Personal Guaranty - Guarantee of Agreement for the Lease and Acquisition of Real Estate.

- You can also access forms you have previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

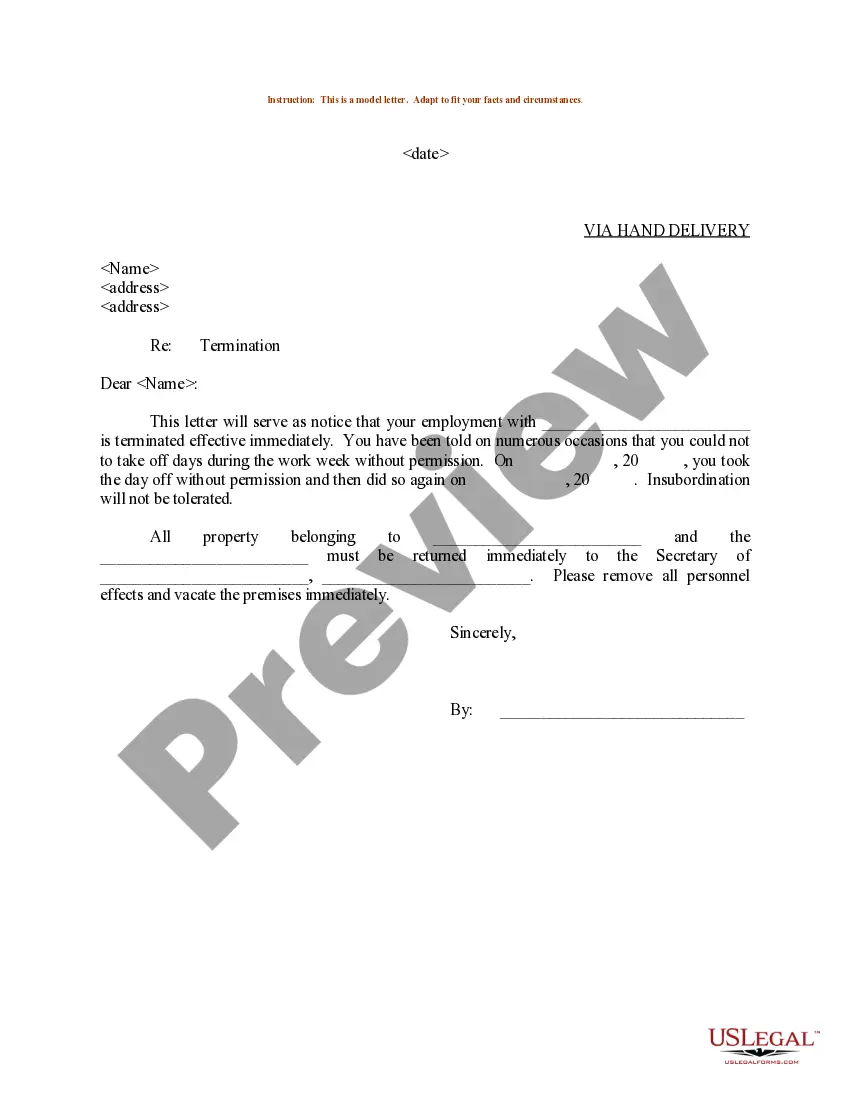

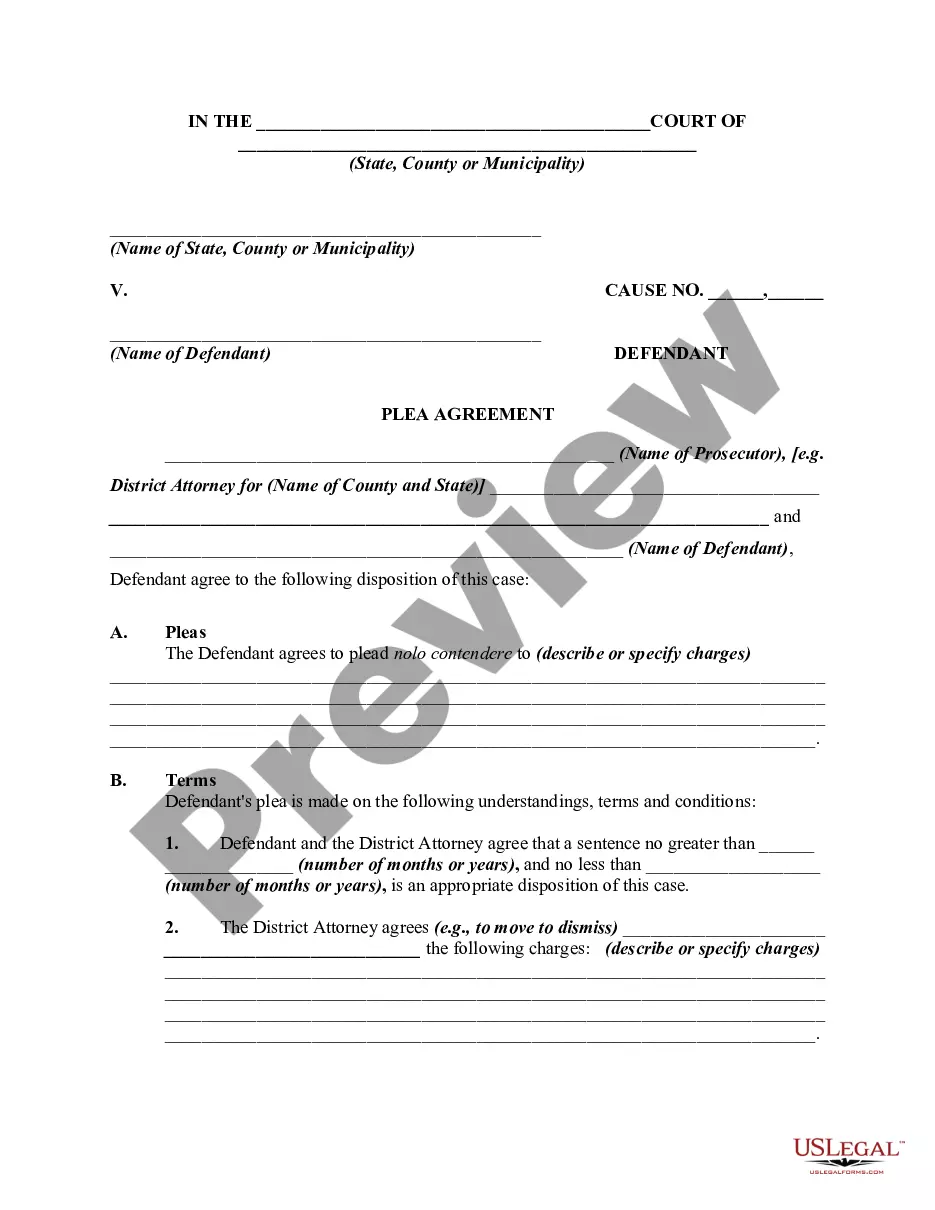

- Step 2. Use the Preview option to view the form's content. Remember to review the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other models in the legal form template.

- Step 4. Once you have identified the form you need, click on the Get now button. Choose the pricing plan that suits you and provide your information to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to execute the transaction.

- Step 6. Select the format of the legal form and download it onto your device.

- Step 7. Complete, modify, and print or sign the Illinois Personal Guaranty - Guarantee of Agreement for the Lease and Acquisition of Real Estate.

Form popularity

FAQ

The implied warranty of habitability ensures that rental properties are safe and livable for tenants in Illinois. Landlords have a responsibility to maintain housing standards, including plumbing, heating, and safety features. Understanding this concept is essential, especially when dealing with the Illinois Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, which can help protect tenant rights.

Enforcing a guaranty can involve several steps, starting with clearly defining the terms in the lease agreement. If a tenant defaults, the guarantor must be contacted to fulfill their obligations as stated in the Illinois Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate. Legal action may also be considered if voluntary payment is not made.

To complete a lease, ensure all necessary information is properly filled in, including tenant details, lease terms, and payment schedules. Review the document thoroughly to confirm mutual understanding of the rules and obligations. Incorporating aspects like the Illinois Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate can safeguard interests and facilitate a smoother transaction.

Filling in a lease agreement begins with accurately entering the names of the landlord and tenant and the duration of the lease. Include details such as the rent amount, due date, and conditions of the security deposit. When integrating the Illinois Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, ensure that all stipulations are carefully written to protect both parties.

To fill out an Illinois residential lease agreement, begin by entering the names of all parties involved and the property address. Specify the lease term, monthly rent, and security deposit amounts. It's essential to detail any specific terms, including maintenance responsibilities and the Illinois Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, to make expectations clear between landlords and tenants.

Landlords in Illinois cannot engage in retaliatory actions against tenants, such as raising rent or terminating leases after a tenant reports a violation. They also cannot illegally lock out tenants or enter leased properties without proper notice. Understanding these restrictions is crucial, especially when considering the Illinois Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, to ensure all parties fulfill their obligations.

Similar to leases, lease agreements in Illinois do not require notarization to be valid. While notarization is not mandatory, it can ensure that both parties fully understand the terms laid out. When dealing with the Illinois Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, notarized agreements may offer additional peace of mind for both landlords and tenants.

In Illinois, leases generally do not need to be notarized to be considered valid. The state allows landlords and tenants to enter into a lease agreement without notarization. However, having a notary can provide an extra layer of security, especially when discussing the Illinois Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate. It's always wise to consult legal resources for specific situations.

Yes, many leases incorporate personal guarantees as part of the Illinois Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate. A personal guarantee provides landlords with additional security, ensuring that if a business tenant cannot fulfill their lease obligations, the individual guarantor assumes responsibility. This arrangement protects landlords and can foster trust in a lease agreement. For those exploring leasing options, the US Legal Forms platform offers templates to streamline the process.

Creating a personal guarantee for the Illinois Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate involves several steps. First, identify the specific obligations you are guaranteeing within the lease or purchase agreement. Next, draft the guarantee document, ensuring it outlines the terms clearly. Finally, both you and the other party should sign the document to make it legally binding. This process can be made easier with the help of resources available on the US Legal Forms platform.