Illinois Stop Annuity Request

Description

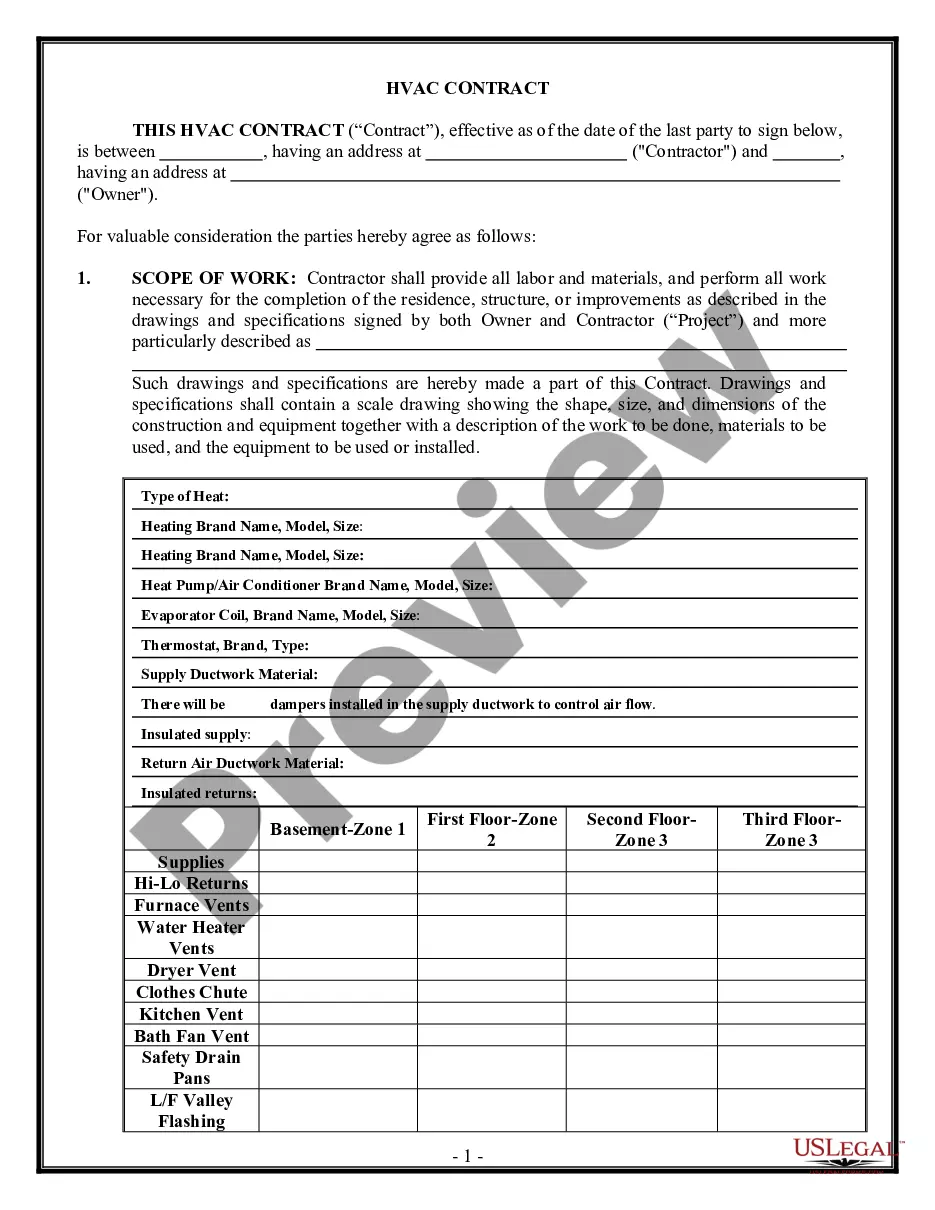

How to fill out Stop Annuity Request?

You might dedicate several hours online looking for the valid document template that meets the federal and state requirements you desire.

US Legal Forms offers a vast array of valid forms that are examined by experts.

You can download or print the Illinois Stop Annuity Request from my service.

To locate another version of the form, use the Search field to find the template that fits your needs and requirements.

- If you possess a US Legal Forms account, you can Log In and then click the Obtain button.

- Later, you can complete, edit, print, or sign the Illinois Stop Annuity Request.

- Every valid document template you acquire is yours indefinitely.

- To obtain an additional copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are utilizing the US Legal Forms site for the first time, follow the simple instructions listed below.

- First, ensure you have chosen the correct document template for the state/city of your choice.

- Check the form description to ensure you have selected the appropriate document.

- If available, use the Preview button to view the document template as well.

Form popularity

FAQ

To obtain a refund, a member must file a Refund Application with TRS. The application is avail- able by calling TRS's Member Services Division at 877-927-5877 (877-9-ASK-TRS). The application can be returned any time after the member has formally resigned from his or her TRS-covered position.

And of the 41 states that have an income tax, Illinois is one of just three that does not extend that tax to public and private pensions, 401(k) withdrawals, annuities, Social Security payments, and IRA withdrawals.

Key Takeaways. Pension plans can become underfunded due to mismanagement, poor investment returns, employer bankruptcy, and other factors. Religious organizations may opt out of pension insurance, giving their employees less of a safety net.

Employers can end a pension plan through a process called "plan termination." There are two ways an employer can terminate its pension plan. The employer can end the plan in a standard termination but only after showing PBGC that the plan has enough money to pay all benefits owed to participants.

Only the interest portion of the payment is taxable. With a deferred annuity, IRS rules state that you must withdraw all of the taxable interest first before withdrawing any tax-free principal.

You do not owe income taxes on your annuity until you withdraw money or begin receiving payments. Upon a withdrawal, the money will be taxed as income if you purchased the annuity with pre-tax funds. If you purchased the annuity with post-tax funds, you would only pay tax on the earnings.

If you receive retirement benefits in the form of pension or annuity payments from a qualified employer retirement plan, all or some portion of the amounts you receive may be taxable unless the payment is a qualified distribution from a designated Roth account.

Pensions and other benefits are generally terminated when you're fired, but there are certain rights that an employee has after his or her job has been terminated.

Why Illinois has a pension crisis. Illinois' massive, growing, government-worker pension debt is a direct result of three major factors: overgenerous pension benefits, political manipulation and inherent flaws of pension plans.

Employers were completely in control of and responsible for pensions, which would guarantee specific payments to retired workers. Starting in the 1980s, pensions rapidly began disappearing, as the defined contribution 401(k) plan dominated.