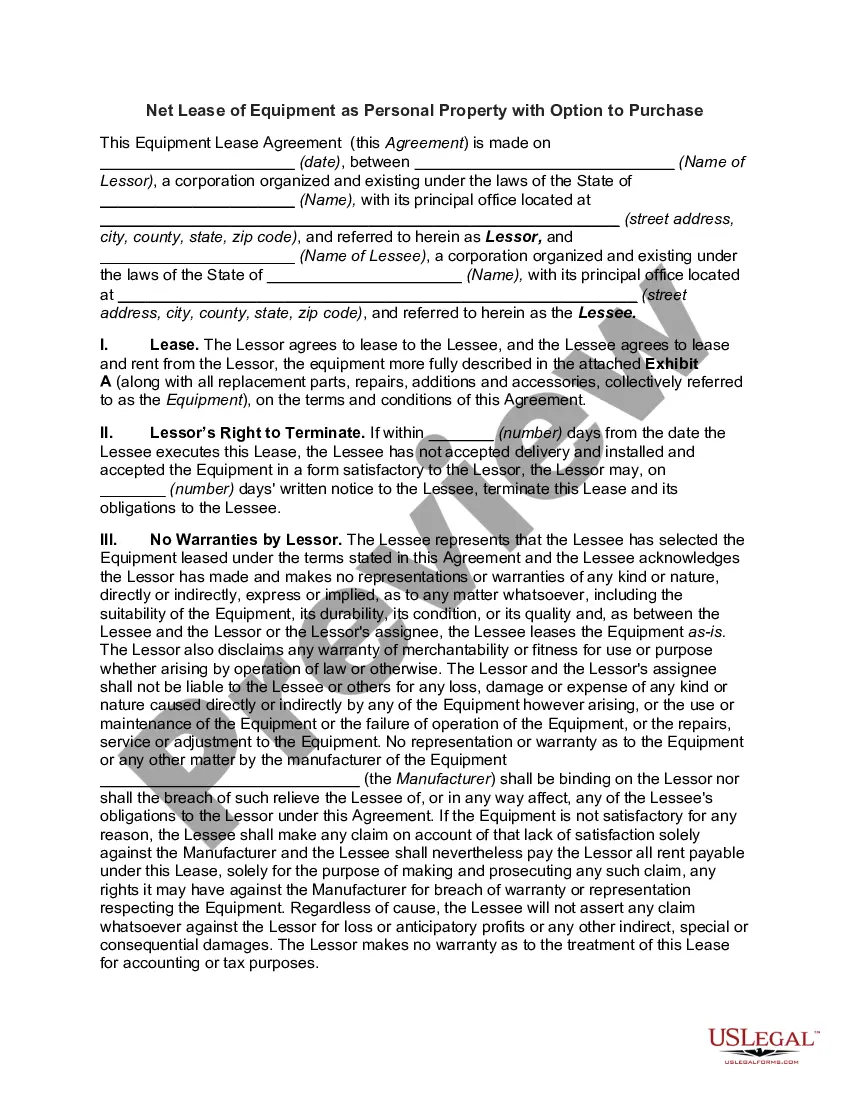

Illinois Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase

Description

How to fill out Net Lease Of Equipment (personal Propety Net Lease) With No Warranties By Lessor And Option To Purchase?

If you are seeking thorough, acquire, or printing legal document formats, utilize US Legal Forms, the largest collection of legal templates, available online.

Take advantage of the site’s user-friendly and efficient search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the purchase. You may use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the Illinois Net Lease of Equipment (personal Property Net Lease) devoid of Warranties by Lessor and Option to Purchase in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Illinois Net Lease of Equipment (personal Property Net Lease) without Warranties by Lessor and Option to Purchase.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the following instructions.

- Step 1. Ensure you have selected the form for your correct city/state.

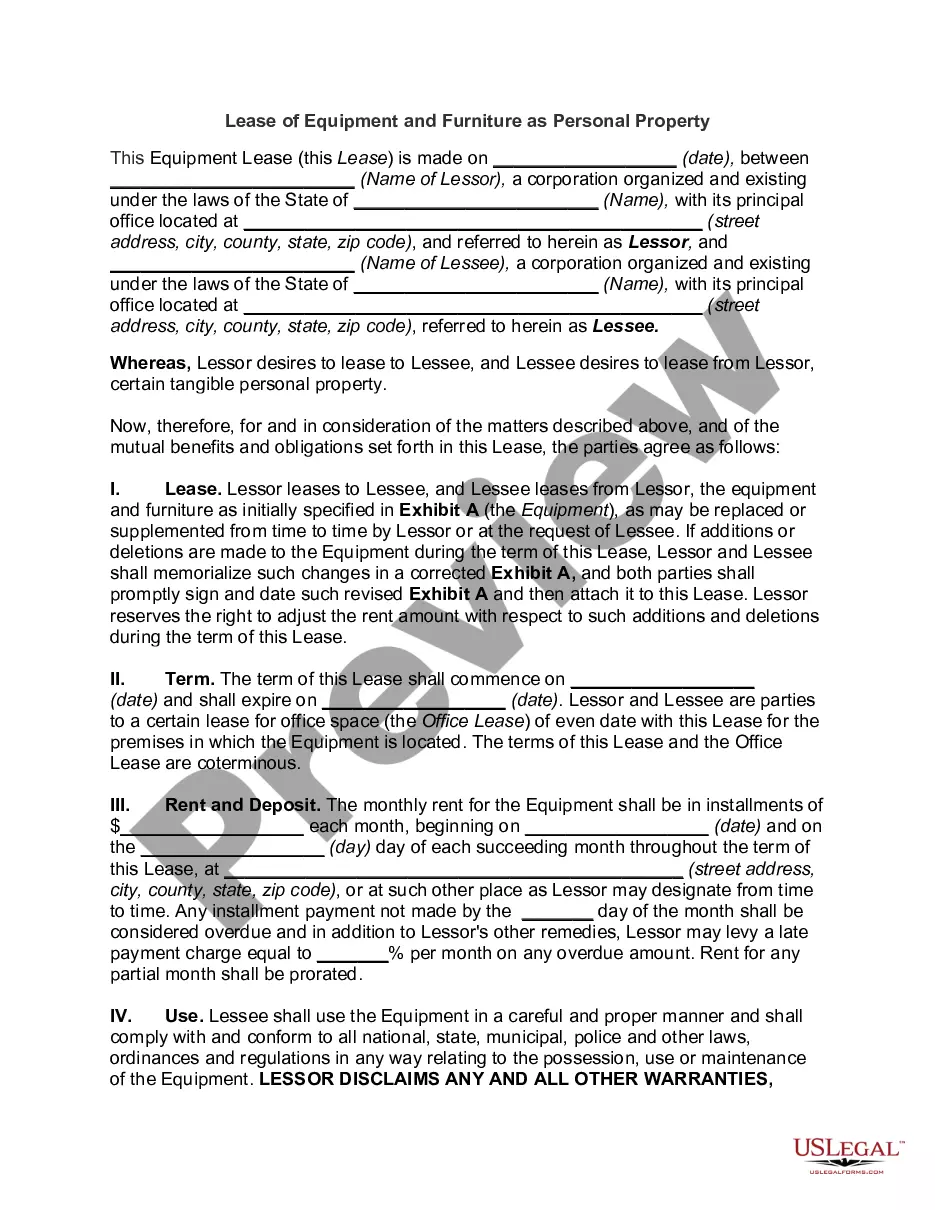

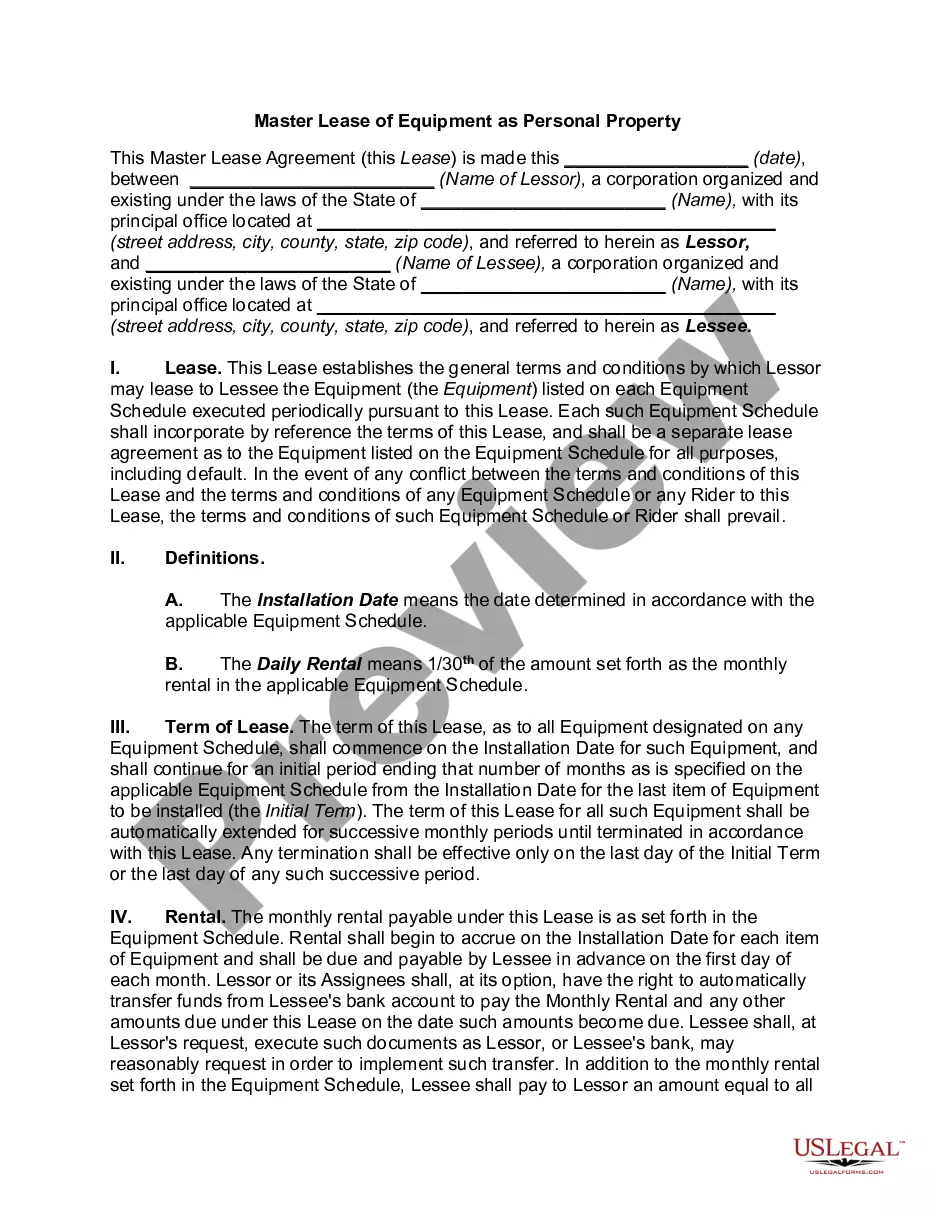

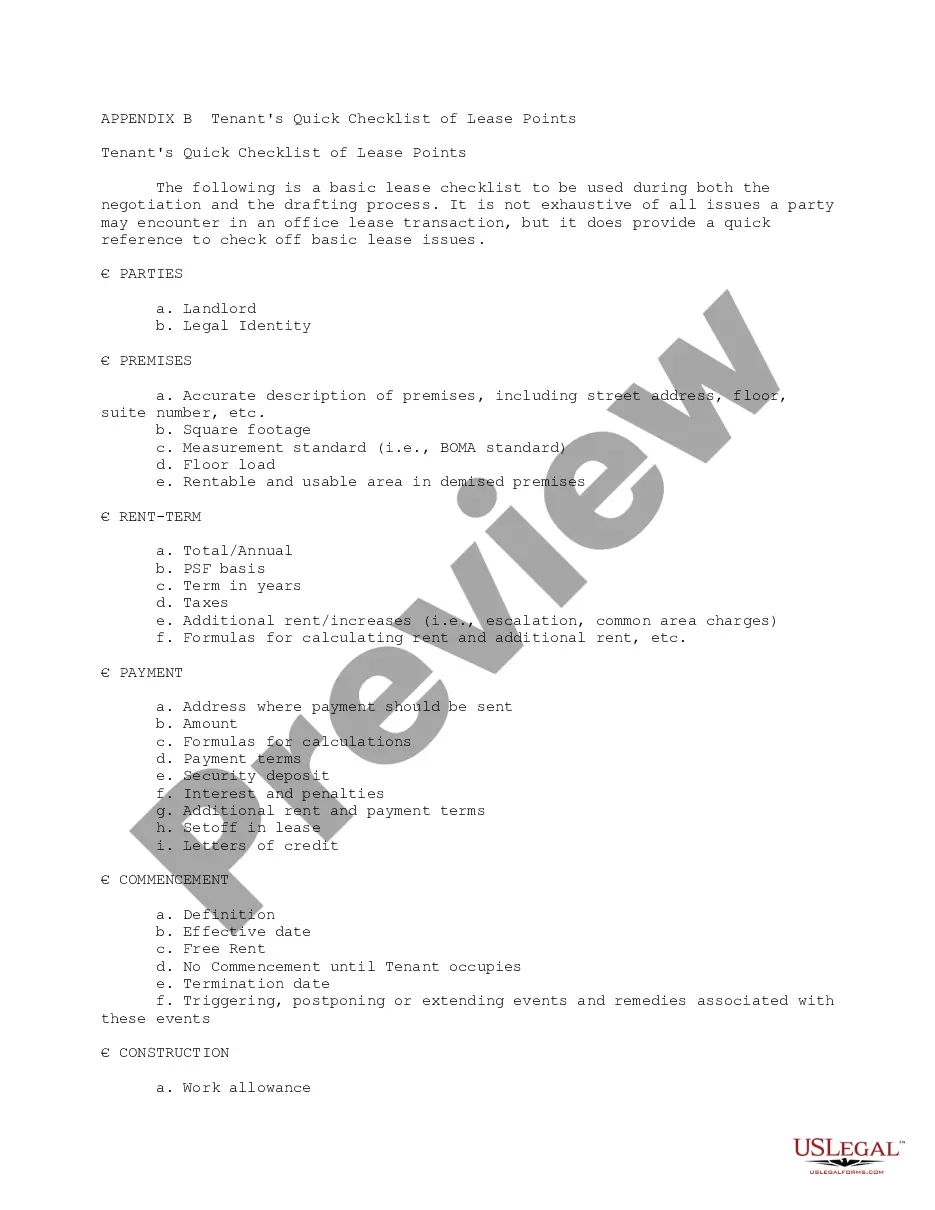

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the document, utilize the Search field at the top of the screen to find other variations of the legal document template.

Form popularity

FAQ

In Illinois, leased equipment generally is subject to sales tax. This means that whether you are in a standard lease or an Illinois Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, you may need to account for additional tax expenses. Understanding your obligations is crucial, so working with a tax advisor can provide clarity and help you navigate any complexities that may arise. It's essential to protect your finances.

Exiting a lease early in California often requires careful negotiation with your landlord or lessor. You might be able to terminate the lease by finding a replacement tenant or negotiating an exit agreement. Additionally, familiarity with the specifics of an Illinois Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase can open avenues for early exit. Engaging a legal expert can certainly provide you with valuable advice and options.

To exit an equipment lease, start by reviewing your lease agreement for any termination clauses or conditions. Open a dialogue with your lessor to explore options like early termination or equipment buyout, especially if you have an Illinois Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase. Moreover, documenting your communications can help support your case if any disputes arise. Seeking legal counsel could also enhance your negotiation power.

Yes, generally, leased equipment is subject to sales tax in California. However, tax obligations can vary based on specific circumstances, such as the type of equipment and the agreement structure. If you're considering an Illinois Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase in California, consulting a tax professional can ensure you comply with local tax laws. Protecting yourself from unexpected liabilities is always wise.

A standalone lease refers to an agreement focused solely on leasing without any ties to additional contracts or obligations. It allows for straightforward terms related to the leased equipment or property. In the context of the Illinois Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, this means clear ownership rights and options for future purchase. It simplifies your use of equipment, maximizing your operational efficiency.

The simplest way to get out of a lease often involves communicating directly with the lessor to discuss your situation. Many lessors appreciate transparency and may offer solutions, such as subletting or lease termination options. By understanding the specifics of the Illinois Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, you can explore your options without unnecessary complications. Consulting a lease expert can streamline this process.

To exit a commercial lease, consider negotiating with your landlord. You may find that they are willing to compromise, especially if they can secure a new tenant quickly. Additionally, reviewing your lease for any termination clauses can provide pathways for early exit. Engaging with a legal expert familiar with the Illinois Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase may also help clarify your options.