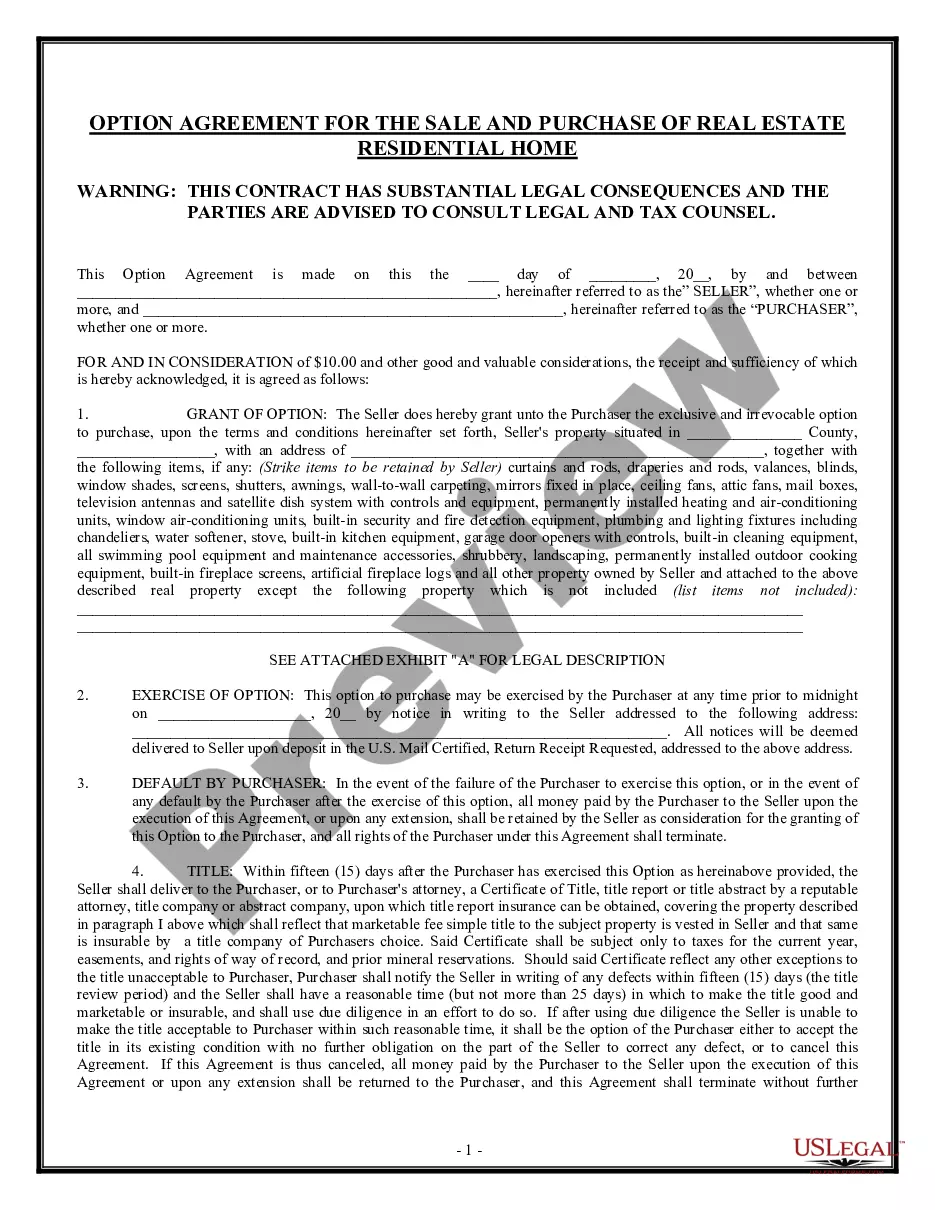

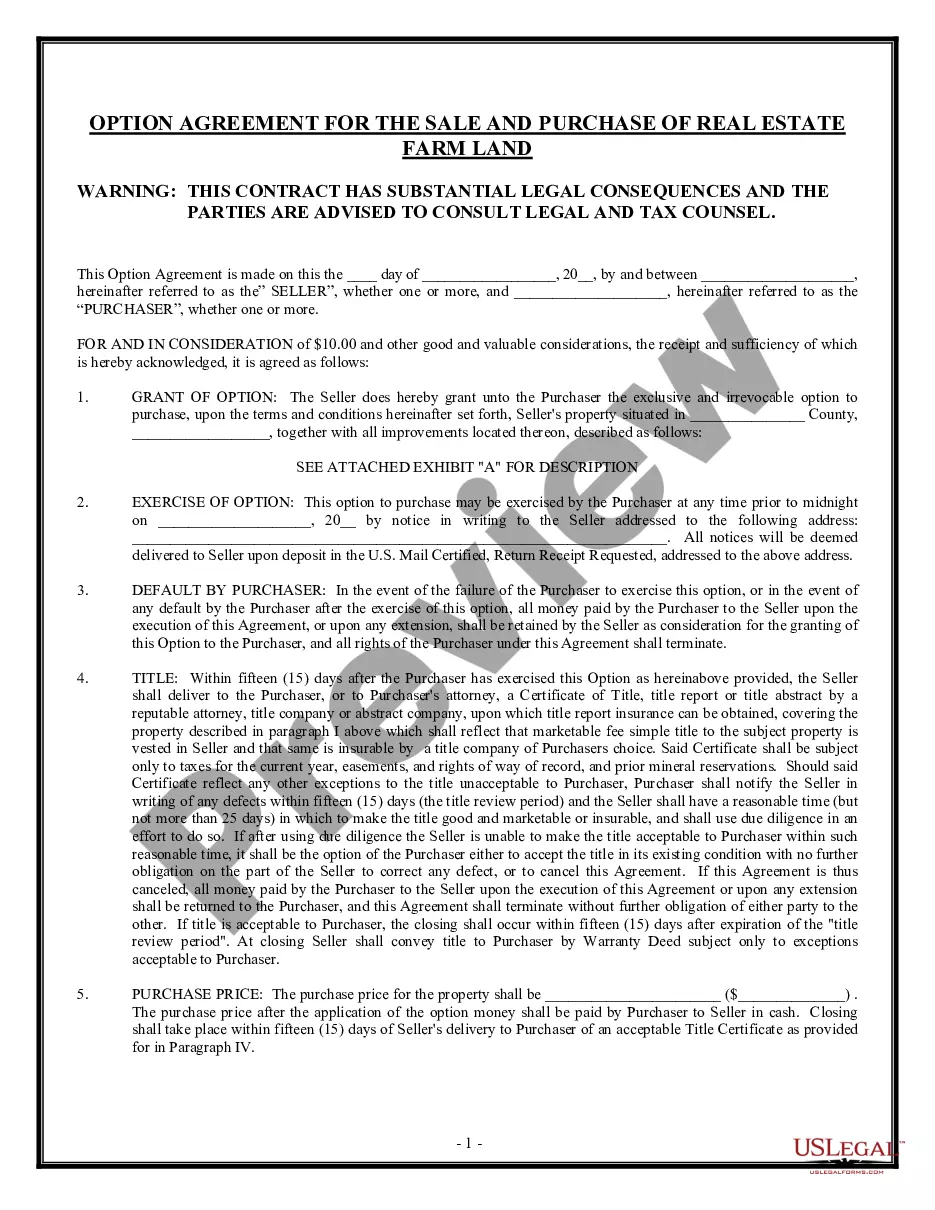

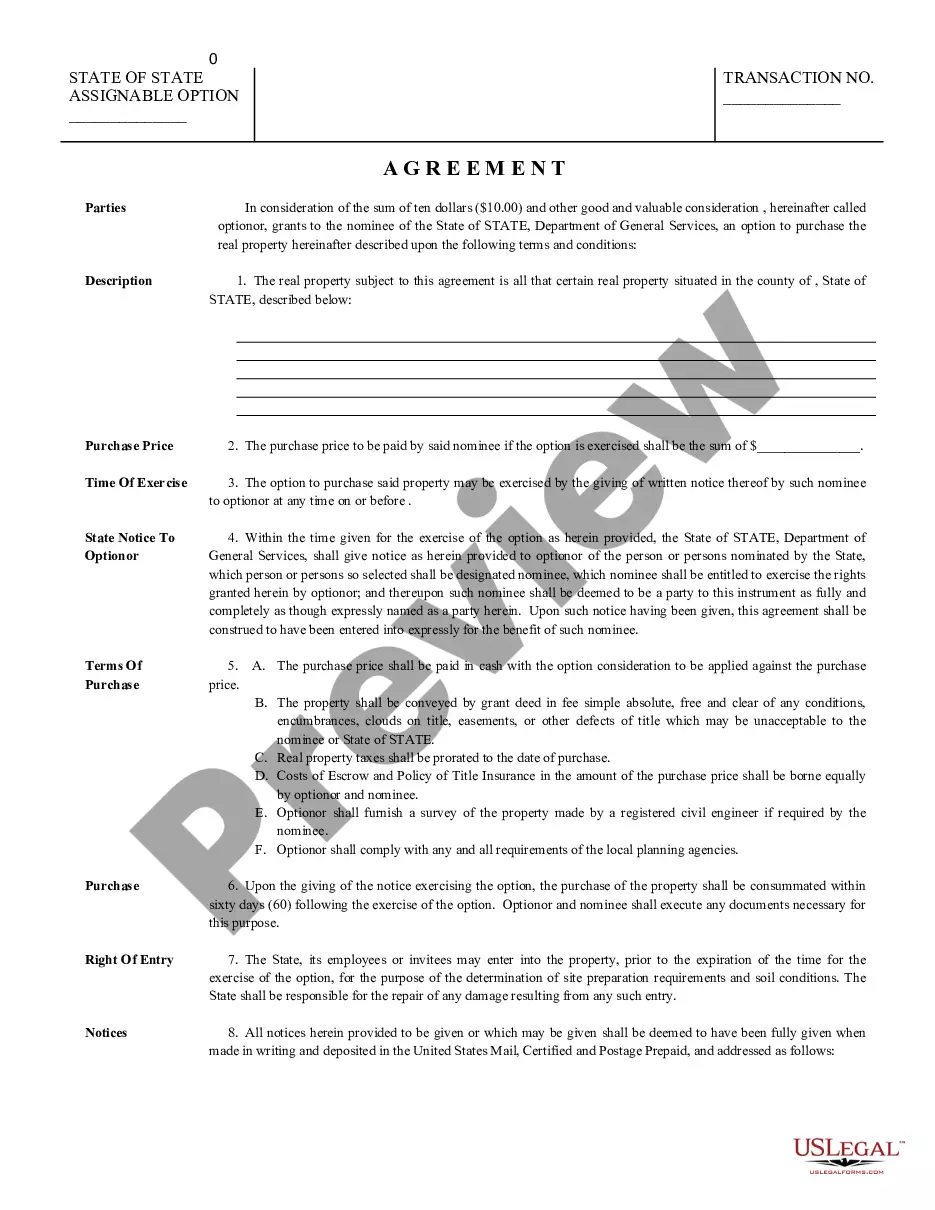

Illinois Option to Purchase Vacant Real Property

Description

How to fill out Option To Purchase Vacant Real Property?

You can allocate time online looking for the legal document template that aligns with the state and federal requirements you will need.

US Legal Forms provides a vast array of legal forms that are reviewed by professionals.

You can download or print the Illinois Option to Purchase Vacant Real Property from their service.

First, ensure you have selected the appropriate document template for your location/region of choice. Review the form description to ensure you have chosen the correct form. If available, use the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can Log In and hit the Download button.

- After that, you can fill out, modify, print, or sign the Illinois Option to Purchase Vacant Real Property.

- Every legal document template you acquire is yours forever.

- To obtain another copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions outlined below.

Form popularity

FAQ

4 Real estate options are commonly used by property developers and investors in commercial or high-end residential property deals. Real estate options provide more flexibility and potentially a greater investment opportunity to buyers, with limited benefits to sellers.

The option can also be used as an investment: Someone buys the option, waits for the land's value to increase, then exercises the option, buys the property, and makes a profit on its sale. In an option contract, only the seller is bound. That is, the buyer is not required to eventually buy the place.

According to a 2016 Gallup Poll1, real estate was rated the best long-term investment well ahead of gold, stocks and mutual funds, savings accounts/CDs and bonds. And it's the same in India where the emotional satisfaction of owning your own property is inherently very strong.

How does an option contract benefit a land developer? It allows the option holder to control a parcel for minimum cost and risk while putting the project together.

The purpose of an options contract in real estate is to offer the buyer alternatives. Outcomes may vary according to the type of buyer, including early exercise, option expiration, or second-buyer sales. Real estate professionals use option contracts to provide flexibility on specific types of real estate transactions.

An option contract in real estate ensures that the buyer has exclusive real estate purchase rights. In addition to exclusivity, the buyer is under no obligation to follow through on the purchase. A seller is also not required to reserve the property indefinitely.

A real estate purchase option is a contract on a specific piece of real estate that allows the buyer the exclusive right to purchase the property. Once a buyer has an option to buy a property, the seller cannot sell the property to anyone else. The buyer pays for the option to make this real estate purchase.

Options contracts are agreements between a buyer and seller which give the buyer the right to buy or sell a particular asset at a later date (expiration date) and an agreed-upon price (strike price). They're often used for securities, commodities, and real estate transactions.

The option is considered an asset, and any profit or loss resulting from its sale is subject to tax laws. Section 1234(a) of the Internal Revenue Code states that the optionee's gain or loss from selling the option is of the same nature as the gain or loss from the sale of the optioned property.

To assure that the Purchaser will be able to enforce the option if the Purchaser chooses to buy the Property, the Purchaser should pay the seller something at the time the option agreement is made. The payment should be non-refundable, even if the Purchaser decides not to buy the Property.