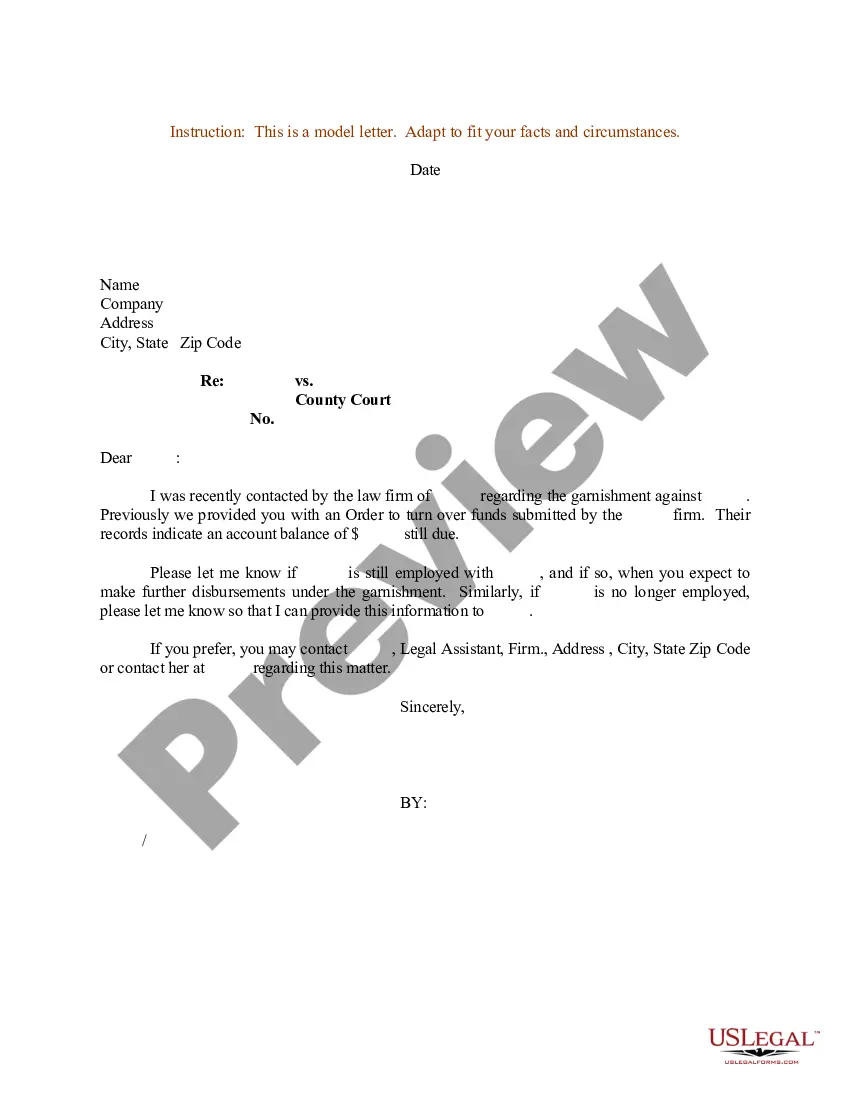

Illinois Sample Letter for Garnishment

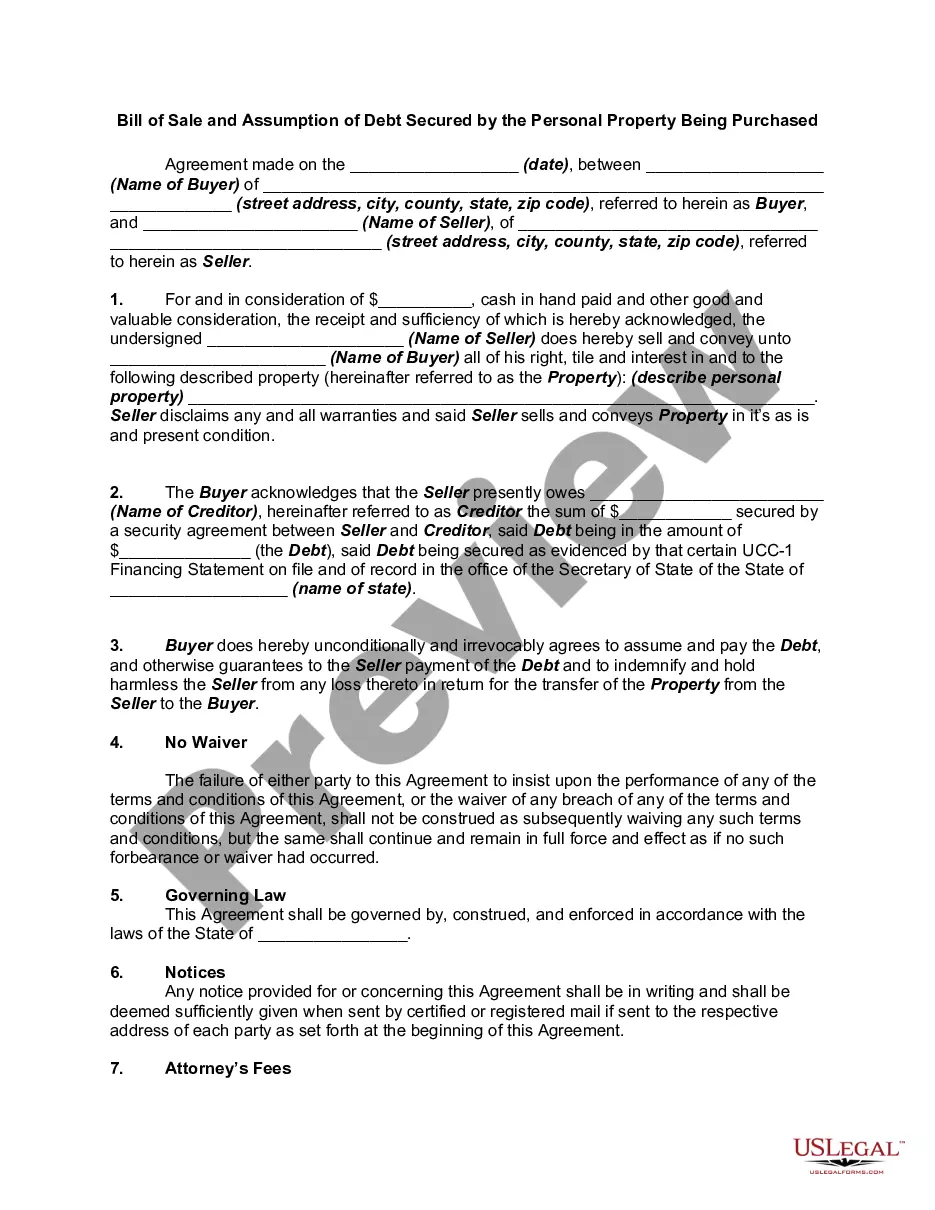

Description

How to fill out Sample Letter For Garnishment?

If you want to total, obtain, or produce authorized file web templates, use US Legal Forms, the largest assortment of authorized forms, which can be found on the web. Make use of the site`s simple and practical lookup to discover the files you want. Numerous web templates for enterprise and person reasons are sorted by classes and claims, or key phrases. Use US Legal Forms to discover the Illinois Sample Letter for Garnishment in just a handful of click throughs.

In case you are already a US Legal Forms customer, log in for your accounts and click on the Down load switch to obtain the Illinois Sample Letter for Garnishment. You may also accessibility forms you formerly delivered electronically from the My Forms tab of your accounts.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for that right metropolis/nation.

- Step 2. Use the Review option to examine the form`s information. Do not neglect to read the information.

- Step 3. In case you are unsatisfied together with the develop, take advantage of the Search field at the top of the display to get other variations from the authorized develop web template.

- Step 4. Upon having found the form you want, click the Purchase now switch. Choose the costs program you like and put your qualifications to sign up to have an accounts.

- Step 5. Process the financial transaction. You can use your bank card or PayPal accounts to accomplish the financial transaction.

- Step 6. Select the file format from the authorized develop and obtain it in your product.

- Step 7. Comprehensive, revise and produce or sign the Illinois Sample Letter for Garnishment.

Each authorized file web template you acquire is the one you have forever. You possess acces to every develop you delivered electronically with your acccount. Select the My Forms portion and pick a develop to produce or obtain once more.

Remain competitive and obtain, and produce the Illinois Sample Letter for Garnishment with US Legal Forms. There are millions of professional and express-certain forms you can utilize for your personal enterprise or person demands.

Form popularity

FAQ

Joint Accounts The co-owner of a debtor's bank account can stop a creditor from garnishing money from the account if a majority of the money came from them and not the debtor. The creditor bears the initial burden of proving that the account belongs to the debtor and should be eligible for garnishment.

Conditional judgment. (a) When any person summoned as garnishee fails to appear and answer as required by Part 7 of Article XII of this Act, the court may enter a conditional judgment against the garnishee for the amount due upon the judgment against the judgment debtor.

Illinois has set different rules for wage garnishment. In Illinois, if a creditor wins a court judgment against you, the maximum your employer can garnish from your weekly earnings is either 15 percent of your earnings or the amount left over after you deduct 45 hours' worth of Illinois' minimum wage.

Collect evidence showing how detrimental the wage garnishment is to your financial stability or how you qualify for an exemption. In either case, the creditor may agree to a solution that doesn't involve a garnishment, such as an adjustment payment plan or a settlement for a lump sum.

Dear Sir/Madam, I am writing to request that you stop the wage garnishment that is currently being imposed on me. I am unable to make the payments at this time due to [insert reason, such as financial hardship]. I have attached documentation that supports my claim.

One of the most common forms of defense is to file for an Illinois Chapter 7 or Chapter 13 bankruptcy. Once you file a bankruptcy petition and the required forms in court, the judge will issue an automatic stay that forbids your creditors from contacting you or taking any other action to try to collect on the debt.

The most the employer can hold out for you is 15% of the debtor's gross income before taxes or deductions. However, the withholding can't leave the debtor with less than 45 times the state minimum wage as weekly take-home pay.