Both the Model Business Corporation Act and the Revised Model Business Corporation Act provide that any action required or permitted by these Acts to be taken at a meeting of the shareholders or a meeting of the directors of a corporation may be taken without a meeting if the action is taken by all the shareholders or directors entitled to vote on the action. The action should be evidenced by one or more written consents bearing the date of signature and describing the action taken, signed by all the shareholders and/or directors entitled to vote on the action, and delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Illinois Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement

Description

How to fill out Resolutions Of Shareholders And Directors Approving Liquidating Trust Agreement?

Are you presently in a circumstance where you require documents for both business or personal purposes almost every day.

There are many reliable document templates available online, but finding ones you can trust isn't easy.

US Legal Forms offers thousands of form templates, including the Illinois Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, designed to comply with federal and state regulations.

Choose the pricing plan you want, fill in the required information to create your account, and place an order using your PayPal or credit card.

Select a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Illinois Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/county.

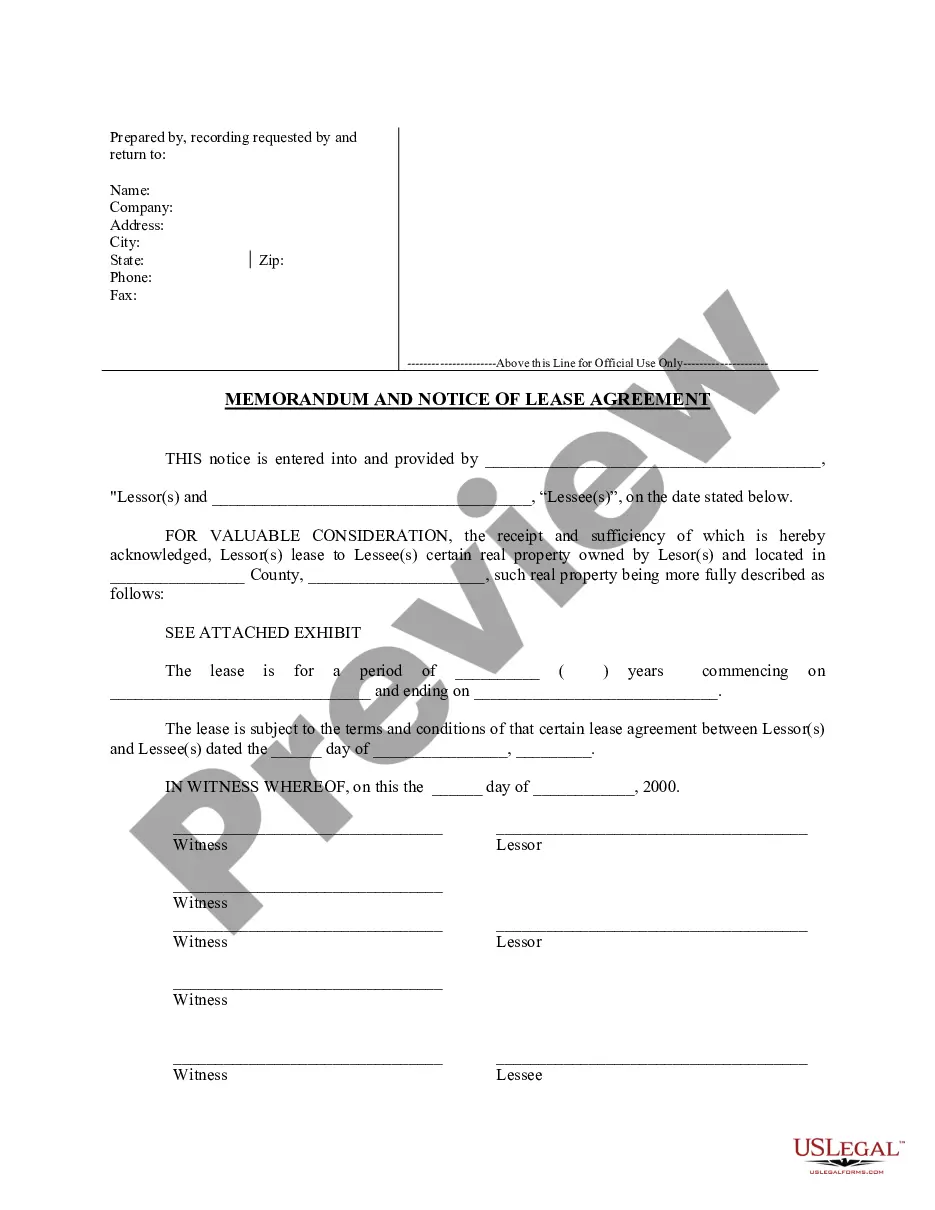

- Utilize the Preview option to review the form.

- Read the description to confirm that you have chosen the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that meets your needs.

- If you locate the correct form, just click Buy now.

Form popularity

FAQ

A resolution for a shareholders agreement is a formal indication of decisions made by the shareholders regarding the management and direction of the company. This can include various decisions such as the approval of amendments or agreements, including the Illinois resolutions of shareholders and directors approving the liquidating trust agreement. It serves as a binding record of the shareholders’ collective decision, promoting clarity and accountability.

To create a shareholder resolution, begin by drafting a document that outlines the proposed action and the rationale behind it. Ensure that it includes the Illinois resolution of shareholders and directors approving the liquidating trust agreement for formal recognition. After preparing the resolution, present it to the shareholders for a vote, documenting the results for legal compliance.

Yes, when you dissolve an S Corporation, you are required to file Form 966 with the IRS. This form notifies the IRS that you are formally terminating the corporation and it is an integral part of the timeline for the Illinois resolutions of shareholders and directors approving the liquidating trust agreement. Completing this form correctly helps you avoid penalties and ensures compliance.

A shareholder resolution to liquidate is a formal document that indicates shareholders' agreement to dissolve the corporation and distribute its assets. This resolution is essential for legal compliance, particularly in Illinois, where the board and shareholders must approve actions through an Illinois resolution of shareholders and directors approving the liquidating trust agreement. It unifies the decision-making process and ensures transparency.

To close an S Corporation in Illinois, begin with a shareholder meeting to discuss and vote on dissolution. Following the meeting, file the Illinois resolution of shareholders and directors approving the liquidating trust agreement to formalize the process. Remember to settle any outstanding financial obligations and file relevant forms with the state and IRS.

To close down an S corporation, start by obtaining a unanimous decision from both shareholders and directors. You must draft and adopt an Illinois resolution of shareholders and directors approving the liquidating trust agreement. Lastly, ensure you file the necessary paperwork with the state, such as notifying the IRS and settling all debts and obligations.

No, a corporate seal is not required in Illinois for business operations; however, many corporations choose to maintain one for official documents. A corporate seal can add a level of authenticity to important agreements and contracts. When creating Illinois Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, using a seal may signify the seriousness of the matter.

The Close Corporation Act in Illinois allows small corporations to operate without the formalities required of larger corporations, such as holding regular meetings. This act is beneficial for closely-held companies seeking flexibility. If you are involved in Illinois Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, knowing about the Close Corporation Act can streamline processes and enhance collaboration.

The Illinois Limited Liability Company Act provides the legal framework for the formation and operation of limited liability companies (LLCs) in Illinois. This act outlines the rights of members and managers, ensuring a clear understanding of obligations. When drafting Illinois Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, familiarity with LLC regulations can provide beneficial insights.

The Fiduciary Act in Illinois regulates the duties and responsibilities of individuals who manage another's funds or property. This law reinforces the obligation to act in the best interest of others, such as shareholders or beneficiaries. Ensuring compliance with the Fiduciary Act is critical when implementing Illinois Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement.