Illinois Limited Liability Partnership Agreement

Description

How to fill out Limited Liability Partnership Agreement?

You can invest numerous hours online attempting to discover the legal document format that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

It is easy to obtain or create the Illinois Limited Liability Partnership Agreement through your service.

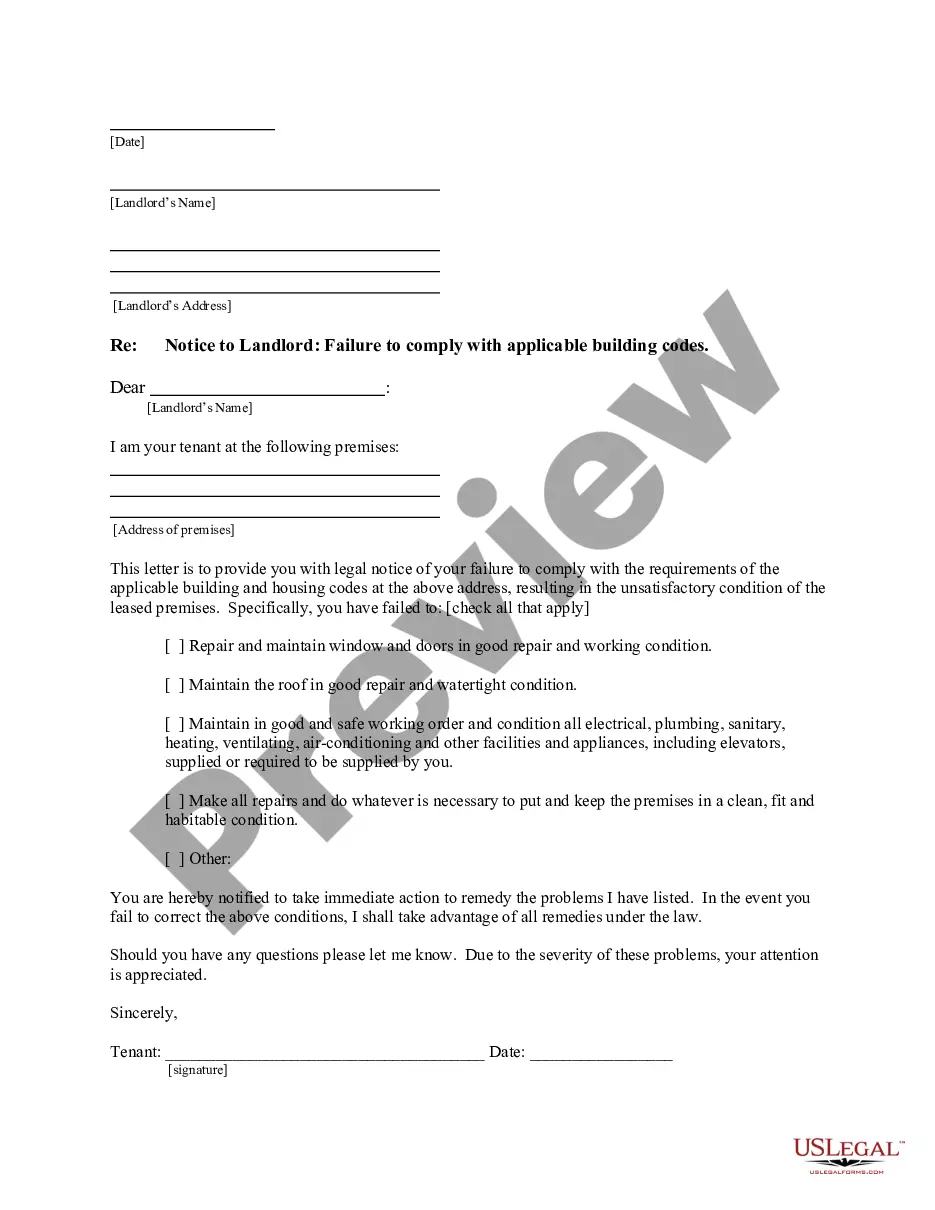

If available, use the Preview button to view the format as well.

- If you already have a US Legal Forms account, you may Log In and then click the Download button.

- Next, you can complete, modify, print, or sign the Illinois Limited Liability Partnership Agreement.

- Every legal document format you download is yours indefinitely.

- To get another copy of any downloaded form, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the area/city of your choice.

- Review the form details to confirm you have chosen the right document.

Form popularity

FAQ

Yes, your LLC may need a business license in Illinois, depending on the type of business activities you plan to engage in. Local governments often require licenses or permits that align with your specific industry. It's wise to consult with legal experts or use platforms like USLegalForms to ensure that your Illinois Limited Liability Partnership Agreement meets all regulatory requirements, including obtaining any necessary licenses.

Typically, the approval process for an LLC in Illinois can take around 10 to 15 business days. However, if you choose expedited processing, you might receive approval in as little as 24 hours. Having a well-prepared Illinois Limited Liability Partnership Agreement can help streamline the process, as clarity in your business structure and member roles helps avoid potential delays.

Setting up an LLC in Illinois involves several steps. First, you need to choose a unique name for your LLC that complies with Illinois naming rules. After that, you can file the Articles of Organization with the Illinois Secretary of State. Finally, you may want to create an Illinois Limited Liability Partnership Agreement, which outlines the management structure and operating procedures of your LLC, providing clarity and protection to all members involved.

To draft an LLP agreement, start by including essential elements such as the partnership's name, purpose, and address. Define each partner's rights, responsibilities, and contributions to the partnership. Finally, consider consulting resources like US Legal Forms to guide you in creating a complete Illinois Limited Liability Partnership Agreement that covers all necessary aspects.

Writing a limited partnership agreement involves detailing the terms of the partnership, the roles of general and limited partners, and how profits and losses will be distributed. It is important to specify the duration of the partnership and the procedures for admitting new partners. Utilizing an online platform like US Legal Forms can help you draft a thorough Illinois Limited Liability Partnership Agreement while ensuring you meet all legal requirements.

To form a partnership LLC in Illinois, start by selecting a name that includes 'Limited Liability Company' or its acronym, 'LLC'. After that, file your Articles of Organization with the Illinois Secretary of State. Beyond the legal filings, it is vital to create an Illinois Limited Liability Partnership Agreement to govern the relationship and obligations among the partners.

Forming a partnership LLC in Illinois involves several key steps. First, choose a name for your LLC that reflects your business and meets Illinois naming compliance. Then, file Articles of Organization with the Illinois Secretary of State, and craft an Illinois Limited Liability Partnership Agreement that outlines each partner's interests and responsibilities within the LLC.

The primary difference lies in how each structure handles liabilities and assets. An LLC protects the assets of the entire entity, while a Series LLC can have multiple 'series' that operate separately and limit liabilities individually. This makes the Illinois Limited Liability Partnership Agreement essential for specifying how each series functions and manages its own obligations.

Absolutely, you can set up your own LLC in Illinois without a lawyer. The process is straightforward, and you can handle it through the Illinois Secretary of State's office. It's advisable to create an Illinois Limited Liability Partnership Agreement or an LLC Operating Agreement to clarify the management and operations of your business.

Yes, Illinois recognizes Limited Liability Partnerships (LLPs) as a legal business structure. Entrepreneurs can take advantage of the limited liability protection offered by the Illinois Limited Liability Partnership Agreement. This structure permits partners to manage the business while protecting personal assets from business debts.