Illinois Earnest Money Promissory Note

Description

How to fill out Earnest Money Promissory Note?

If you wish to compile, obtain, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's simple and convenient search feature to locate the forms you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

Step 6. Choose the format of your legal form and download it to your device.

- Utilize US Legal Forms to find the Illinois Earnest Money Promissory Note in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download button to access the Illinois Earnest Money Promissory Note.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have chosen the form for your specific city/state.

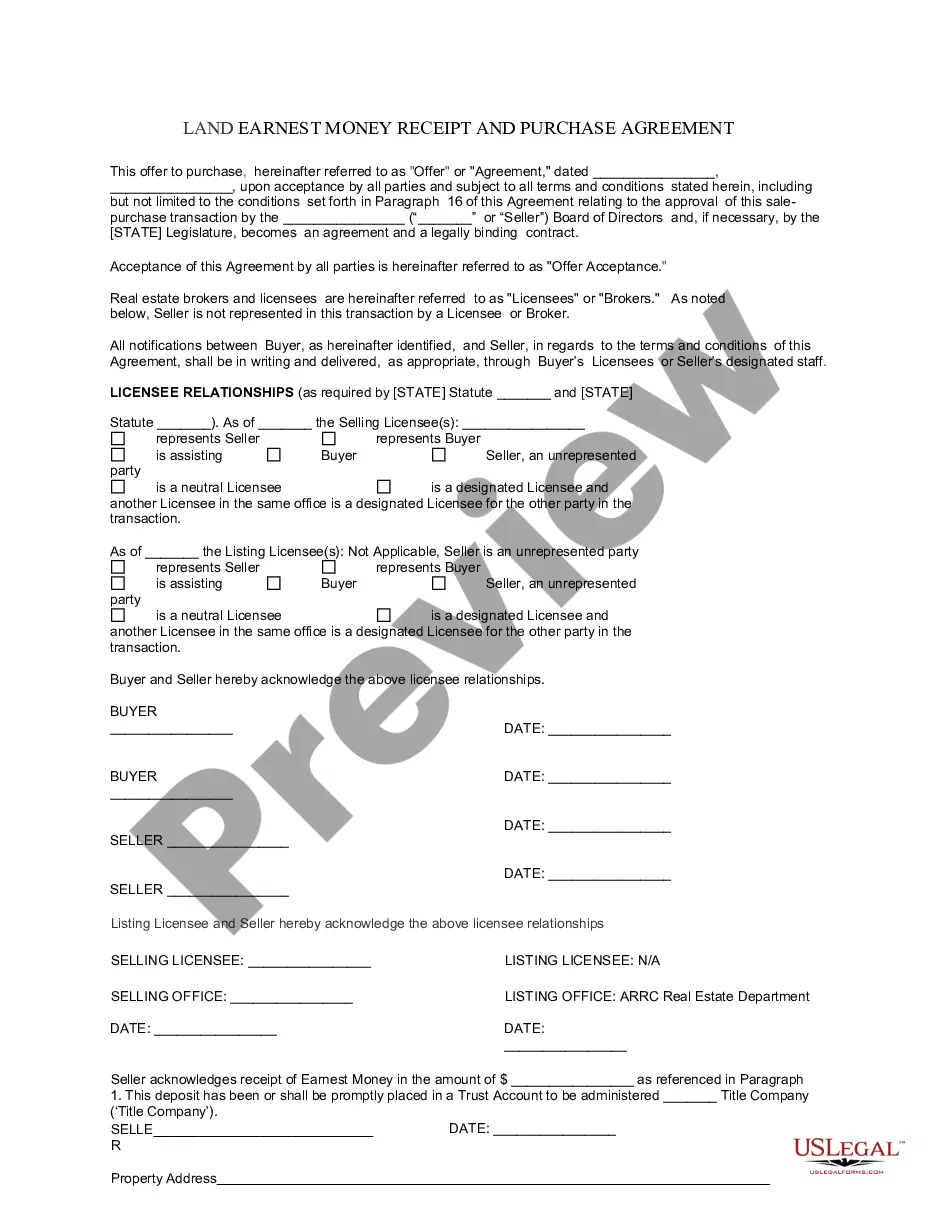

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are dissatisfied with the form, employ the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Download now button. Select your preferred pricing plan and enter your credentials to create an account.

Form popularity

FAQ

Deposit Promissory Note means a debt instrument issued by the Bank; upon maturity the Bank is obliged to pay to the Client the Amount Payable. Concurrently the Bank ensures the custody of such promissory note.

Earnest money is always returned to the buyer if the seller terminates the deal. While the buyer and seller can negotiate the earnest money deposit, it often ranges between 1% and 2% of the home's purchase price, depending on the market.

For example, let's assume John wants to buy a home that is listed for $500,000. To show that he is serious and ready to close the deal quickly, he provides $10,000 in earnest money.

The owner must be aware that the earnest money deposit will be made in the form of a promissory note (i.e., not in cash) before it accepts the purchase offer. This fact must also be stated clearly in the purchase agreement itself.

An earnest money deposit is money is put up by a potential buyer of real estate to show that it is seriously interested in making the purchase. The money is usually paid within 24-48 hours after the offer is accepted, and is held by a third party or escrow company until the deal is completed.

Earnest money protects the seller if the buyer backs out. It's typically around 1 3% of the sale price and is held in an escrow account until the deal is complete.

Earnest money is a percentage of the purchase price paid up front by the buyer and held in escrow by a third party called the "escrowee." The escrowee can be either the buyer or seller's broker or attorney or any other third party mutually agreed by the parties.

An earnest promissory note shows good faith commitment to purchase an asset and outlines the aspects of the purchase agreement between a buyer and seller.

The parties should sign only one original note, and the seller or escrow agent should keep that document. If you are the buyer, you will want to keep the note in the hands of an escrow agent or company.