Illinois Chattel Mortgage on Mobile Home

Description

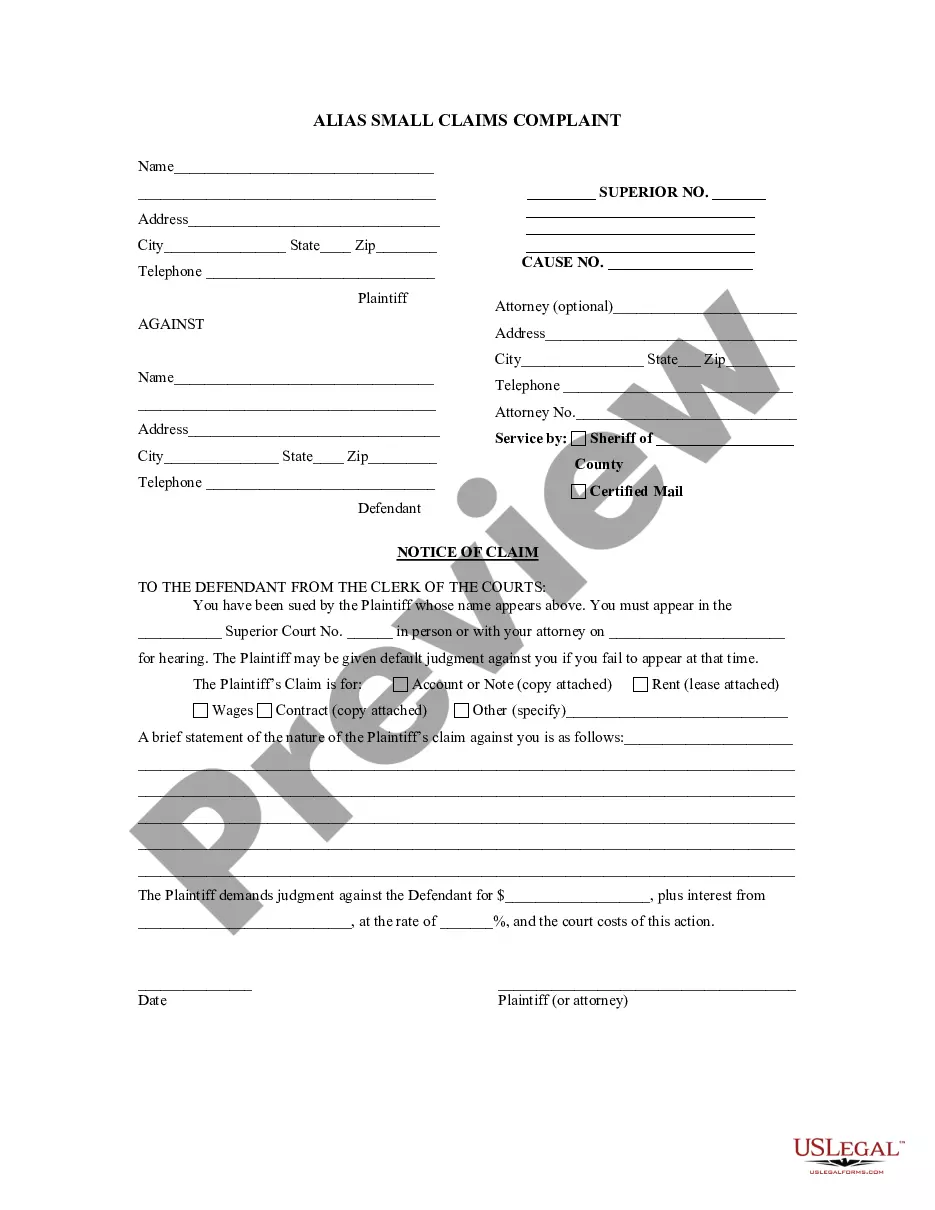

How to fill out Chattel Mortgage On Mobile Home?

If you wish to complete, acquire, or create authorized document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Employ the site’s straightforward and user-friendly search to locate the documents you require. A range of templates for business and personal purposes are categorized by types and states, or keywords.

Utilize US Legal Forms to obtain the Illinois Chattel Mortgage on Mobile Home with just a few clicks.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Illinois Chattel Mortgage on Mobile Home. Every legal document template you obtain is yours indefinitely. You have access to every form you purchased within your account. Click on the My documents section and select a form to print or download again. Be proactive and acquire, and print the Illinois Chattel Mortgage on Mobile Home with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal requirements.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to access the Illinois Chattel Mortgage on Mobile Home.

- You may also retrieve forms you have previously obtained from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

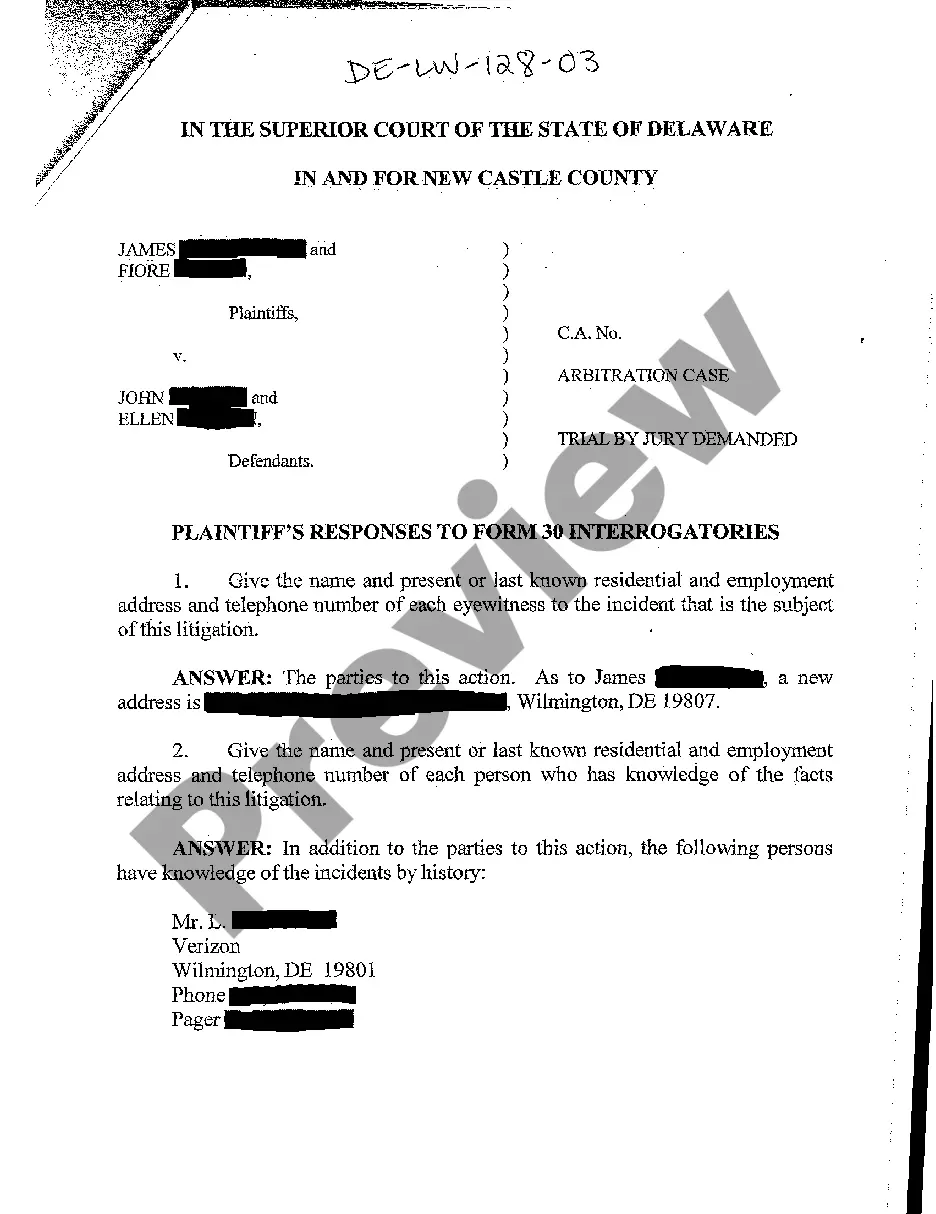

- Step 2. Utilize the Review option to examine the form’s content. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred payment plan and enter your details to register for an account.

Form popularity

FAQ

In Illinois, a mobile home is generally classified as personal property unless it is permanently affixed to land. If the mobile home is placed on a foundation and meets specific criteria, it can be converted to real property. This conversion allows for the use of an Illinois Chattel Mortgage on Mobile Home, which provides financing options for mobile homeowners. Understanding this classification is crucial for owners looking to navigate financing and property rights.

A chattel mortgage is a loan to purchase movable personal property, such as a manufactured home or construction equipment. The property, or chattel, secures the loan, and the lender holds an ownership interest. Chattel loans are commonly referred to as security agreements.

A chattel mortgage is a type of loan that is secured by a movable piece of property. In contrast, a traditional mortgage is typically secured by a fixed property.

Most lenders will not give you a conventional loan for a mobile or manufactured home because these structures are not considered real property. If you have a manufactured home that meets some very specific criteria, however, conventional mortgage sources Freddie Mac and Fannie Mae do actually offer specialized loans.

MODULAR DWELLINGS The construction of modular dwelling units located in Illinois is regulated by the Illinois Department of Public Health. These units include one and two family dwellings, apartments, and hotels. The units must be placed on a permanent perimeter foundation which extends below the frost depth.

Without an included property, banks feel there is a greater risk they will not get their money back in the event of a foreclosure. In order for banks to cover their risk, a chattel loan will have interest rates between 5.99% and 12.99%, depending on income, credit score, and other variables.

A chattel mortgage is used to purchase movable personal property, other than real estate, which serves as collateral for the loan until it's repaid. Farm equipment, livestock, farm assets, and mobile and manufactured homes are a few examples of property you could purchase with a chattel loan.