An Illinois Turnover Order is a court order issued by an Illinois court allowing a bank or other financial institution to turn over money or property held for a debtor to a creditor. This type of order is commonly used to enforce a judgment or to collect a debt. There are two types of Illinois Turnover Orders: a Turnover Order to Bank and a Turnover Order to Third Party. A Turnover Order to Bank requires the bank or financial institution to turn over any funds or property held by the debtor to the creditor. A Turnover Order to Third Party requires an individual or entity other than the debtor or the bank or financial institution to turn over any funds or property held by the debtor to the creditor.

Illinois Turnover Order

Description

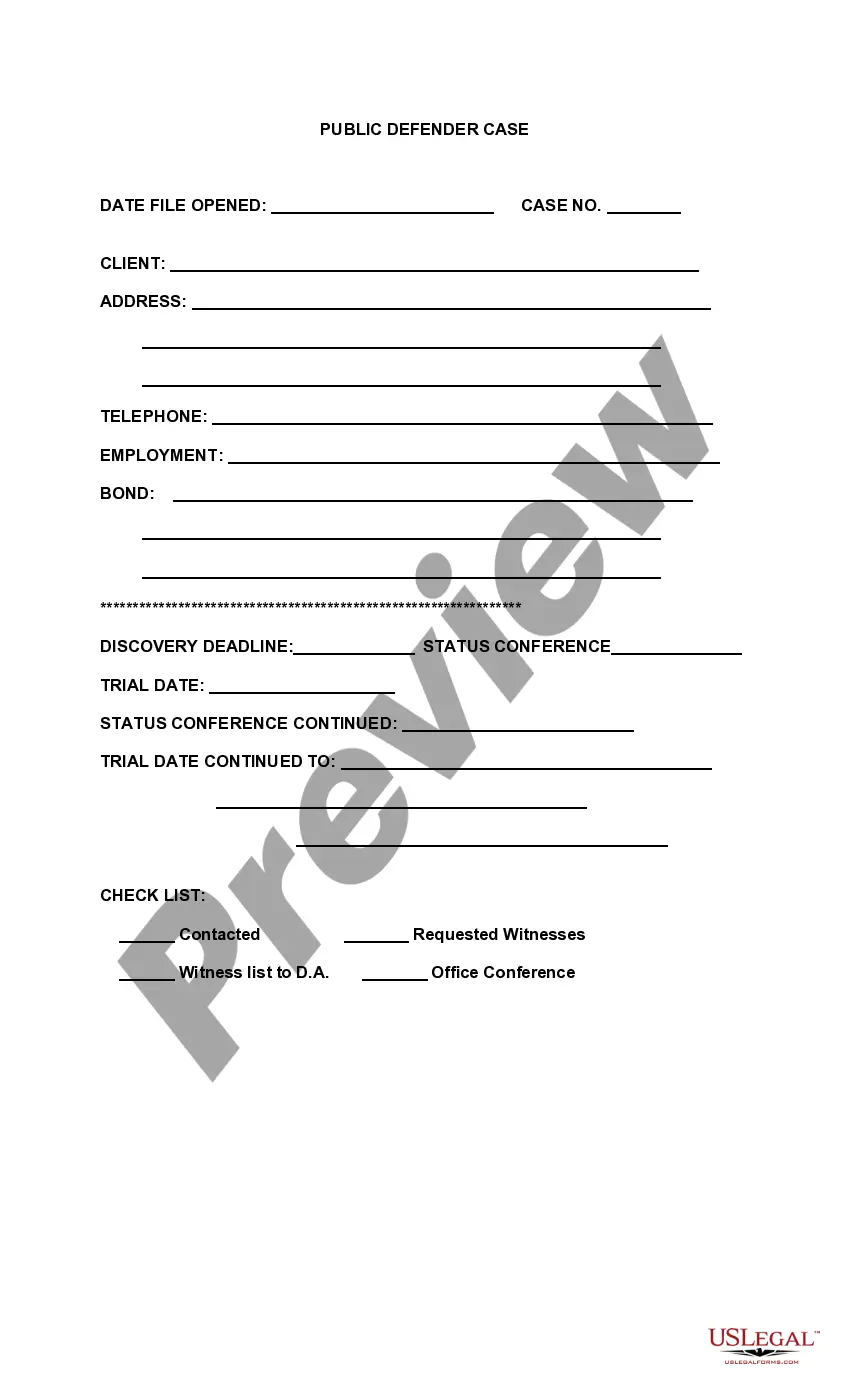

How to fill out Illinois Turnover Order?

US Legal Forms is the easiest and most affordable method to discover suitable legal templates.

It is the largest online repository of business and personal legal documents crafted and verified by lawyers.

Here, you can find printable and fillable forms that adhere to national and local regulations - just like your Illinois Turnover Order.

Review the form description or view a preview of the document to confirm you’ve found one that suits your needs, or find another one using the search bar above.

Hit Buy now when you are confident about its suitability for all the requirements, and choose the subscription plan that you prefer most.

- Getting your template requires only a few simple steps.

- Users with an existing account and a valid subscription just need to Log In to the site and download the form onto their device.

- Then, they can locate it in their profile under the My documents section.

- And here’s how to acquire a professionally prepared Illinois Turnover Order if you are using US Legal Forms for the first time.

Form popularity

FAQ

Creditors in Illinois can pursue collection on a judgment for a period of 20 years. This extensive time frame means that creditors can actively seek repayment until the debt is resolved or legally addressed. If you find yourself facing ongoing collection efforts, seeking assistance with the Illinois turnover order can help you manage these obligations effectively.

Once a judgment is entered against you in Illinois, the creditor can initiate collection actions to recover the owed amount. This may include garnishing wages or bank accounts, or placing liens on your property. If you receive notice of a judgment, you have the option to appeal or negotiate a payment plan. It’s critical to understand your rights and options, so considering an Illinois turnover order might be beneficial.

Enforcing a judgment in Illinois typically involves filing a collection action or obtaining a turnover order against the debtor's assets. You may need to locate the debtor's property or income to successfully enforce the judgment. It’s essential to be aware of the laws surrounding judgment enforcement to avoid potential pitfalls. Using services like uslegalforms can assist you in following the proper legal procedures.

Filing a motion to vacate a judgment in Illinois requires you to submit the motion to the court where the judgment was issued. Clearly outline the reasons you believe the judgment should be vacated, such as new evidence or improper service of process. Ensure you file it within the designated time frame to increase your chances of success. Using uslegalforms can simplify the process by providing necessary forms and legal advice.

Employment income is usually not exempt under Illinois law, but other kinds of income are exempt from wage deductions. Some examples of exempt income include Social Security and other income from the federal government, workers' compensation benefits, unemployment benefits, and government assistance, to name a few.

Wage Garnishment in Illinois In Illinois, if a creditor wins a court judgment against you, the maximum your employer can garnish from your weekly earnings is either 15 percent of your earnings or the amount left over after you deduct 45 hours' worth of Illinois' minimum wage.

The most the employer can hold out for you is 15% of the debtor's gross income before taxes or deductions. However, the withholding can't leave the debtor with less than 45 times the state minimum wage as weekly take-home pay.

If wage garnishment means that you can't pay for your family's basic needs, you can ask the court to order the debt collector to stop garnishing your wages or reduce the amount. This is called a Claim of Exemption.

The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government.

In Illinois, if a creditor wins a court judgment against you, the maximum your employer can garnish from your weekly earnings is either 15 percent of your earnings or the amount left over after you deduct 45 hours' worth of Illinois' minimum wage.