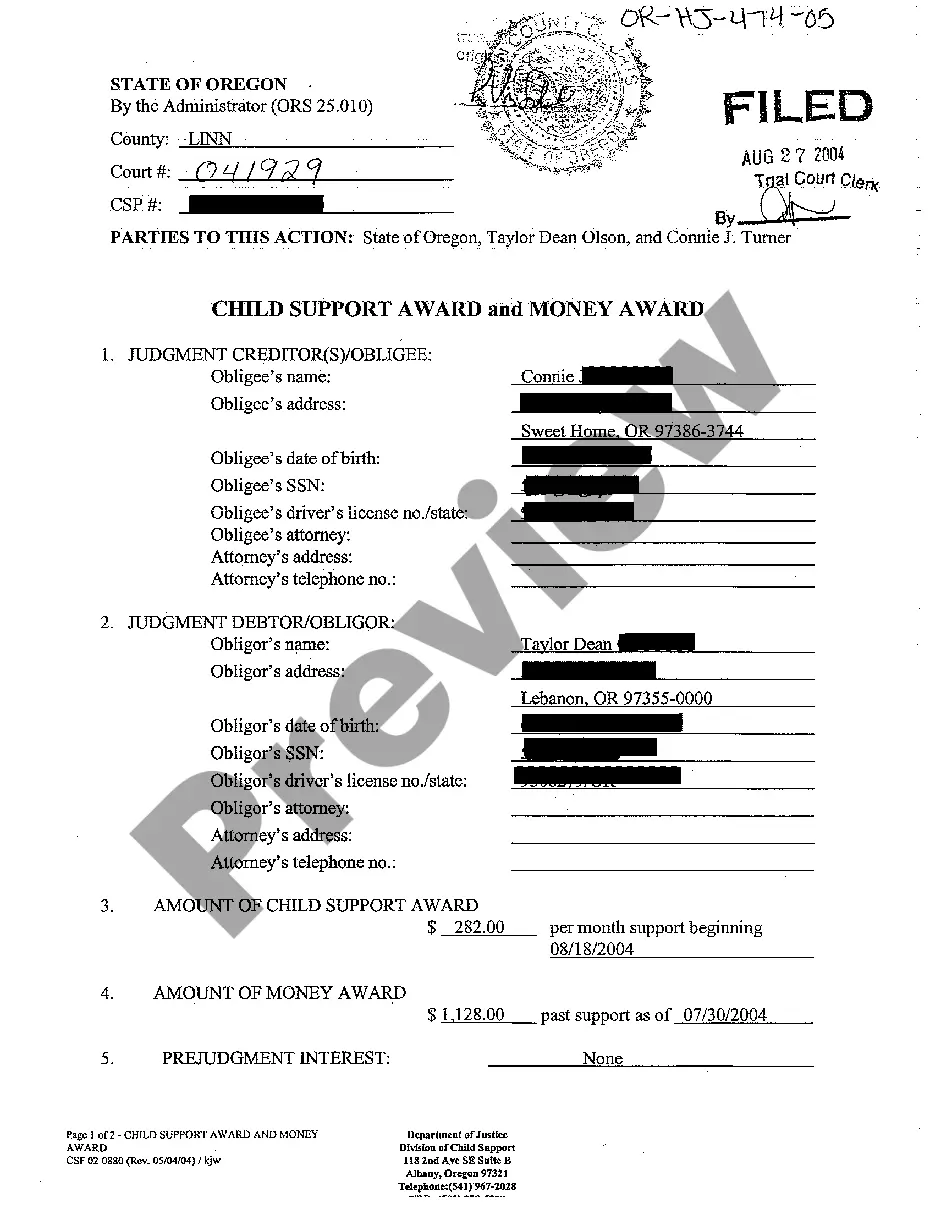

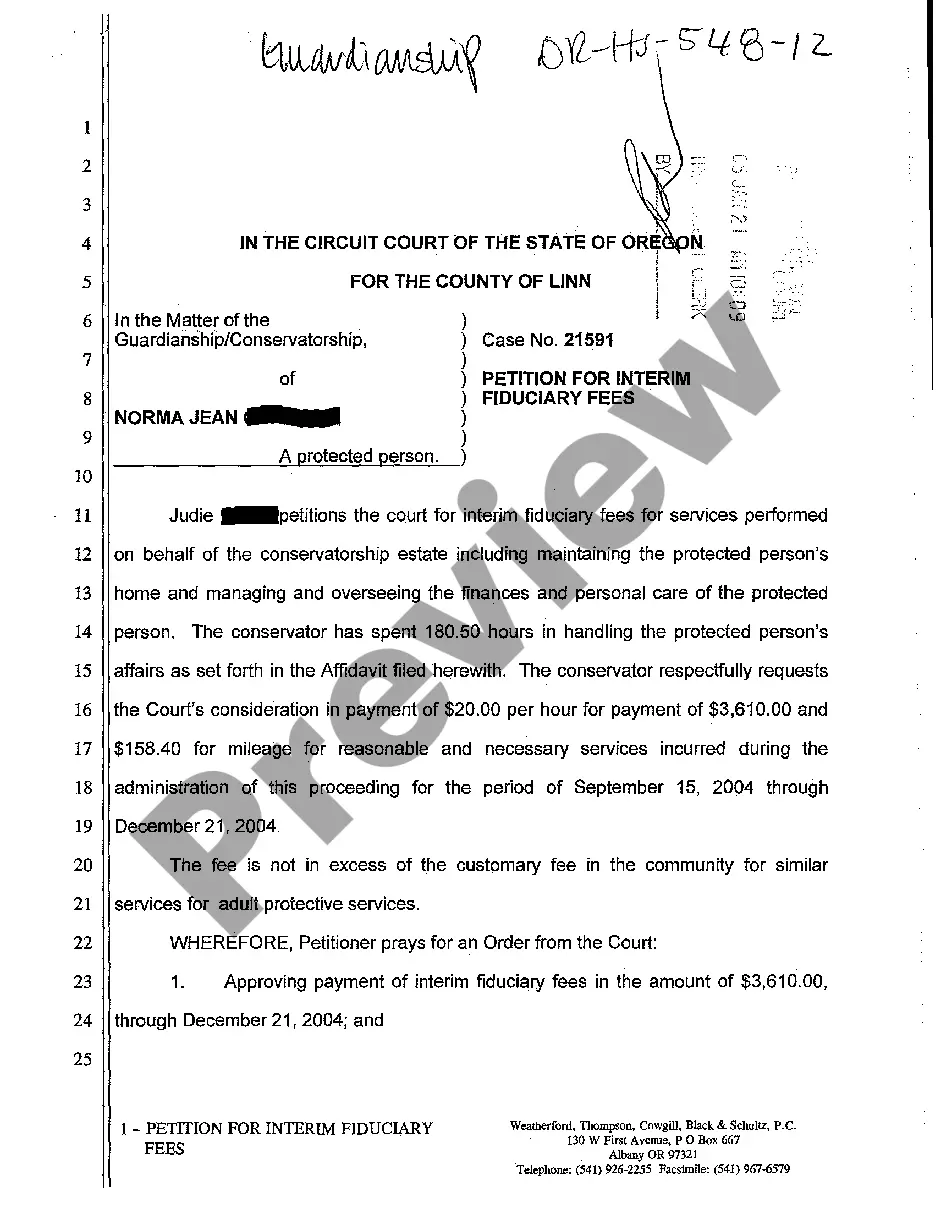

Illinois Citation to Discover Assets is a legal procedure used in the state of Illinois to identify and locate property and assets of a debtor. It is a method used by creditors to collect on a debt by attempting to seize assets. The process involves a court-ordered request that a third party (such as a bank or other financial institution) turn over any assets belonging to the debtor in their possession. The three types of Illinois Citation to Discover assets are: 1. Personal Property: This includes tangible and intangible assets, such as cash, bank accounts, stocks, bonds, jewelry, vehicles, and other items of value. 2. Real Property: This includes real estate, including land and buildings. 3. Business Property: This includes business assets, such as inventory, accounts receivable, equipment, and other business-related assets. The Citation to Discover Assets must be filed in the circuit court of the county in which the debtor resides or has assets. The court then issues an order to the third party to reveal any assets the debtor may have. The third party must comply with the court order and provide a detailed list of assets that are in the debtor’s possession. The creditor can then use the list of assets to attempt to collect on the debt.

Illinois Citation to Discover assets

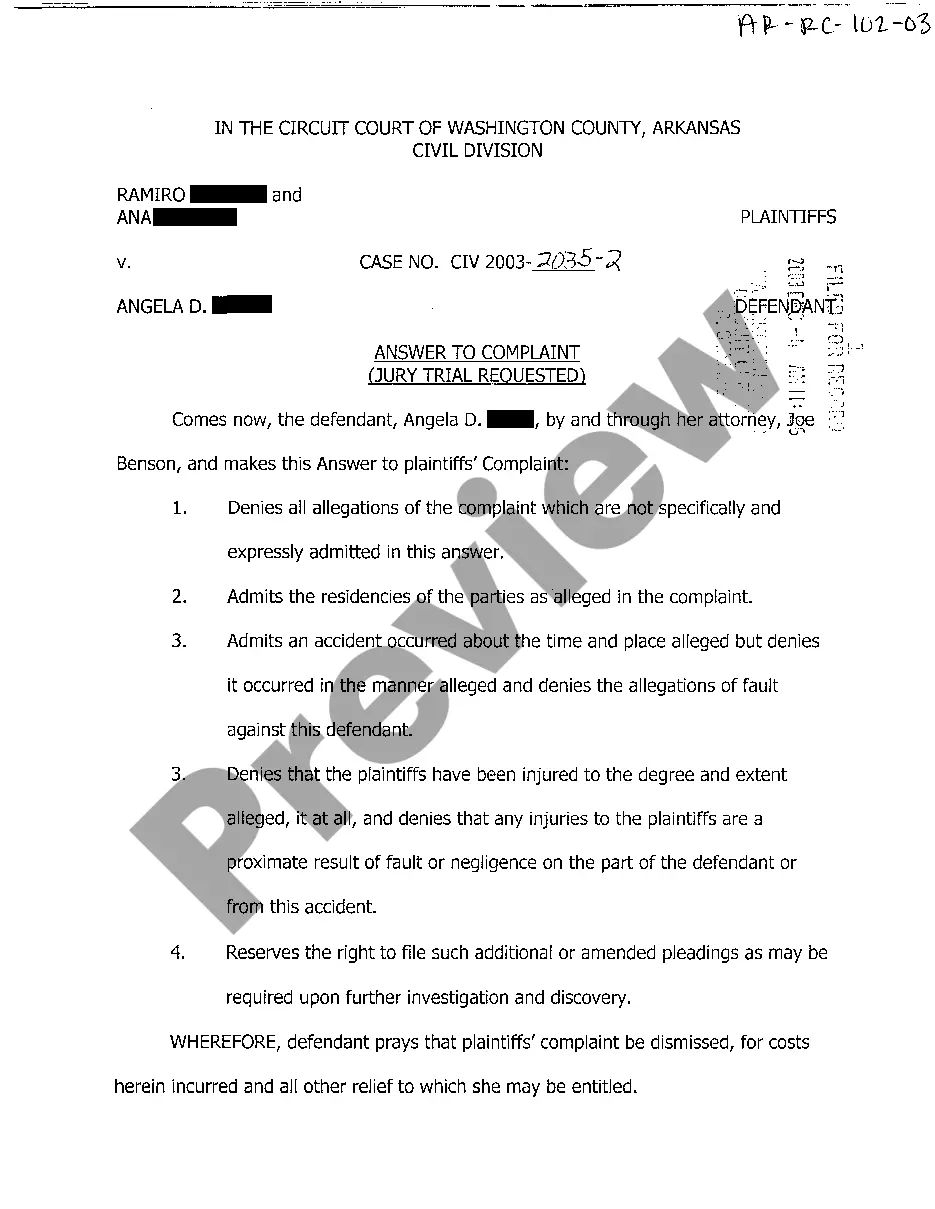

Description

How to fill out Illinois Citation To Discover Assets?

How much duration and resources do you typically devote to creating official documentation.

There’s a more efficient method to obtain such forms than engaging legal professionals or spending extensive time searching online for a suitable template. US Legal Forms is the leading online repository that provides expertly drafted and validated state-specific legal documents for various purposes, such as the Illinois Citation to Discover assets.

Another advantage of our library is that you can retrieve previously acquired documents that you securely store in your profile in the My documents tab. Access them at any time and redo your paperwork as often as you require.

Conserve time and energy preparing formal documentation with US Legal Forms, one of the most dependable online solutions. Join us today!

- Review the form content to verify it adheres to your state standards. To do this, examine the form description or utilize the Preview option.

- If your legal template does not satisfy your needs, find another one by using the search bar at the top of the page.

- If you already possess an account with us, Log In and download the Illinois Citation to Discover assets. If you do not, proceed to the subsequent steps.

- Click Buy now once you identify the appropriate blank. Select the subscription plan that best fits your needs to access the full services of our library.

- Register for an account and pay for your subscription. You can transact with your credit card or via PayPal - our service is completely secure for that.

- Download your Illinois Citation to Discover assets onto your device and complete it on a printed hard copy or electronically.

Form popularity

FAQ

After a judgment is entered against you in Illinois, the creditor has the right to pursue collection of the debt. They may utilize an Illinois Citation to Discover assets to find out what you own, including bank accounts or property. You may face wage garnishment or seizure of assets if the creditor successfully identifies your assets. It's vital to understand your rights and options in this situation, and consulting resources like US Legal Forms can help you navigate the process effectively.

Collecting a judgment in Illinois involves several steps. First, the creditor can file an Illinois Citation to Discover assets to identify the debtor's assets. Once the assets are discovered, the creditor may take further legal action to recover the amount owed, which could include wage garnishment or bank levies. It's important to ensure you follow all legal procedures, which can have complexities, and using a reliable platform like US Legal Forms can provide the necessary documents and guidance.

To domesticate a judgment in Illinois, you should file a motion in the circuit court where you seek enforcement. You need to provide the original judgment from the out-of-state court and any relevant evidence. Utilizing an Illinois Citation to Discover assets may help identify the debtor's resources in the state, facilitating collection and enforcement efforts.

Collecting a judgment in Illinois requires a few essential steps. First, you must obtain a certified copy of your judgment, then you can issue an Illinois Citation to Discover assets to find out what the debtor owns. This process allows you to uncover the debtor's income, bank accounts, and property, making it easier to collect what you are owed.

In Illinois, a judgment does not last indefinitely. Generally, a judgment expires after seven years, unless it is renewed. During this period, the creditor can use an Illinois Citation to Discover assets to locate the debtor's financial resources. It is crucial for creditors to act within this timeframe to ensure they can enforce their rights.

A few ways include taking money from the debtor's bank account or garnishing the debtor's wages. Sometimes, the creditor doesn't know where the debtor works or where they have a bank account. Then, the creditor can use a Citation to Discover Assets to find out this information.

Illinois law governs the enforcement and resurrection of judgments. Under Illinois law, judgments have an enforcement time limit of seven years from the date of their entry.

If you have won a judgment for money against your debtor, you can file a citation to discover assets to a third party....The summons must be given to the third party by: The sheriff; or. Certified or registered mail. Restricted delivery if to an individual.

In Illinois, an unpaid judgment can become a lien on real estate. A judgment lien allows a creditor to force a sale of property owned by the debtor (you).

These are the major exemptions under Illinois law: Wages (exempt in part) ? 85 percent of an individual debtor's wages are exempt.Certain retirement funds ? Pension and individual retirement account (IRA) funds and individual retirement annuities are fully exempt from collections.