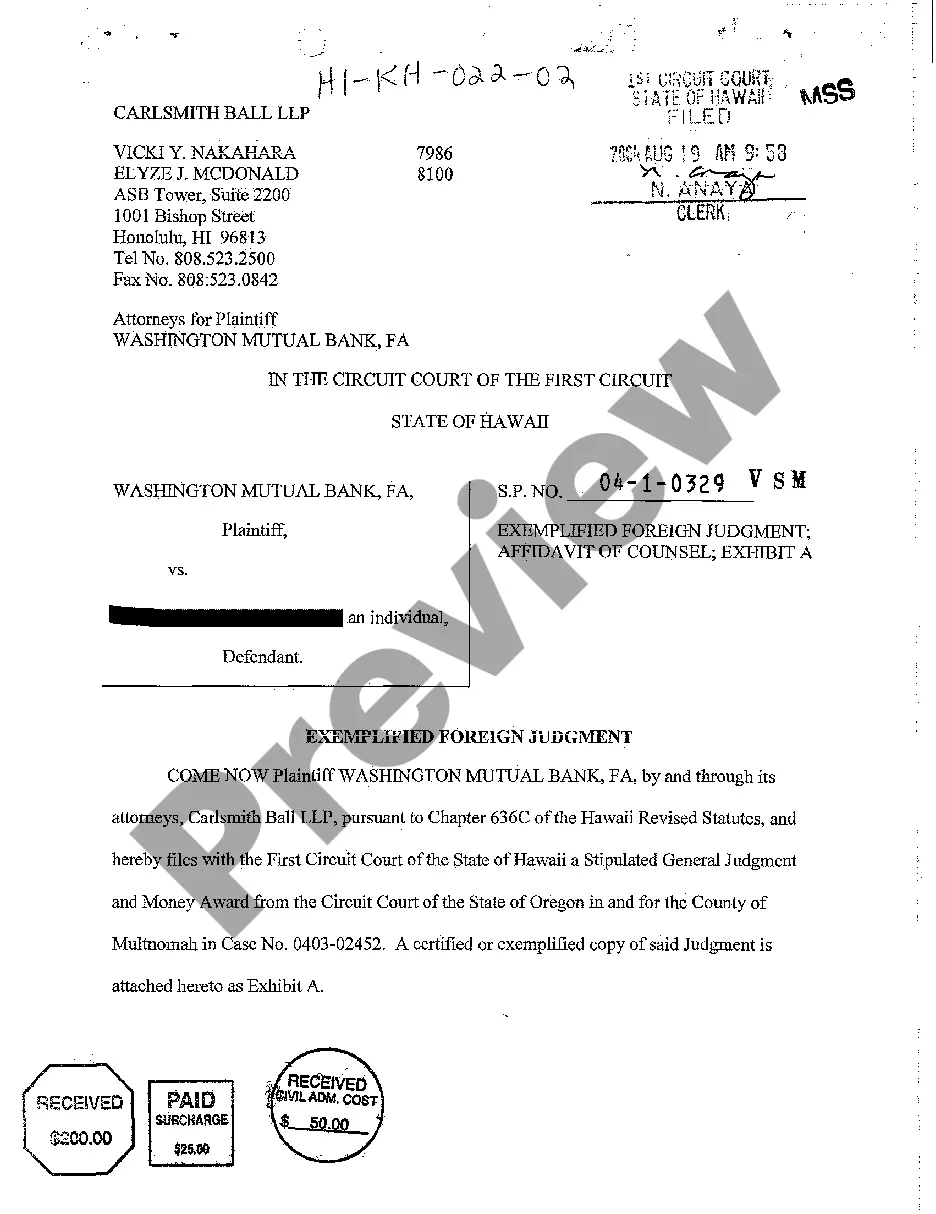

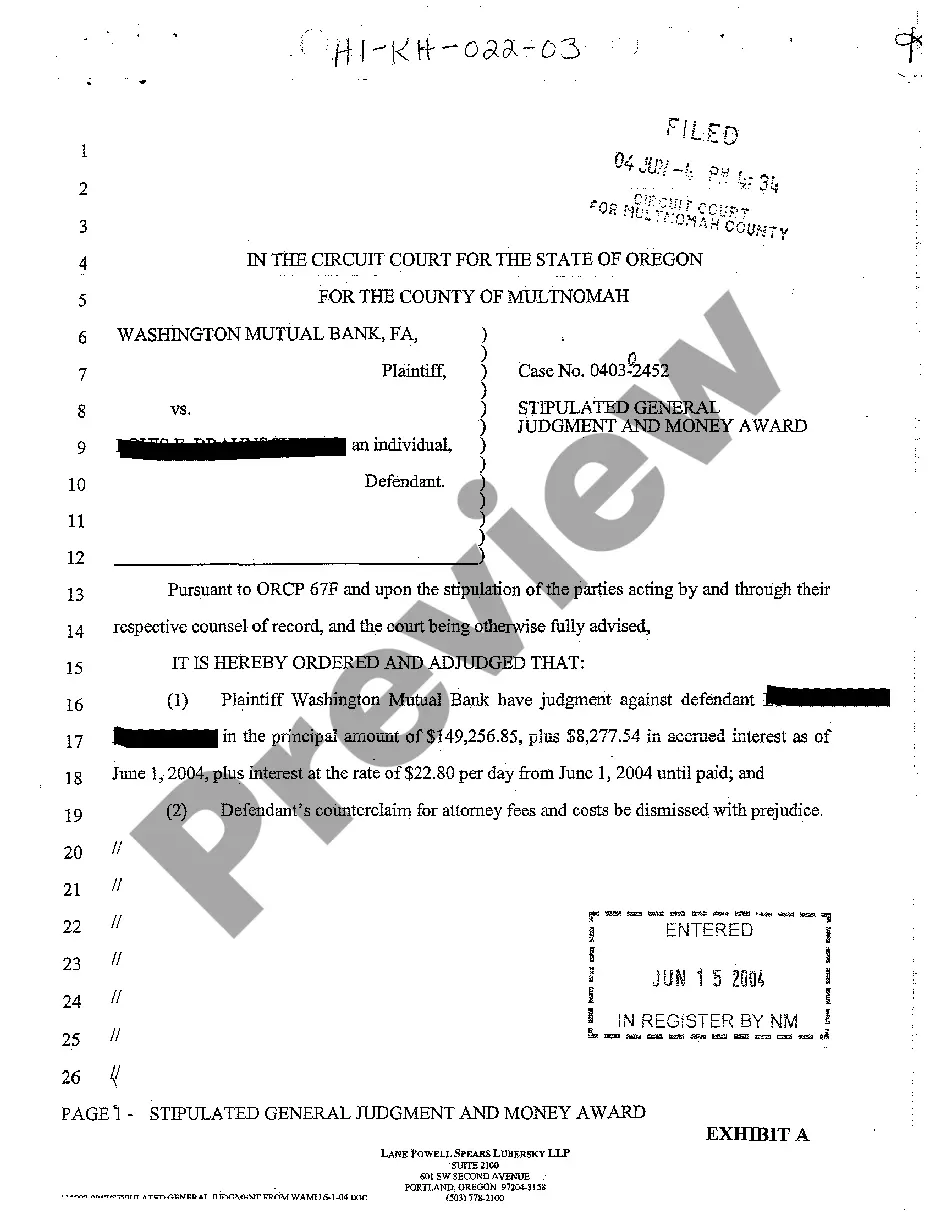

Illinois Affidavit For Non Wage Garnishment is a legal document used to protect an individual from having their wages garnished in the state of Illinois. It allows an individual to claim that they are exempt from wage garnishment or to show that they have already satisfied a garnishment order. The affidavit is used to protect an individual’s wages, salary, commissions, bonuses, and other income from being garnished. There are two types of Illinois Affidavit For Non Wage Garnishment: (1) The Exempt Income Affidavit, which can be used to claim an exemption from wage garnishment and (2) The Satisfied Judgment Affidavit, which can be used to show that a garnishment order has already been satisfied.

Illinois Affidavit For Non Wage Garnishment

Description

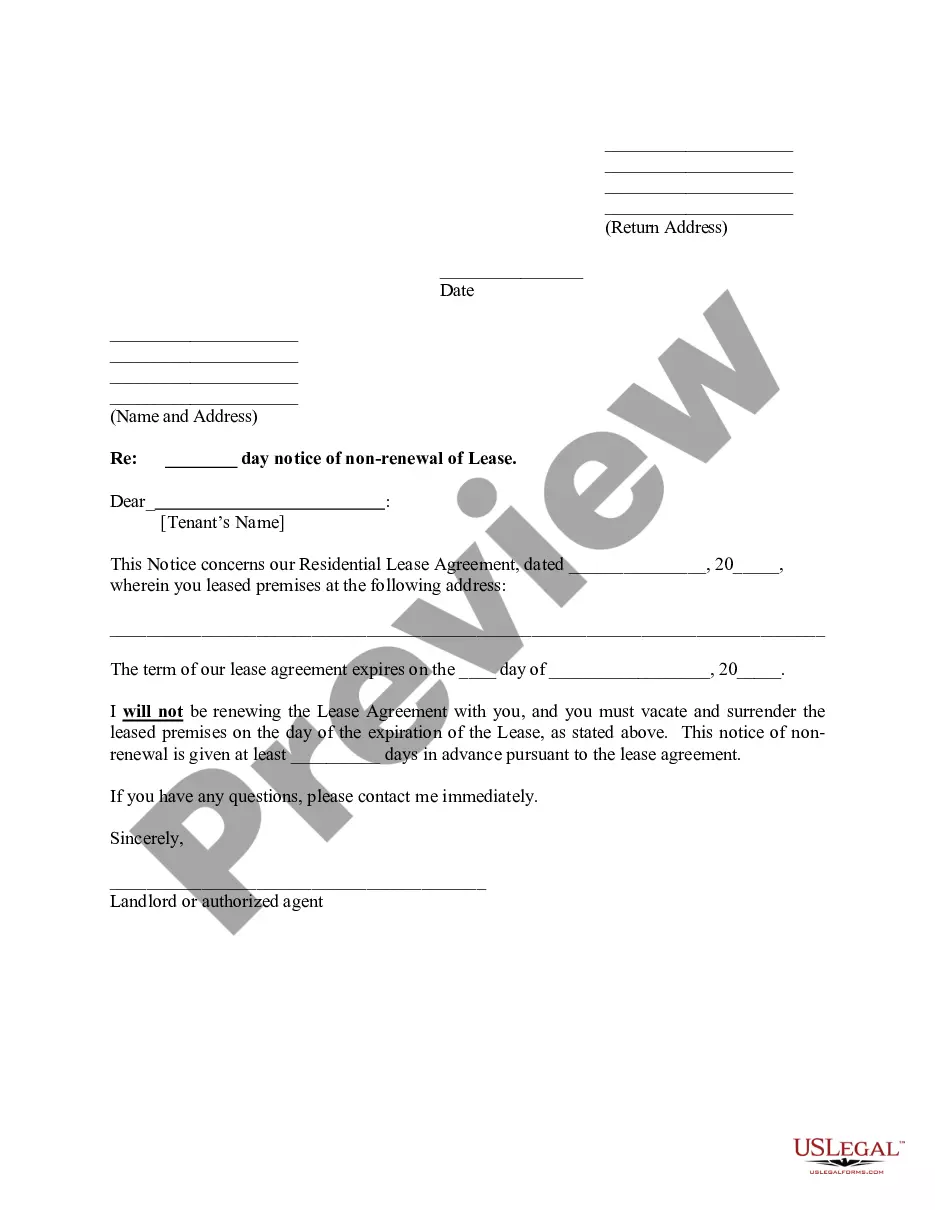

How to fill out Illinois Affidavit For Non Wage Garnishment?

Handling official documents necessitates focus, accuracy, and utilizing correctly-prepared templates. US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your Illinois Affidavit For Non Wage Garnishment form from our platform, you can be confident it complies with federal and state laws.

Utilizing our platform is simple and fast. To obtain the required document, all you need is an account with an active subscription. Here’s a brief overview for you to acquire your Illinois Affidavit For Non Wage Garnishment in just a few minutes.

All documents are created for multiple uses, like the Illinois Affidavit For Non Wage Garnishment displayed on this page. If you need them again, you can complete them without additional payment - simply access the My documents tab in your profile and finalize your document whenever necessary. Explore US Legal Forms and prepare your business and personal documentation swiftly and in full legal conformity!

- Ensure to thoroughly review the form content and its alignment with general and legal standards by previewing it or reading its description.

- Look for another official template if the one you accessed does not suit your circumstances or state regulations (the tab for that is located at the top page corner).

- Sign in to your account and download the Illinois Affidavit For Non Wage Garnishment in your desired format. If it’s your initial experience with our platform, click Buy now to proceed.

- Establish an account, choose your subscription tier, and pay using your credit card or PayPal account.

- Choose the format in which you wish to receive your form and click Download. Print the template or upload it to a compatible PDF editor for electronic preparation.

Form popularity

FAQ

The most the employer can hold out for you is 15% of the debtor's gross income before taxes or deductions. However, the withholding can't leave the debtor with less than 45 times the state minimum wage as weekly take-home pay.

Wage Garnishment in Illinois In Illinois, if a creditor wins a court judgment against you, the maximum your employer can garnish from your weekly earnings is either 15 percent of your earnings or the amount left over after you deduct 45 hours' worth of Illinois' minimum wage.

The written objection should include: the case number (a unique set of numbers or letters specific to your case) your name, address, and phone number. a detailed explanation of your reasons for challenging the garnishment. a request for a hearing if the court has not already set a hearing date.

The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government.

Non-wage garnishment is the judgment creditor's attachment, after judgment, of the judgment debtor's property, other than wages, which is in the possession, custody or control of third parties. Example: A creditor files a non-wage garnishment to attach funds your client has deposited in the local bank.

The document is called a Wage Deduction Affidavit. The creditor states their belief that the debtor's employer owes the creditor wages. In that affidavit, the creditor must certify that, before filing the affidavit, he mailed a wage deduction notice, explained below, to the debtor at the debtor's last known address.

Employment income is usually not exempt under Illinois law, but other kinds of income are exempt from wage deductions. Some examples of exempt income include Social Security and other income from the federal government, workers' compensation benefits, unemployment benefits, and government assistance, to name a few.

For the most part, there are only two ways to stop wage garnishments in Illinois. First, you can pay off the judgment. You may be able to pay the judgment in a lump sum, or you may have to wait for the garnishment to run its course. The second way to stop a garnishment is by filing bankruptcy.