Illinois Satisfaction, Release or Cancellation of Mortgage by Individual

Description

Key Concepts & Definitions

/Satisfaction Release or Cancellation of Mortgage: This is a legal document indicating that a borrower has fulfilled their financial obligations under a mortgage deed, effectively releasing them from any further responsibility tied to that mortgage. Recording Representative: A professional responsible for overseeing the proper recording of real estate documents, including mortgage discharges. Deed of Trust: A type of secured real estate transaction used in some states that involves a trustee, who holds the property's title until the loan is paid off.

Step-by-Step Guide to Processing a Mortgage Release

- Determine the Need: Review mortgage deed, financial records, and payment status to confirm that all financial obligations have been met.

- Prepare Documentation: Compile a discharge mortgage form, written affidavit, and any other required legal forms.

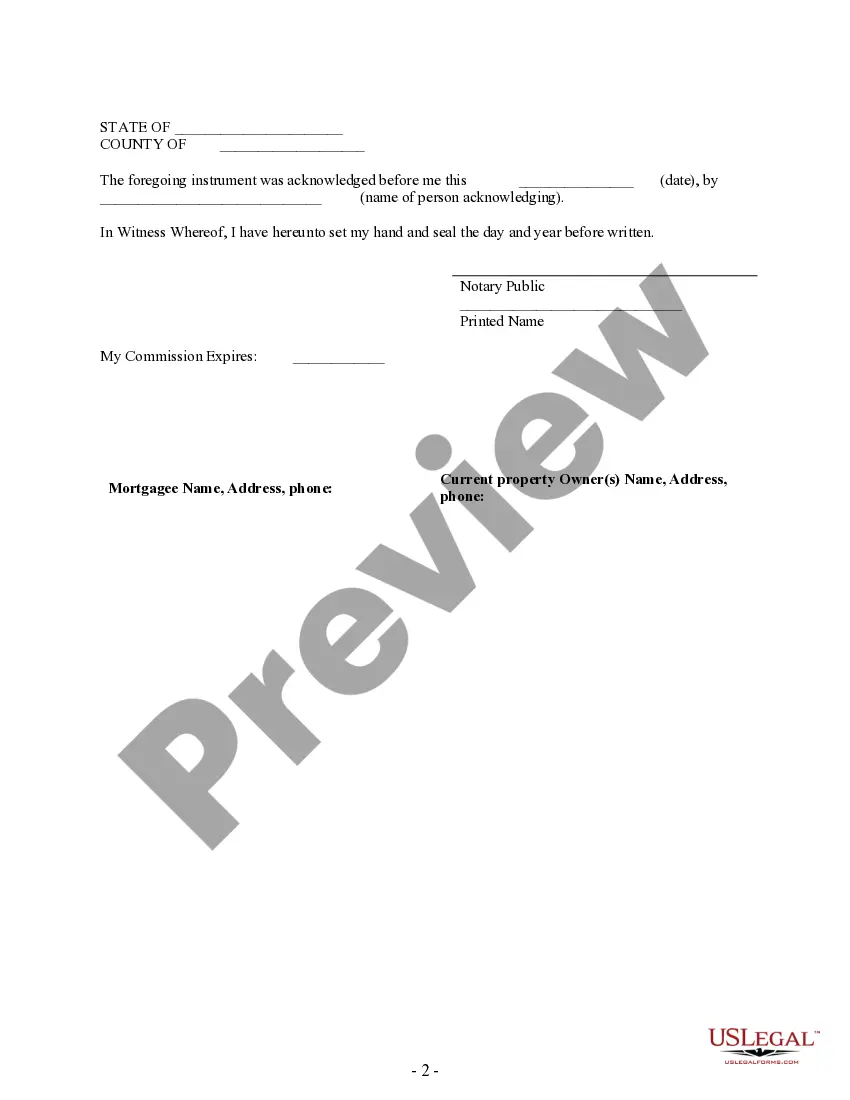

- Submit to Recording Representative: Ensure all forms are accurately filled out and submit them to the appropriate recording representative for your jurisdiction.

- Public Notice: Some states require a public notice to be filed along with the release. Check local laws for specifics.

- Obtain Official Release: After processing, obtain the official satisfaction release or cancellation document from the county recorder's office.

Risk Analysis

- Incorrect Filing: Errors in paperwork or failing to include necessary documents can lead to delays in processing the mortgage release.

- Lacking Public Notice: Non-compliance with local laws regarding public notices can invalidate the release process.

- Financial Discrepancies: Disputes over whether all financial obligations have been met can lead to legal complications. Keep thorough records of all loan payments.

Common Mistakes & How to Avoid Them

- Improper Documentation: Always double-check that all submitted documents, like written affidavits or mortgage deeds, comply with state and local regulations. Utilize a checklist.

- Failure to Use Detailed Records: Maintain detailed documentation of all real estate income and loan payments to swiftly address any disputes or audits.

- Neglecting State Specific Rules: Mortgage laws can vary by state, particularly between states that use mortgages and those that use deeds of trust. Be aware of your state's requirements.

How to fill out Illinois Satisfaction, Release Or Cancellation Of Mortgage By Individual?

In search of Illinois Satisfaction, Release or Cancellation of Mortgage by Individual forms and filling out them might be a problem. In order to save time, costs and effort, use US Legal Forms and find the correct sample specifically for your state within a couple of clicks. Our legal professionals draft each and every document, so you just have to fill them out. It is really so easy.

Log in to your account and return to the form's web page and download the document. Your saved samples are saved in My Forms and are accessible at all times for further use later. If you haven’t subscribed yet, you have to register.

Have a look at our detailed guidelines regarding how to get your Illinois Satisfaction, Release or Cancellation of Mortgage by Individual template in a few minutes:

- To get an eligible sample, check its applicability for your state.

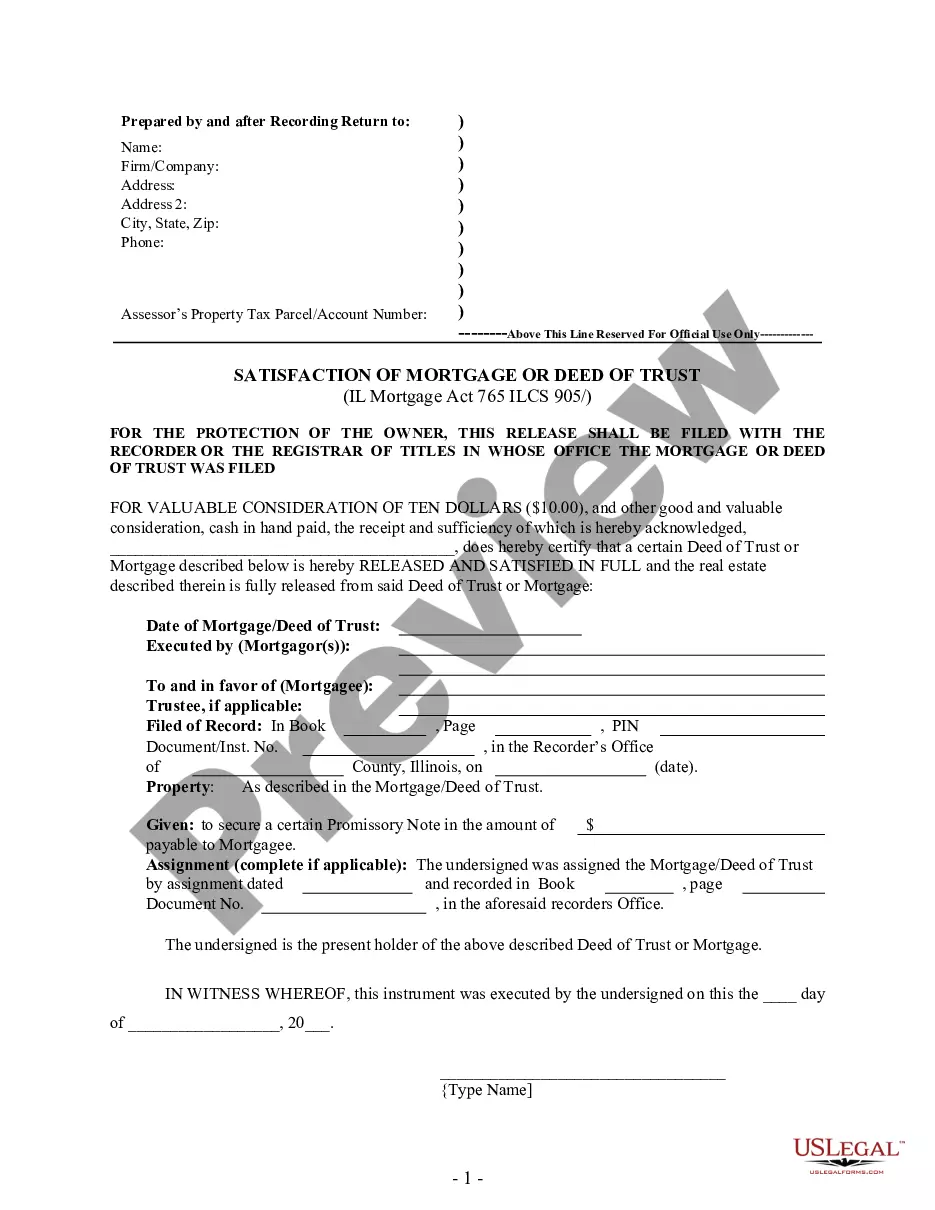

- Take a look at the example using the Preview function (if it’s accessible).

- If there's a description, go through it to understand the specifics.

- Click on Buy Now button if you found what you're seeking.

- Choose your plan on the pricing page and make your account.

- Pick how you would like to pay out by a credit card or by PayPal.

- Save the sample in the favored file format.

You can print the Illinois Satisfaction, Release or Cancellation of Mortgage by Individual form or fill it out making use of any online editor. No need to worry about making typos because your template may be applied and sent away, and published as many times as you wish. Check out US Legal Forms and get access to over 85,000 state-specific legal and tax documents.

Form popularity

FAQ

What is Satisfaction of Mortgage? A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

You may contact us at (407) 836-5115 to request a search of your Satisfaction of Mortgage. You may also utilize our web site (www.occompt.com) to see if your Satisfaction has been recorded. Your Satisfaction is recorded under the names of the borrower/mortgagor on the original loan.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

If you have cleared a debt, a mortgage satisfaction document will give you clear title to real property. In other words, mortgage satisfaction is a document that results in release or discharge of a mortgage lien, and indicates that a borrower has cleared his/her debt.

Go to the county recorder's office or local courthouse to find recorded mortgages. In states such as California, deeds, liens, mortgage documents and various types of land documents are available for review in the recorder's office.

In some cases, a mortgage may have been sold by the mortgage lender to another financial institution. If sold, the owner of the mortgage at the time of the final payment is responsible for completing the satisfaction of mortgage documentation.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

A satisfaction of mortgage is a document that confirms a mortgage has been paid off and details the provisions for the transfer of collateral title rights.

If you can't find out which company took over, call the Federal Deposit Insurance Corporation's (FDIC) lien release number at (888) 206-4662 (toll free) or visit the Closed Banks and Asset Sales section on the FDIC's "Contact Us" page.