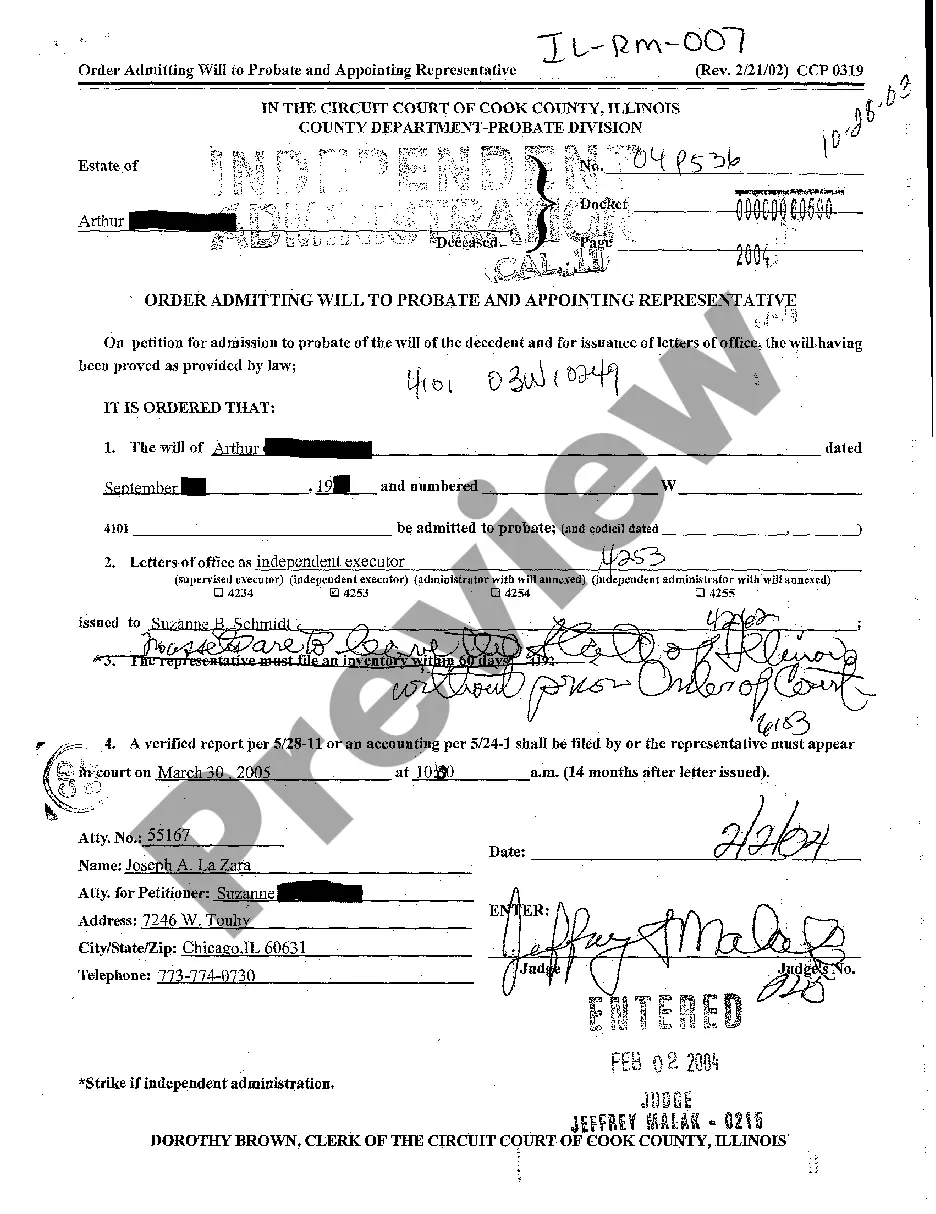

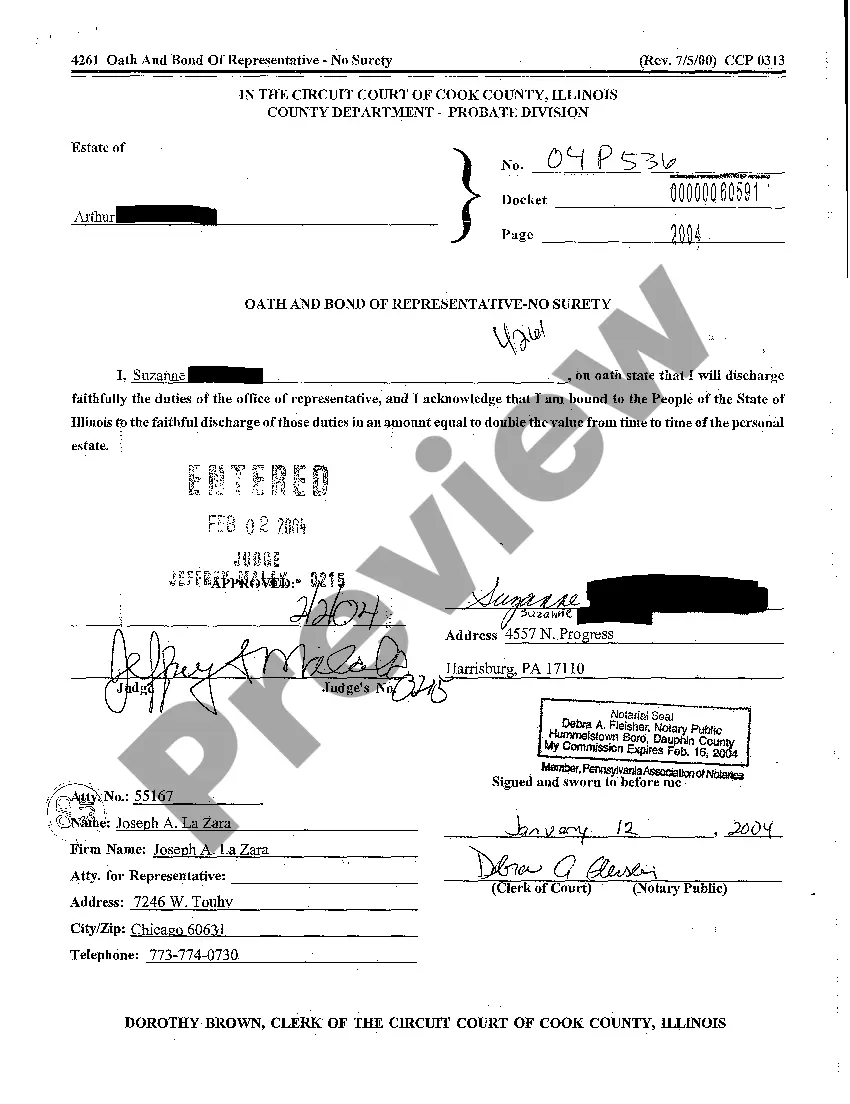

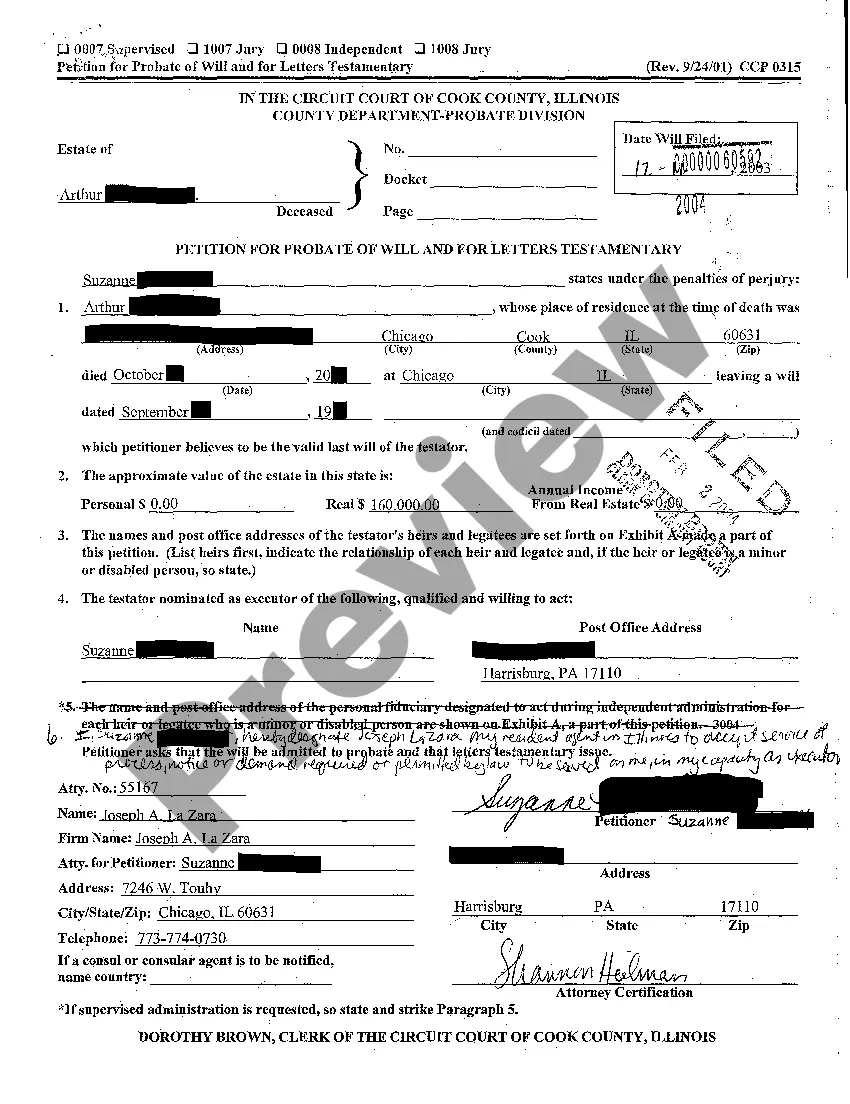

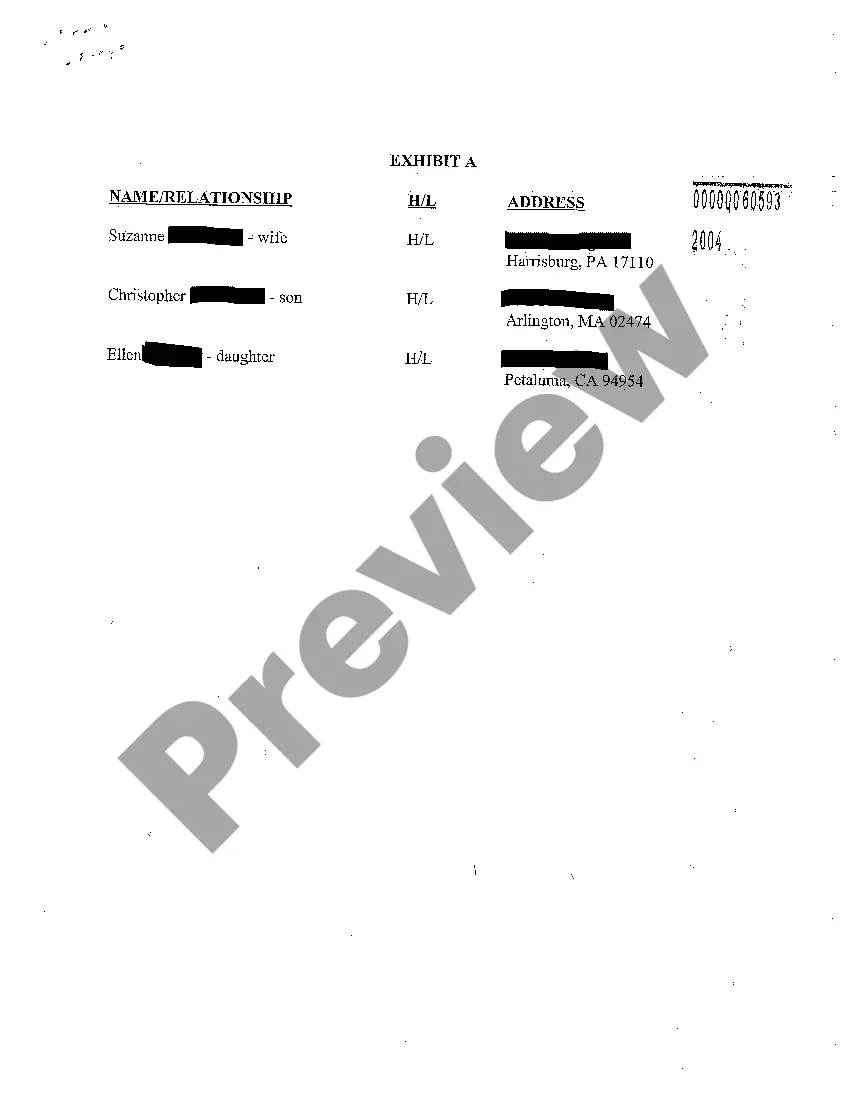

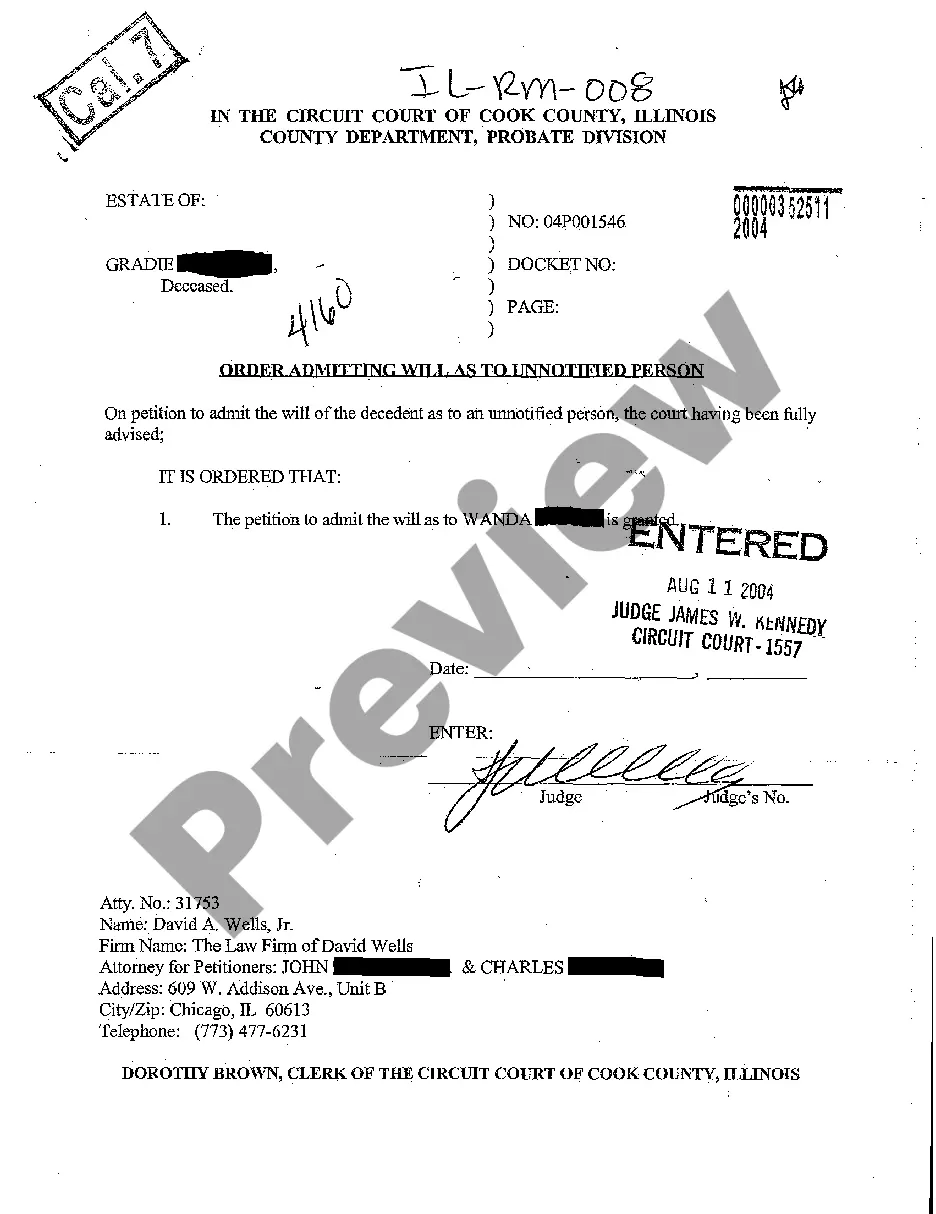

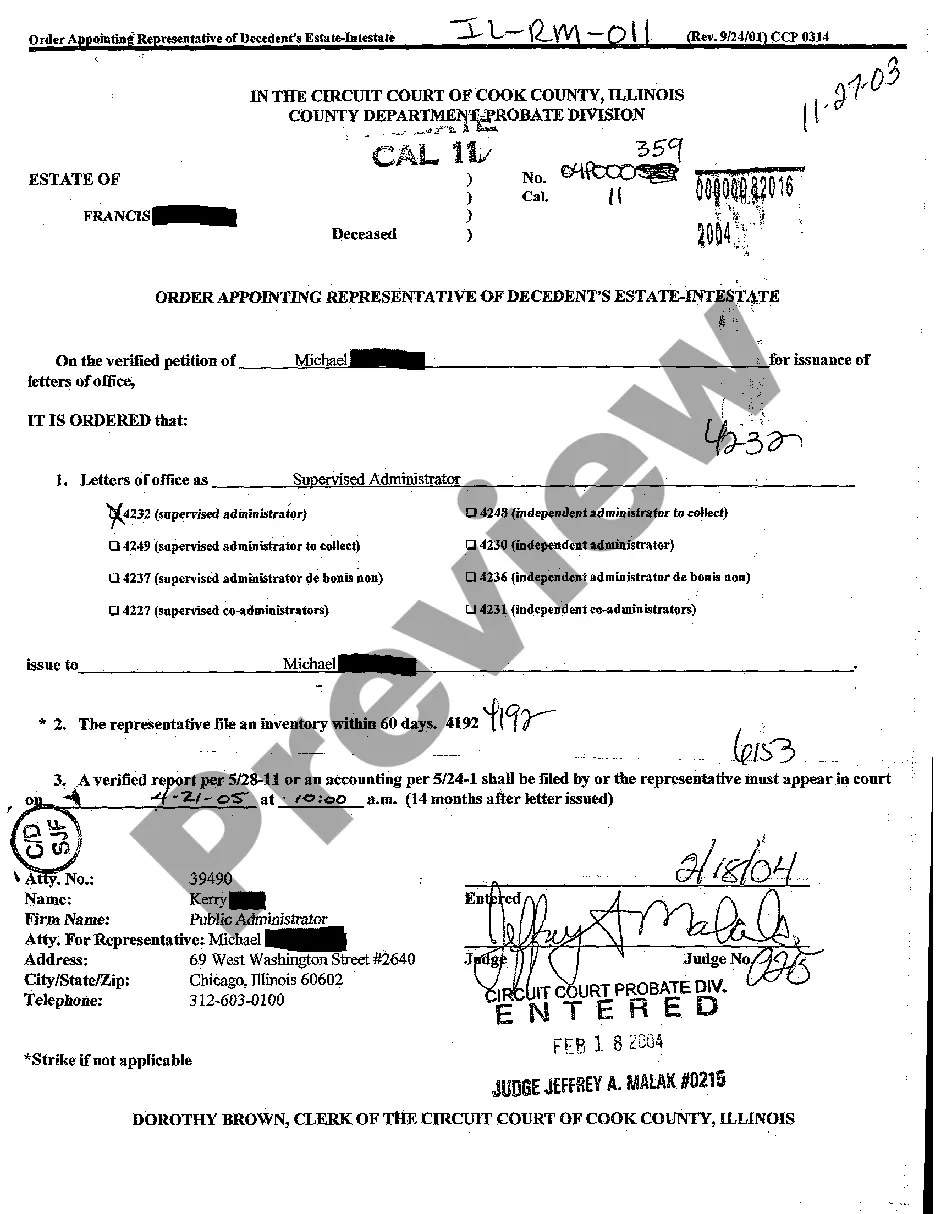

Illinois Order Admitting Will To Probate And Appointing Representative

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Order Admitting Will To Probate And Appointing Representative?

Searching for Illinois Order Admitting Will To Probate And Appointing Representative forms and completing them could pose a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the appropriate template specifically for your state in merely a few clicks.

Our legal experts prepare every document, so you only need to complete them. It truly is that simple.

Select your plan on the pricing page and create your account. Choose if you would like to pay via card or through PayPal. Download the form in your preferred format. You can print the Illinois Order Admitting Will To Probate And Appointing Representative form or fill it out using any online editor. Don’t worry about making errors since your template can be used and sent, and printed as many times as you like. Try out US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to download the sample.

- All your downloaded samples are stored in My documents and are accessible at any time for future use.

- If you haven’t registered yet, you should create an account.

- Review our detailed instructions on how to obtain the Illinois Order Admitting Will To Probate And Appointing Representative form within a few minutes.

- To get a designated form, verify its validity for your state.

- Examine the example using the Preview option (if available).

- If there is a description, read it to grasp the details.

- Click Buy Now if you found what you are looking for.

Form popularity

FAQ

On average, probate in Illinois takes no less than twelve months. The probate process must allow time for creditors to be notified, filing of required income tax returns, and the resolution of any disputes. Creditors must file any claims against the estate within six months of notification.

You can administer an estate even if the deceased died without a will or failed to specify an executor. If your relationship to the deceased doesn't make you the probate court's default choice for administrator, you'll need to get permission from the relatives ahead of you in the priority order.

Generally anyone can be your executor. The major exceptions to this are: Children under the age of 18 typically cannot be executors. Felons typically cannot be executors.

A: An Executor is disqualified generally if they are: Incapacitated (either by age, or by adjudication); A felon, convicted in any state (unless pardoned);

File the Will in Probate Court and Notify Beneficiaries. The probate process begins when a petition is filed in the local probate court to place the will into probate and appoint an executor of the estate. Give Notice to Creditors. Take Inventory of Assets. Pay Expenses From the Estate. Distribute Assets to Beneficiaries.

No, all Wills do not automatically go through the Probate Court system in Illinois after the death of the Testator (the maker of the Will). To the contrary, a majority of estates in Illinois never need a Probate proceeding to be properly administered.

The Illinois probate process is a court-supervised legal procedure that is sometimes (but not always) required after someone dies. Its purpose is to make it clear who inherits the deceased person's property and to make sure valid debts and taxes are paid.

The qualifications to serve as an executor or administrator are: 1) individual is 18 years or older; 2) a United States resident; 3) not a convicted felon; and 4) not under a legal disability.

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.