Illinois Supervised Administration Mailed Notices To Creditors is a process that is used to notify creditors of a debtor’s bankruptcy filing. In Illinois, creditors are sent a notice via mail informing them of the debtor’s status and the rights they have to collect on any outstanding debt. This process is conducted under the supervision of the Bankruptcy Court. There are three types of notices sent to creditors in Illinois Supervised Administration Mailed Notices To Creditors: 1. Notice of Bankruptcy Filing: This notice is sent to all creditors listed on the debtor’s bankruptcy petition. It contains information about the debtor’s status and the rights they have to collect on any outstanding debt. 2. Notice of Asset Sale: This notice is sent to creditors when the debtor is selling off assets. It contains information about the assets that will be sold and the rights creditors have to bid on them. 3. Notice of Bankruptcy Discharge: This notice is sent to creditors when a debtor has been discharged from bankruptcy. It contains information about the discharge and the rights creditors have to collect on any outstanding debt.

Illinois Supervised administration Mailed Notices To Creditors

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

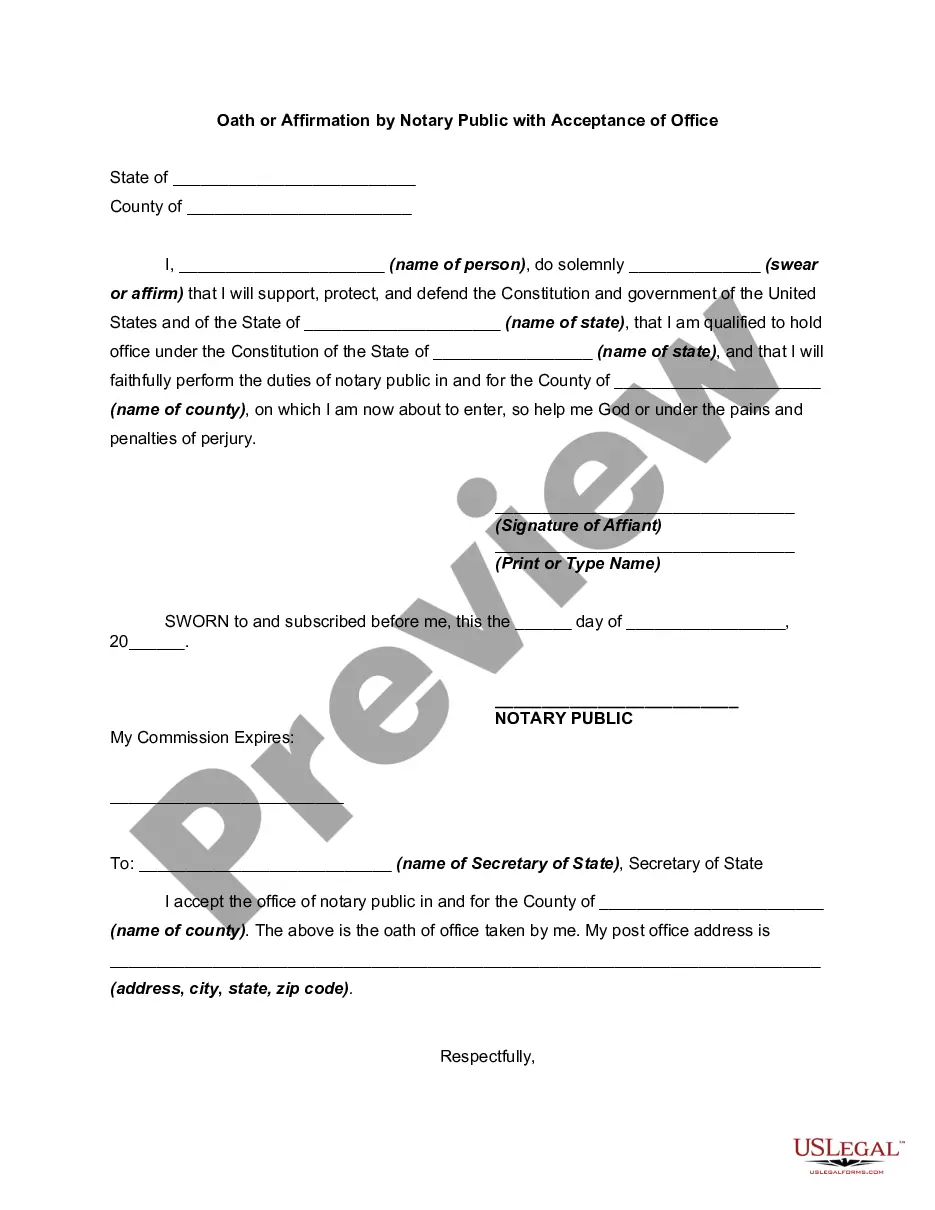

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Supervised Administration Mailed Notices To Creditors?

US Legal Forms is the easiest and most cost-effective method to find suitable legal documents.

It’s the largest online collection of business and personal legal forms created and verified by attorneys.

Here, you can discover printable and fillable forms that adhere to national and local laws - just like your Illinois Supervised administration Mailed Notices To Creditors.

Review the form description or examine the document to ensure you’ve selected one that fits your needs, or find another by using the search feature above.

Click Buy now when you are confident of its compatibility with your needs, and select the subscription plan that best suits you.

- Acquiring your form involves just a few straightforward steps.

- Users with an existing account and a valid subscription merely need to Log In to the online service and download the document to their device.

- Subsequently, they can locate it in their profile under the My documents section.

- Here’s how you can obtain a correctly drafted Illinois Supervised administration Mailed Notices To Creditors using US Legal Forms for the first time.

Form popularity

FAQ

If the decedent dies without a Will, a Petition for Letters of Administration is filed. In this Petition a close family member or friend asks the court's permission to serve as the Administrator of the estate. The court will generally appoint this person as the estate's Administrator.

18-11. Allowance and disallowance of claims by representative. (a) The representative may at any time pay or consent in writing to all or any part of any claim that is not barred under Section 18-12, if and to the extent the claim has not been disallowed by the court and the representative determines it to be valid.

California law does allow creditors to pursue a decedent's potentially inheritable assets. In the event an estate does not possess or contain adequate assets to fulfill a valid creditor claim, creditors can look to assets in which heirs might possess interest, if: The assets are joint accounts.

The executor immediately must publish a written notice in a newspaper within the county of the Probate Court to notify potential creditors of the existence of the estate and the necessity for their filing of written claims against the estate. The law in Illinois provides such creditors six months to file those claims.

Deadline to close the estate: 14 months from the date the will is admitted to probate. If the estate remains open after 14 months, the court will expect the representative to account or report to the court to explain why the estate needs to remain open.

The statute of limitations for probate claims in Illinois provides that creditors have two years from the decedent's death to file a claim against the estate. However, the representative can shorten this period by providing notice to known and unknown creditors.

6-3. Duty of executor to present will for probate.) (a) Within 30 days after a person acquires knowledge that he is named as executor of the will of a deceased person, he shall either institute a proceeding to have the will admitted to probate in the court of the proper county or declare his refusal to act as executor.

Generally, the statute of limitations for probate claims in Illinois provides that a collector has up to two years following the death of the person in question to file a claim against the estate.