Illinois Loan Modification Agreement (Providing for Fixed Interest Rate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Loan Modification Agreement (Providing For Fixed Interest Rate?

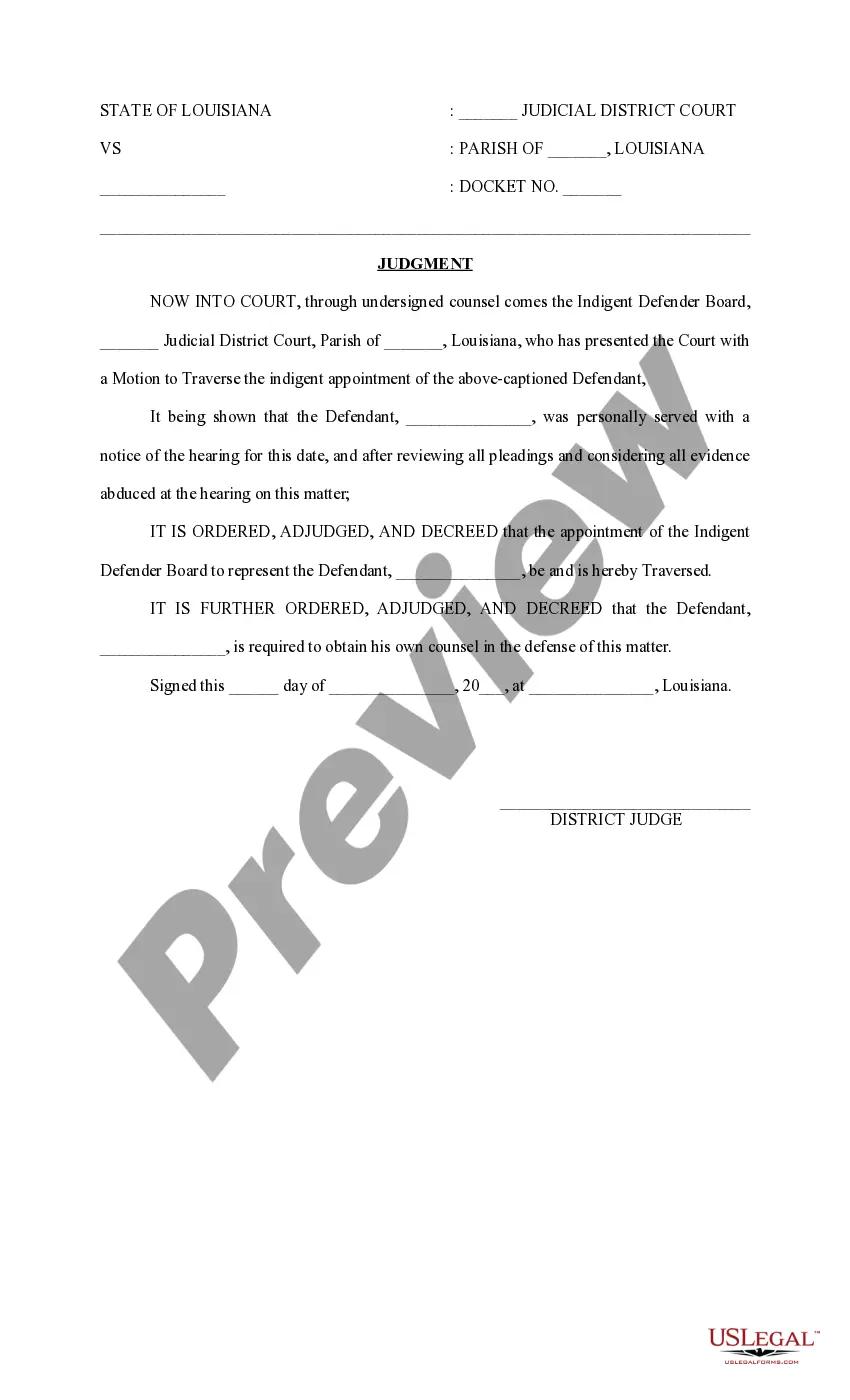

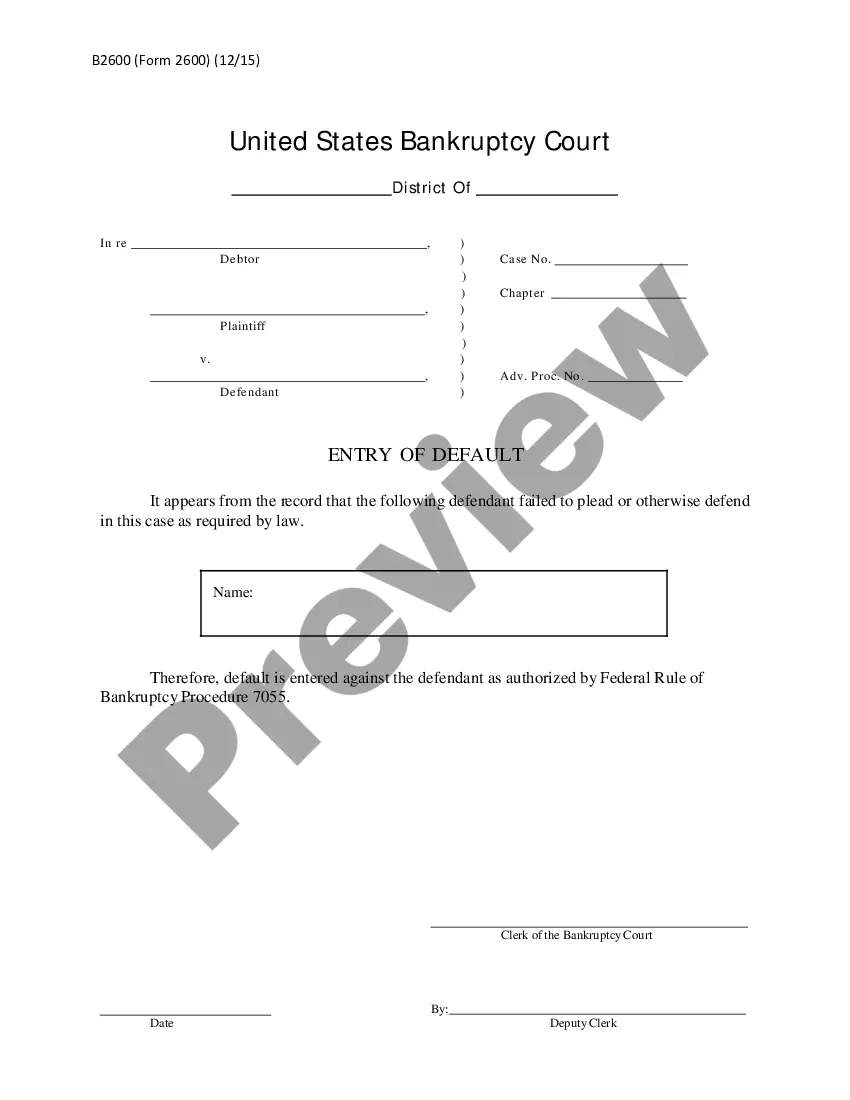

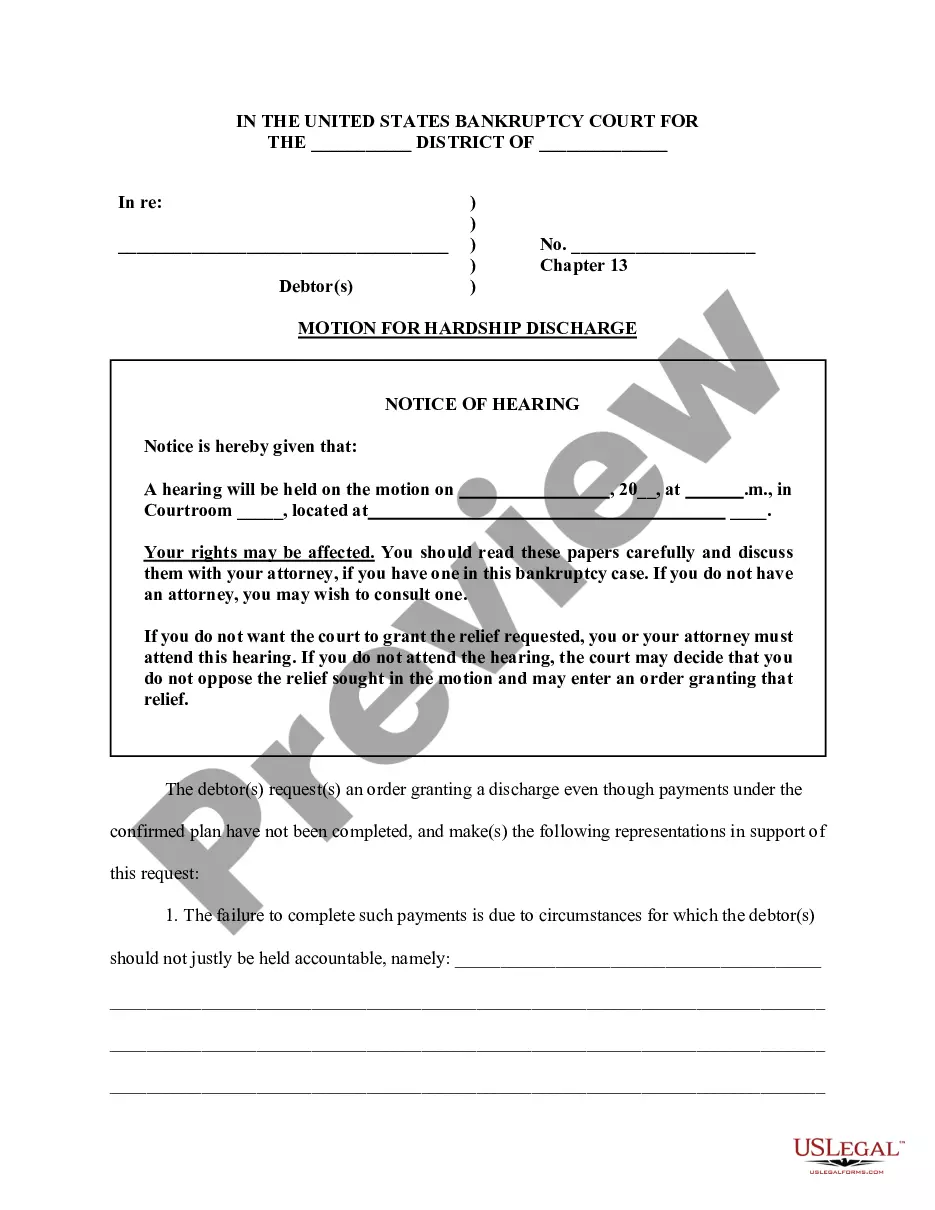

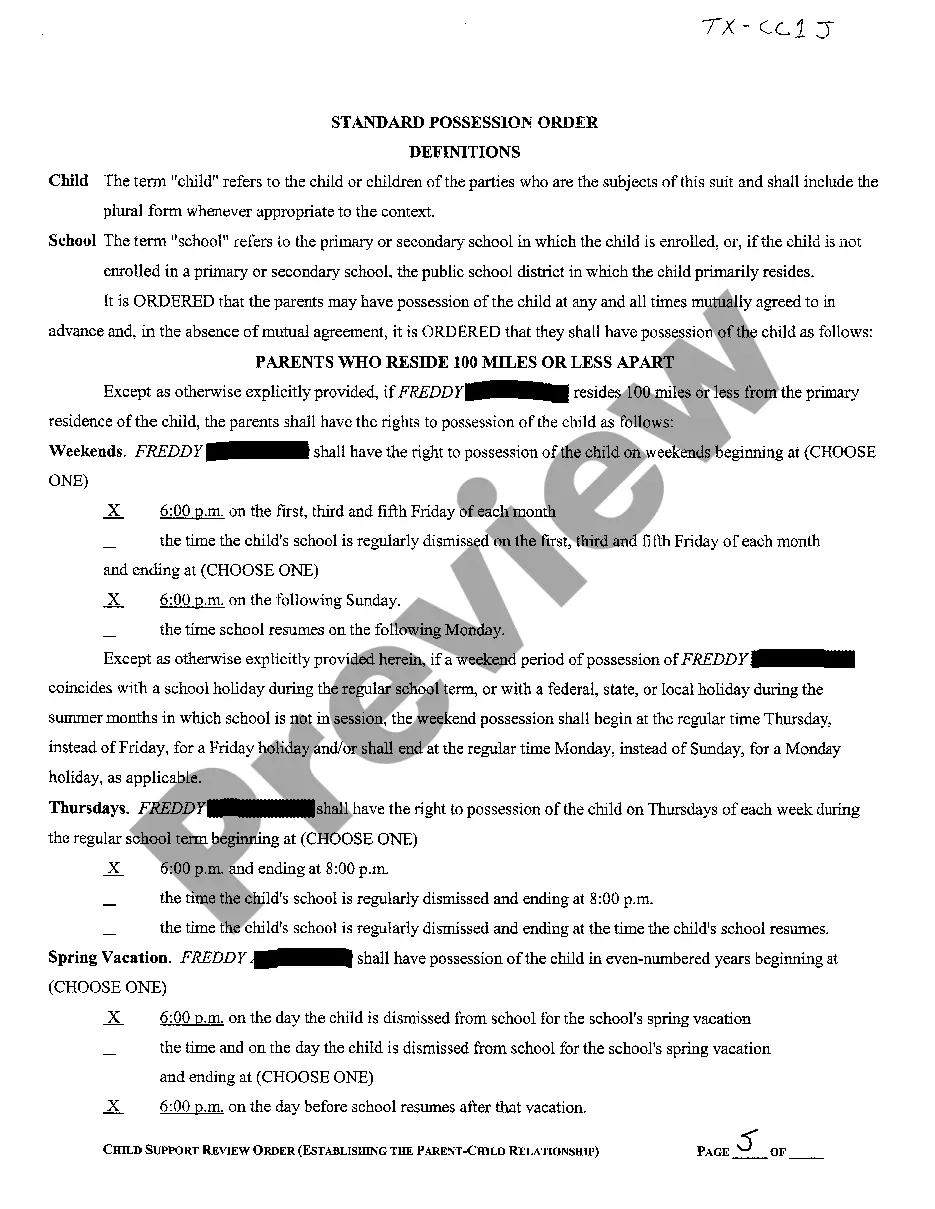

Utilize US Legal Forms to obtain a printable Illinois Loan Modification Agreement (Offering Fixed Interest Rate). Our court-acceptable documents are crafted and frequently revised by qualified attorneys.

Ours is the most all-encompassing Forms collection available online, providing budget-friendly and precise templates for individuals, legal professionals, and small to medium-sized businesses.

The files are organized into state-specific categories, and several of them can be previewed prior to downloading.

Create your account and make a payment via PayPal or credit card. Download the document to your device and feel free to use it multiple times. Employ the Search function if you need to locate another document template. US Legal Forms provides thousands of legal and tax templates and packages for both business and personal requirements, including the Illinois Loan Modification Agreement (Offering Fixed Interest Rate). More than three million users have successfully utilized our service. Choose your subscription plan and obtain high-quality forms in just a few clicks.

- To acquire templates, users must possess a subscription and sign in to their account.

- Click Download next to any form you require and locate it in My documents.

- For those lacking a subscription, adhere to the following instructions to swiftly locate and download the Illinois Loan Modification Agreement (Offering Fixed Interest Rate).

- Verify to ensure you obtain the correct form pertaining to the state it is intended for.

- Examine the form by reviewing its description and utilizing the Preview feature.

- Select Buy Now if it is the document you need.

Form popularity

FAQ

A loan modification is different from a refinance. When you take a loan modification, you change the terms of your loan directly through your lender.When you refinance, you can change your loan's term, your interest rate and even your loan type. You can also take cash out of your equity with a cash-out refinance.

If your servicer or lender agrees to a mortgage loan modification, it may result in lowering your monthly payment, extending or shortening your loan's term, or decreasing the interest rate you pay.

A loan modification can relieve some of the financial pressure you feel by lowering your monthly payments and stopping collection activity. But loan modifications are not foolproof. They could increase the cost of your loan and add derogatory remarks to your credit report.

There are several reasons to renegotiate a mortgage. Perhaps you cannot afford your mortgage, and you are at risk of falling behind in your payments, or you are already several payments late. Alternatively, you might be able to afford your mortgage but want to take advantage of lower fixed interest rates.

Just Call and Request a Lower Rate While not conventional or at all common, some folks have obtained lower interest rates simply by calling up their mortgage lender and requesting one. You need to indicate that you have no interest in refinancing with them because otherwise they'll just take you down that route.

Conventional loan modification In particular, Freddie Mac and Fannie Mae offer Flex Modification programs designed to decrease a qualified borrower's mortgage payment by about 20%.

You would avoid foreclosure and remain in your home. If you are behind on payments, you would resolve your delinquency status. You may be able to reduce your monthly payments so they are more affordable. You would suffer less damage to your credit than if the bank foreclosed on your house.

There is one way you can get a lower mortgage interest rate without refinancing, however.A mortgage modification allows you to change the original terms of your home loan due to a financial hardship. Your lender may adjust your loan by: Extending your loan term.