Illinois Promissory Note

Description

Definition and meaning

An Illinois Promissory Note is a legally binding document in which one party (the Debtor) promises to pay a specific amount of money to another party (the Creditor) under agreed-upon terms. This type of note outlines the principal amount of the loan, the interest rate, and the repayment schedule. It serves as a formal record of the debt, providing protection to both parties involved in a financial transaction.

How to complete a form

To successfully complete the Illinois Promissory Note, follow these steps:

- Identify the parties: Clearly state the names and addresses of both the Creditor and Debtor.

- Enter the loan amount: Specify the total amount being borrowed.

- Set the interest rate: Indicate the annual interest rate applicable to the loan.

- Detail the repayment plan: Outline when payments are due and the amount of each payment.

- Include any additional terms: Specify any fees, conditions for default, and security interests if applicable.

- Sign and date: Both the Creditor and Debtor must sign and date the document to make it valid.

Who should use this form

The Illinois Promissory Note is suitable for individuals or businesses that need to formalize a loan agreement. This form is commonly utilized by:

- Individual lenders and borrowers for personal loans.

- Business owners borrowing funds from investors or financial institutions.

- Families lending money to relatives.

- Real estate investors for private financing.

Key components of the form

An Illinois Promissory Note typically contains the following essential components:

- Parties involved: Identification of the Creditor and Debtor.

- Loan amount: The total sum borrowed.

- Interest rate: The percentage charged on the unpaid balance.

- Repayment schedule: Dates and amounts of payments due.

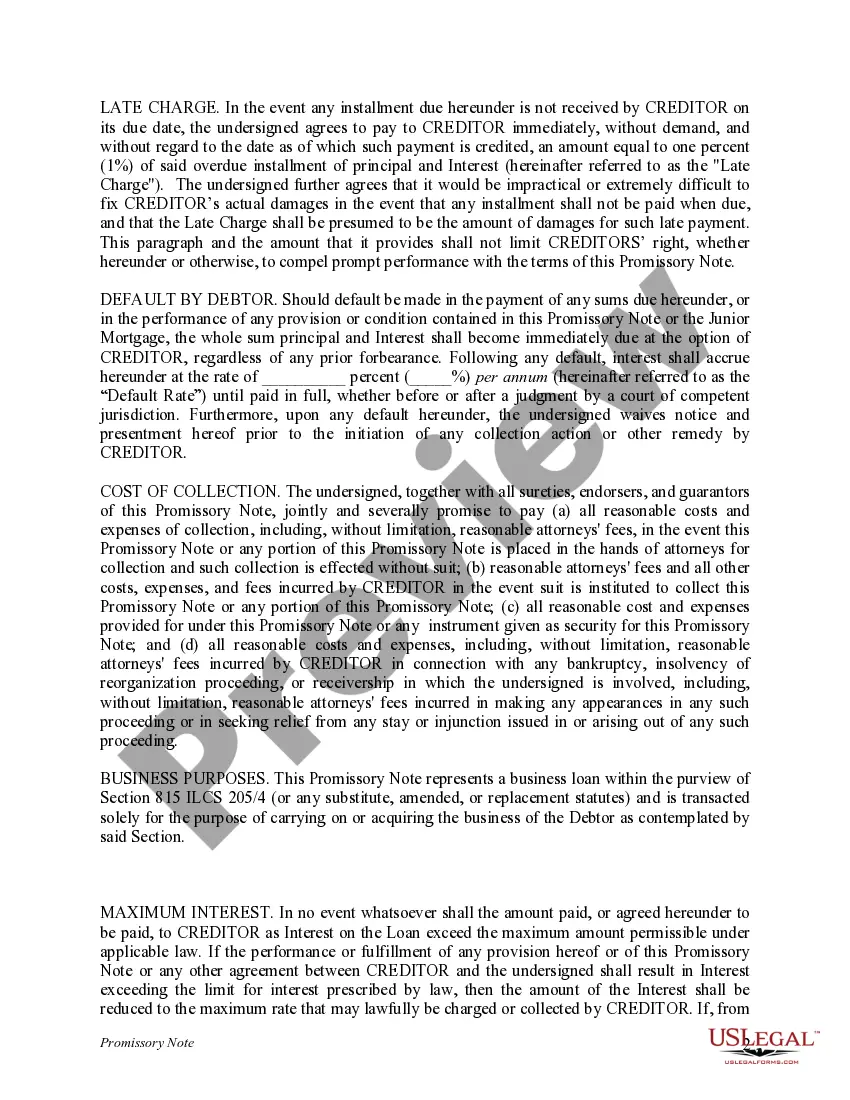

- Late charges: Terms detailing penalties for missed payments.

- Default consequences: Information on what occurs in the event of non-payment.

Common mistakes to avoid when using this form

When completing an Illinois Promissory Note, be mindful of the following common mistakes:

- Failing to include the complete names and addresses of the parties involved.

- Not specifying the interest rate or using an ambiguous rate.

- Missing signatures or dates on the document.

- Neglecting to outline the repayment schedule clearly.

- Using vague terms for late charges or default clauses.

What documents you may need alongside this one

When executing an Illinois Promissory Note, it may be helpful to have the following documents:

- Identification: Government-issued ID to verify the identities of both parties.

- Financial statements: Documents showing the Debtor's financial status, if applicable.

- Collateral documentation: Papers supporting any security interests tied to the loan.

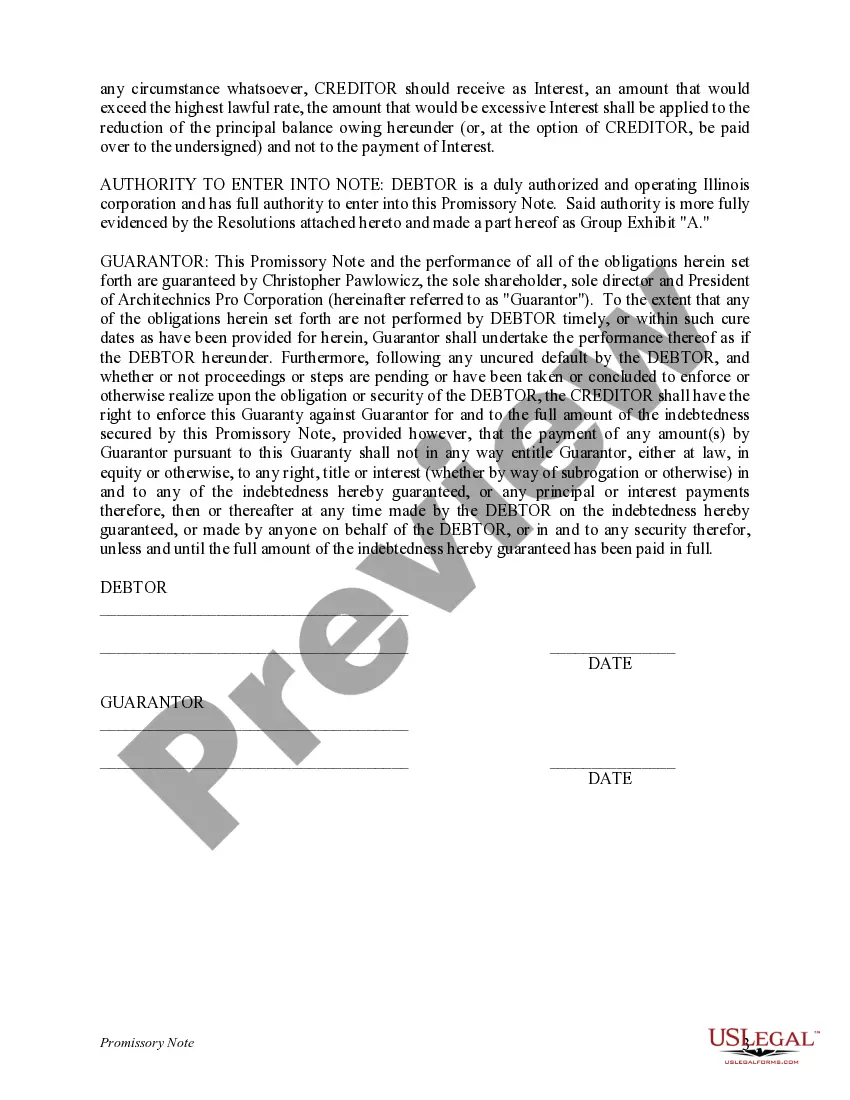

- Business resolution: If applicable, a resolution authorizing the Debtor’s representative to sign on behalf of the business.

Benefits of using this form online

Using an Illinois Promissory Note template online offers several advantages:

- Accessibility: Easy access to form templates anytime and anywhere.

- Time-saving: Instant downloads eliminate the need for physical forms.

- Customizable: Online forms can be tailored to fit specific loan arrangements.

- Accuracy: Professional templates ensure compliance with legal standards and minimal errors.

How to fill out Illinois Promissory Note?

Locating Illinois Promissory Note templates and completing them can be a struggle.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically for your state with just a few clicks.

Our attorneys create every document, so you merely have to complete them. It’s truly that straightforward.

Select your payment option on the pricing page and create your account. Choose whether to pay with a credit card or via PayPal. Save the form in your preferred format. Now you can print the Illinois Promissory Note form or fill it out using any online editor. Don't worry about typos, as your form can be used and submitted, and printed as many times as needed. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log into your account and return to the form's webpage to download the sample.

- All your downloaded templates are kept in My documents and can be accessed anytime for future use.

- If you haven’t subscribed yet, you will need to register.

- Review our detailed guidelines on how to obtain the Illinois Promissory Note sample in just a few moments.

- To get a valid template, verify its suitability for your state.

- Examine the template using the Preview feature (if available).

- If a description is provided, read it to understand the details.

- Click on the Buy Now button if you've located what you're looking for.

Form popularity

FAQ

A valid Illinois promissory note must contain specific elements, including the principal amount, interest rate, due date, and the names of the parties involved. Additionally, it should be in writing and signed by the maker of the note. These essentials ensure clarity and enforceability.

A Promissory Note must always be written by hand. It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements.

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

Amount of repayment. Repayment terms. Interest rate. Default penalties.

However, it is still smart to contact a lawyer to help you prepare a personal promissory note, even if you already used an online template. A lawyer can prepare and/or review the note to ensure that all state law requirements are included. This will help with enforceability if there are any issues down the road.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.