This Plan of Dissolution of a Law Firm covers covers all necessary topics for the dissolution of the firm. Included are: Plan of dissolution, liquidation objectives, surrender of leasehold estates, estimated balance sheet items, termination of personnel, accounts receivable billing and collecting, cash management, professional liability, and indemnity issues.

Idaho Dissolving a Law Firm

Description

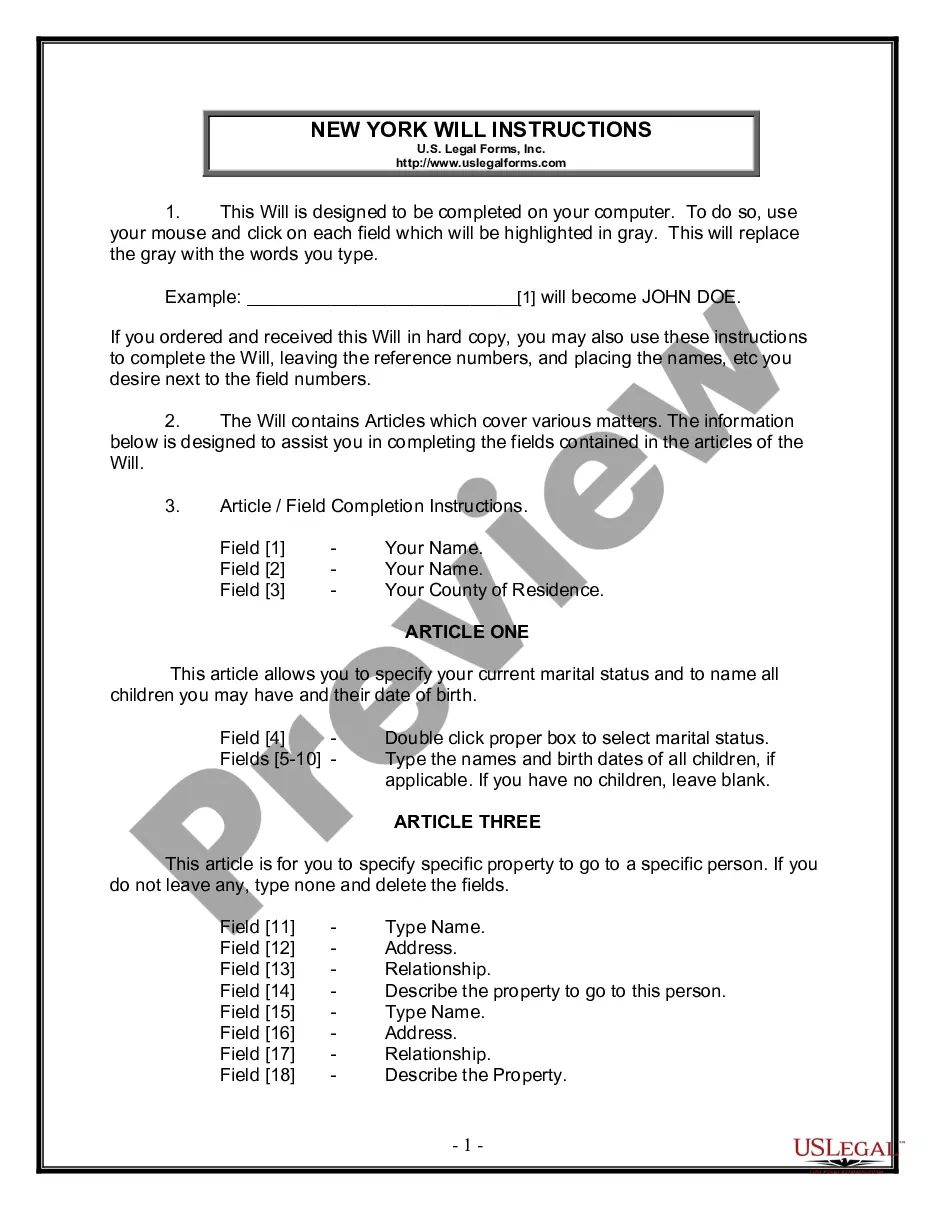

How to fill out Dissolving A Law Firm?

You are able to invest hours online trying to find the legitimate file design that meets the federal and state needs you will need. US Legal Forms provides a large number of legitimate varieties which are reviewed by experts. It is possible to down load or print the Idaho Dissolving a Law Firm from my service.

If you already possess a US Legal Forms account, it is possible to log in and click the Down load switch. After that, it is possible to total, change, print, or indication the Idaho Dissolving a Law Firm. Every legitimate file design you purchase is the one you have for a long time. To have an additional duplicate associated with a purchased type, proceed to the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms web site the very first time, follow the easy instructions beneath:

- Initially, make sure that you have selected the right file design for your area/town that you pick. Read the type outline to make sure you have picked out the right type. If accessible, utilize the Preview switch to search from the file design too.

- If you would like get an additional variation from the type, utilize the Look for field to discover the design that suits you and needs.

- Once you have identified the design you need, simply click Buy now to carry on.

- Select the pricing strategy you need, enter your accreditations, and register for your account on US Legal Forms.

- Comprehensive the purchase. You should use your charge card or PayPal account to cover the legitimate type.

- Select the file format from the file and down load it in your gadget.

- Make adjustments in your file if possible. You are able to total, change and indication and print Idaho Dissolving a Law Firm.

Down load and print a large number of file templates making use of the US Legal Forms website, which offers the greatest selection of legitimate varieties. Use specialist and state-certain templates to handle your company or individual needs.

Form popularity

FAQ

LLC ownership is personal property to its members. Therefore the operating agreement and Idaho state laws declare the necessary steps of membership removal. To remove a member from your LLC, a withdrawal notice, a unanimous vote, or a procedure depicted in the articles of organization may entail.

To dissolve your corporation in Idaho, you can sign in to your SOSBiz account and choose ?terminate business.? Or, you can provide the completed Articles of Dissolution form in duplicate to the Secretary of State by mail or in person, along with the filing fee.

To revive an Idaho LLC, you'll need to file the Reinstatement Form with the Idaho Secretary of State. You'll also have to fix the issues that led to your Idaho LLC's dissolution.

Judicial Dissolution A Court gets involved in determining how the business will be dissolved and how the assets of the business will be distributed between the owners. In a judicial dissolution, the owners of the business have voluntarily given up their ability to dissolve the company on their own.

After your board (and, where applicable, voting members) have approved the dissolution, you'll need to submit articles of dissolution to the Secretary of State (SOS). The articles of dissolution must contain: the name of your nonprofit. the date dissolution was authorized.

Dissolution is a legal process that terminates a business entity's existence. If a corporation or LLC is not properly dissolved, it continues to exist as a legal entity under state law. This means that it still faces corporate or LLC filing requirements, such as annual reports and franchise taxes.

30-25-702. WINDING UP. (a) A dissolved limited liability company shall wind up its activities and affairs and, except as otherwise provided in section 30-25-703, Idaho Code, the company continues after dissolution only for the purpose of winding up.