Idaho Dancer Agreement - Self-Employed Independent Contractor

Description

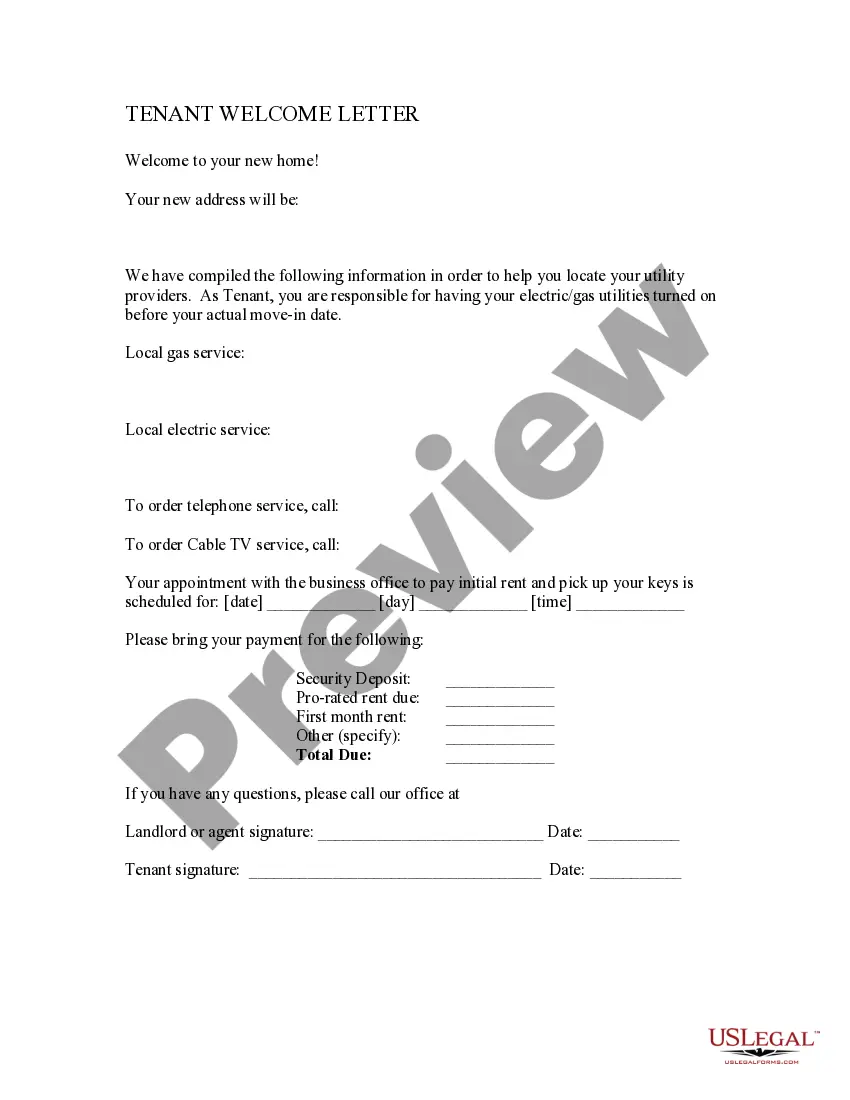

How to fill out Dancer Agreement - Self-Employed Independent Contractor?

It is feasible to spend hours online trying to locate the legal document template that fulfills the state and federal requirements you require.

US Legal Forms offers thousands of legal documents that have been evaluated by professionals.

You can easily obtain or print the Idaho Dancer Agreement - Self-Employed Independent Contractor from my service.

If available, utilize the Preview option to view the document template as well. If you wish to find another version of the form, use the Search field to locate the template that suits your needs and specifications. Once you have found the template you want, click on Buy now to proceed. Choose the pricing plan you prefer, enter your information, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal document. Select the format of the document and download it to your device. Make adjustments to your document if possible. You can fill out, modify, sign, and print the Idaho Dancer Agreement - Self-Employed Independent Contractor. Download and print thousands of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can sign in and select the Download option.

- After that, you can fill out, modify, print, or sign the Idaho Dancer Agreement - Self-Employed Independent Contractor.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click on the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the form details to confirm you have chosen the right form.

Form popularity

FAQ

Writing an independent contractor agreement involves a few key steps. Start by outlining the project details, including the services provided and payment terms. Clearly state the terms of termination and any legal obligations. You can use platforms like US Legal Forms to access templates specifically designed for the Idaho Dancer Agreement - Self-Employed Independent Contractor, making the process efficient and compliant.

Yes, independent contractors file taxes as self-employed individuals. This means you report your income and expenses on IRS Form 1040, using Schedule C to outline your business profits or losses. Additionally, it's important to keep detailed records of your earnings and any allowable expenses related to your Idaho Dancer Agreement - Self-Employed Independent Contractor. This ensures compliance with tax regulations and helps minimize liabilities.

To fill out an independent contractor agreement, begin by clearly stating the parties involved and the scope of work. Include essential details like payment terms, deadlines, and any confidentiality clauses. This document serves as the formal Idaho Dancer Agreement - Self-Employed Independent Contractor, so accuracy is crucial. Ensure both parties sign and date the agreement to make it binding.

Filling out an independent contractor form is straightforward. Start by entering your personal information, such as your name, address, and contact details. Next, detail the services you will provide as part of the Idaho Dancer Agreement - Self-Employed Independent Contractor. Finally, review the form to ensure accuracy before submission.

The classification of exotic dancers can vary, but many are considered independent contractors. This means they operate under contracts and set their own schedules, unlike traditional employees. An Idaho Dancer Agreement - Self-Employed Independent Contractor can help clarify this status and provide protections for dancers working in this unique field.

Yes, if you receive a 1099 form, you are usually classified as self-employed. This form indicates that you earned income without taxes being withheld, a hallmark of independent contractor work. With an Idaho Dancer Agreement - Self-Employed Independent Contractor, you further underscore your self-employed status and outline your working terms, reinforcing your professional identity.

In Idaho, whether you need a business license depends on your specific circumstances. Generally, independent contractors, including dancers, may need to apply for a business license to operate legally. Consulting local regulations and securing an Idaho Dancer Agreement - Self-Employed Independent Contractor can clarify your responsibilities and help ensure you meet all the required standards.

Both terms are often used interchangeably, but they do have subtle differences. Self-employed refers to anyone who runs their own business, while an independent contractor usually works on a contract basis. Using the term Idaho Dancer Agreement - Self-Employed Independent Contractor provides clarity about your role within the greater context of performing arts and business arrangement.

Yes, an independent contractor is considered self-employed. This classification means that you are running your own business rather than working for another company as an employee. An Idaho Dancer Agreement - Self-Employed Independent Contractor solidifies this relationship, outlining the terms and conditions of your work. By entering into this agreement, you affirm your status and protect your rights as an independent worker.