This due diligence questionnaire is provided to gather information required to evaluate antitrust aspects of the proposed transaction. It lists certain information that is required in order to assess the competitive consequences of the proposed acquisition, and, to determine is preparation of any required Hart-Scott-Rodino filing is necessary.

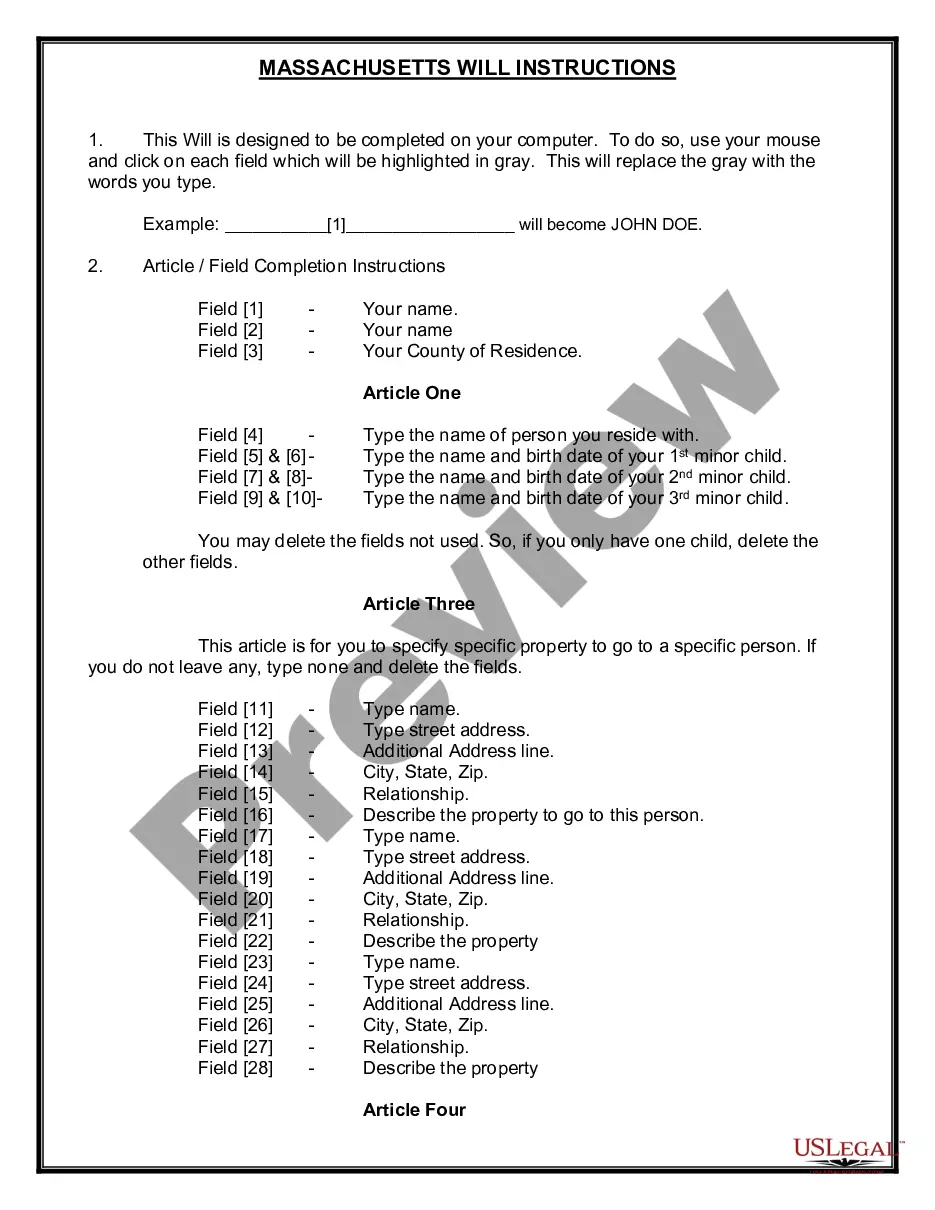

Idaho Hart Scott Rodino Questionnaire

Description

How to fill out Hart Scott Rodino Questionnaire?

You might spend hours online looking for the legal format that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that can be examined by experts.

You can download or print the Idaho Hart Scott Rodino Questionnaire from our service.

If available, utilize the Review button to examine the format as well.

- If you already possess a US Legal Forms account, you can sign in and click the Download button.

- Then, you may complete, edit, print, or sign the Idaho Hart Scott Rodino Questionnaire.

- Every legal format you obtain is yours permanently.

- To request another copy of the received form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure you have chosen the correct format for the county/city of your selection.

- Review the form outline to confirm you have selected the correct document.

Form popularity

FAQ

Hart Scott Rodino filings are partially public, but specific details may remain confidential. While the Idaho Hart Scott Rodino Questionnaire itself is accessible to the public, certain sensitive information is exempt from disclosure. Therefore, if you are looking for specific data, you might need to request it formally or consult legal guidance. USLegalForms offers support for understanding these nuances.

The responsibility for HSR filing typically falls on the acquiring party in a transaction. This means that the entity initiating the merger or acquisition must submit the Idaho Hart Scott Rodino Questionnaire. It is important to ensure that all required forms are completed accurately and submitted on time. Utilizing platforms like USLegalForms can streamline this process, making compliance easier.

Yes, the new Hart Scott Rodino (HSR) rules have been published in the Federal Register. These rules introduce important updates affecting the filing process for the Idaho Hart Scott Rodino Questionnaire. Staying informed about these changes is crucial for compliance and can help you prepare better. To access the latest information, you might visit the Federal Register's website.

A Hart Scott Rodino filing is triggered when certain thresholds regarding the size of transactions are met, specifically in terms of financial figures related to mergers or acquisitions. Both parties involved must file if the transaction exceeds these thresholds, which are subject to change. The Idaho Hart Scott Rodino Questionnaire provides essential details on these thresholds and the information needed for submission. Understanding these triggers can help you plan your business strategy effectively.

The Hart-Scott-Rodino Act aims to prevent anti-competitive practices in the marketplace by regulating mergers and acquisitions. It establishes a pre-merger notification process that allows regulatory bodies to assess the potential impact of these transactions on competition. Utilizing the Idaho Hart Scott Rodino Questionnaire can help clarify the necessary information required for compliance and ensure that your transaction aligns with legal requirements. By understanding this act, you can confidently move forward with your business plans.

A Hart Scott Rodino filing is a legal requirement for parties involved in significant mergers and acquisitions to submit information to the Federal Trade Commission and the Department of Justice. This process aims to ensure that transactions do not violate antitrust laws. Understanding the Idaho Hart Scott Rodino Questionnaire can help streamline this filing, making compliance easier and more efficient. By following the guidelines provided, you can effectively navigate this complex legal landscape.

The HSR "size of parties" threshold generally requires that one party to the transaction have annual net sales or total assets of $202 million or more (up from $184 million in 2021), and that the other party have annual net sales or total assets of $20.2 million (up from $18.4 million).

The most significant threshold in determining reportability is the minimum size of transaction threshold. This is often referred to as the $50 million (as adjusted) threshold because it started at $50 million and is now adjusted annually. For 2022, that threshold will be $101 million.

Once both parties have filed, a specific merger review timeline begins. For most but not all transactions, this starts with an initial 30-day waiting period. For cash tender offers and bankruptcies, the initial waiting period is only 15 days.

The HSR Act requires that parties to mergers and acquisitions, including acquisitions of voting securities and assets, notify the DOJ and the FTC, and observe a statutory waiting period if the acquisition meets specified size-of-person and size-of-transaction thresholds and doesn't fall within an exemption to the