This due diligence form is used to summarize data for each partnership entity associated with the company in business transactions.

Idaho Partnership Data Summary

Description

How to fill out Partnership Data Summary?

Are you situated in a location where you require documentation for either professional or personal reasons on nearly every business day.

There are numerous legal document templates accessible online, but finding ones that you can rely on isn't straightforward.

US Legal Forms provides an extensive collection of form templates, such as the Idaho Partnership Data Summary, which are designed to comply with both federal and state regulations.

Once you acquire the correct form, click on Purchase now.

Choose the pricing plan you prefer, fill in the necessary details to create your account, and pay for the order with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess your account, simply sign in.

- Next, you can download the Idaho Partnership Data Summary template.

- If you do not yet have an account and wish to begin using US Legal Forms, follow these instructions.

- Locate the form you need and verify that it is appropriate for your city/state.

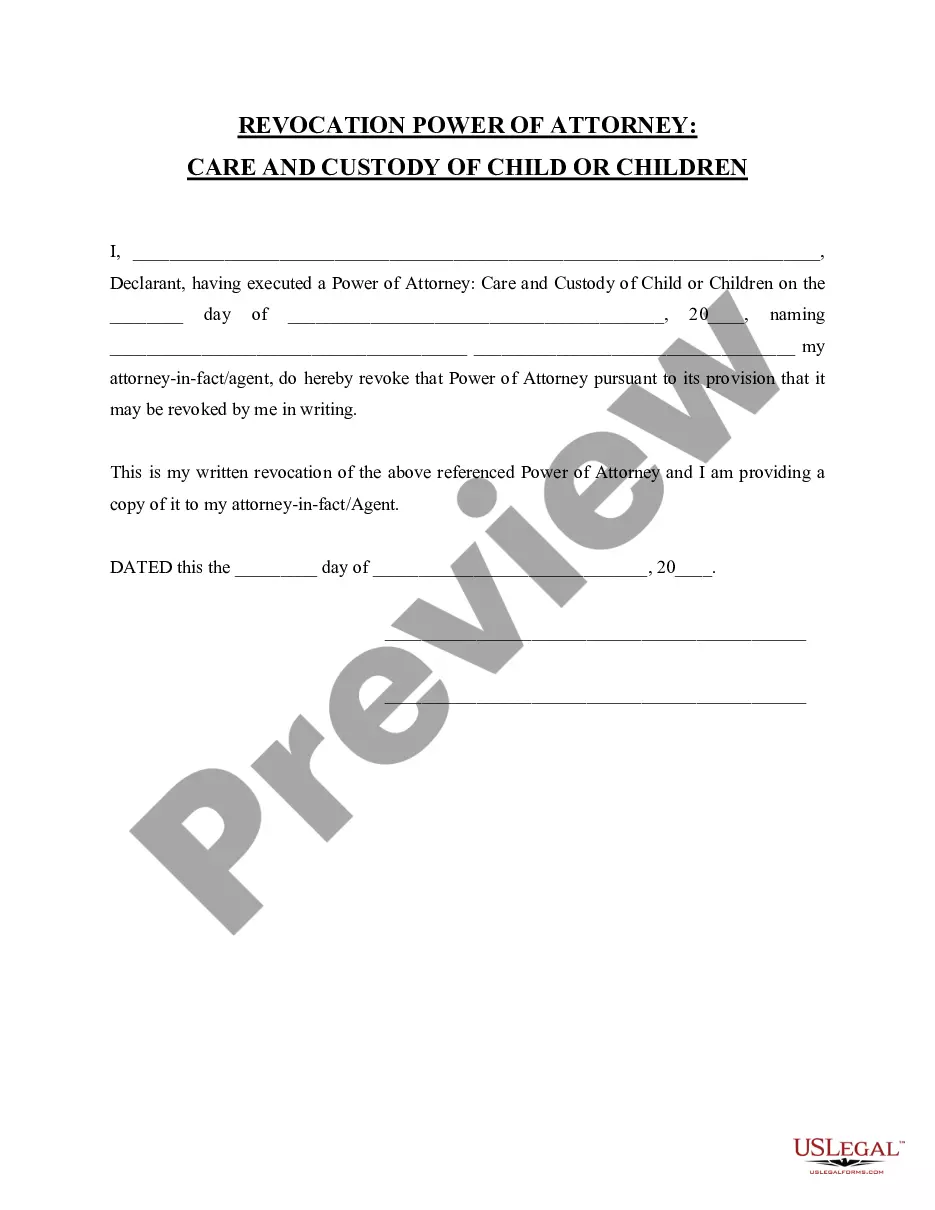

- Use the Preview button to review the document.

- Read the description to confirm that you have selected the correct form.

- If the form isn't what you're after, utilize the Search field to find the form that meets your requirements.

Form popularity

FAQ

Idaho's main source of income comes from its thriving agriculture and natural resources sectors. The state's economy benefits significantly from the production of crops such as potatoes, grains, and sugar beets, which contribute to its agricultural identity. Additionally, the mining and manufacturing industries play a vital role in generating income. By utilizing the Idaho Partnership Data Summary, you can easily access essential information about the state's economic activities and understand how various industries interact in this region.

In Idaho, various records are considered public, including vital records, court documents, and business filings. The Idaho Partnership Data Summary details specific partnerships registered within the state, allowing you to access ownership information and partnership structures. You can find this information through official state databases and services like US Legal Forms, which simplify the process of obtaining necessary partnership data. By being informed of these public records, individuals and businesses can make better decisions and foster transparency.

To file a partnership return, you need to complete IRS Form 1065 and submit it by the due date. Additionally, each partner receives a K-1, which they must include with their individual tax return. The Idaho Partnership Data Summary provides helpful insights and resources for navigating the filing process efficiently, making compliance easier for all partners involved.

Yes, K-1 distributions are generally taxed as ordinary income, depending on the nature of the income reported. Each partner must report their share of the income shown on their K-1 when filing their taxes. By understanding the Idaho Partnership Data Summary, you can better navigate how these distributions impact your tax situation and plan accordingly.

You report partnership distributions on the Schedule K-1, which partners receive at the end of the tax year. Each partner uses this information to report their share of income and distributions on their personal tax returns. The Idaho Partnership Data Summary can guide you in accurately filling out this form and ensure you comply with state regulations.

In Idaho, seniors who meet specific income criteria may qualify for a property tax deferral program starting at age 65. This benefit helps eligible seniors manage their financial responsibilities effectively. For a deeper understanding of these provisions, check out the Idaho Partnership Data Summary that encompasses various benefits available to Idaho residents.

Typically, partnerships with any form of income or partnership activity must file a return. This includes multi-member LLCs and general partnerships. Use the resources provided in the Idaho Partnership Data Summary to understand your filing obligations further.

All partnerships engaged in trade or business activities in Idaho must file an Idaho partnership return. This requirement applies to both domestic and foreign partnerships operating within the state. For detailed filing guidance, refer to the Idaho Partnership Data Summary.

Idaho's economy has shown steady growth, driven by agriculture, technology, and manufacturing sectors. Understanding the economic landscape can provide valuable insight for businesses and investors, and the Idaho Partnership Data Summary offers key data that reflects these economic conditions.

Yes, if your partnership conducts business in Idaho or has income from Idaho sources, you must file an Idaho return. It's important to understand how your business activities align with the Idaho Partnership Data Summary to ensure you meet all filing requirements.