Idaho Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment

Description

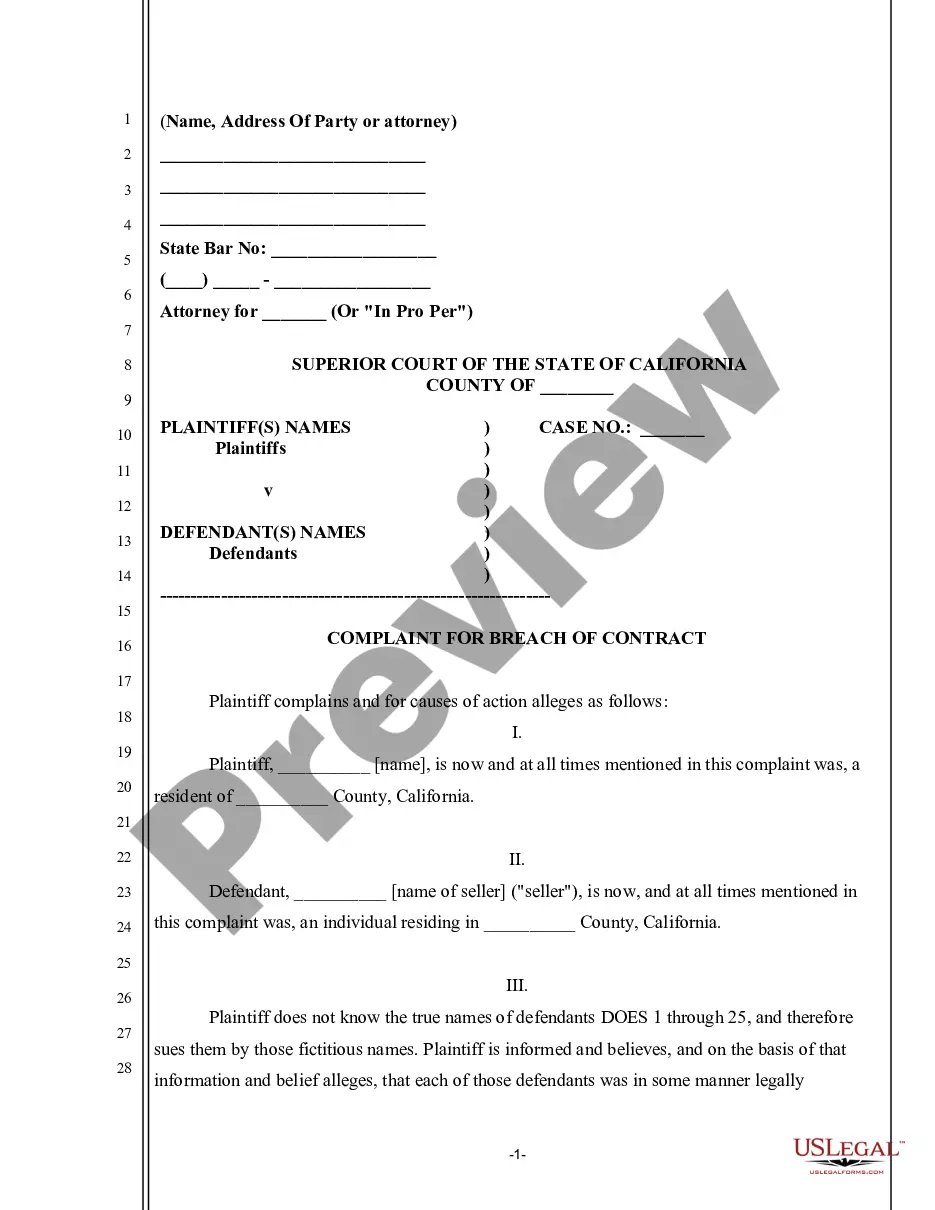

How to fill out Proposed Amendment To The Certificate Of Incorporation To Authorize Up To 10,000,000 Shares Of Preferred Stock With Amendment?

If you need to complete, download, or print out legitimate file themes, use US Legal Forms, the greatest collection of legitimate kinds, which can be found on the Internet. Utilize the site`s easy and handy look for to find the paperwork you want. Various themes for business and individual uses are categorized by classes and claims, or key phrases. Use US Legal Forms to find the Idaho Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment with a number of mouse clicks.

If you are already a US Legal Forms consumer, log in to your accounts and click the Obtain switch to have the Idaho Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment. Also you can accessibility kinds you earlier saved inside the My Forms tab of your accounts.

If you are using US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for your proper city/country.

- Step 2. Use the Review choice to look over the form`s information. Don`t forget about to see the outline.

- Step 3. If you are not happy using the develop, make use of the Search industry on top of the display to locate other variations of the legitimate develop template.

- Step 4. When you have located the shape you want, click the Buy now switch. Select the pricing strategy you prefer and include your qualifications to sign up on an accounts.

- Step 5. Method the financial transaction. You can use your Мisa or Ьastercard or PayPal accounts to perform the financial transaction.

- Step 6. Pick the formatting of the legitimate develop and download it on your own system.

- Step 7. Full, revise and print out or signal the Idaho Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment.

Each legitimate file template you acquire is the one you have eternally. You may have acces to every develop you saved inside your acccount. Click the My Forms segment and decide on a develop to print out or download again.

Be competitive and download, and print out the Idaho Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment with US Legal Forms. There are many expert and express-distinct kinds you can use for your business or individual needs.

Form popularity

FAQ

The Articles of Incorporation states the name, purpose, place of office, incorporators, capital stock, and term of the Company upon its establishment. The By-Laws outline the rules on annual and special meetings, voting, quorum, notice of meeting and auditors and inspectors of election.

Common shares represent residual ownership in a company and in the event of liquidation or dividend payments, common shares can only receive payments after preferred shareholders have been paid first.

This legal document contains general information about the corporation, that includes its business name, address and other essential information. It is the primary document of authentication of the company, and the Registrar of Companies (ROC) issues this document.

An entrepreneur needs to submit the following documents for the incorporation of a company. (a) Memorandum of association. (b) Articles of association. (c) Written approval of the proposed directors to function as directors and an undertaking to buy the qualification shares.

If the articles of incorporation of a close corporation states the number of persons, not exceeding twenty (20), who are entitled to be holders of record of its stock, and if the certificate for such stock conspicuously states such number, and if the issuance or transfer of stock to any person would cause the stock to ...

Articles of Incorporation refers to the highest governing document in a corporation. It is also known known as the corporate charter. The Articles of Incorporation generally include the purpose of the corporation, the type and number of shares, and the process of electing a board of directors.

Corporation defined. - A corporation is an artificial being created by operation of law, having the right of succession and the powers, attributes and properties expressly authorized by law or incident to its existence.