Idaho Renunciation of Legacy in Favor of Other Family Members

Description

How to fill out Renunciation Of Legacy In Favor Of Other Family Members?

You are able to invest time on the Internet trying to find the legal file template which fits the federal and state demands you require. US Legal Forms gives thousands of legal forms which are evaluated by professionals. It is simple to download or produce the Idaho Renunciation of Legacy in Favor of Other Family Members from our support.

If you already have a US Legal Forms bank account, you may log in and click the Download button. After that, you may full, edit, produce, or signal the Idaho Renunciation of Legacy in Favor of Other Family Members. Every single legal file template you purchase is yours for a long time. To obtain an additional version associated with a obtained form, proceed to the My Forms tab and click the corresponding button.

Should you use the US Legal Forms web site the first time, stick to the straightforward directions listed below:

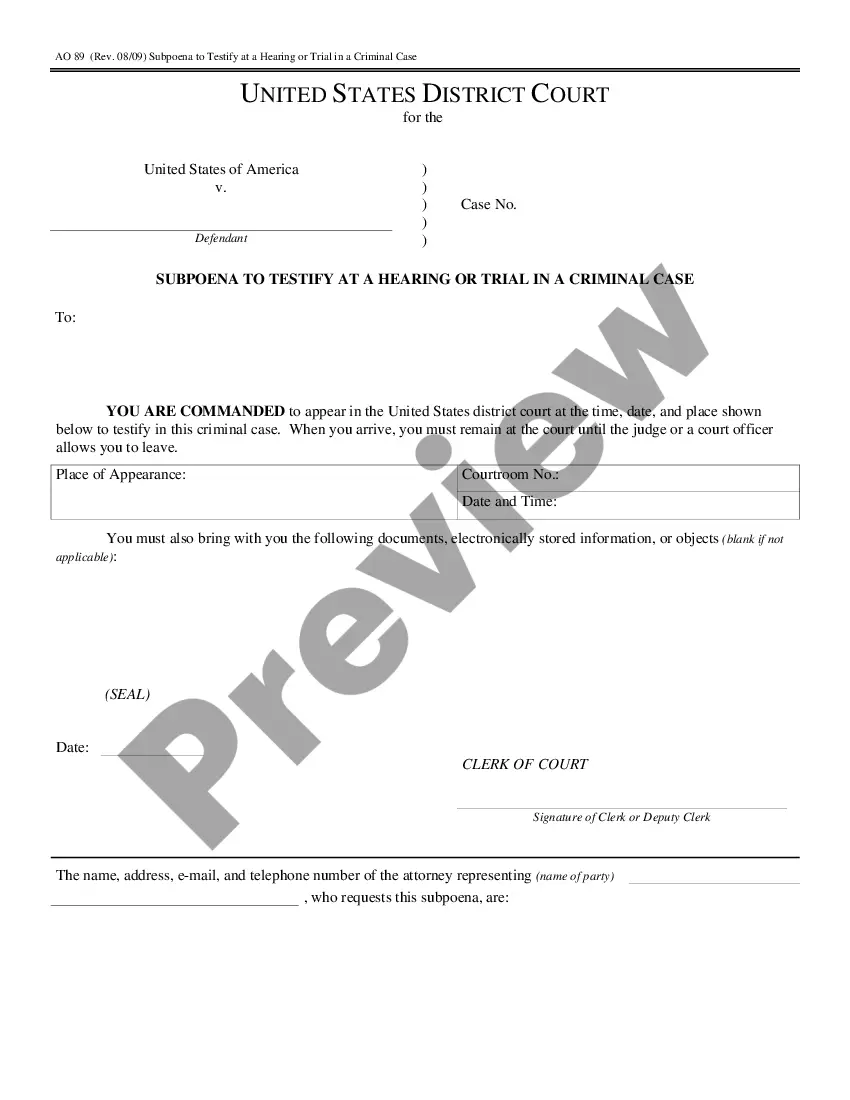

- First, make certain you have selected the proper file template for that county/area of your choosing. See the form description to make sure you have picked the proper form. If available, take advantage of the Preview button to search through the file template too.

- If you want to find an additional variation of the form, take advantage of the Research field to get the template that meets your needs and demands.

- Upon having found the template you want, just click Buy now to move forward.

- Choose the prices plan you want, type in your qualifications, and sign up for your account on US Legal Forms.

- Comprehensive the purchase. You can use your Visa or Mastercard or PayPal bank account to fund the legal form.

- Choose the format of the file and download it to your product.

- Make changes to your file if needed. You are able to full, edit and signal and produce Idaho Renunciation of Legacy in Favor of Other Family Members.

Download and produce thousands of file web templates making use of the US Legal Forms site, that offers the most important selection of legal forms. Use expert and state-specific web templates to tackle your business or personal requirements.

Form popularity

FAQ

If you have descendants, such as children, grandchildren, or great grandchildren, but no surviving spouse, they will inherit all of your intestate property. If you have descendants and a surviving spouse, the surviving spouse will inherit all of your community property and half of your separate property.

Idaho does not allow real estate to be transferred with transfer-on-death deeds.

Real Property Joint Tenancies are Still Relevant and Valid One section of Idaho's Probate Code excludes ?a survivorship interest in a joint tenancy of real estate? from the definition of a non-probate transfer.

If you die without a will (intestate), your property passes ing to the laws of Idaho. In general, a surviving spouse receives all of the community property and the spouse and children share the decedent's separate property.

Search Idaho Statutes 15-6-401. Community property with right of survivorship in real property. Any estate in real property held by a husband and wife as community property with right of survivorship shall, upon the death of one (1) spouse, transfer and belong to the surviving spouse.

15-2-803. Effect of homicide on distribution at death. (a) (1) "Slayer" shall mean any person who participates, either as principal or as an accessory before the fact, in the wilful and unlawful killing of any other person.

15-6-401. Community property with right of survivorship in real property. Any estate in real property held by a husband and wife as community property with right of survivorship shall, upon the death of one (1) spouse, transfer and belong to the surviving spouse.

Under Internal Revenue Service (IRS) rules, to refuse an inheritance, you must execute a written disclaimer that clearly expresses your "irrevocable and unqualified" intent to refuse the bequest.