Idaho Revocable Trust for House

Description

How to fill out Revocable Trust For House?

You might dedicate time online attempting to locate the legal document format that satisfies the state and federal requirements you need.

US Legal Forms offers a vast array of legal templates that are evaluated by experts.

You can download or print the Idaho Revocable Trust for House from their platform.

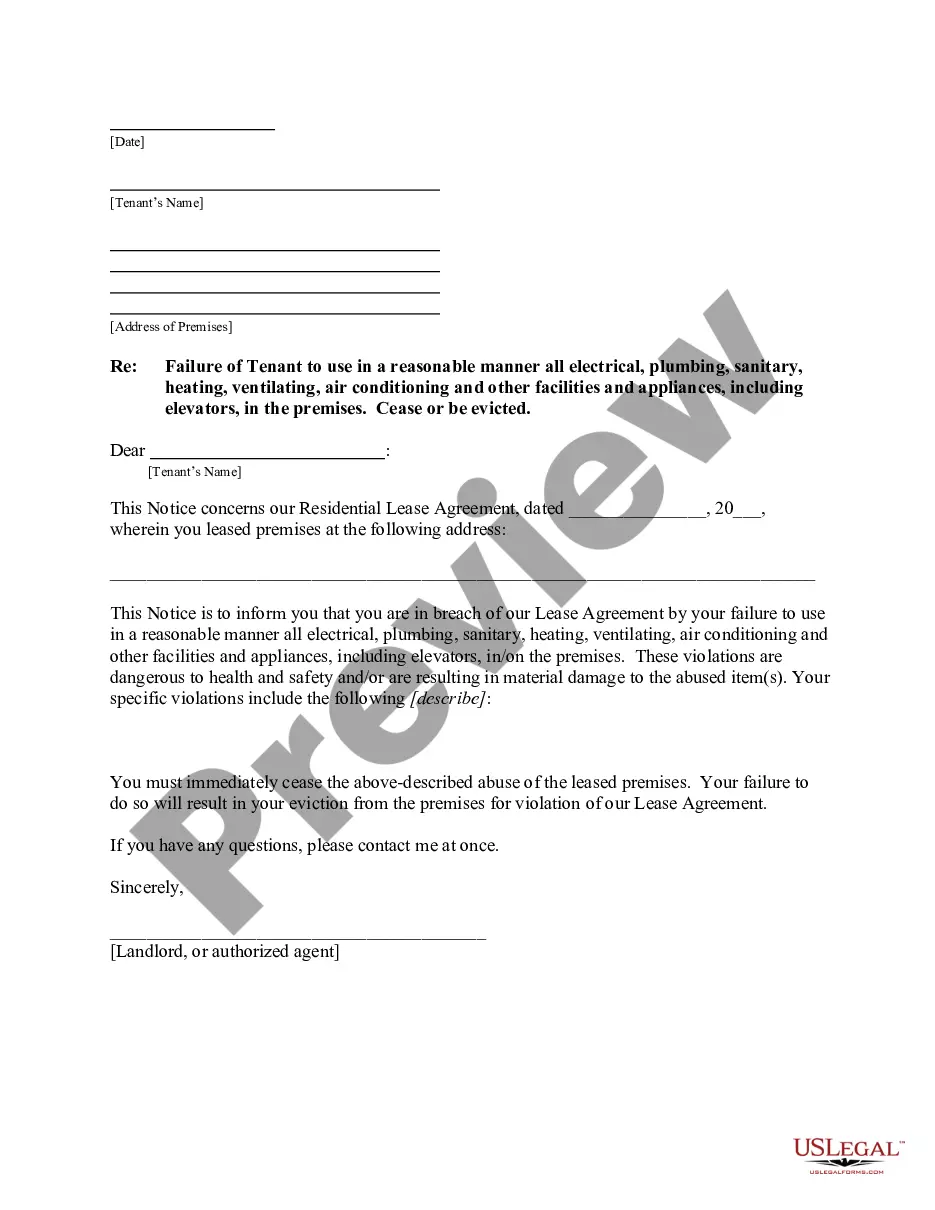

If available, use the Preview option to view the format at the same time.

- If you possess an account with US Legal Forms, you can sign in and select the Download option.

- Subsequently, you can complete, modify, print, or sign the Idaho Revocable Trust for House.

- Every legal document you obtain is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and select the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have selected the correct format for your region/city.

- Review the form description to confirm you have chosen the right document.

Form popularity

FAQ

While an Idaho Revocable Trust for House offers many benefits, you should consider a few downsides. Creating and managing the trust can incur legal fees and administrative work. Additionally, assets in the trust may not be protected from creditors. It's vital to weigh these factors against your goals for estate planning.

Deciding whether your parents should put their assets in an Idaho Revocable Trust for House can hinge on various factors, including their financial situation and estate planning goals. A trust can provide peace of mind by ensuring assets are managed according to their wishes and can simplify the transfer process. Consulting with a legal expert can help clarify whether this option is right for them.

Some disadvantages of placing your home in an Idaho Revocable Trust for House include potential restrictions on how you can manage the property. You might also face complications if you don’t keep the trust properly funded. Furthermore, if not correctly structured, it could result in increased tax liabilities or difficulties when selling.

The Idaho Revocable Trust for House is often considered an excellent option for individuals seeking a flexible and manageable solution. This type of trust allows you to retain control of your property while making essential arrangements for its future. It’s usually a good idea to consult with a legal professional to determine the best fit for your specific needs.

One disadvantage of a family trust, such as an Idaho Revocable Trust for House, is that it may require you to relinquish some control over your assets. Depending on the trust structure, you might not be able to sell or change properties as freely. Additionally, there can be tax implications or ongoing costs associated with maintaining the trust.

You may wish to put your house in an Idaho Revocable Trust for House to simplify the transfer of ownership upon your passing. This can help avoid the lengthy probate process, allowing your heirs to access the property more smoothly. Moreover, it provides a level of control over how your assets are managed during your lifetime.

To place your property in an Idaho Revocable Trust for House, you typically need to first create the trust document, which outlines your wishes. Next, execute a deed transferring your home into the trust's name. It's advisable to work with a legal expert to ensure all aspects are executed correctly, minimizing future complications.

Placing your house in an Idaho Revocable Trust for House may limit your flexibility. Once the property is in the trust, you might face challenges if you want to sell it quickly. There can also be complications if you do not properly fund the trust, which can lead to probate issues later on.

To place your house in an Idaho Revocable Trust for House, you need to execute a deed transferring ownership from your name to the trust's name. This typically involves preparing and filing the appropriate deed with your county recorder's office. It is important to follow proper procedures to maintain your trust's validity and ensure compliance with Idaho law. Uslegalforms can provide templates and guidance to simplify this process.

Yes, you can write your own trust in Idaho. However, it is crucial to ensure that the document meets all legal requirements to be valid and effective. An Idaho Revocable Trust for House should clearly outline your intentions for property management and distribution. Consider consulting a legal professional or using platforms like uslegalforms to assist you in drafting a comprehensive trust.