Idaho Receipt Template for Child Care

Description

How to fill out Receipt Template For Child Care?

If you need to aggregate, retrieve, or create official document templates, utilize US Legal Forms, the primary collection of legal forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are categorized by types and regions, or keywords.

Every legal document format you obtain is yours permanently. You have access to all forms you saved in your account.

Complete, download, and print the Idaho Receipt Template for Child Care using US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to obtain the Idaho Receipt Template for Child Care with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Idaho Receipt Template for Child Care.

- You can also retrieve forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure that you have selected the form for the correct state/region.

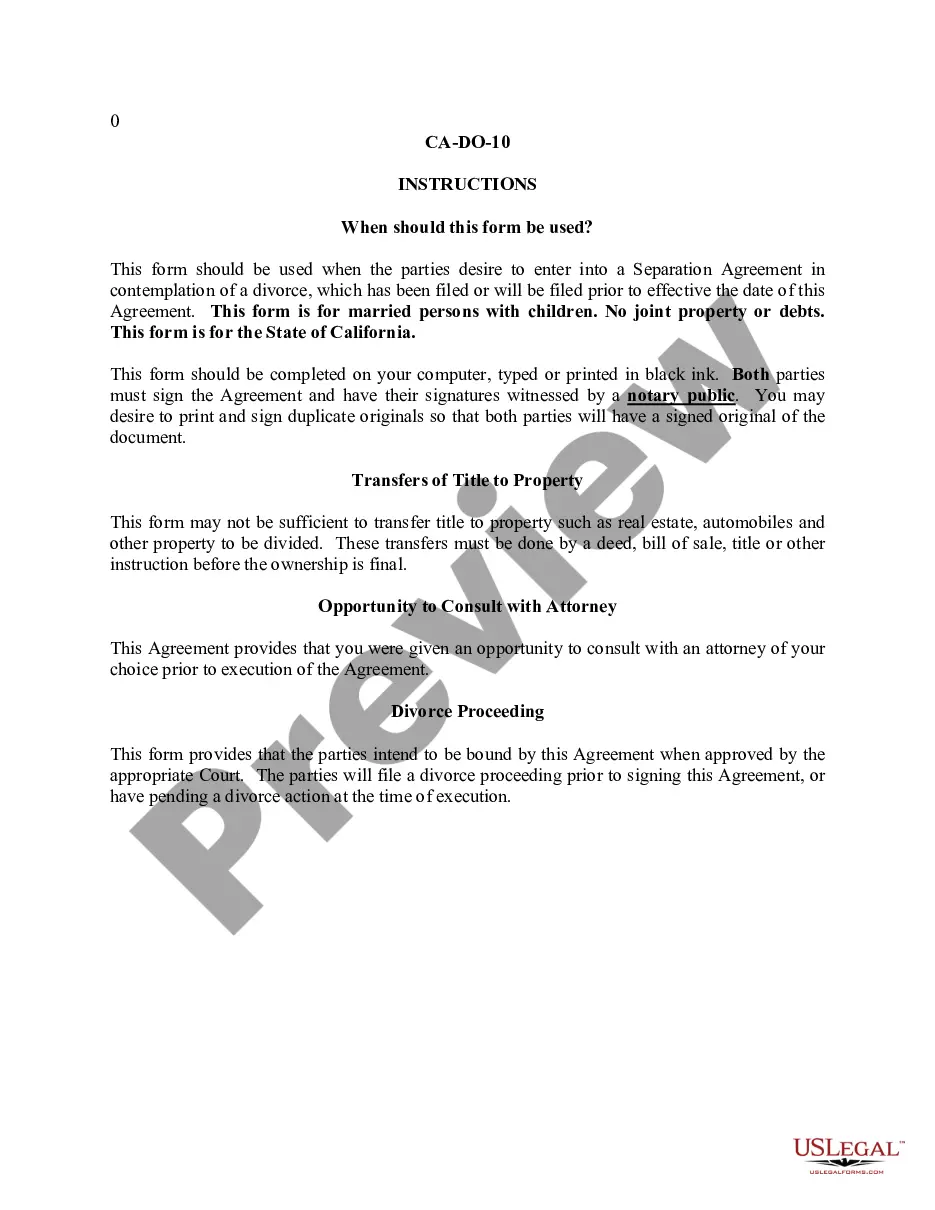

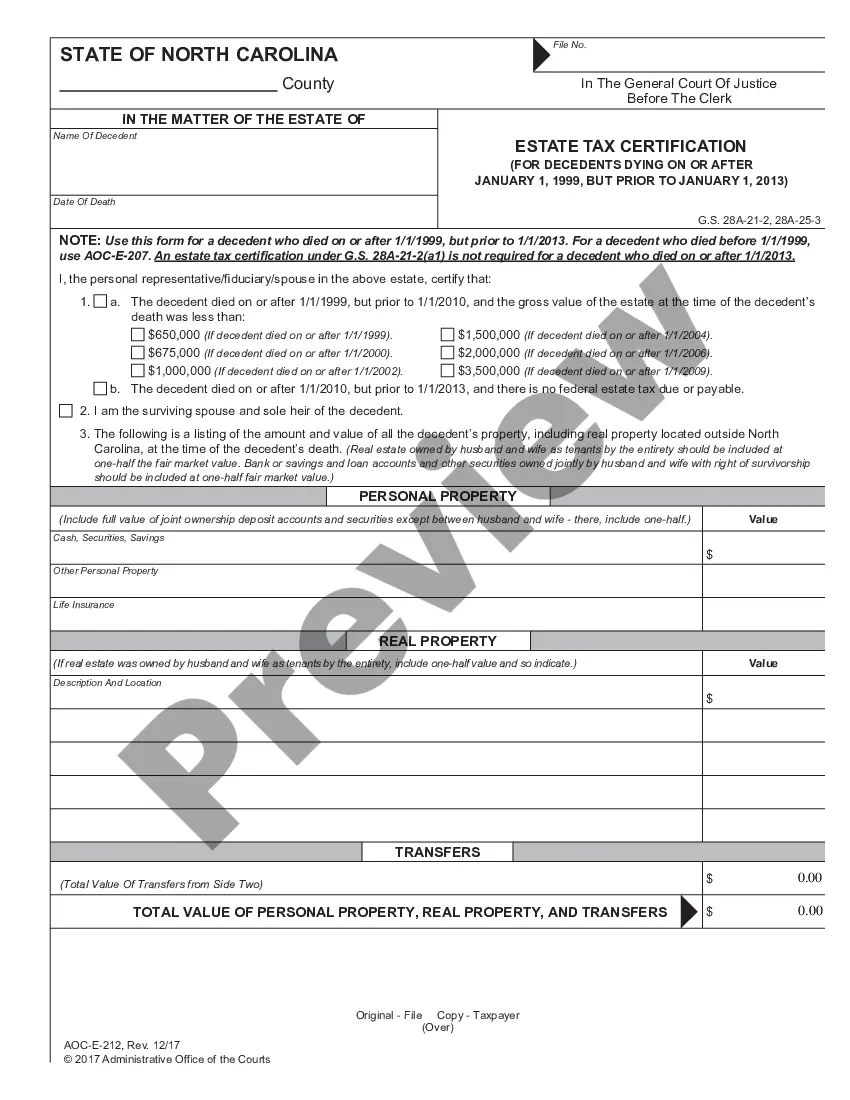

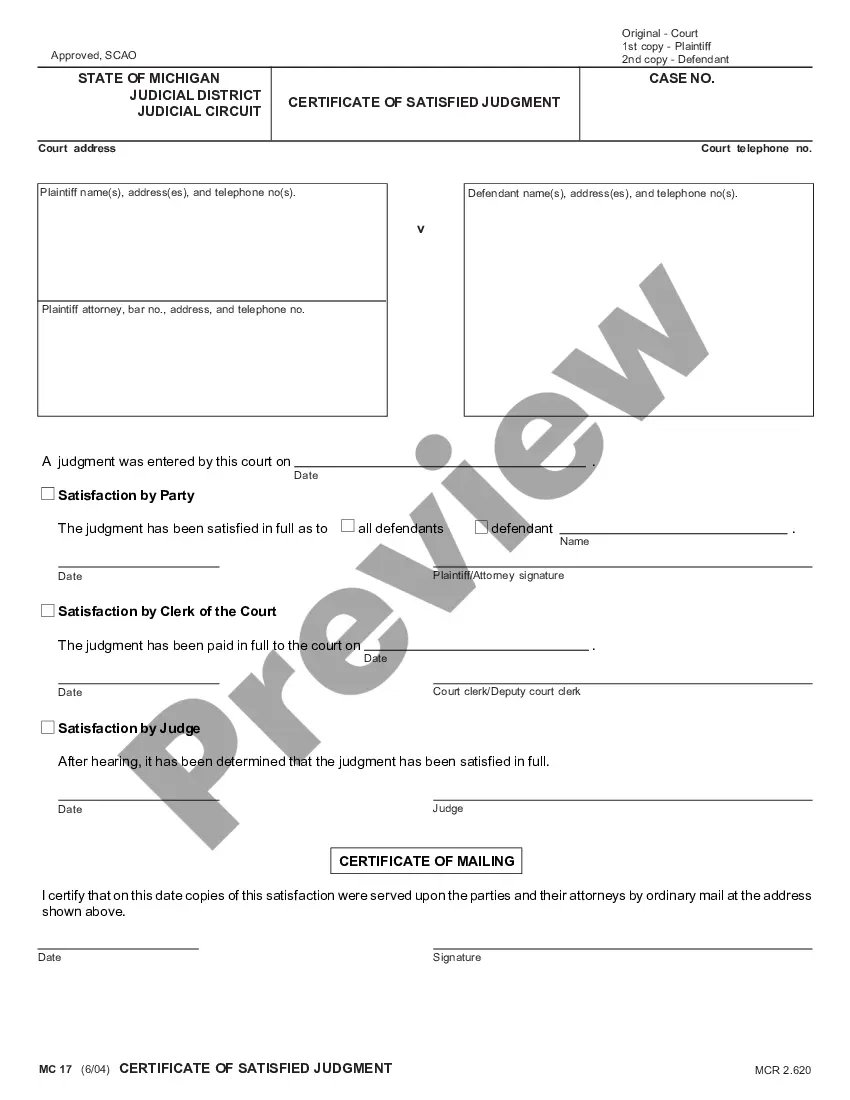

- Step 2. Use the Preview option to review the content of the form. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search feature at the top of the screen to find alternative versions of the legal document format.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your payment plan and provide your details to register for an account.

- Step 5. Complete the transaction. You can use either your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Idaho Receipt Template for Child Care.

Form popularity

FAQ

To create a babysitting invoice, include your contact information, the parent's details, and the date services were provided. Itemize the hours worked and the rate per hour, ensuring clarity and accuracy. The Idaho Receipt Template for Child Care is a valuable resource that offers a straightforward format for your babysitting invoice, making the process smoother for you and the parent.

The best wording for an invoice should be professional yet clear. Start with 'Invoice' at the top, followed by 'Bill To' with the parent's name. Include services rendered, the amount due, and a payment due date. Utilizing the Idaho Receipt Template for Child Care can help you create a concise and informative invoice that meets all these requirements effortlessly.

When writing an invoice for childcare, start with your name and contact information at the top. Include the parent's name, the child's name, the date of service, and a description of the services provided. You can simplify this process by using the Idaho Receipt Template for Child Care, which offers a clear structure for your invoice and ensures that all necessary details are included.

To claim child care expenses without receipts, you should gather any available documentation that supports your claim, such as bank statements or canceled checks. Additionally, you can use the Idaho Receipt Template for Child Care, which helps create a formal acknowledgment of payments made. It's essential to keep accurate records and provide as much information as possible to the IRS when filing your taxes.

Creating receipts for daycare is straightforward with the Idaho Receipt Template for Child Care from uslegalforms. This user-friendly template guides you in recording essential details such as payment dates, amounts, and services provided. Using this template helps both you and the parents keep track of payments, promoting transparency and trust in your child care service.

To obtain a receipt for your dependent care Flexible Spending Account (FSA), you can use the Idaho Receipt Template for Child Care from uslegalforms. This template allows you to document your child care expenses accurately. Make sure to include necessary details like provider information and dates of service. Submitting this organized receipt will help you receive your FSA reimbursements smoothly.

To create a daycare invoice, you can use the Idaho Receipt Template for Child Care provided by uslegalforms. Start by entering your daycare's name, address, and contact information. Include the services rendered, such as hours of care and the total amount due. This template ensures you provide a clear and professional invoice to parents.

Yes, the IRS often requires proof of child care expenses, especially when you’re filing for tax credits. Using the Idaho Receipt Template for Child Care helps you create a clear and detailed record that meets IRS requirements. Always include receipts and any relevant documentation to back up your claims, ensuring a smooth process during tax season.

You can itemize child care expenses by organizing your costs into specific categories such as meals, transportation, and activities. The Idaho Receipt Template for Child Care helps you keep detailed records, enabling you to separate and document each expense accurately. This approach simplifies your financial management and supports any future tax-related claims.

To prove child care, you should gather documentation such as receipts, invoices, or letters verifying services rendered. These documents act as evidence of the care provided and can help solidify any claims for child support or tax deductions. An Idaho Receipt Template for Child Care can serve as an effective tool in this process, providing a structured way to document and present care services. This level of organization can be beneficial for both tax and legal purposes.