Idaho Limited Liability Partnership Agreement

Description

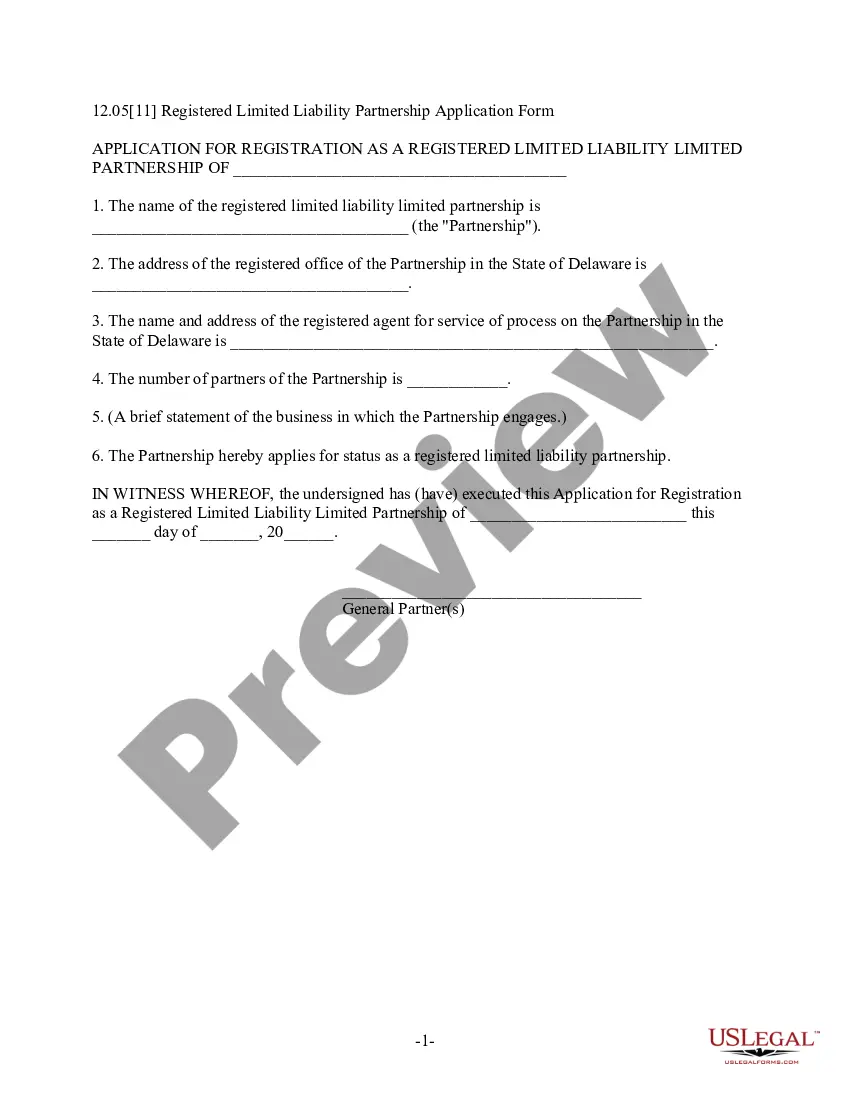

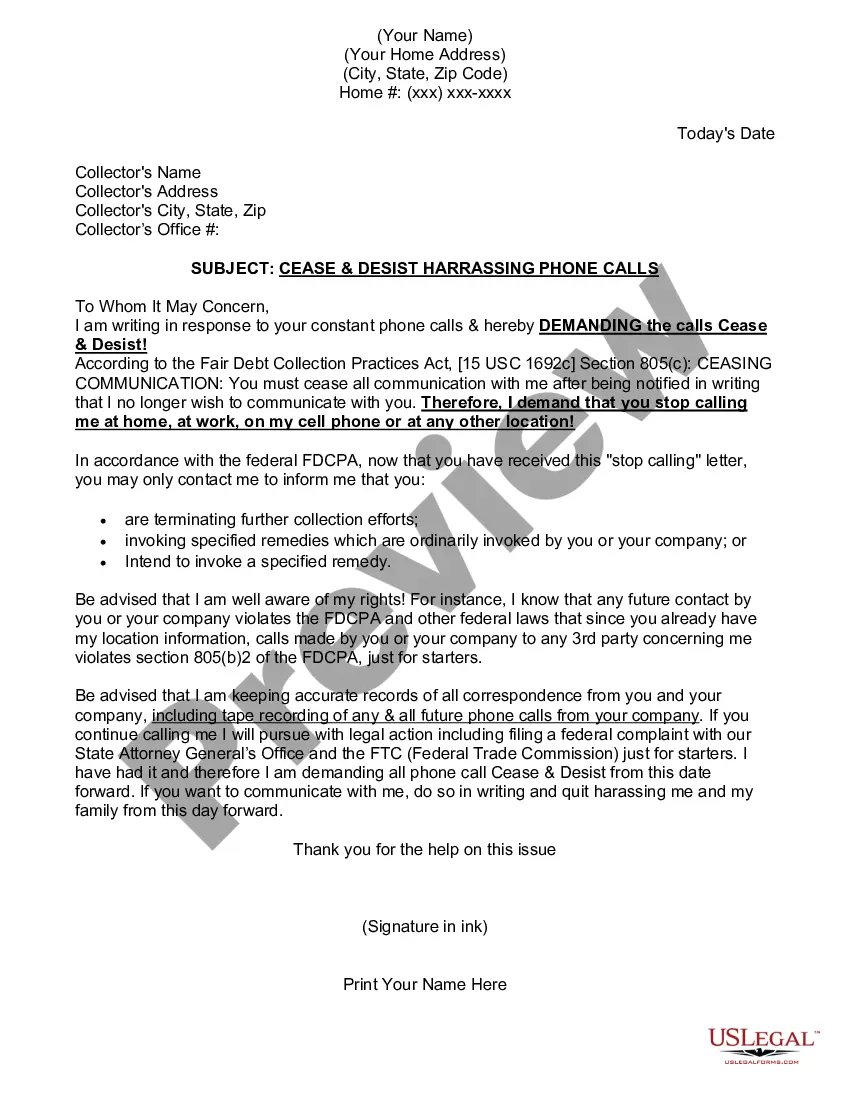

How to fill out Limited Liability Partnership Agreement?

US Legal Documents - one of the largest collections of legal forms in the United States - offers a broad selection of legal document templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can find the newest forms like the Idaho Limited Liability Partnership Agreement in just a few minutes.

If you possess an account, Log In and obtain the Idaho Limited Liability Partnership Agreement from your US Legal Documents library. The Download option will be available on every form you view.

Select the format and download the form to your device.

Make modifications. Fill out, edit, print, and sign the saved Idaho Limited Liability Partnership Agreement.

- If you are using US Legal Documents for the first time, here are simple tips to get started.

- Ensure you have chosen the correct form for your city/county. Click the Review option to review the form's content.

- Check the form description to ensure you have selected the appropriate document.

- If the form does not suit your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now option. Then, choose the pricing plan you prefer and provide your details to register for an account.

- Process the payment. Use a credit card or PayPal account to complete the transaction.

Form popularity

FAQ

In Idaho, a member of an LLC refers to an owner of the company, while a manager is responsible for the day-to-day operations. Members have equity in the LLC and can take part in decision-making processes, whereas managers can be members or non-members appointed to handle specific tasks. Understanding these roles is essential when drafting your Idaho Limited Liability Partnership Agreement to ensure proper governance.

In Idaho, LLCs are typically treated as pass-through entities by default. This means that the profits and losses pass through to your personal tax return, avoiding double taxation. However, you can also elect for your LLC to be taxed as a corporation if that suits your business needs better. It's advisable to review your Idaho Limited Liability Partnership Agreement with a tax professional for tailored guidance.

An LLC, or Limited Liability Company, offers several benefits in Idaho. It protects your personal assets from business liabilities, allowing you to separate your finances. Moreover, an LLC can provide tax flexibility, enabling you to choose how you want to be taxed, whether as a corporation or a pass-through entity. Additionally, if you have an Idaho Limited Liability Partnership Agreement, it can enhance your business's credibility.

Yes, Idaho allows single-member LLCs to operate legally without any partners. This flexibility enables entrepreneurs to maintain full control of their business. Having an Idaho Limited Liability Partnership Agreement, even for a single-member LLC, is wise as it sets out your business’s framework and can protect your personal assets.

While not a requirement in Idaho, an operating agreement serves as an important document for your LLC. It details the governance structure and operating procedures, which can prevent misunderstandings among members. By having an Idaho Limited Liability Partnership Agreement, you enhance your business’s credibility and provide a reference point for resolving disputes.

Idaho does not legally require LLCs to have an operating agreement, but it is highly recommended. An operating agreement outlines the management structure, member responsibilities, and financial agreements among members. By creating an Idaho Limited Liability Partnership Agreement, you can make clear arrangements that prevent conflicts and ensure smooth operations.

Idaho Code 30-25-409 pertains to the management structure of a Limited Liability Partnership (LLP) in Idaho. This code dictates how management decisions are made and outlines the rights and responsibilities of partners. Understanding this code is vital when creating an Idaho Limited Liability Partnership Agreement, as it helps establish how your business will be governed.

The three primary requirements of a limited partnership include having at least one general partner responsible for daily operations, one or more limited partners whose liability is capped to their investment, and a clearly written partnership agreement detailing all terms. Meeting these requirements protects all partners and ensures clarity in the partnership's operation. An Idaho Limited Liability Partnership Agreement can assist in fulfilling these legal prerequisites efficiently.

Writing a simple partnership agreement involves outlining the business's name, purpose, and the contributions of each partner. Ensure you specify how profits and losses will be shared, and include a plan for resolving disputes. Adopting an Idaho Limited Liability Partnership Agreement can help clarify these points, leading to smoother collaboration among partners.

To write a limited partnership agreement, start by clearly defining the roles of general and limited partners, along with their contributions and profit-sharing arrangements. It's vital to include terms for decision-making, dispute resolution, and changes in partnership structure. Using an Idaho Limited Liability Partnership Agreement template can streamline the drafting process while ensuring that all essential elements are included.