Idaho Declare None - Resolution Form - Corporate Resolutions

Description

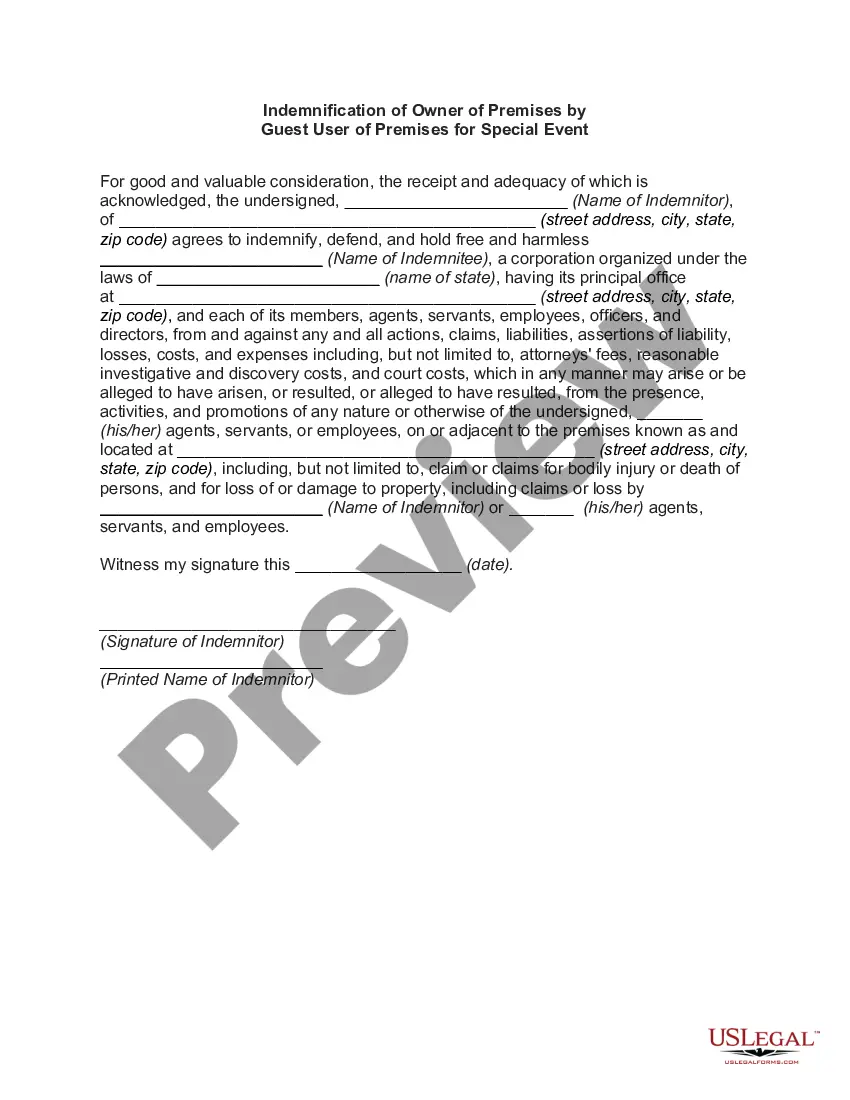

How to fill out Declare None - Resolution Form - Corporate Resolutions?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can purchase or print. By using the website, you can access numerous forms for business and personal needs, organized by categories, states, or keywords.

You can find the latest versions of forms like the Idaho Declare None - Resolution Form - Corporate Resolutions in just moments.

If you already have a subscription, Log In and obtain the Idaho Declare None - Resolution Form - Corporate Resolutions from the US Legal Forms library. The Download option will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finish the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Idaho Declare None - Resolution Form - Corporate Resolutions. Each format you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Access the Idaho Declare None - Resolution Form - Corporate Resolutions with US Legal Forms, the most extensive library of legal document templates. Enjoy a plethora of professional and state-specific templates that cater to your business or personal requirements.

- If you want to use US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the correct form for your city/region.

- Click on the Review option to check the form's content.

- Examine the form description to confirm you have chosen the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

Your Idaho state tax return should be mailed to the address provided in the instruction booklet for your forms. Many people send their returns to the Idaho State Tax Commission in Boise, but it’s best to verify. For smoother handling of your corporate matters, consider using resources regarding the Idaho Declare None - Resolution Form - Corporate Resolutions.

Mail Idaho form 41 to the address listed in its instructions. Typically, this is directed to the Idaho State Tax Commission. Ensure you double-check the mailing address, as it can change. Correctly filing documents like the Idaho Declare None - Resolution Form - Corporate Resolutions can avoid processing delays.

Yes, you can use a PO Box for your LLC in Idaho when registering your business. However, it's essential to provide a physical location for official documents, such as the Idaho Declare None - Resolution Form - Corporate Resolutions. Always check with local regulations to ensure compliance when using a PO Box.

To file for an S Corp in Idaho, you need to complete the necessary forms, including form 2553 to elect S Corporation status. You can submit the return online or by mail, following state-specific instructions. Additionally, using platforms like uslegalforms can help ensure you properly manage corporate resolutions, including the Idaho Declare None - Resolution Form - Corporate Resolutions.

To email the Idaho State Tax Commission, you can find the appropriate email address on their official website. Their contact page generally lists different departments, making it easy to reach the right one. For inquiries related to the Idaho Declare None - Resolution Form - Corporate Resolutions, consider including specifics in your email to expedite the response.

You can file your Idaho state taxes electronically through approved online platforms, or you can file by mailing your completed forms. If you prefer the latter, ensure you send your tax forms to the Idaho State Tax Commission. Using reliable services helps streamline filing processes like the Idaho Declare None - Resolution Form - Corporate Resolutions.

You should mail Idaho form 40 to the address specified in the instruction booklet accompanying the form. Generally, it is sent to the Idaho State Tax Commission in Boise. Always ensure you check for the most up-to-date mailing information to avoid delays in processing your Idaho Declare None - Resolution Form - Corporate Resolutions.

Yes, you can file Idaho taxes online through the Idaho State Tax Commission's website or other authorized e-filing services. Many taxpayers find this method convenient and efficient. Additionally, using online services simplifies the filing process for forms like the Idaho Declare None - Resolution Form - Corporate Resolutions.

The Equal Protection Clause in the Idaho Constitution guarantees that no person shall be denied equal protection under the law. This principle seeks to prevent discrimination and unequal treatment by the state. As you engage in corporate governance and prepare your Idaho Declare None - Resolution Form - Corporate Resolutions, consider how these legal protections may impact your organization's policies and practices.

A concurrent resolution in Idaho is a legislative measure that requires approval from both the House and the Senate but does not require the governor's signature. These resolutions can express the sentiment of the legislature or recognize specific events. Familiarizing yourself with concurrent resolutions can enhance your understanding of legislative processes while preparing for any related corporate resolutions.