Idaho General Guaranty and Indemnification Agreement

Description

How to fill out General Guaranty And Indemnification Agreement?

Selecting the optimal legal document format can be a challenge. Naturally, there are numerous templates available online, but how will you find the legal format you require? Visit the US Legal Forms website.

This service offers a wide array of templates, such as the Idaho General Guaranty and Indemnification Agreement, which you can utilize for both business and personal purposes. All of the templates are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to acquire the Idaho General Guaranty and Indemnification Agreement. Use your account to browse the legal templates you may have previously purchased. Navigate to the My documents tab of your account to retrieve another copy of the document you need.

Fill out, modify, print, and sign the obtained Idaho General Guaranty and Indemnification Agreement. US Legal Forms is the largest repository of legal templates where you can find various document formats. Use the service to download properly crafted papers that comply with state requirements.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have chosen the correct template for your area/state. You can review the document using the Review button and check the document description to confirm it is suitable for you.

- If the template does not fulfill your needs, use the Search feature to find the right one.

- Once you are confident that the template is appropriate, click on the Get now button to obtain the document.

- Select the pricing plan you prefer and input the required information. Create your account and finalize your order using your PayPal account or credit card.

- Choose the file format and download the legal document format to your device.

Form popularity

FAQ

An indemnity is a contract by one party to keep the other harmless against loss, but a contract of guarantee is a contract to answer for the debt, default or miscarriage of another who is to be primarily liable to the promisee .

Company/Business/Individual Name shall fully indemnify, hold harmless and defend and its directors, officers, employees, agents, stockholders and Affiliates from and against all claims, demands, actions, suits, damages, liabilities, losses, settlements, judgments, costs and expenses (including but not

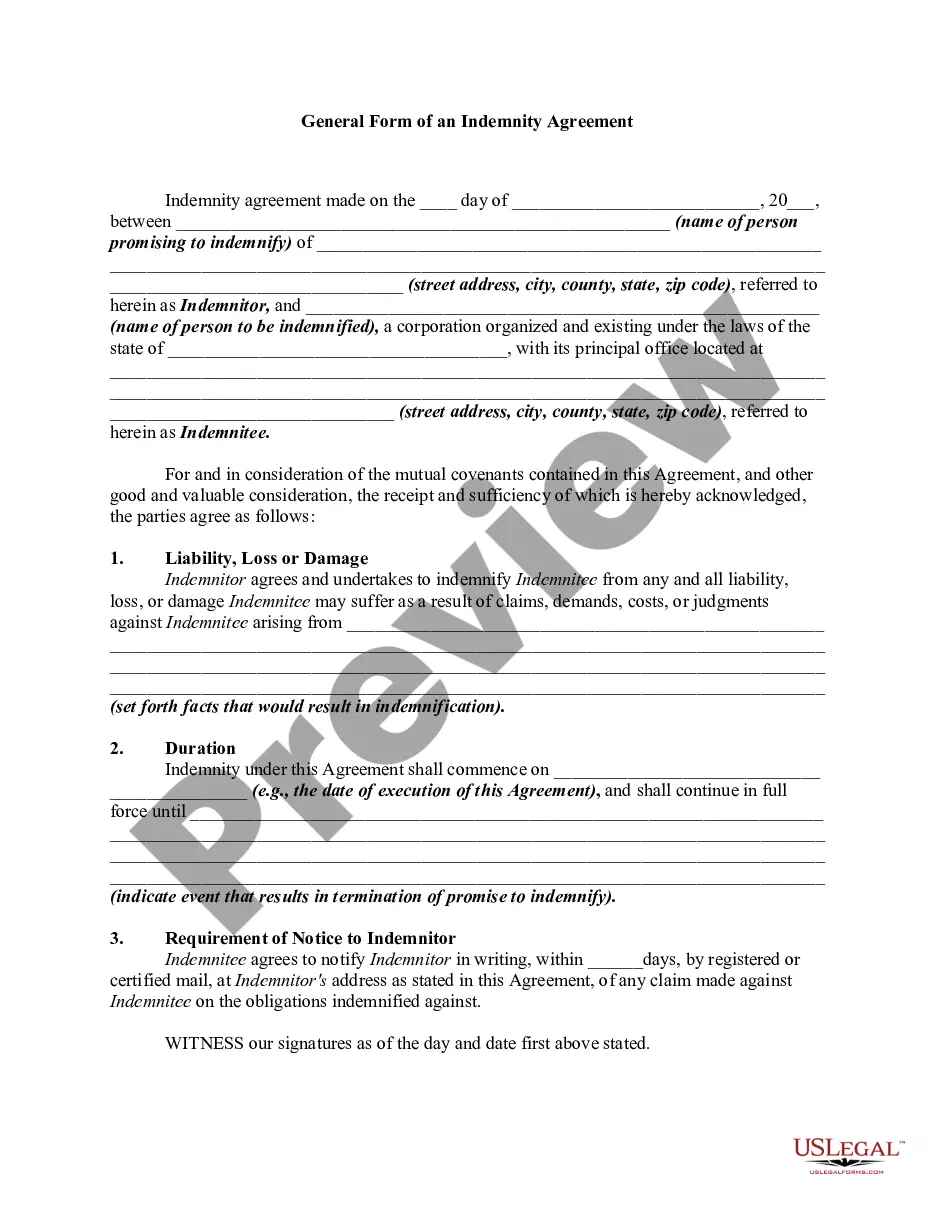

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

To have a guarantee and indemnity, you need three parties: Party One, Party Two, and a third party which can be a Guarantor and/or Indemnifier.

Indemnity is when one party promises to compensate the loss occurred to the other party, due to the act of the promisor or any other party. On the other hand, the guarantee is when a person assures the other party that he/she will perform the promise or fulfill the obligation of the third party, in case he/she default.

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

Differences between guarantees and indemnitiesa guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

$20/Month. The cost of professional indemnity insurance varies considerably. While these policies are extremely common, and typically inexpensive for most industries, the cost can increase significantly for specialized services with much higher risks.

For example, in the case of home insurance, the homeowner pays insurance premiums to the insurance company in exchange for the assurance that the homeowner will be indemnified if the house sustains damage from fire, natural disasters, or other perils specified in the insurance agreement.

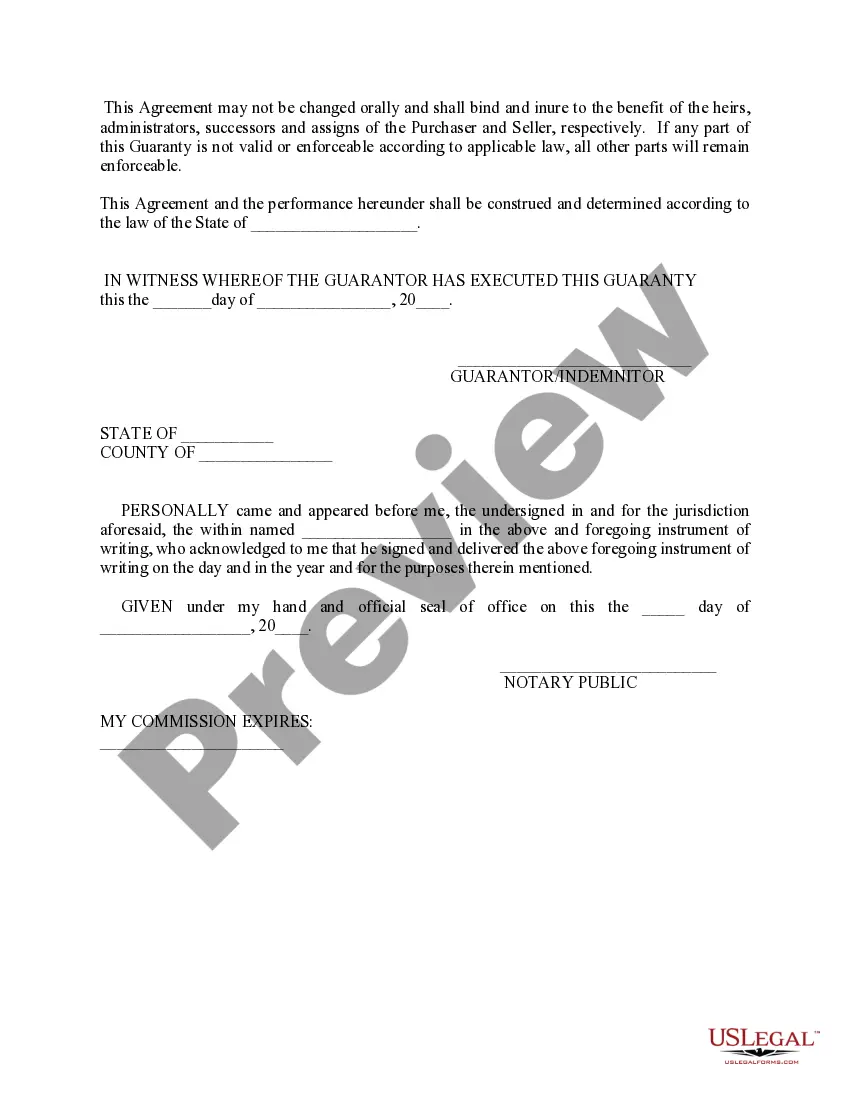

A guarantee must be in writing (or evidenced in writing) and signed by the guarantor or a person authorised by the guarantor (section 4, Statute of Frauds 1677). Guarantees and indemnities are often executed as deeds to overcome any argument about whether good consideration has been given.