Idaho Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate

Description

How to fill out Affidavit By An Attorney-in-Fact In The Capacity Of An Executor Of An Estate?

If you need to complete, obtain, or print legal document templates, use US Legal Forms, the leading collection of legal forms available online.

Utilize the site's straightforward and user-friendly search to find the documents you require.

Numerous templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to retrieve the Idaho Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate in just a few clicks.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, edit, and print or sign the Idaho Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate. Each legal document template you acquire is yours permanently. You will have access to every document you downloaded in your account. Visit the My documents section and select a document to print or download again. Compete and acquire, and print the Idaho Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal requirements.

- If you are currently a US Legal Forms customer, Log In to your account and click on the Acquire button to find the Idaho Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct region/state.

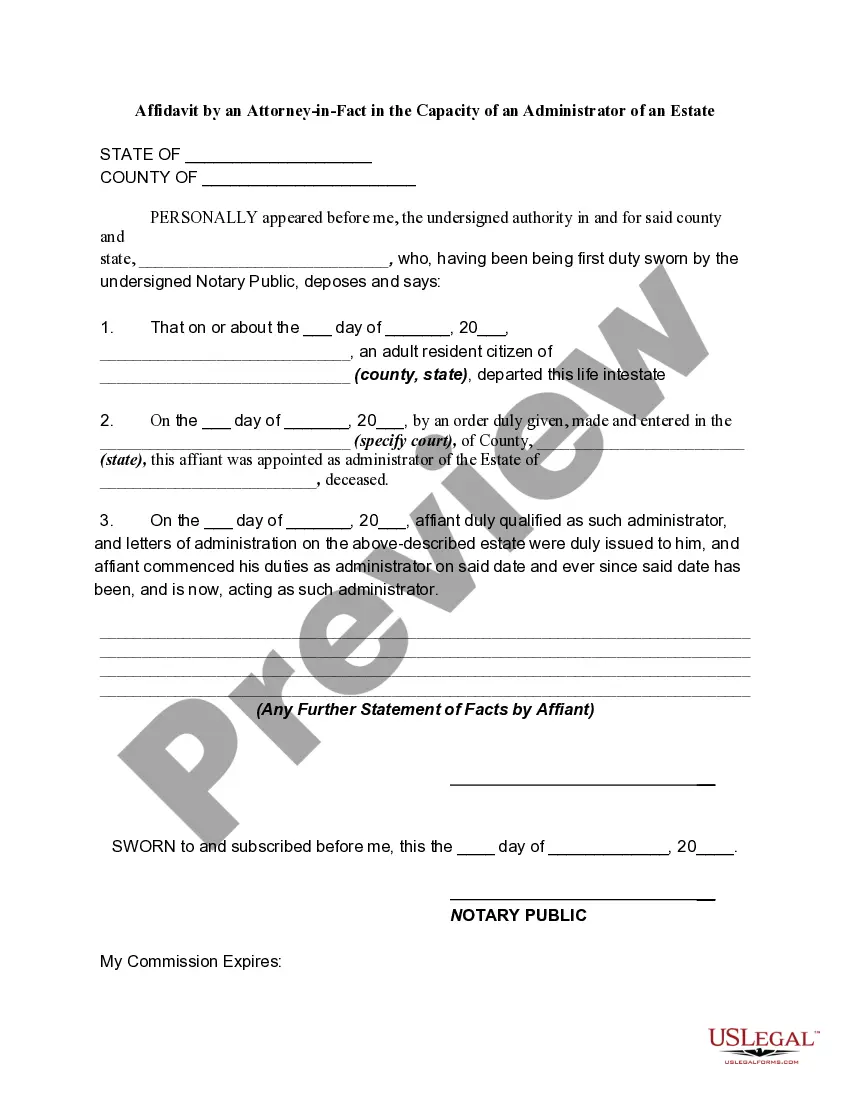

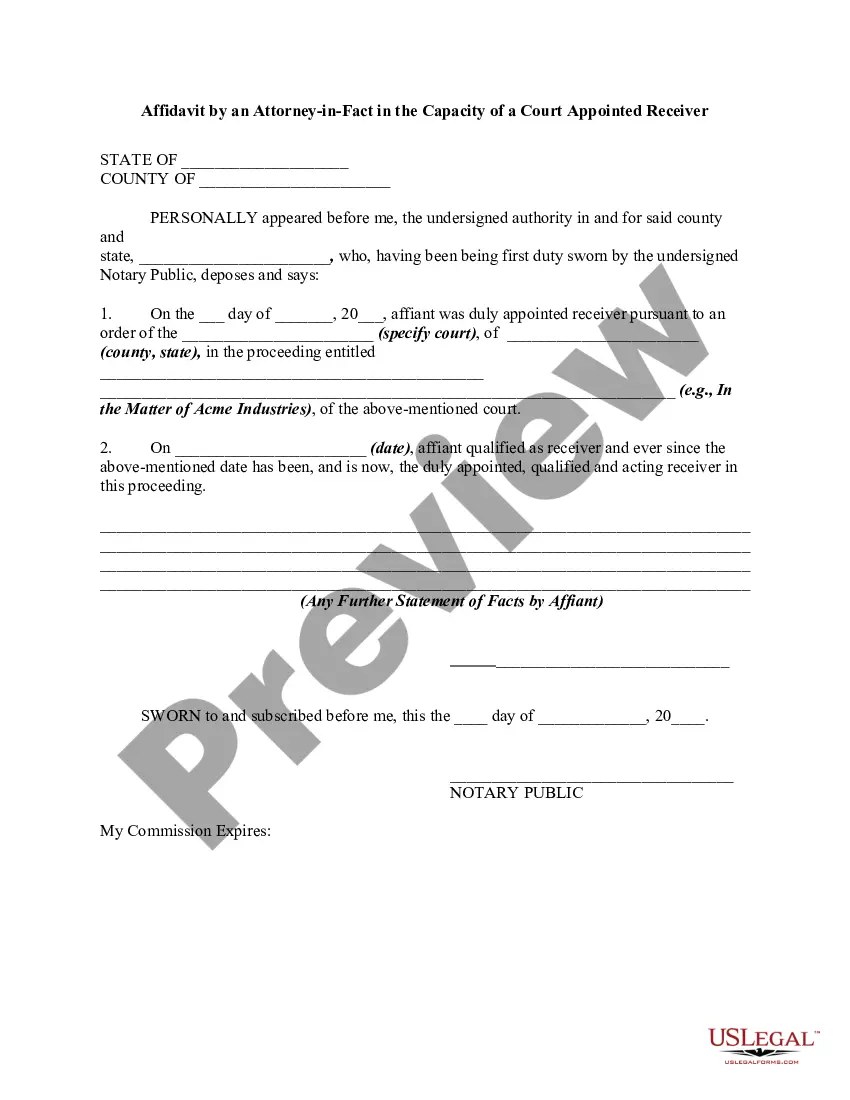

- Step 2. Use the Preview option to review the form’s content. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal document template.

- Step 4. Once you have found the form you need, click on the Purchase now button. Choose the payment plan you prefer and enter your details to register for the account.

Form popularity

FAQ

The fair market value of the entire estate of the decedent, wherever located, which is subject to probate, less liens and encumbrances, does not exceed one hundred thousand dollars ($100,000).

If you do want to avoid probate in Idaho here are four specific ways that it can be done. Spend Your Estate on Yourself. ... Give Your Estate Away While You are Alive. ... If You are a Surviving Spouse, use a Summary Administration. ... Use a Trust.

Under normal circumstances, as listed above, a probate must be completed within 3 years of a person's death. However, Idaho has a specific statute that allows for a joint probate to be completed for both spouses regardless of how much time has gone by since the first spouse passed away.

How to Write (1) Name Of Deceased. The full name of the Idaho Deceased must be produced. ... (2) Residential County Of Idaho Deceased. ... (3) Date Idaho Deceased Pronounced Dead. ... (4) Location Of Idaho Deceased's Death. ... (5) Name Of Successor. ... (6) Proportion Of Estate. ... (7) Signature Of Affiant. ... (8) Idaho Notarization.

Under Section 15-3-1201 of the Idaho Code, this Affidavit permits me to collect property (but not real estate), possessions, and accounts with a total value (after the deduction of liens, debts, and encumbrances) of up to $100,000.00 without the requirement of probate.

Specifically, in Idaho a probate is required after you die anytime your estate includes any assets that have a value of $100,000 or more. Additionally, a probate is required in Idaho anytime your name is on the deed to any real estate, homes, or land regardless of its value.

An executor (which in Idaho is called a ?personal representative? even though these two different names means the same thing) is the person who is given legal authority to deal with the money, property, and other assets of a person's estate after they die.

Ing to Idaho Code § 15-3-1201 et seq., after a family member or loved one passes away, an individual can use a small estate affidavit that specifically identifies them as the recipient of personal property owned by the decedent. The small estate affidavit has to have some specific language in it.