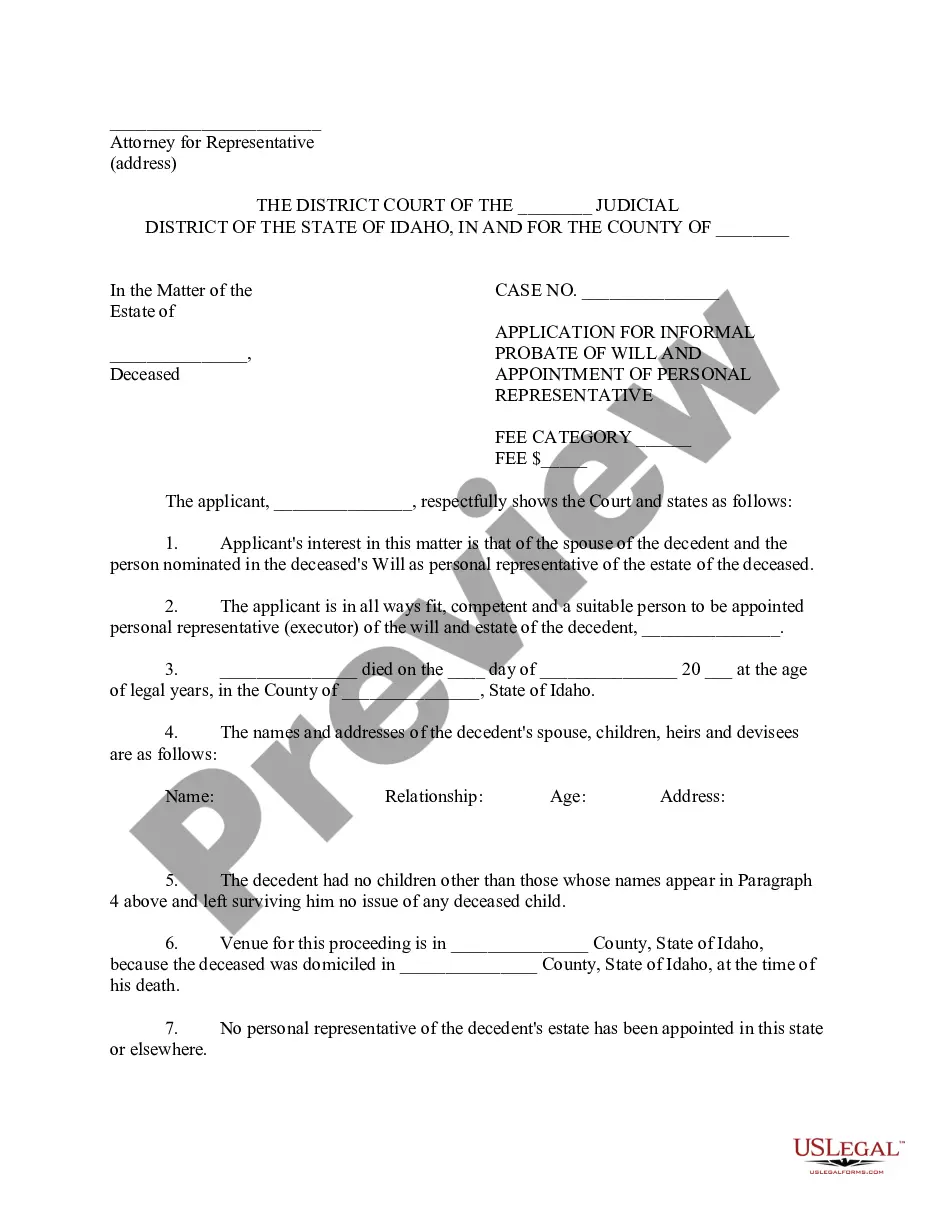

Idaho Application for Informal Probate of Will and Appointment of Personal Representative

Definition and meaning

The Idaho Application for Informal Probate of Will and Appointment of Personal Representative is a legal document used to initiate the probate process for a deceased individual's estate in Idaho. This form allows an appointed individual, typically named in the decedent's Last Will and Testament, to be officially recognized as the personal representative (executor) of the estate. By using this application, the appointed representative can manage and distribute the estate's assets according to the decedent's wishes outlined in the will.

Who should use this form

This form is intended for individuals who have been nominated as personal representatives in a will. Generally, this includes spouses, adult children, or other trusted family members or friends of the deceased. To use this form, the applicant must have the decedent's original last will in their possession and be ready to provide information about the decedent’s family, estate, and residence.

Key components of the form

The application includes several important sections that must be completed, including:

- Applicant's Information - Details about the person applying to be the personal representative.

- Decedent's Information - Information about the deceased, including their date of death and last known residence.

- Family Information - Names and addresses of the decedent's spouse, children, and heirs.

- Will Information - The date of the will and confirmation of its validity.

- Asset Information - An estimate of the total assets of the estate and confirmation of no bond requirement.

State-specific requirements

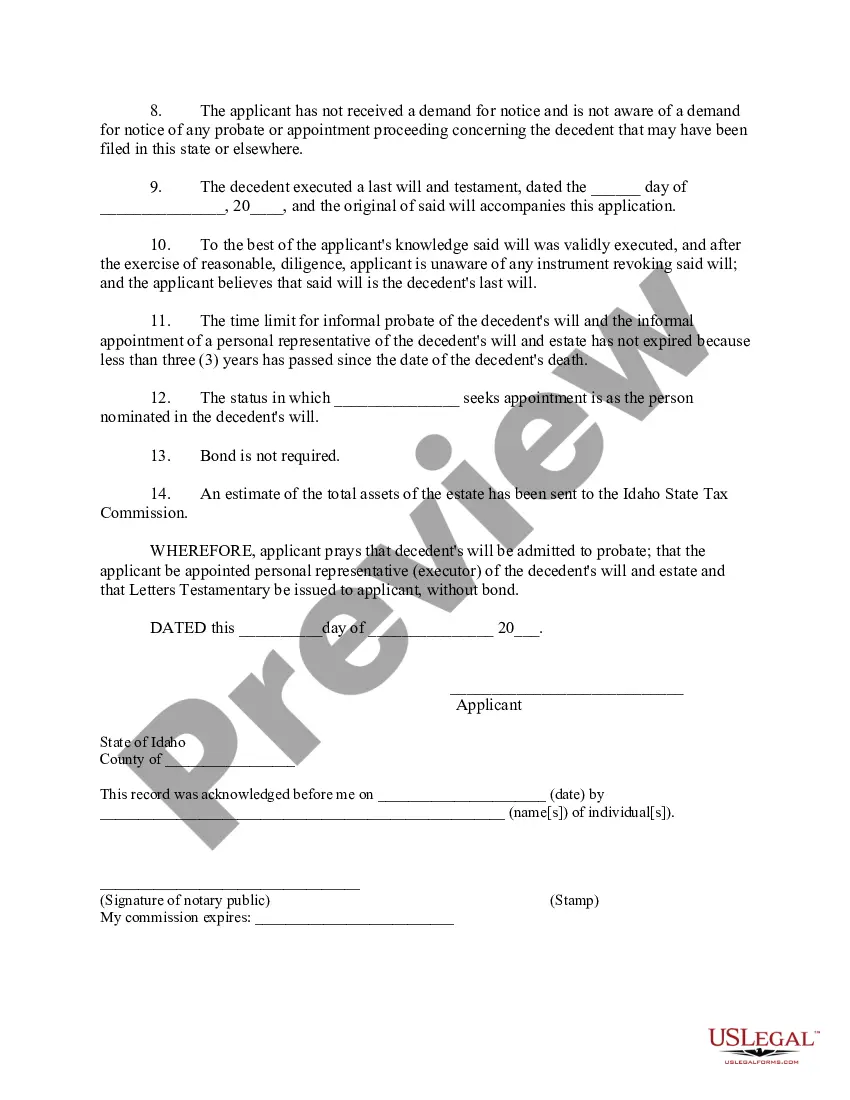

Idaho law mandates certain provisions for informal probate applications. The applicant must confirm that no other personal representative has been appointed. Furthermore, the application must be filed within three years of the decedent's passing. Additionally, the applicant needs to ensure that they have the original last will, as a copy cannot be used for probate purposes.

Common mistakes to avoid when using this form

When completing the Idaho Application for Informal Probate, be mindful of the following common errors:

- Failing to provide complete and accurate personal information.

- Not including the original will or misunderstanding the date when the will was executed.

- Omitting family members or heirs that should be listed.

- Ignoring the requirement to file within the specified time frame.

What documents you may need alongside this one

Along with the application, you will typically need the following documents:

- The original last will and testament of the decedent.

- A certified death certificate.

- Documents verifying the relationships of all heirs and beneficiaries.

Form popularity

FAQ

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.

That person (it could be one or more individuals, a bank or trust company, or both) who acts for, or stands in the shoes of, the deceased is generally called the personal representative. If the decedent dies testate that is, with a Will an Executor is appointed as the personal representative.

You can administer an estate even if the deceased died without a will or failed to specify an executor. If your relationship to the deceased doesn't make you the probate court's default choice for administrator, you'll need to get permission from the relatives ahead of you in the priority order.

The Costs to Probate in Idaho In Idaho the filing fee for doing a probate is $166. After that the total costs and fees for most average estates that we complete for our clients is somewhere between $2,000 to $2,500.

Idaho has a simplified probate process for small estates. To use it, an executor files a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

Can I appoint a beneficiary as my executor? Yes, your executor may also be a beneficiary to your estate. In fact, if you are leaving everything to your spouse or adult children who are capable of managing their finances, it is a natural choice to appoint your spouse or one or more of your children as your executor(s).