Iowa Employer Training Memo - Payroll Deductions

Description

How to fill out Employer Training Memo - Payroll Deductions?

If you wish to acquire, download, or print authorized document templates, utilize US Legal Forms, the most extensive range of legal forms available online.

Take advantage of the site’s user-friendly and simple search to locate the documents you require.

Different templates for business and personal purposes are categorized by types and regions, or keywords. Use US Legal Forms to find the Iowa Employer Training Memo - Payroll Deductions in just a few clicks.

Step 4. After locating the form you wish to obtain, click the Purchase now button. Choose the payment plan you desire and provide your information to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Iowa Employer Training Memo - Payroll Deductions.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

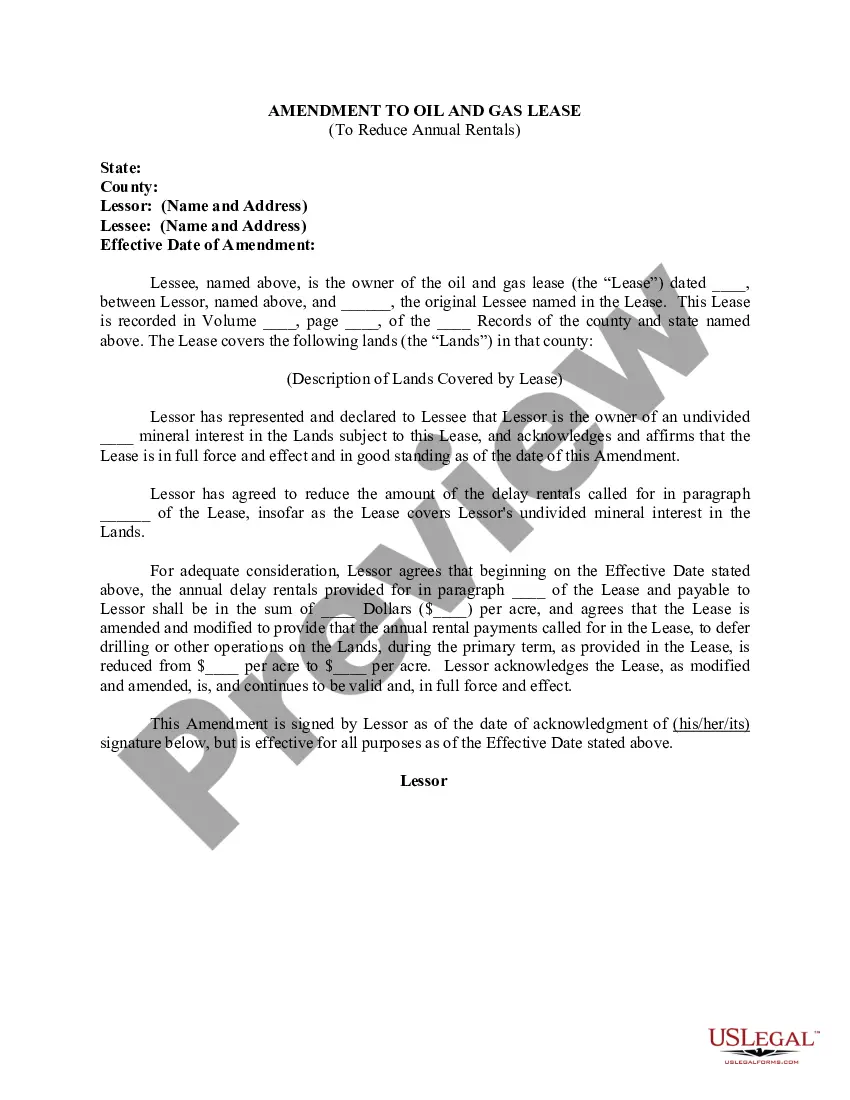

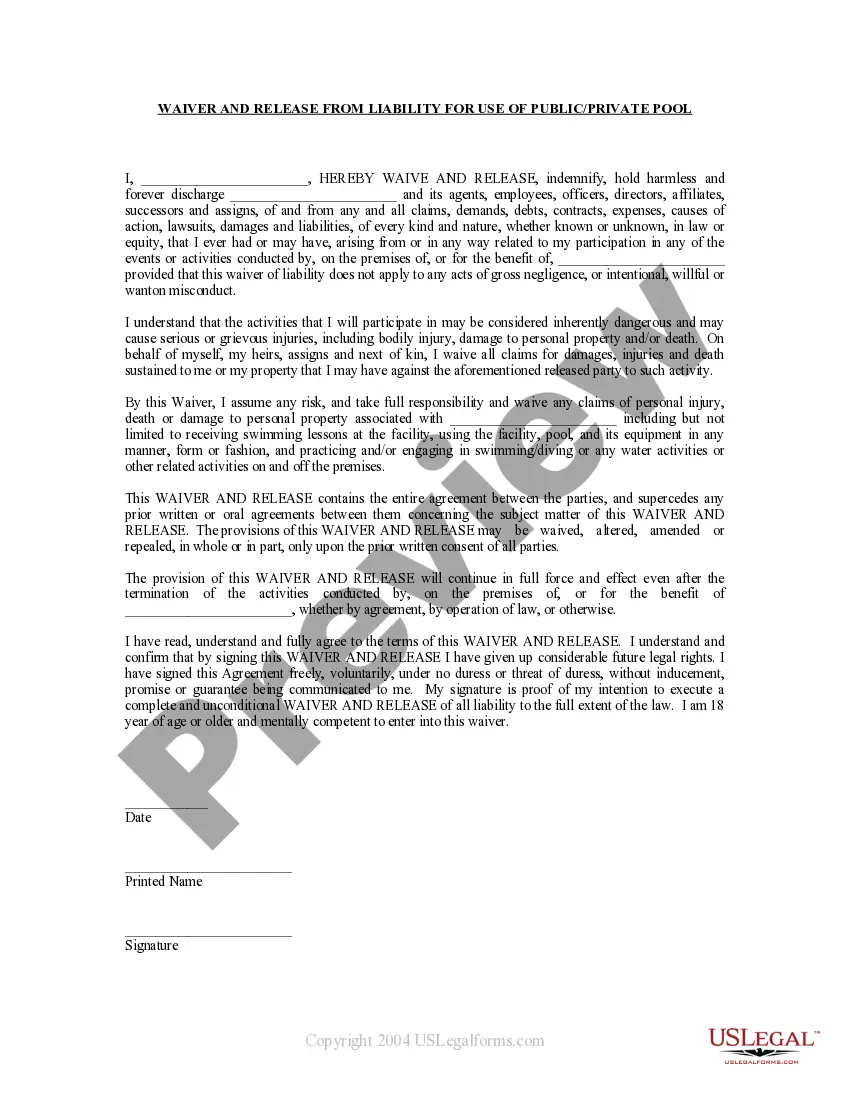

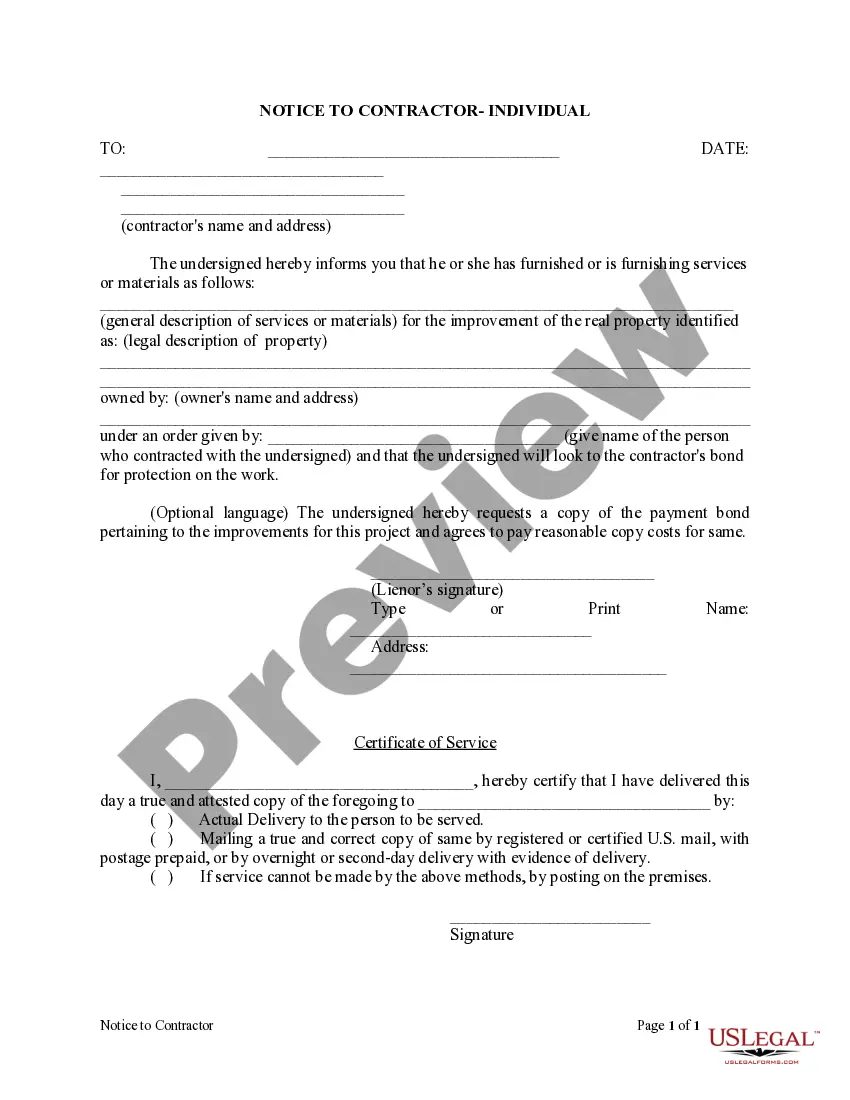

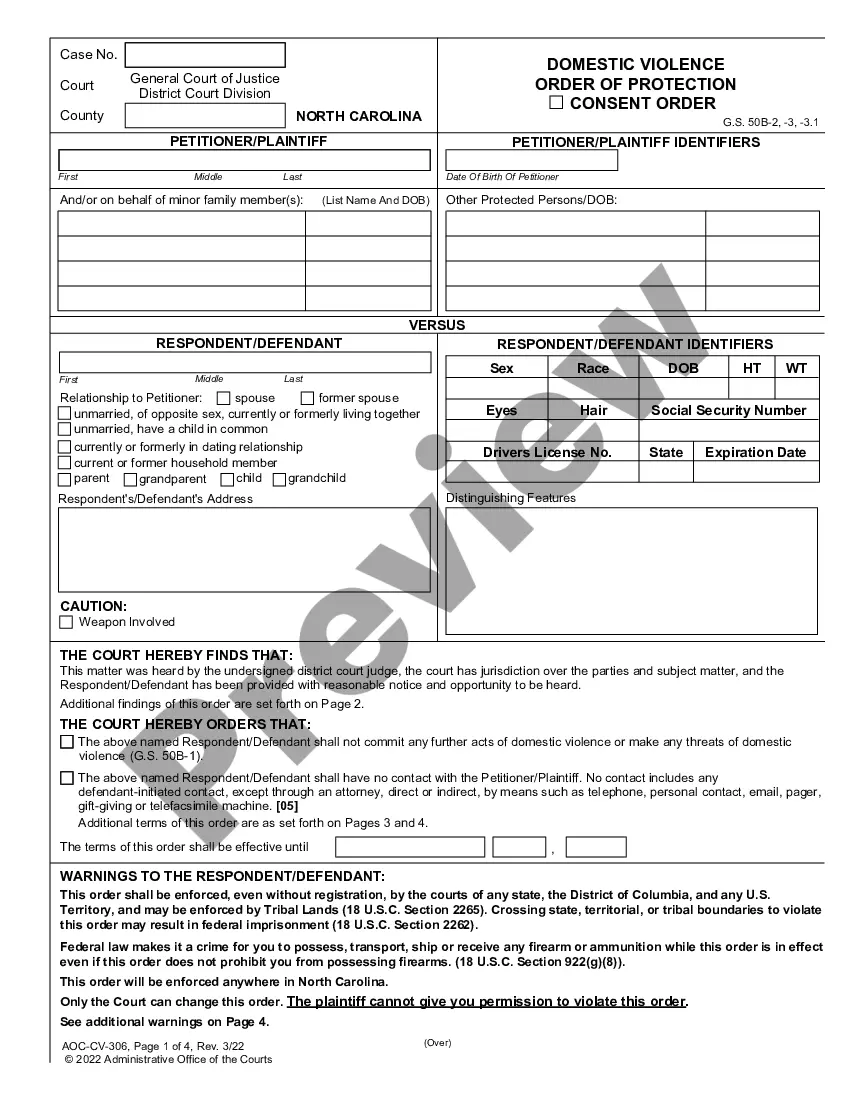

- Step 2. Use the Preview option to review the form’s details. Don't forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

To fill out your W4 correctly, begin by reviewing the form's instructions and gathering necessary personal information. Ensure that you accurately report your filing status, number of dependents, and any additional adjustments. Consult the Iowa Employer Training Memo - Payroll Deductions for guidance and clarification on common pitfalls. Following these steps will help you achieve appropriate tax withholding.

Whether to claim 0 or 1 on your W4 depends on your personal tax situation. Claiming 0 means more taxes will be withheld, potentially leading to a larger refund, while claiming 1 might reduce withholding and result in a smaller refund. In relation to the Iowa Employer Training Memo - Payroll Deductions, it's advisable to assess your financial health and future tax liabilities carefully. If in doubt, consult a tax advisor to make the best decision.

In step 3 of filling out a W4, employees need to account for the total number of dependents they claim. This information influences the amount of tax withheld. For further clarity on the Iowa Employer Training Memo - Payroll Deductions, consider using our resources that guide you through each step of the process. Accurate information at this stage will prevent surprises during tax season.

Yes, payroll deductions generally require written approval from the employee, especially for voluntary deductions. It's important to document this consent to avoid any misunderstandings. In the context of the Iowa Employer Training Memo - Payroll Deductions, forming clear agreements plays a significant role in maintaining trust between employers and employees. Use US Legal Forms to find templates that facilitate these agreements.

To calculate employer payroll taxes, start by determining the employee's gross wages. Next, apply the applicable tax rates for Social Security, Medicare, and federal and state unemployment taxes. When reviewing the Iowa Employer Training Memo - Payroll Deductions, you’ll find resources that simplify this calculation and help ensure compliance with state laws. This clarity can help employers manage their payroll expenses effectively.

The Iowa W4 allows employees to claim allowances that affect their state income tax withholding. These allowances typically relate to the number of dependents and other eligible factors. When completing the Iowa Employer Training Memo - Payroll Deductions, it's crucial for employees to understand how their choices influence their tax situation. Accurate claims can ensure proper withholding and avoid large tax bills at year-end.

The Iowa W-4 2025 update reflects any new regulations or changes to tax withholding that impact employees. It's critical for employers to utilize the most up-to-date version to avoid compliance issues. For detailed guidance on these updates, the Iowa Employer Training Memo - Payroll Deductions serves as an excellent resource to understand what these changes mean for your payroll process.

Tax filing for 2025 in Iowa is generally set for the traditional tax season, with deadlines typically falling on April 30th. Being prepared and aware of this timeline helps prevent penalties. Consult the Iowa Employer Training Memo - Payroll Deductions to ensure you have the correct forms and resources, allowing for a smooth filing experience.

The new W-4 changes impact how employees report their tax withholding. These changes allow for more flexibility and accuracy in reporting allowances and dependents. Employers must stay compliant by updating their payroll systems accordingly, and the Iowa Employer Training Memo - Payroll Deductions provides essential information on implementing these changes effectively.

Iowa tax changes for 2025 may include adjustments in rates, brackets, or credits that affect both individual and corporate taxpayers. Keeping up with these changes is crucial for compliance. For comprehensive updates and guidance, refer to the Iowa Employer Training Memo - Payroll Deductions to stay informed about these vital updates that impact payroll calculations.