Iowa Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent

Description

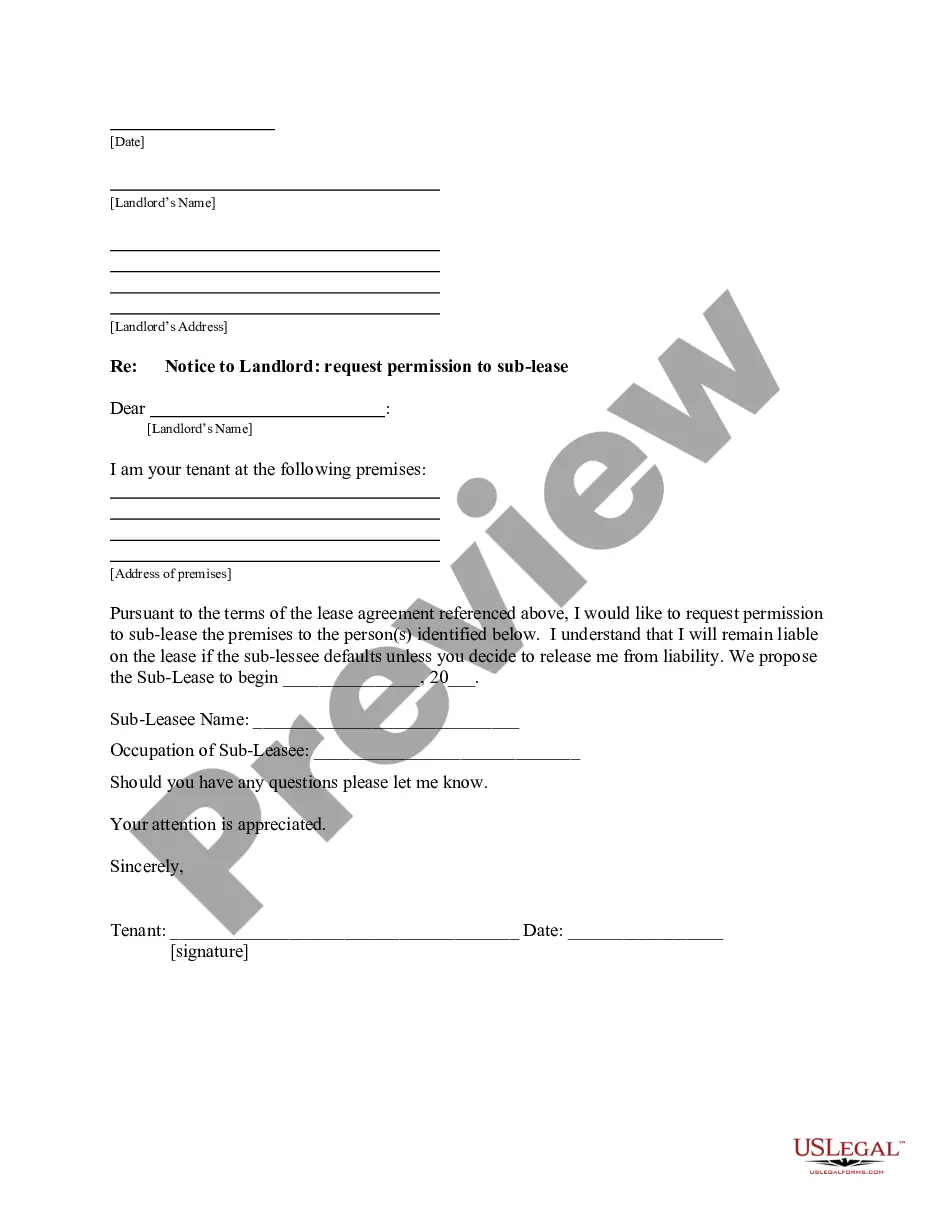

How to fill out Domestic Subsidiary Security Agreement Regarding Ratable Benefit Of Lenders And Agent?

US Legal Forms - among the most significant libraries of authorized types in America - offers a wide array of authorized record web templates you are able to obtain or printing. Making use of the internet site, you will get a large number of types for company and specific reasons, categorized by groups, says, or key phrases.You will discover the newest models of types just like the Iowa Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent in seconds.

If you have a membership, log in and obtain Iowa Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent in the US Legal Forms local library. The Down load option will appear on each and every develop you look at. You have accessibility to all previously downloaded types within the My Forms tab of your own profile.

If you wish to use US Legal Forms initially, listed below are straightforward guidelines to get you started:

- Make sure you have selected the best develop for the town/area. Select the Review option to review the form`s information. Browse the develop description to ensure that you have selected the correct develop.

- In the event the develop does not suit your specifications, utilize the Research industry towards the top of the display to obtain the the one that does.

- In case you are content with the form, affirm your decision by clicking the Get now option. Then, opt for the pricing prepare you prefer and provide your references to sign up to have an profile.

- Procedure the transaction. Utilize your credit card or PayPal profile to finish the transaction.

- Find the structure and obtain the form in your gadget.

- Make alterations. Complete, revise and printing and indicator the downloaded Iowa Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent.

Every single template you put into your bank account lacks an expiry time and is also your own property eternally. So, if you want to obtain or printing an additional backup, just go to the My Forms portion and then click in the develop you want.

Obtain access to the Iowa Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent with US Legal Forms, one of the most extensive local library of authorized record web templates. Use a large number of professional and state-particular web templates that fulfill your company or specific demands and specifications.

Form popularity

FAQ

The key risks associated with securities lending are counterparty credit risk, credit risk on fixed obligations, settlement risk, liquidity risk, operational risk, tax risks, and reputational risk.

Borrowing money can fund a new home, pay for college tuition or help start a new business. Traditional lenders include banks, credit unions, and financing companies. Peer-to-peer (P2P) lending is also known as social lending or crowdlending.

A securities lending agreement governs the terms of a security lending loan. The agreement includes the type of collateral ? cash, securities or LOC ? of value equal to or greater than 100% of the loaned security. The borrower of the security will pay a lending fee, which is typically paid monthly to the lender.

Securities lending allow borrowers to take a short-selling position which they can take advantage of during a market downturn. The short-selling tactic is prevalent amongst veteran investors.

Collateral. Collateral is an asset you can pledge to the lender as an additional form of security, should you not be able to repay the loan. Collateral can help a borrower secure the financing they need and can help the lender recoup their investment if the borrower defaults on the loan.

With reference to lending, security or collateral, is an asset that is pledged by the borrower as protection in case he or she defaults on the repayment, not paying some or all back.

Securities lending involves the owner of shares or bonds transferring them temporarily to a borrower. In return, the borrower transfers other shares, bonds or cash to the lender as collateral and pays a borrowing fee. Securities lending can, therefore, be used to incrementally increase fund returns for investors.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.