Iowa Sale and Servicing Agreement

Description

How to fill out Sale And Servicing Agreement?

You can spend several hours online trying to find the legitimate file format that fits the state and federal specifications you require. US Legal Forms gives a huge number of legitimate varieties which are analyzed by experts. You can actually obtain or printing the Iowa Sale and Servicing Agreement from my services.

If you have a US Legal Forms bank account, it is possible to log in and click the Obtain button. Afterward, it is possible to total, modify, printing, or sign the Iowa Sale and Servicing Agreement. Each legitimate file format you get is your own for a long time. To obtain yet another duplicate for any bought kind, go to the My Forms tab and click the corresponding button.

Should you use the US Legal Forms web site the very first time, keep to the easy instructions listed below:

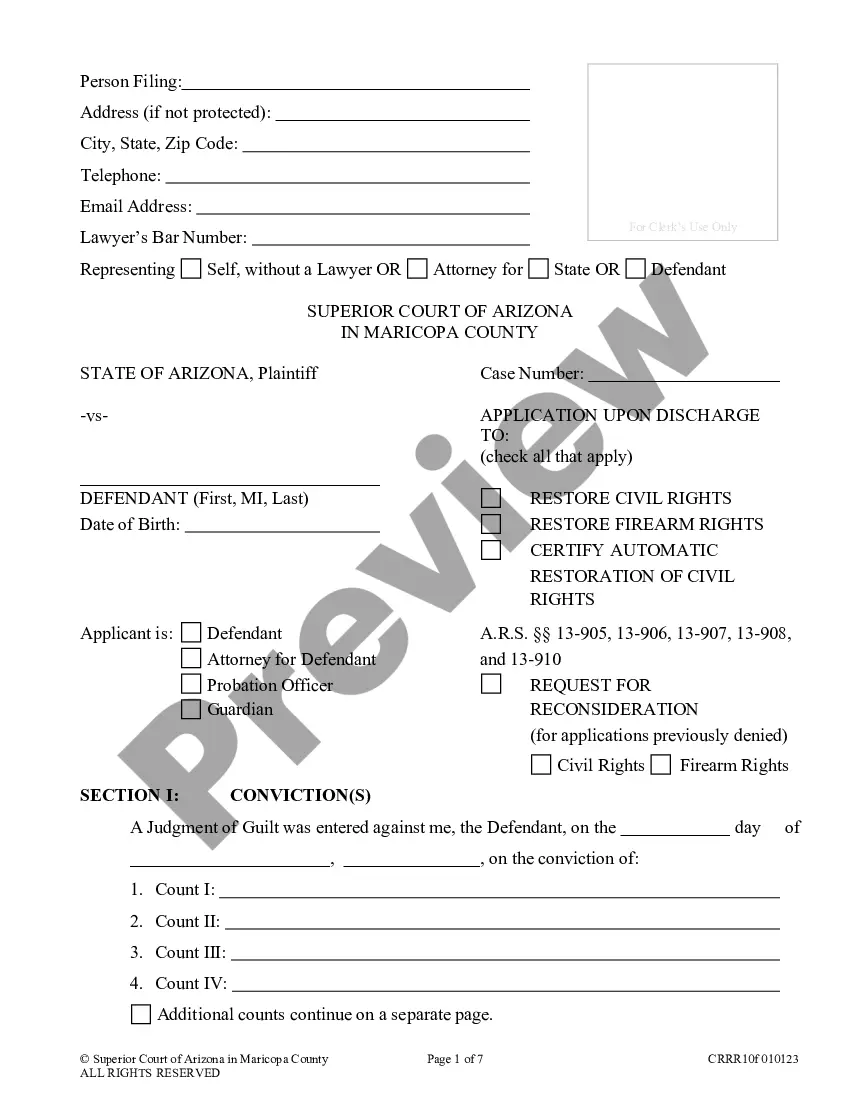

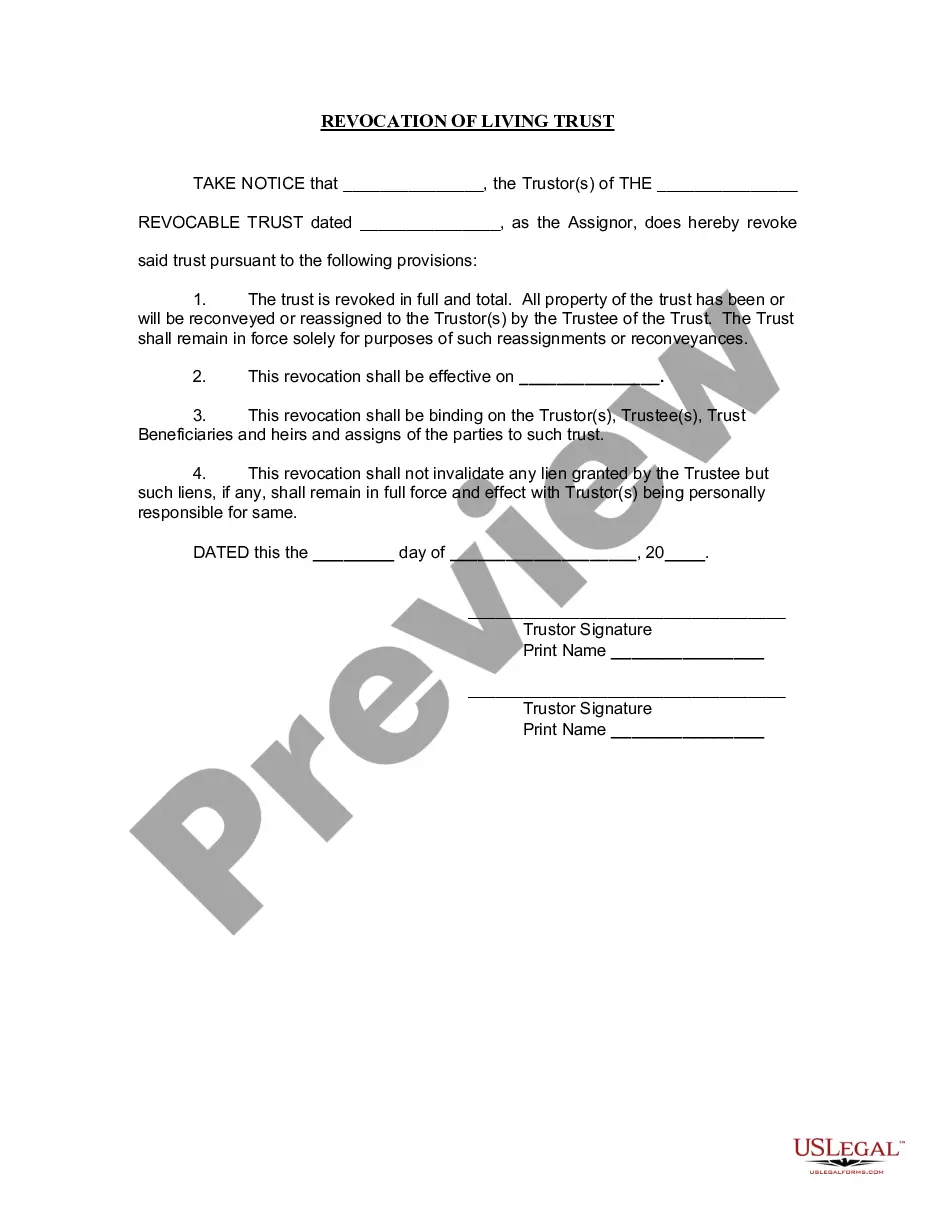

- Initial, be sure that you have selected the correct file format for your region/metropolis of your choosing. Read the kind information to make sure you have chosen the right kind. If offered, utilize the Preview button to check through the file format at the same time.

- If you want to find yet another variation of your kind, utilize the Search discipline to discover the format that meets your needs and specifications.

- Once you have discovered the format you desire, simply click Buy now to carry on.

- Find the rates prepare you desire, key in your accreditations, and sign up for a free account on US Legal Forms.

- Complete the deal. You can utilize your Visa or Mastercard or PayPal bank account to fund the legitimate kind.

- Find the structure of your file and obtain it in your device.

- Make modifications in your file if required. You can total, modify and sign and printing Iowa Sale and Servicing Agreement.

Obtain and printing a huge number of file themes utilizing the US Legal Forms web site, that provides the most important assortment of legitimate varieties. Use specialist and condition-certain themes to deal with your organization or specific demands.

Form popularity

FAQ

(10)Painting, papering and interior decorating. a.In general. Persons engaged in the business of painting, papering, and interior decorating are selling a service subject to sales tax.

A 5% motor vehicle use tax is imposed on the purchase price of a vehicle subject to registration. or Iowa Department of Transportation.

Description: The sales or lease price of vehicles subject to registration is exempt from sales tax. These vehicles are subject to a fee for new registration equal to 5% of the sales or lease price. This fee for new registration also applies when vehicles are sold between private individuals.

Sales of tangible personal property in Iowa are subject to sales tax unless exempted by state law. Sales of services are exempt from Iowa sales tax unless taxed by state law. The retailer must add the tax to the price and collect the tax from the purchaser.

On the IA 126, A will report only the wages and interest income earned while an Iowa resident as Iowa-source income. The interest income earned the last half of the year is not considered Iowa-source income since A was no longer an Iowa resident.

Iowa has a state sales tax rate of 6%, with additional local option taxes that can raise the rate up to 8%. Our calculator takes into account the location of the transaction, ensuring accurate sales tax calculations for every purchase.

Although there is no property tax on vehicles in Iowa, there is an annual registration fee based on age, weight, and list price of the vehicle.

Fee for a numbered regular plate with the emblem is $25 with a $5 renewal fee that is in addition to the regular annual registration fee. Fee for a personalized plate with the emblem is $50 with a $5 renewal fee that is in addition to the regular annual registration fee.