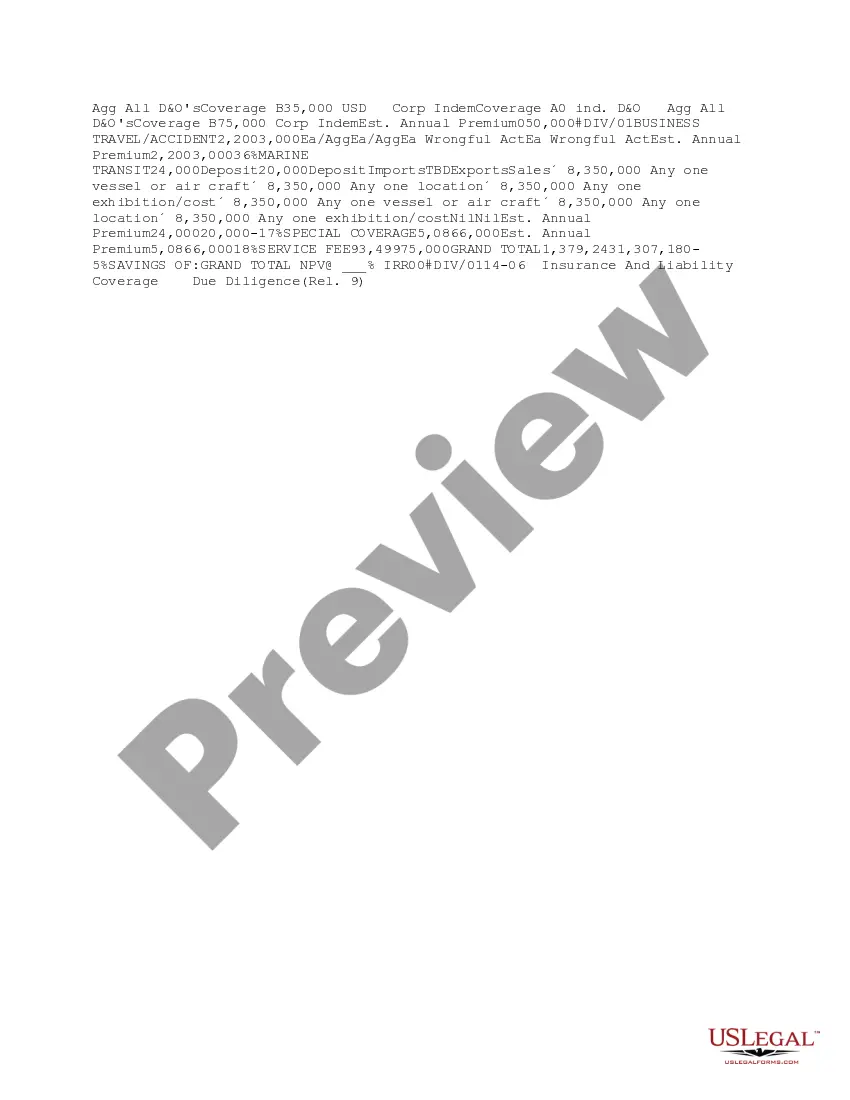

This due diligence form contains information documented from a risk evaluation within a company regarding business transactions.

Iowa Risk Evaluation Specialist Matrix

Description

How to fill out Risk Evaluation Specialist Matrix?

You are capable of dedicating multiple hours online searching for the legal document template that meets the federal and state requirements you desire.

US Legal Forms provides thousands of legal documents that have been reviewed by experts.

You can easily download or print the Iowa Risk Evaluation Specialist Matrix from my service.

If available, utilize the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you may sign in and then click the Download button.

- Subsequently, you can complete, modify, print, or sign the Iowa Risk Evaluation Specialist Matrix.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the appropriate button.

- For first-time users of the US Legal Forms site, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice. Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

Because a 5x5 risk matrix is just a way of calculating risk with 5 categories for likelihood, and 5 categories severity. Each risk box in the matrix represents the combination of a particular level of likelihood and consequence, and can be assigned either a numerical or descriptive risk value (the risk estimate).

The Health and Safety Executive's Five steps to risk assessment.Step 1: Identify the hazards.Step 2: Decide who might be harmed and how.Step 3: Evaluate the risks and decide on precautions.Step 4: Record your findings and implement them.Step 5: Review your risk assessment and update if. necessary.

The risk assessment matrix works by presenting various risks as a chart, color-coded by severity: high risks in red, moderate risks in yellow, and low risks in green. Every risk matrix also has two axes: one that measures likelihood, and another that measures impact.

A risk matrix is a matrix that is used during risk assessment to define the level of risk by considering the category of probability or likelihood against the category of consequence severity. This is a simple mechanism to increase visibility of risks and assist management decision making.

Levels of RiskMild Risk: Disruptive or concerning behavior. Individual may or may not show signs of distress.Moderate Risk: More involved or repeated disruption; behavior is more concerning.Elevated Risk: Seriously disruptive incidents.Severe Risk: Disturbed behavior; not one's normal self.Extreme Risk:

A risk matrix (also called a risk diagram) visualizes risks in a diagram. In the diagram, the risks are divided depending on their likelihood and their effects or the extent of damage, so that the worst case scenario can be determined at a glance.

How do you calculate risk in a risk matrix?Step 1: Identify the risks related to your project.Step 2: Define and determine risk criteria for your project.Step 3: Analyze the risks you've identified.Step 4: Prioritize the risks and make an action plan.

4x4 Risk MatrixThe matrix works by selecting the appropriate consequences from across the bottom, and then cross referencing against the row containing the likelihood, to read off the estimated risk rating. Likelihood (Probability) 4. Likely or frequent (likely to occur, to be expected) 3.

The risk assessment matrix works by presenting various risks as a chart, color-coded by severity: high risks in red, moderate risks in yellow, and low risks in green. Every risk matrix also has two axes: one that measures likelihood, and another that measures impact.

The risk assessment matrix will help your organization identify and prioritize different risks, by estimating the probability of the risk occurring and how severe the impact would be if it were to happen....The process:Identify the risk universe.Determine the risk criteria.Assess the risks.Prioritize the risks.