Iowa Debt Conversion Agreement with exhibit A only

Description

How to fill out Debt Conversion Agreement With Exhibit A Only?

US Legal Forms - one of many biggest libraries of legal forms in the USA - delivers a wide array of legal file web templates you may down load or print. Utilizing the internet site, you may get thousands of forms for organization and person purposes, categorized by classes, suggests, or key phrases.You can get the most recent types of forms such as the Iowa Debt Conversion Agreement with exhibit A only within minutes.

If you currently have a membership, log in and down load Iowa Debt Conversion Agreement with exhibit A only from your US Legal Forms local library. The Obtain button can look on each and every form you see. You have access to all earlier delivered electronically forms in the My Forms tab of your respective profile.

If you wish to use US Legal Forms initially, allow me to share easy recommendations to get you started:

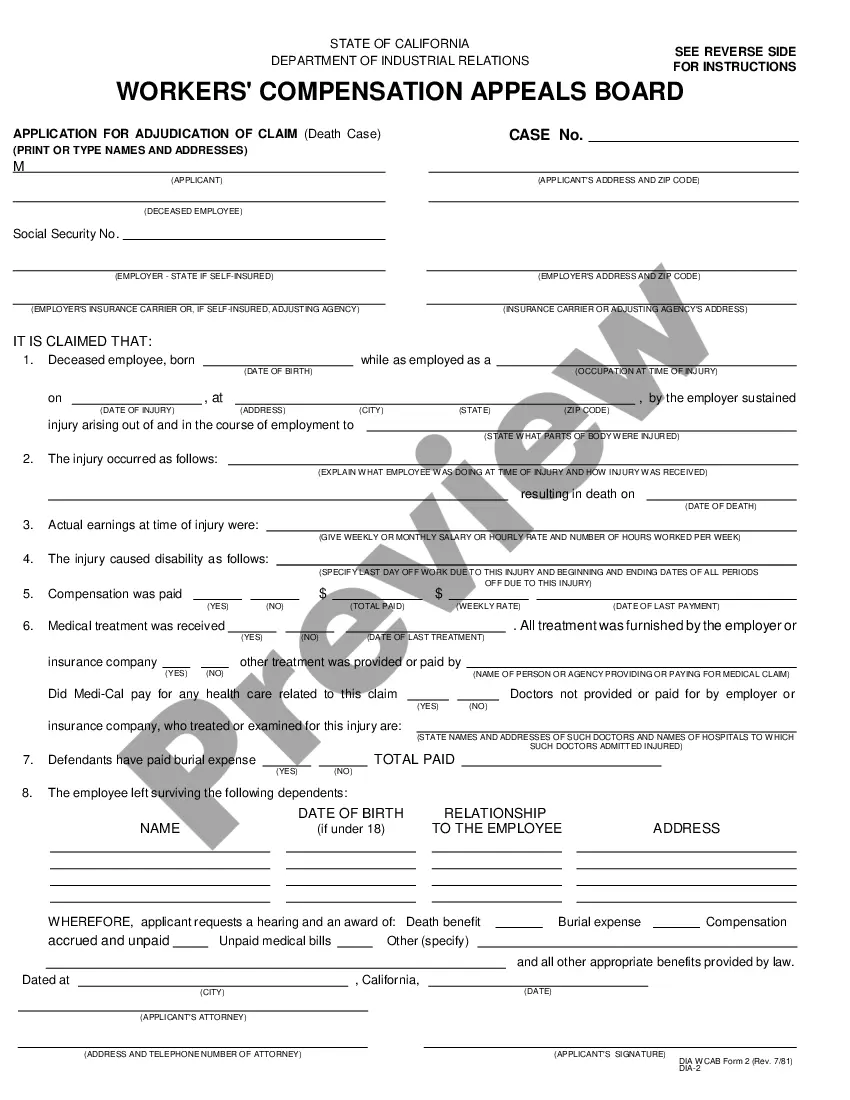

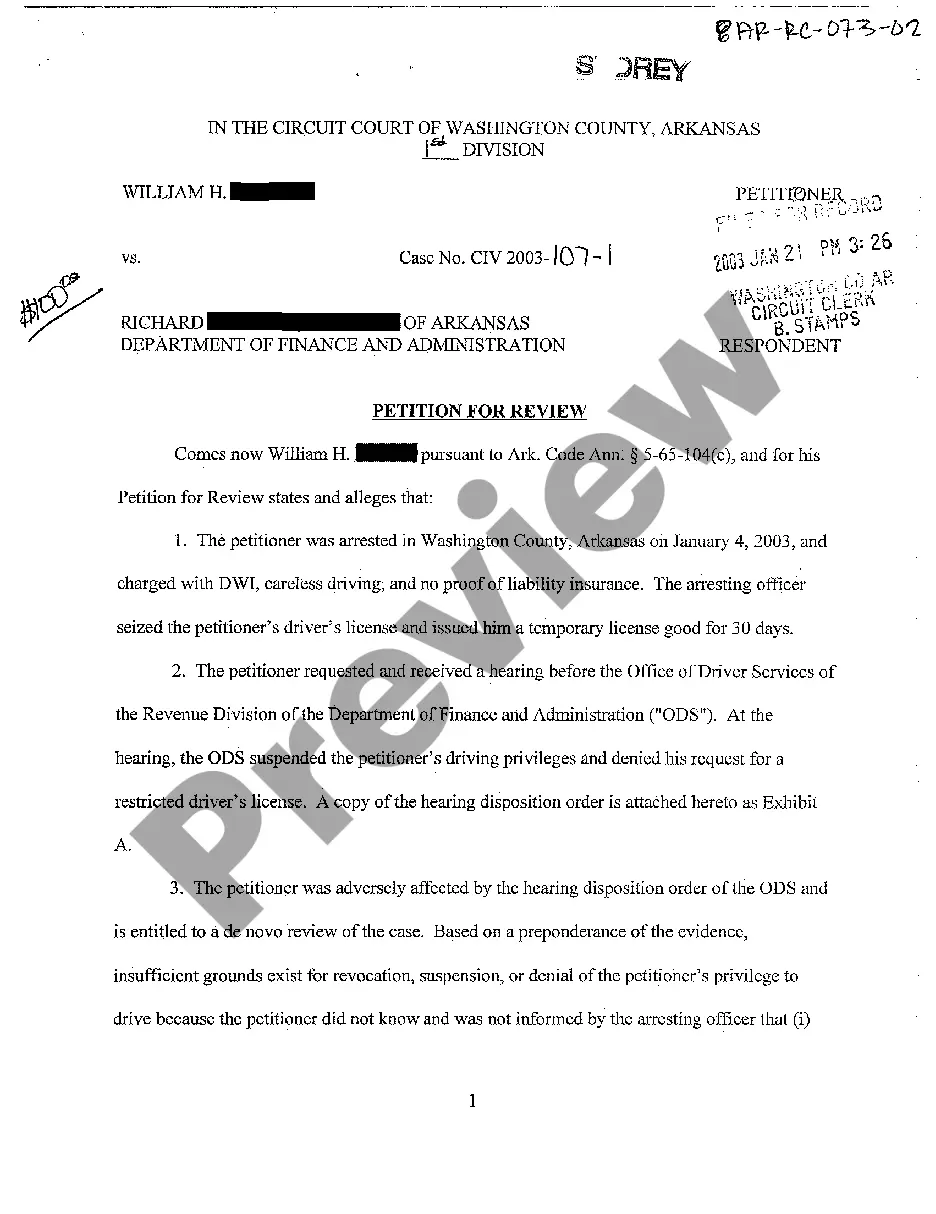

- Be sure you have picked the right form for your personal town/area. Click on the Review button to check the form`s content material. See the form outline to ensure that you have selected the proper form.

- If the form doesn`t match your needs, take advantage of the Research field on top of the display to find the the one that does.

- Should you be pleased with the form, validate your choice by visiting the Acquire now button. Then, opt for the prices strategy you like and offer your qualifications to sign up to have an profile.

- Method the financial transaction. Make use of your bank card or PayPal profile to accomplish the financial transaction.

- Pick the structure and down load the form on your own system.

- Make changes. Fill out, revise and print and sign the delivered electronically Iowa Debt Conversion Agreement with exhibit A only.

Every single design you included with your bank account does not have an expiry day and is your own property eternally. So, if you would like down load or print yet another backup, just check out the My Forms area and click on the form you want.

Get access to the Iowa Debt Conversion Agreement with exhibit A only with US Legal Forms, by far the most comprehensive local library of legal file web templates. Use thousands of professional and status-specific web templates that fulfill your company or person needs and needs.

Form popularity

FAQ

Paying too high a price ? The lender may ask for an equity interest that represents a much higher financial price than the outstanding loan balance. Loss of equity ? By giving away part of the company's equity, the owners lose part of their interest and control in the business.

A debt for equity swap involves a creditor converting debt owed to it by a company into equity in that company. The effect of the swap is the issue of the equity to the creditor in satisfaction of the debt, such that the debt is discharged, released or extinguished.

Reasons for Swaps The company may want to keep the debt/equity ratio in a target range so they can get good terms on credit/debt if they need it, or will be able to raise cash through a share offering if needed. If the ratio is too lopsided, it may limit what they can do in the future to raise cash.

There are a number of risks and rewards associated with debt conversion. One of the biggest risks is that the company may not be able to make the required interest payments on the new equity. If this happens, the company may be forced to issue more equity or take on additional debt in order to make the payments.

With convertible debt, a business borrows money from a lender or investor where both parties enter the agreement with the intent (from the outset) to repay all (or part) of the loan by converting it into a certain number of its preferred or common shares at some point in the future.

Debt-to-equity swaps are common transactions that enable a borrower to transform loans into shares of stock or equity. Mostly, a financial institution such as an insurer or a bank will hold the new shares after the original debt is transformed into equity shares.

A debt/equity swap is a refinancing deal in which a debt holder gets an equity position in exchange for the cancellation of the debt. The swap is generally done to help a struggling company continue to operate. The logic behind this is an insolvent company cannot pay its debts or improve its equity standing.

In a debt-for-adaptation swap, countries who borrowed money from other nations or multilateral development banks (e.g., the IMF and World Bank) could have that debt forgiven, if the money that was to be spent on repayment was instead diverted to climate adaptation and resilience projects.