Iowa Book Value Phantom Stock Plan of First Florida Banks, Inc.

Description

How to fill out Book Value Phantom Stock Plan Of First Florida Banks, Inc.?

Are you presently inside a place that you need files for either business or personal reasons just about every day? There are a lot of lawful file layouts available on the Internet, but finding kinds you can rely on isn`t easy. US Legal Forms provides a large number of type layouts, just like the Iowa Book Value Phantom Stock Plan of First Florida Banks, Inc., that happen to be created to fulfill state and federal specifications.

If you are already acquainted with US Legal Forms internet site and get an account, just log in. Afterward, you are able to obtain the Iowa Book Value Phantom Stock Plan of First Florida Banks, Inc. design.

Should you not offer an profile and need to begin to use US Legal Forms, abide by these steps:

- Find the type you want and make sure it is for the appropriate city/county.

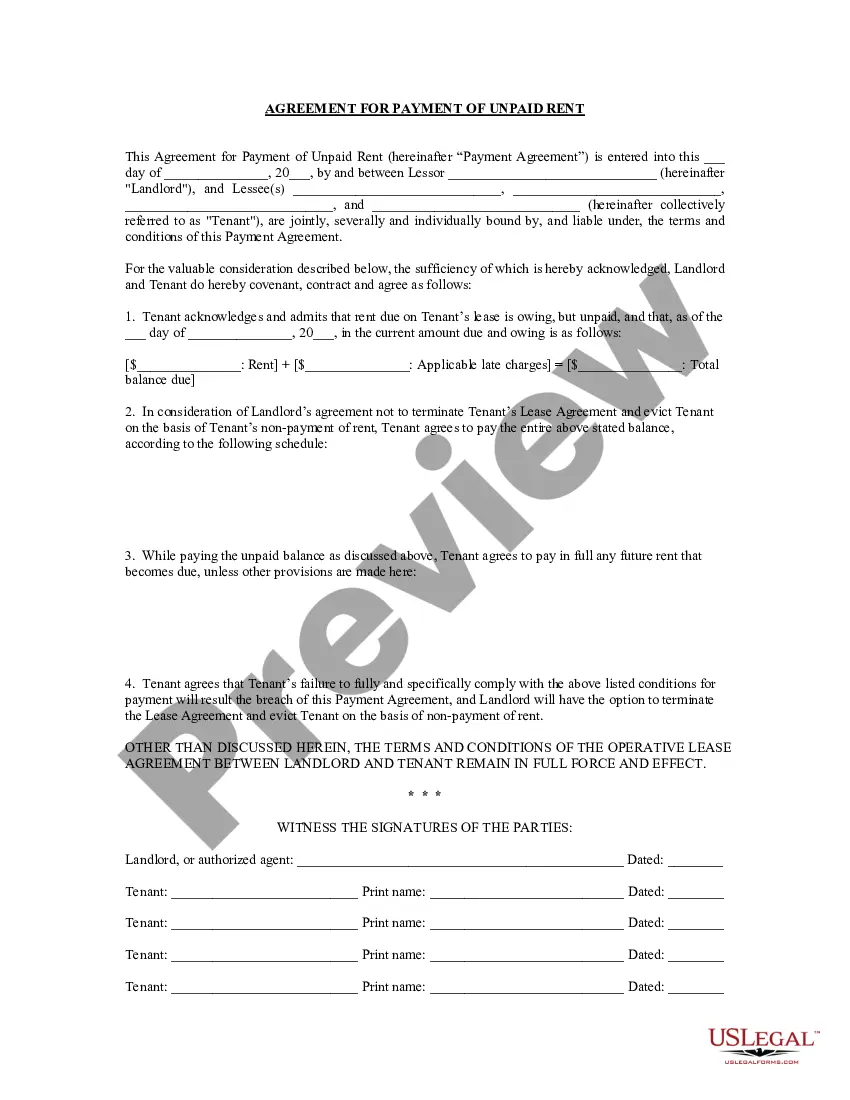

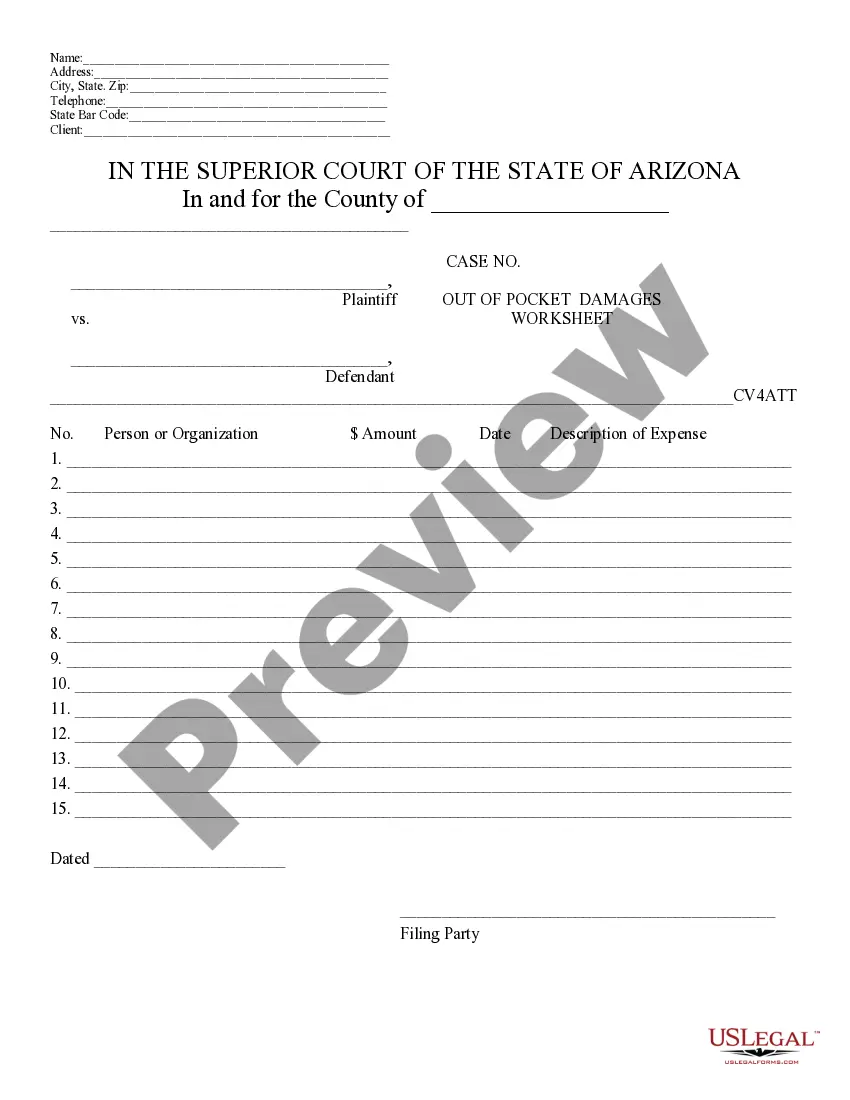

- Take advantage of the Preview option to analyze the form.

- Look at the explanation to actually have selected the right type.

- In case the type isn`t what you are seeking, make use of the Lookup industry to find the type that meets your requirements and specifications.

- If you obtain the appropriate type, click on Purchase now.

- Pick the pricing program you desire, fill out the specified info to produce your bank account, and pay for an order with your PayPal or charge card.

- Pick a convenient document structure and obtain your backup.

Locate each of the file layouts you possess bought in the My Forms menu. You may get a more backup of Iowa Book Value Phantom Stock Plan of First Florida Banks, Inc. anytime, if possible. Just click on the necessary type to obtain or printing the file design.

Use US Legal Forms, probably the most substantial assortment of lawful types, in order to save time and steer clear of mistakes. The assistance provides professionally produced lawful file layouts that you can use for a range of reasons. Create an account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

The plan may provide for a single payment, or it may provide for installment payments over a period of time after the phantom stock vests. In some cases, the employer may let the employee elect to receive the payout in the form of an equivalent amount of stock.

The answer involves two variables: (a) the presumed value of the company, and (b) the number of shares to be used in the plan. Once these two answers are known, the phantom share price is calculated as the former (the value) divided by the latter (the number of shares).

Phantom stock plans are considered ?liability awards? for accounting purposes (assuming they will be settled in cash rather than stock).

However, phantom stocks come with a considerable amount of disadvantages that can diminish participants' perceived control and influence, strain company liquidity, require extensive administrative efforts, introduce tax complexities, create disagreements, and subject participants to volatility in financial benefits ...

Phantom stock plans are considered ?liability awards? for accounting purposes (assuming they will be settled in cash rather than stock). As such, the sponsoring company must recognize the plan expense ratably over the vesting period. Varying accrual schedules can be found in the market.

Phantom shares are usually paid out when the company gets acquired or IPOes. The phantom shares are paid out in cash for their corresponding value.

If a business is sold, employees that own phantom stock receive money that is equal to the amount they would have received had they owned actual stock in the company. For that reason, it's financially beneficial to employees to own phantom stock, as they don't need to worry about dilution.

As a default, this form plan provides for forfeiture of all unvested phantom stock units upon a participant's termination of employment (subject to the terms of the award agreement).