Iowa Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation

Description

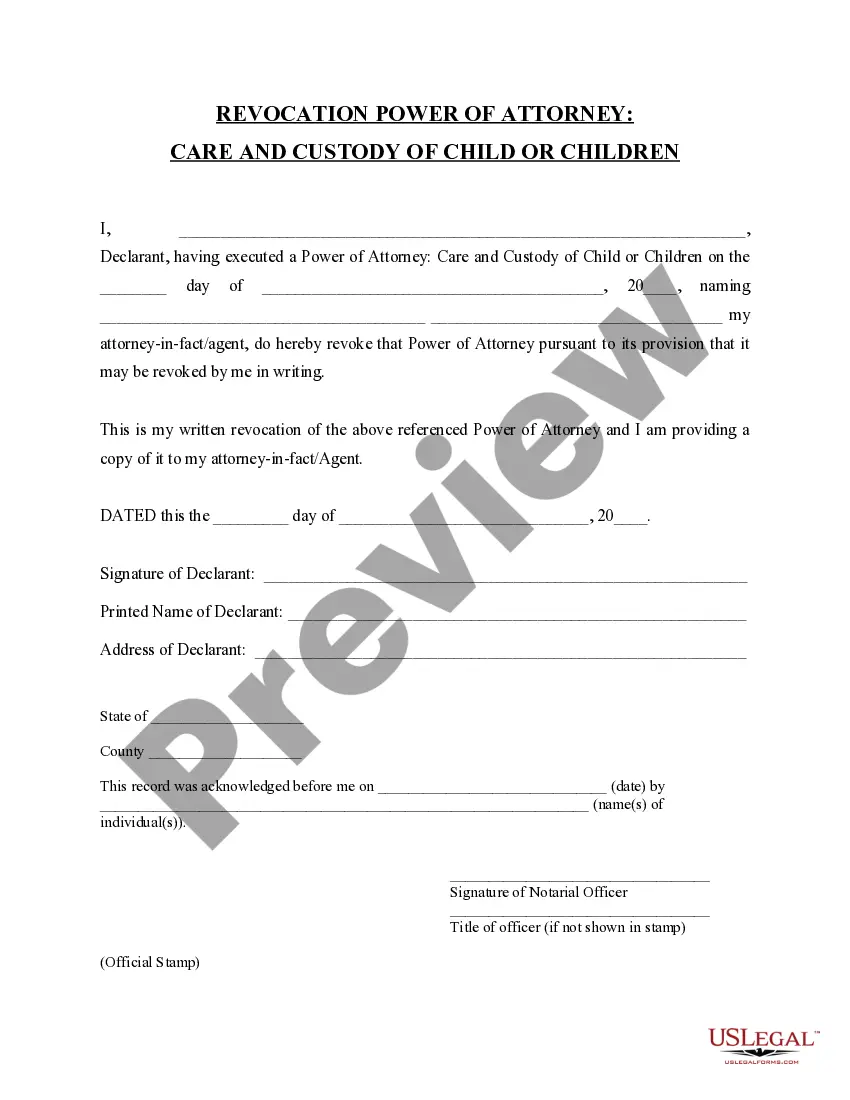

How to fill out Cash Award Paid To Holders Of Non-Exercisable Stock Options Upon Merger Or Consolidation?

If you wish to comprehensive, down load, or print out legitimate record templates, use US Legal Forms, the greatest collection of legitimate kinds, that can be found online. Take advantage of the site`s easy and hassle-free search to discover the files you need. Different templates for organization and person reasons are sorted by classes and suggests, or keywords and phrases. Use US Legal Forms to discover the Iowa Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation in a couple of click throughs.

If you are already a US Legal Forms buyer, log in in your profile and click the Acquire button to find the Iowa Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation. You may also entry kinds you previously delivered electronically inside the My Forms tab of your profile.

Should you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Ensure you have chosen the shape for that appropriate area/region.

- Step 2. Use the Preview method to look over the form`s articles. Don`t forget about to read the information.

- Step 3. If you are unsatisfied with all the kind, use the Research industry towards the top of the monitor to locate other models of the legitimate kind design.

- Step 4. Upon having discovered the shape you need, select the Buy now button. Opt for the prices program you prefer and include your credentials to register for the profile.

- Step 5. Approach the purchase. You can use your Мisa or Ьastercard or PayPal profile to accomplish the purchase.

- Step 6. Pick the file format of the legitimate kind and down load it on the system.

- Step 7. Comprehensive, change and print out or sign the Iowa Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation.

Each and every legitimate record design you purchase is the one you have for a long time. You may have acces to each and every kind you delivered electronically inside your acccount. Click on the My Forms portion and choose a kind to print out or down load once more.

Compete and down load, and print out the Iowa Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation with US Legal Forms. There are many specialist and state-distinct kinds you can utilize to your organization or person demands.

Form popularity

FAQ

A corporation is formed by submitting an Articles of Incorporation document to the Secretary of State, pursuant to Iowa Code Chapter 490. You may submit this file through the Fast Track Filing website. The cost to form a profit corporation is $50.

Vested employee stock options contain guarantees, so when a company is acquired employees with vested options will have some options. First is the acquiring company may buy out the options for cash. They may also offer to replace those contracts with options of the acquirer of equal or greater value.

A person who is the owner of twenty percent or more of the outstanding voting stock of any corporation, partnership, unincorporated association, or other entity is presumed to have control of such entity, in the absence of proof by a preponderance of the evidence to the contrary.

The new company could assume your current unvested stock options or RSUs or substitute them. The same goes for vested options. You'd likely still have to wait to buy shares or receive cash, but could at least retain your unvested shares.

490.1106 Articles of merger or share exchange.