Iowa Letter to Client - Status Report

Description

How to fill out Letter To Client - Status Report?

If you need to complete, download, or print legal record themes, use US Legal Forms, the biggest collection of legal forms, which can be found on the web. Take advantage of the site`s easy and hassle-free lookup to discover the documents you will need. Numerous themes for business and specific uses are sorted by categories and says, or search phrases. Use US Legal Forms to discover the Iowa Letter to Client - Status Report in just a few click throughs.

Should you be already a US Legal Forms buyer, log in in your account and click on the Obtain button to obtain the Iowa Letter to Client - Status Report. You may also accessibility forms you in the past saved inside the My Forms tab of your respective account.

Should you use US Legal Forms the very first time, refer to the instructions listed below:

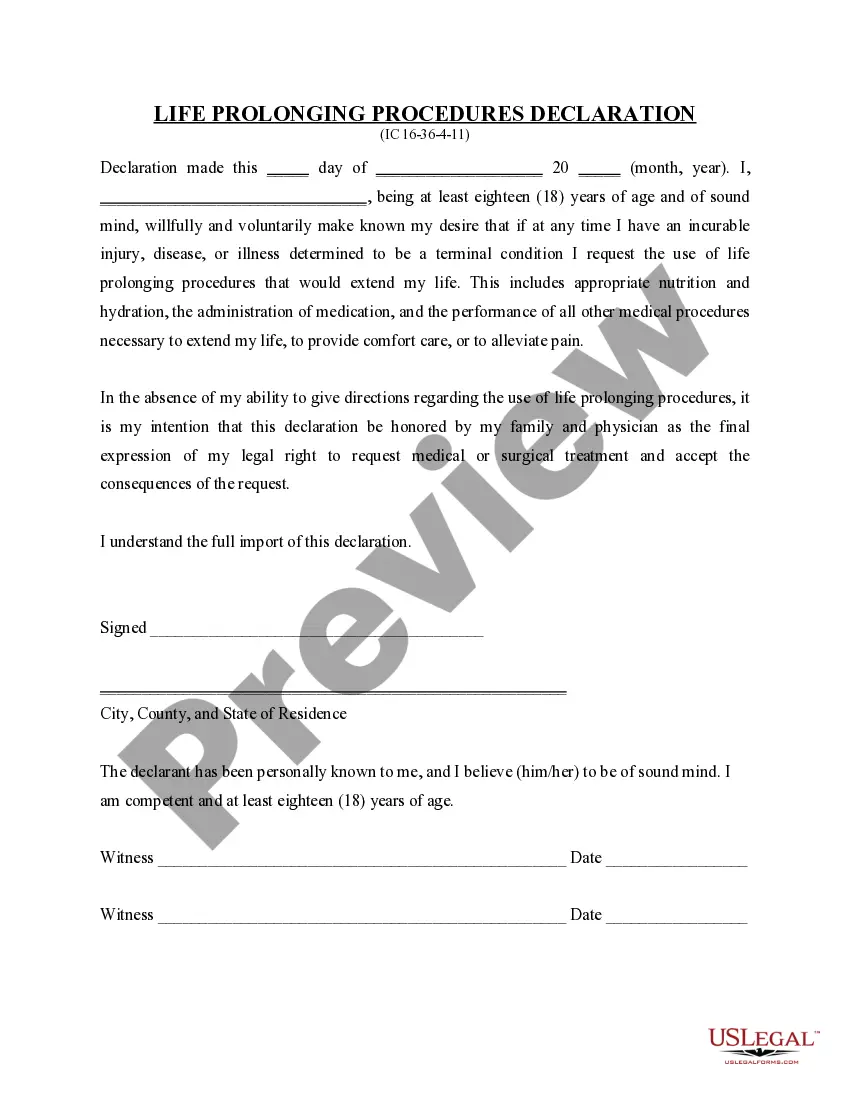

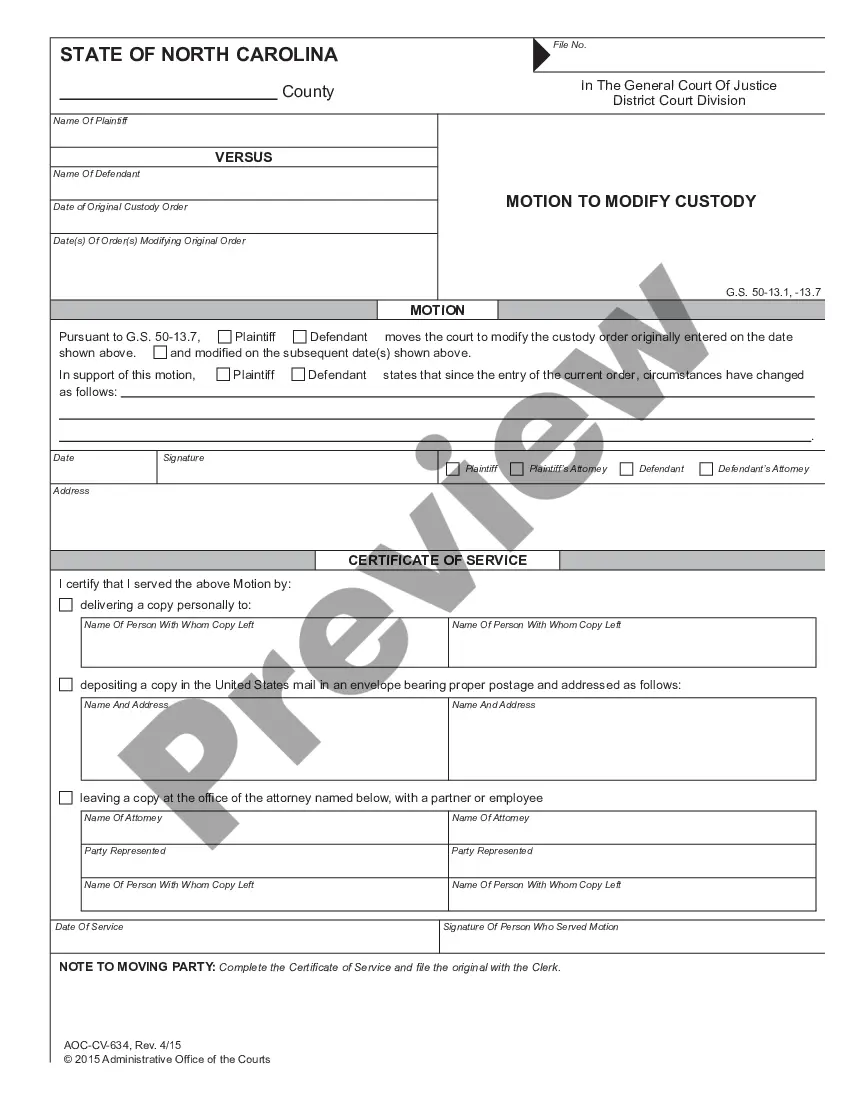

- Step 1. Ensure you have selected the form for the appropriate area/nation.

- Step 2. Take advantage of the Preview solution to examine the form`s content. Do not overlook to read through the information.

- Step 3. Should you be not satisfied using the kind, use the Lookup area at the top of the monitor to get other types in the legal kind web template.

- Step 4. Once you have discovered the form you will need, click on the Purchase now button. Choose the rates prepare you like and put your qualifications to register on an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Find the file format in the legal kind and download it in your product.

- Step 7. Full, change and print or indicator the Iowa Letter to Client - Status Report.

Every single legal record web template you get is your own forever. You might have acces to every single kind you saved in your acccount. Select the My Forms segment and decide on a kind to print or download once more.

Be competitive and download, and print the Iowa Letter to Client - Status Report with US Legal Forms. There are many professional and status-certain forms you can use to your business or specific needs.

Form popularity

FAQ

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.

Why did the Department send me a letter? We send letters for the following reasons: You have a balance due. We have a question about your tax return.

The Department will accept both the 12-digit permit number and 9-digit permit number when filing withholding returns, W-2s, and 1099s. All permits issued after November 15, 2021 will have a 9-digit number. The Department recommends using the 9-digit number when possible.

Why did the Department send me a letter? We send letters for the following reasons: You have a balance due. We have a question about your tax return.

If you owe money to the state, you will receive a notice. Do not ignore this notice. It is important for you to know how much you owe, why you owe it, and what state agency you will be dealing with.

Call or Visit the Department Visit the Department. Hoover State Office Building - 1st Floor. 1305 E. Walnut. Des Moines, IA 50319. ... Fax Options. Business Registration: 515-281-3906. Collections, after appeal period expires: 515-725-0264.

If you do not pay your tax bill within 20 days of its issuance, you will receive a Notice of Assessment. If you do not resolve your liability within 60 days of this point, your account will be transferred to the Collections Department.

If you have unpaid Iowa taxes, the DOR will send you notices and may call you. The state can also take a number of involuntary collection actions against you. This may include liens, levies, refusing to renew licenses and more.