Iowa Sample Letter for Writ of Garnishment

Description

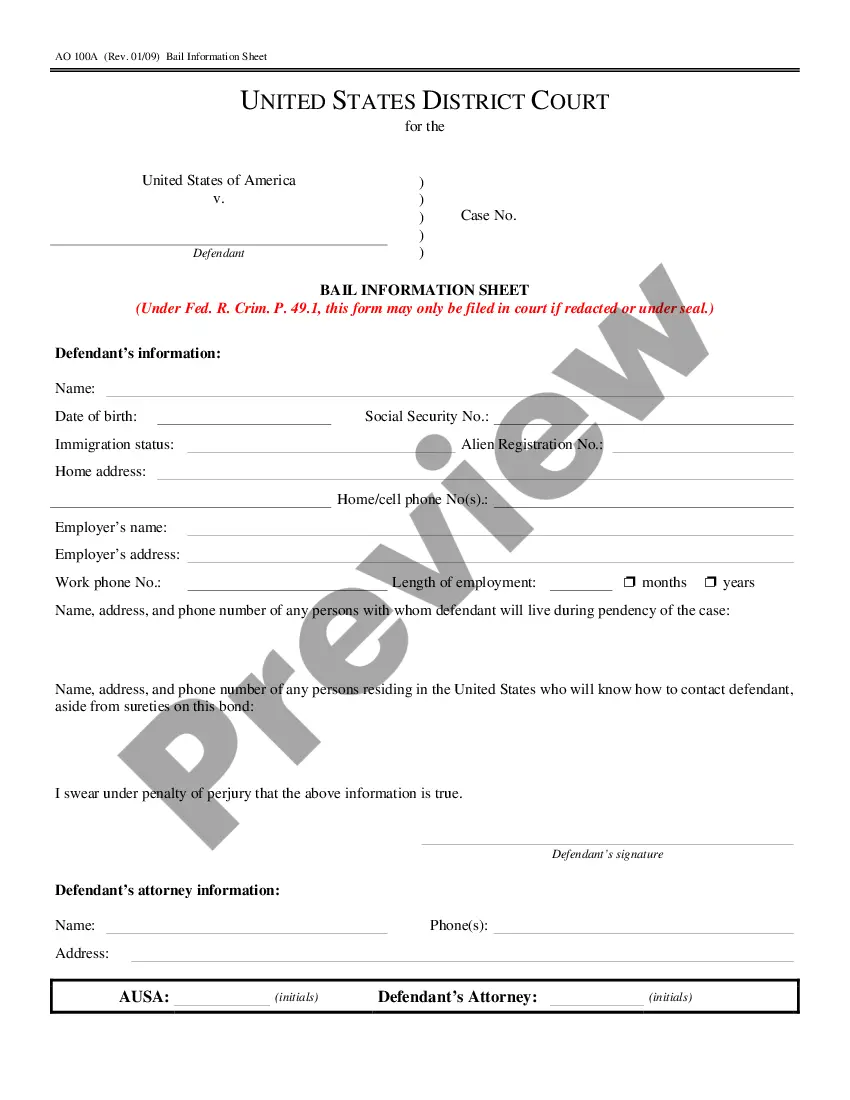

How to fill out Sample Letter For Writ Of Garnishment?

Finding the right legitimate record web template might be a struggle. Of course, there are tons of layouts available on the Internet, but how do you obtain the legitimate form you need? Take advantage of the US Legal Forms website. The assistance provides thousands of layouts, including the Iowa Sample Letter for Writ of Garnishment, that can be used for organization and private requires. All the kinds are checked out by pros and meet federal and state specifications.

If you are presently registered, log in in your accounts and click on the Obtain option to obtain the Iowa Sample Letter for Writ of Garnishment. Make use of your accounts to look through the legitimate kinds you have bought in the past. Proceed to the My Forms tab of your own accounts and get another version of your record you need.

If you are a whole new user of US Legal Forms, here are easy instructions that you can follow:

- Initial, make sure you have selected the right form for your personal area/county. You may examine the form using the Review option and study the form outline to guarantee it is the best for you.

- When the form is not going to meet your expectations, make use of the Seach area to obtain the right form.

- When you are sure that the form is suitable, select the Acquire now option to obtain the form.

- Choose the costs strategy you need and enter the required information and facts. Design your accounts and pay money for an order making use of your PayPal accounts or charge card.

- Pick the submit file format and down load the legitimate record web template in your product.

- Comprehensive, edit and produce and indication the received Iowa Sample Letter for Writ of Garnishment.

US Legal Forms may be the greatest library of legitimate kinds in which you can find numerous record layouts. Take advantage of the service to down load skillfully-produced files that follow express specifications.

Form popularity

FAQ

You can challenge the wage garnishment by filing a motion to quash the execution. You could also file a claim of exemption with the court. However, you need to do so within ten days of receiving the notice from your employer. You can also request a hearing to present your case to the judge.

If a garnishment has been placed on your wages, but you believe the garnishment is incorrect or should be stopped, you may file a ?Motion to Quash Garnishment and Request for Hearing? (Iowa Court Rule form 3.20).

Between $16,000 and $23,999 per year: up to $800 may be garnished. between $24,000 and $34,999 per year: up to $1,500 may be garnished. between $35,000 and $49,999 per year: up to $2,000 may be garnished, or. $50,000 or more per year: no more than 10% of your wages may be garnished.

I'm on a limited income, can I be garnished? Iowa and federal law provide exemptions that allow people to protect basic necessities (minimum income and some property) from judgment creditors. Some types of income, like that from Social Security, unemployment benefits, and veterans' benefits, are also protected.

Your creditor cannot garnish your wages or bank account unless there has been a judgment entered against you. Your creditor must first sue you in court. If the creditor gets a court judgment saying that you owe them money, then your creditor may be able to garnish your wages or your bank account.

Garnishments expire 120 days from the date it was issued by the Clerk of Court. The Sheriff's Office will require the last known address for the defendant, since for all non-wage garnishment a notice of garnishment is required to be mailed by restricted certified mail, as well as, one copy by first class mail.

If the child support amount exceeds 50% of a parent's net income, no more than 50% can be withheld for child support. If the payment is more than is owed to the family and an amount remains owed to the state, the Bureau of Collections applies the remainder to the amount owed to the state.