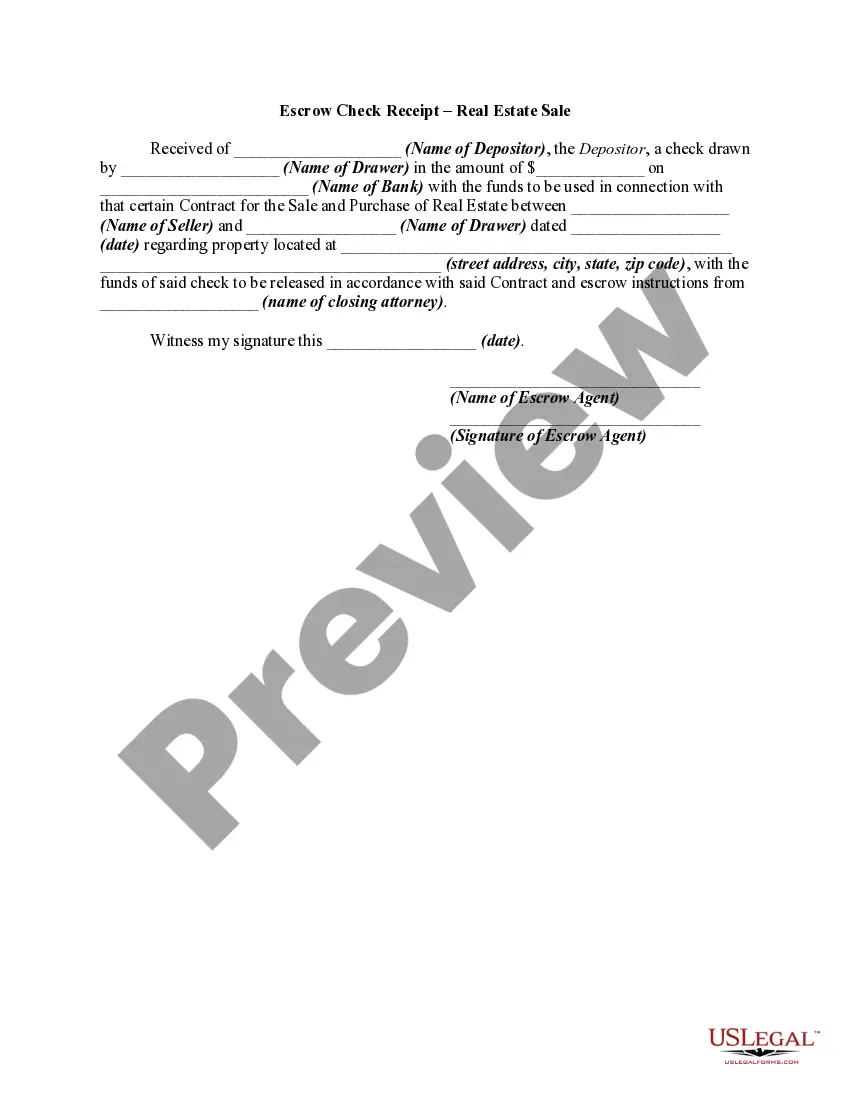

Iowa Escrow Check Receipt Form

Description

How to fill out Escrow Check Receipt Form?

Selecting the appropriate legitimate document format can be challenging.

Obviously, many designs are available online, but how do you locate the genuine form you need.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Iowa Escrow Check Receipt Form, which can be used for both business and personal purposes.

You can preview the form using the Preview button and read the form details to confirm it is suitable for you.

- All documents are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Get button to find the Iowa Escrow Check Receipt Form.

- Use your account to browse the official forms you have previously purchased.

- Go to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct form for your region/state.

Form popularity

FAQ

Iowa law provides a grace period of 31 days after your tags expire. During this time, you can still legally drive your vehicle; however, you should complete your registration renewal as soon as possible to avoid potential penalties. The Iowa Escrow Check Receipt Form can be beneficial for handling any payments involved in this process smoothly through the US Legal Forms platform.

When renewing your tags in Iowa, you'll need your vehicle's title, proof of insurance, and payment for the registration fees. Ensure all your documents are ready to avoid any delays. Consider utilizing the Iowa Escrow Check Receipt Form through US Legal Forms, which simplifies payment processes and helps you keep track of your transactions.

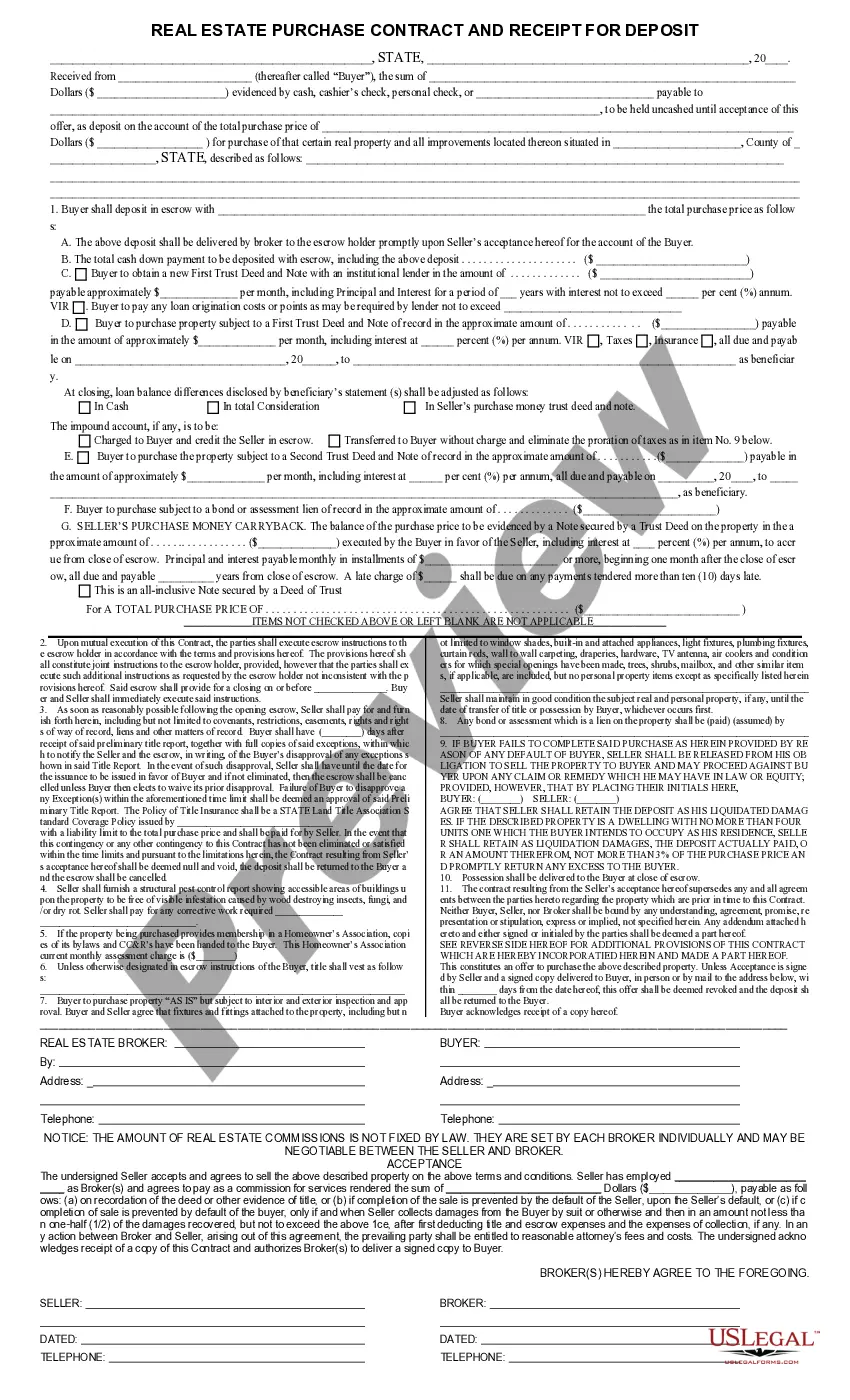

A deposit receipt is a record that a buyer paid an earnest money deposit. It is most commonly used in conjunction with real estate. The receipt is essential to prove the buyer deposited the funds. Funds must come from the buyer's resources.

Right way Be Specific:Find out the name of the title company and make the check payable to that particular title company.Put the property address in the memo line.Write a new check for every offer.

How to make journal entry for Earnest Money depositGo to the Banking menu and click Transfer Funds.In the Transfer Funds window, select the account from which you want to transfer the funds.Select the account to which you want to transfer the funds.Enter the amount that you want to transfer.Save the transaction.

Date the receipt and state the name of the person giving money, the amount and the name of the person who is receiving it. Use an ink pen (nonerasable) to create the receipt or print the document from your computer - never use a pencil. State what form of deposit is being left, such as cash, check or bank check.

Earnest Money Release Form Required to be signed by the buyer and seller if the earnest money is requested to be returned prior to the closing of the property.

In Iowa, property owners pay property taxes in arrears. Most homeowners pay their property taxes through an escrow service offered by their mortgage holder.

On the day of closing, the buyer owns the property and is responsible for the tax bills that come due on or after that date. Since Iowa's taxes are paid a year behind, the buyer is given a credit to cover the property taxes during the year they did not own the house.

Interest shall be disbursed to the owner or owners of the funds at the time of settlement of the transaction or as agreed to in the management contract and shall be properly accounted for on closing statements. A broker shall not disburse interest on trust funds except as provided in 13.1(3) and 13.1(7).