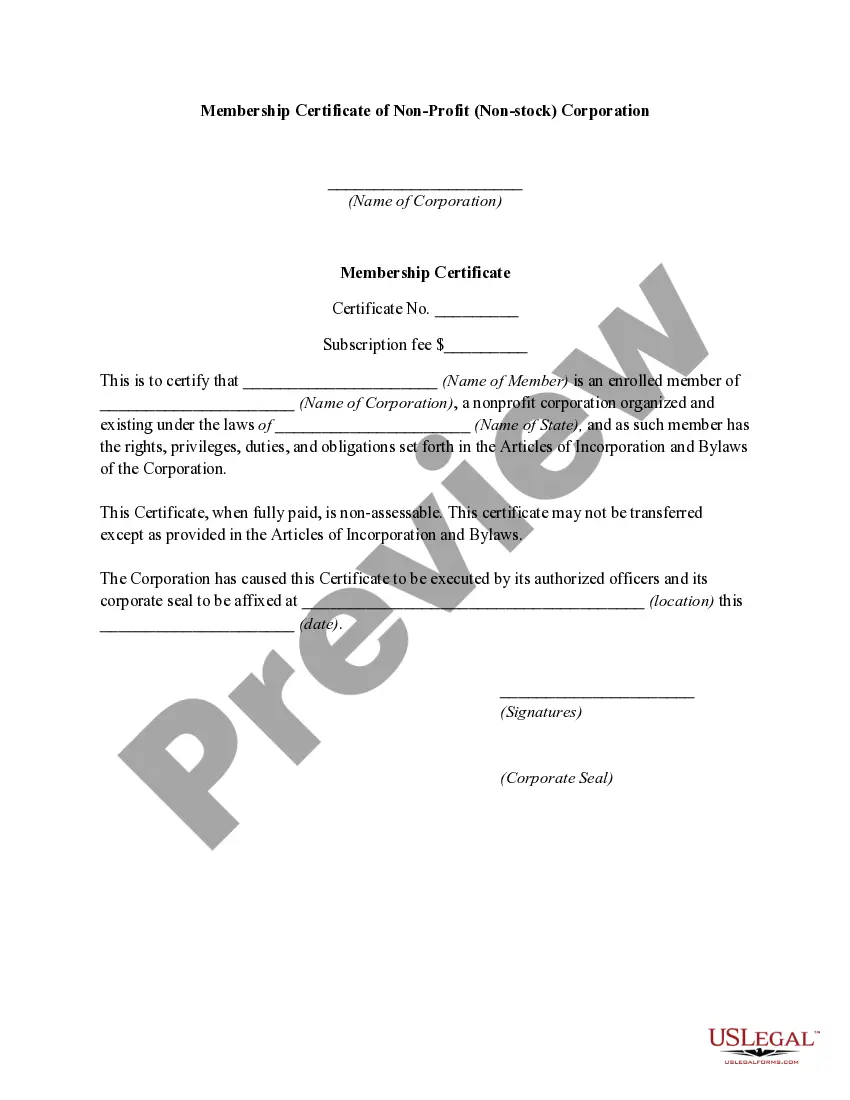

Iowa Membership Certificate of Nonprofit or Non Stock Corporation

Description

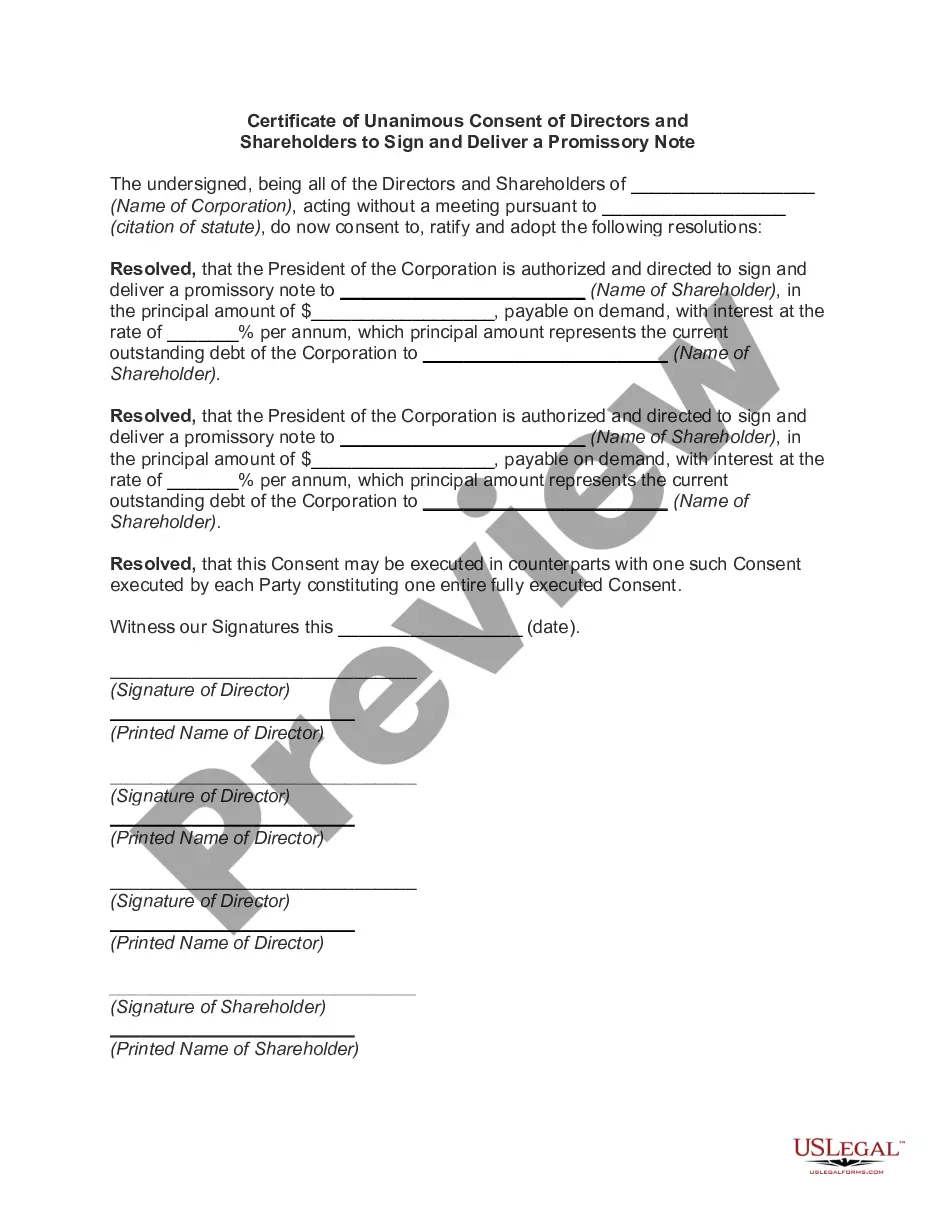

How to fill out Membership Certificate Of Nonprofit Or Non Stock Corporation?

US Legal Forms - among the most significant libraries of legal varieties in the United States - gives an array of legal file web templates it is possible to download or print out. While using web site, you will get a large number of varieties for business and person uses, sorted by classes, states, or keywords.You can get the most recent versions of varieties such as the Iowa Membership Certificate of Nonprofit or Non Stock Corporation in seconds.

If you already possess a monthly subscription, log in and download Iowa Membership Certificate of Nonprofit or Non Stock Corporation in the US Legal Forms library. The Obtain key can look on each and every type you view. You get access to all previously acquired varieties within the My Forms tab of your own profile.

If you would like use US Legal Forms the very first time, here are simple instructions to get you started:

- Ensure you have picked the right type for the city/region. Click the Preview key to review the form`s articles. Read the type description to actually have selected the appropriate type.

- When the type doesn`t fit your requirements, use the Look for area on top of the display screen to find the one who does.

- Should you be content with the form, confirm your selection by simply clicking the Purchase now key. Then, select the pricing strategy you prefer and supply your qualifications to register on an profile.

- Approach the deal. Use your Visa or Mastercard or PayPal profile to perform the deal.

- Pick the format and download the form in your device.

- Make alterations. Fill out, modify and print out and indication the acquired Iowa Membership Certificate of Nonprofit or Non Stock Corporation.

Each and every format you included with your account does not have an expiry particular date and is also your own eternally. So, if you would like download or print out one more duplicate, just visit the My Forms segment and then click around the type you need.

Gain access to the Iowa Membership Certificate of Nonprofit or Non Stock Corporation with US Legal Forms, by far the most extensive library of legal file web templates. Use a large number of professional and condition-particular web templates that satisfy your business or person requirements and requirements.

Form popularity

FAQ

Non-profit charities get revenue from donations, grants, and memberships. They may also get revenue from selling branded products. A non-profit organization's expenses may include: Rent or mortgage payments.

Prepare and File Articles of Incorporation Agency:Iowa Secretary of StateFiling Method:Mail, fax, or onlineAgency Fee:$20Turnaround:~1-2 business daysLaw:Iowa Code - Chapter 504: Revised Iowa Nonprofit Corporations Act2 more rows

Iowa charges a $20 filing fee for forming a nonprofit corporation. The IRS also charges a fee for your tax-exemption application. This fee is currently $400 if your annual revenues are $10,000 or less, and $850 if your revenues are more than $10,000.

A charitable nonprofit organization can be organized in Iowa as a corporation, a trust, a limited liability company or an unincorporated association.

Another difference between non-profit corporations and benefit corporations is that the stock certificates of the latter must be clearly marked with the words ?Benefit Corporation.? A non-profit company has no shareholders and therefore no stock certificates.

Membership Nonprofits In a membership nonprofit, individuals who support the nonprofit can join the organization as members and become part of the decision-making process. Nonprofit members can elect and vote for new board members and suggest changes to the nonprofit's bylaws.

Nonprofits that are exempt from federal income tax under 501(c)(3) are automatically exempt from parallel state income tax but not automatically exempt from other state level taxes such as sales, use, and property taxes.

So?. how much does it cost to start a nonprofit? The answer is ?it's complicated.? Generally, you need an investment of $500 at a bare minimum, but costs can be as high as $1,000 or more.