Iowa Disclaimer of Inheritance Rights for Stepchildren

Description

How to fill out Disclaimer Of Inheritance Rights For Stepchildren?

If you need to total, down load, or produce legitimate document themes, use US Legal Forms, the largest collection of legitimate forms, which can be found on the web. Take advantage of the site`s basic and convenient look for to discover the documents you require. Numerous themes for company and individual uses are sorted by categories and suggests, or key phrases. Use US Legal Forms to discover the Iowa Disclaimer of Inheritance Rights for Stepchildren with a couple of click throughs.

In case you are currently a US Legal Forms client, log in to your accounts and then click the Acquire option to obtain the Iowa Disclaimer of Inheritance Rights for Stepchildren. You can also access forms you formerly downloaded in the My Forms tab of your accounts.

If you use US Legal Forms the first time, follow the instructions under:

- Step 1. Ensure you have selected the form to the right city/nation.

- Step 2. Utilize the Preview option to look through the form`s content material. Do not neglect to read the description.

- Step 3. In case you are not satisfied with the type, utilize the Lookup industry on top of the display screen to find other types of your legitimate type design.

- Step 4. After you have identified the form you require, click the Get now option. Select the prices plan you favor and include your credentials to sign up on an accounts.

- Step 5. Method the financial transaction. You should use your Мisa or Ьastercard or PayPal accounts to finish the financial transaction.

- Step 6. Find the file format of your legitimate type and down load it on the gadget.

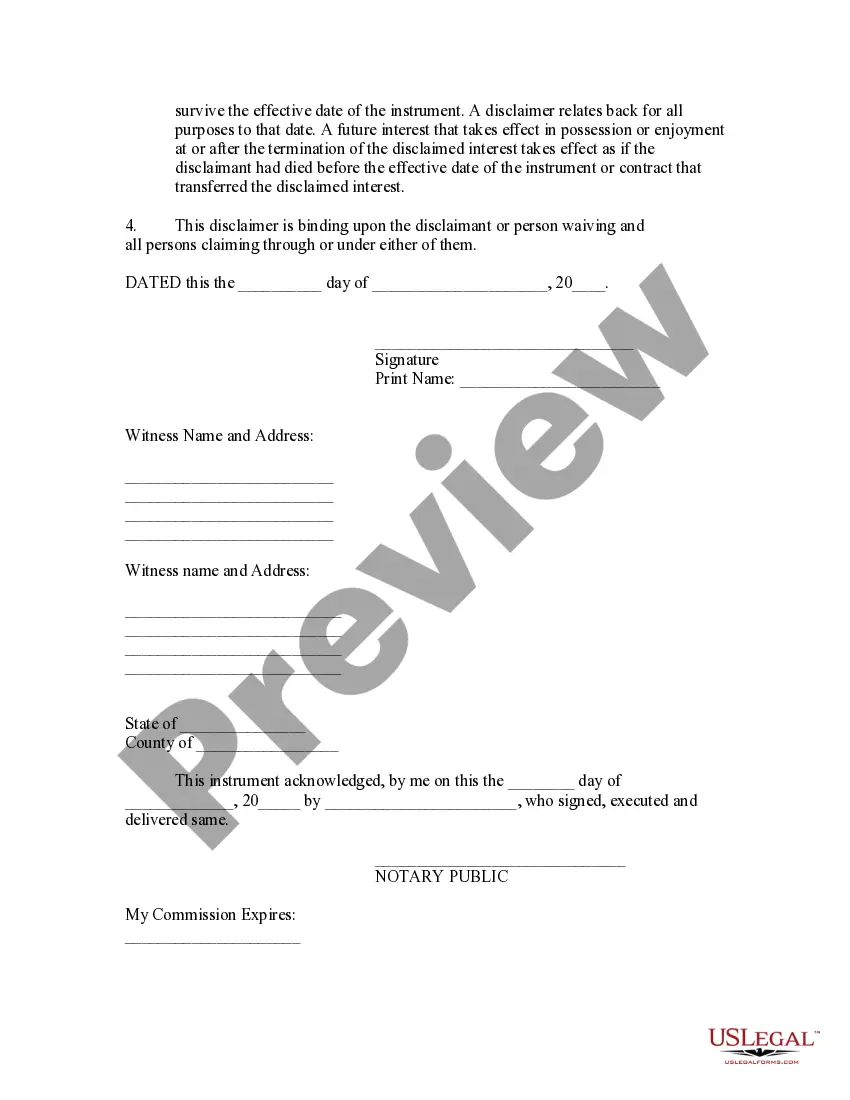

- Step 7. Comprehensive, revise and produce or signal the Iowa Disclaimer of Inheritance Rights for Stepchildren.

Each legitimate document design you buy is your own forever. You possess acces to every single type you downloaded in your acccount. Select the My Forms section and select a type to produce or down load once again.

Contend and down load, and produce the Iowa Disclaimer of Inheritance Rights for Stepchildren with US Legal Forms. There are millions of professional and state-specific forms you may use for your company or individual requirements.

Form popularity

FAQ

That is because Iowa's inheritance taxes are slowly being phased out through 2025. After January 1, 2025, there will be no Iowa inheritance tax charged. But inheritance taxes will apply for 2023 and 2024.

Children you legally adopted will receive an intestate share, just as your biological children do. Iowa Code § 633.223. Foster children and stepchildren. Foster children and stepchildren you never legally adopted will not automatically receive a share.

If the decedent's estate has been probated, the personal representative (executor or administrator) must file the return with the Iowa Department of Revenue. If the personal representative fails to file the return or if the estate is not probated, the beneficiary must file the return.

Children in Iowa Inheritance Law Intestate Succession: Spouses and ChildrenInheritance SituationWho Inherits Your PropertyChildren but no spouse? Children inherit everythingSpouse but no descendants? Spouse inherits everythingSpouse and descendants from you and that spouse? Spouse inherits everything1 more row ?

Update: In 2021, Iowa decided to repeal its inheritance tax by the year 2025. In the meantime, there is a phase-out period before the tax completely disappears. For deaths in 2021-2024, Iowa is reducing the tax rate by an additional 20% each year until the tax is fully phased out.

Inheritance Tax Exemption Spousal Exemption: Spouses who are married can transfer assets to each other tax-free, and the surviving spouse receives an inheritance tax exemption when receiving assets from their spouse. Charitable Donations: Donations made to qualified charitable organizations are exempt from these taxes.

450.9 Individual exemptions. In computing the tax on the net estate, the entire amount of property, interest in property, and income passing to the surviving spouse, lineal ascendants, lineal descendants, and stepchildren and their lineal descendants are exempt from tax.

For deaths on or after July 1, 1997, no tax is due on the following shares: Parents, grandparents, great-grandparents, children, stepchildren, grandchildren, great-grandchildren, and other lineal ascendants and lineal descendants, which includes descendants by adoption.