Iowa Sample Letter for Explanation of Insurance Rate Increase

Description

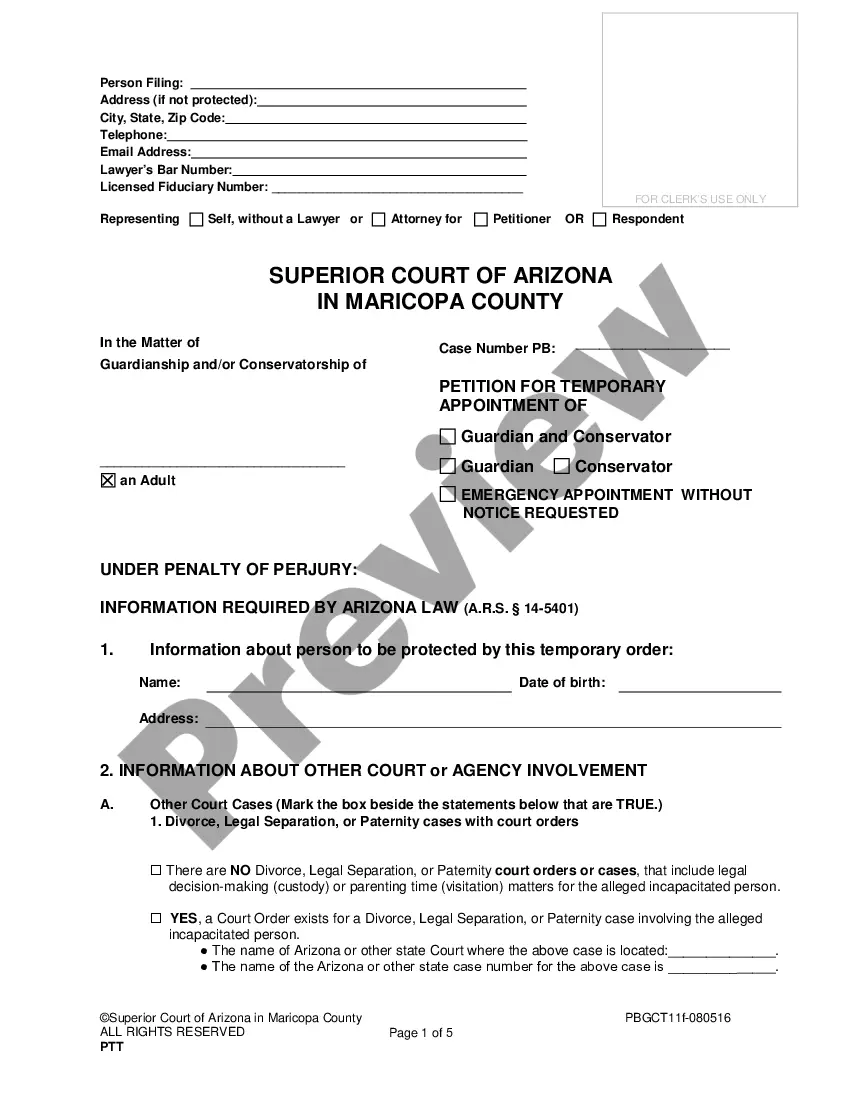

How to fill out Sample Letter For Explanation Of Insurance Rate Increase?

If you want to be thorough, download, or print legal document templates, utilize US Legal Forms, the largest repository of legal forms, available online.

Employ the site's simple and user-friendly search to locate the documents you need.

Various templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, select the Purchase now button. Choose the payment plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to obtain the Iowa Sample Letter for Explanation of Insurance Rate Increase in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Iowa Sample Letter for Explanation of Insurance Rate Increase.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions listed below.

- Step 1. Make sure you have selected the form for your correct region/country.

- Step 2. Use the Preview function to review the form’s content. Don’t forget to go through the description.

- Step 3. If you are unsatisfied with the form, use the Search bar at the top of the screen to find other forms within the legal form database.

Form popularity

FAQ

To write a letter claiming compensation, begin by clearly stating your intent and providing details about the incident that led to your claim. Include your contact information and any essential documentation that supports your request. An Iowa Sample Letter for Explanation of Insurance Rate Increase could be an excellent resource to guide the format and content of your letter.

When writing a letter to an insurance company regarding pain and suffering, describe the circumstances surrounding your claim clearly and succinctly. Provide details about your injuries and how they have affected your life. Again, referring to an Iowa Sample Letter for Explanation of Insurance Rate Increase can offer you a structured way to present your case persuasively.

To write an appeal letter for insurance, start by stating your position and the specifics of the insurance decision you are contesting. Clearly present any relevant facts and documents to support your case, and maintain a respectful tone throughout. An Iowa Sample Letter for Explanation of Insurance Rate Increase can serve as a helpful template to ensure your points are communicated effectively.

A good appeal letter to an insurance company should outline the reasons for your appeal clearly and include any supporting documentation. Be polite and specific about the decision you are appealing, and request a review. Referencing an Iowa Sample Letter for Explanation of Insurance Rate Increase can provide you with a solid foundation for crafting your letter.

Writing a formal letter to an insurance company involves using a professional tone. Address the letter to the appropriate department, include your contact information, and explicitly express your concern or request. Utilizing an Iowa Sample Letter for Explanation of Insurance Rate Increase can help ensure that you cover all necessary points clearly and effectively.

To write a letter to an insurance company, start with your details, including your name and policy number, at the top. Clearly state the purpose of your letter, whether it’s to inquire about a rate increase or request clarification. Be concise and respectful, and consider using an Iowa Sample Letter for Explanation of Insurance Rate Increase as a guide for structure.

One common reason for claim rejection is insufficient documentation or lack of clarity in the submitted information. To avoid this, ensure that all documents are complete and clear when submitting a claim. Familiarizing yourself with the Iowa Sample Letter for Explanation of Insurance Rate Increase can also help you understand the importance of documentation when communicating with your insurance provider.

Writing a reconsideration letter for insurance involves stating your request clearly and presenting your case. Include your personal information, explain the context of your insurance rate increase, and provide reasons that justify your request. The Iowa Sample Letter for Explanation of Insurance Rate Increase can be a valuable resource to guide you through the process.

To craft a powerful appeal letter, focus on clarity and persuasion. Start with a professional greeting, and state your purpose right away. Make sure to back up your claims with facts and be respectful. Consider using the Iowa Sample Letter for Explanation of Insurance Rate Increase to help present your case in a structured, compelling way.

When writing a reconsideration request, begin by outlining your situation concisely. Clearly explain why you believe a review of your insurance rate is warranted, and include any supporting documentation. Use the Iowa Sample Letter for Explanation of Insurance Rate Increase as a helpful template to ensure you cover all necessary points effectively.