Iowa Miller Trust Forms for Medicaid

Description

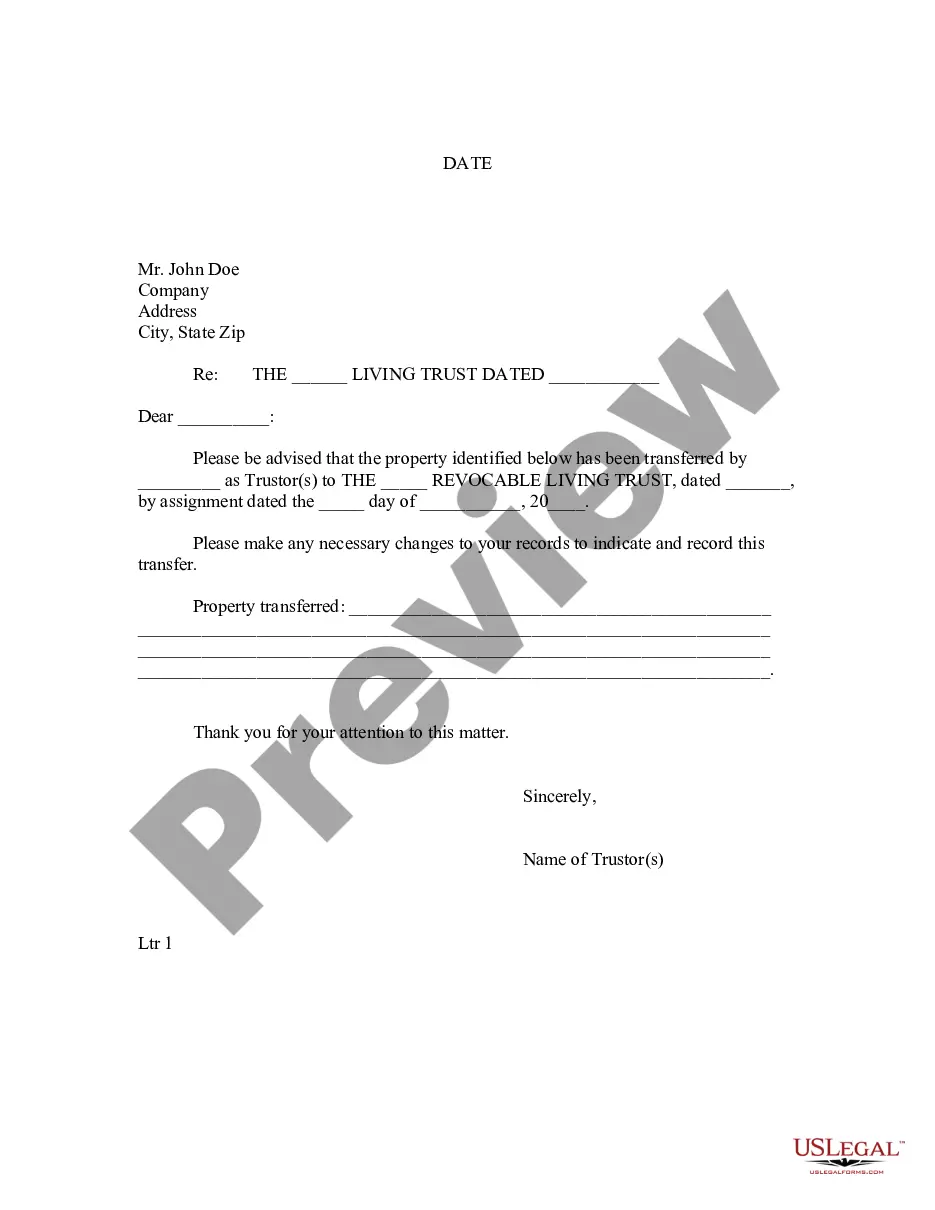

How to fill out Miller Trust Forms For Medicaid?

If you wish to finalize, obtain, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you require.

A variety of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your credentials to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to access the Iowa Miller Trust Forms for Medicaid with just a few mouse clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Iowa Miller Trust Forms for Medicaid.

- You can also access forms you have previously acquired from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Utilize the Review option to inspect the form’s content. Be sure to read the explanation.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternatives of the legal form template.

Form popularity

FAQ

Certain trusts, such as irrevocable trusts, can be exempt from Medicaid evaluations. However, these trusts must be set up properly to ensure they meet all requirements. The specifics can vary by state, so it’s essential to understand how the Iowa Miller Trust Forms for Medicaid fit within your planning. Consulting a legal expert can provide clarity on which trusts are exempt.

Yes, using a Miller trust can help you qualify for Medicaid if your income exceeds the allowed limits. The trust allows you to place the extra income into a dedicated account, thereby meeting Medicaid's requirements. It’s crucial to ensure that the trust complies with state regulations, so consider utilizing resources like uslegalforms to assist you in the process.

A Miller trust is specifically designed to help individuals qualify for Medicaid when their income exceeds certain limits. By funneling excess income into the trust, you can reduce your countable income for Medicaid eligibility. This can make a significant difference in accessing the health care benefits you need. To set up a Miller trust correctly, consider using Iowa Miller Trust Forms for Medicaid.

Medicaid trusts, including the Iowa Miller Trust Forms for Medicaid, can limit your access to funds. Additionally, creating a trust involves legal fees and requires careful management. If not set up correctly, it could negatively impact your Medicaid eligibility or lead to penalties. Consulting with a professional can help you navigate these challenges.

Yes, Medicaid reviews trusts during the application process. This includes an evaluation of assets and income. If you have an Iowa Miller Trust for Medicaid, it may affect how Medicaid views your financial situation. It’s important to understand the implications of any trust on your eligibility.

Yes, Iowa Medicaid examines your financial status, and this may include reviewing your bank accounts. They do this to determine your eligibility for benefits and to ensure that applicants meet the income and asset requirements outlined in the program. It's important to note that assets placed in an Iowa Miller Trust can be excluded from this assessment, which may help you qualify for Medicaid. Using Iowa Miller Trust Forms for Medicaid is a beneficial strategy to protect your assets while securing the necessary care.

A Medicaid income trust, commonly known as a Miller Trust, takes excess income and places it into a dedicated account to help you qualify for Medicaid. In this arrangement, your income flows into the trust, ensuring you stay within the state's income limits while protecting your assets. The funds in the trust can cover medical expenses, making this an effective strategy for those needing long-term care. Our Iowa Miller Trust Forms for Medicaid simplify the process, enabling you to set up your trust with ease.

The Iowa Miller Trust Forms for Medicaid provide a reliable way to safeguard your assets from the costs associated with long-term care. A Miller Trust allows you to meet Medicaid's income requirements while still protecting your financial resources. This type of trust helps ensure you qualify for Medicaid benefits without losing your hard-earned assets. By utilizing our user-friendly platform, you can easily access the necessary forms to establish a Miller Trust tailored to your needs.

Certain assets are protected from Medicaid liens, thanks to guidelines that delineate what is exempt. Common protected assets include your home (up to a certain value), personal belongings, and retirement accounts. By utilizing Iowa Miller Trust Forms for Medicaid, you can secure additional assets while qualifying for benefits. Understanding these protections plays a crucial role in your financial strategy as you navigate Medicaid eligibility.

A Miller trust, also known as a qualified income trust, allows individuals to become eligible for Medicaid while maintaining some income. In Iowa, this trust acts as a vehicle to hold excess income above the Medicaid limit. By utilizing Iowa Miller Trust Forms for Medicaid, you can effectively manage your financial situation and receive necessary care without losing your assets. It is wise to consult experts to set up and manage this trust accurately.