Iowa Non-Disclosure Agreement for Potential Investors

Description

How to fill out Non-Disclosure Agreement For Potential Investors?

If you need to finalize, acquire, or produce legal document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Take advantage of the site’s simple and convenient search to find the documents you require. Numerous templates for business and personal use are classified by categories and states, or keywords.

Use US Legal Forms to obtain the Iowa Non-Disclosure Agreement for Potential Investors with just a few clicks.

Every legal document template you purchase is yours permanently. You have access to each form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Compete and obtain, then print the Iowa Non-Disclosure Agreement for Potential Investors using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download option to access the Iowa Non-Disclosure Agreement for Potential Investors.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have chosen the form for the correct region/state.

- Step 2. Utilize the Review option to verify the form’s details. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. After you have located the form you want, click the Buy now option. Choose your preferred payment plan and provide your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Iowa Non-Disclosure Agreement for Potential Investors.

Form popularity

FAQ

Certainly, you can write an NDA yourself as long as you cover the crucial points like definitions, obligations, and exclusions. However, it is crucial to ensure that your Iowa Non-Disclosure Agreement for Potential Investors is clear and comprehensive. If you're uncertain, relying on templates or services like USLegalForms could safeguard against common mistakes.

Yes, you can create your own non-disclosure agreement, especially if you understand the essential elements it must include. However, crafting an effective Iowa Non-Disclosure Agreement for Potential Investors requires careful consideration of legal wording and necessary clauses. To simplify this process, using USLegalForms can help you generate a professional NDA that meets your specific needs.

Generally, a non-disclosure agreement (NDA) does not need to be notarized. It is a legally binding contract as long as both parties sign it. However, if you are dealing with sensitive information, having your Iowa Non-Disclosure Agreement for Potential Investors notarized may provide an extra layer of security. It's wise to consult legal advice if you're unsure about this step.

Five key elements of an Iowa Non-Disclosure Agreement for Potential Investors include the definition of confidential information, obligations of confidentiality, the duration of the agreement, exclusions from confidentiality, and consequences for breach of the agreement. These components work together to define what is considered confidential and the responsibilities of both parties in maintaining that confidentiality. By including these elements, you can create a strong legal foundation for your discussions.

Yes, you need an Iowa Non-Disclosure Agreement for Potential Investors to protect sensitive information shared during discussions. Investors often learn about unique business ideas, financial data, and strategies that you might not want to disclose publicly. An NDA establishes a legal framework that ensures investors cannot share your confidential information with others, providing you with peace of mind.

The rules governing an Iowa Non-Disclosure Agreement for Potential Investors typically revolve around maintaining confidentiality and respecting the proprietary information shared. Both parties must refrain from disclosing confidential information without prior consent. Moreover, the agreement should detail the circumstances under which confidential information might be disclosed, thus promoting trust and clarity in business relationships.

Key points of an Iowa Non-Disclosure Agreement for Potential Investors include the definition of confidential information, the obligations of the parties, the duration of confidentiality, and the permitted disclosures. It's also essential to outline the consequences of breaching the agreement and clarify any exceptions to confidentiality, such as information that is already public knowledge. These elements help ensure clarity and protect both parties.

When dealing with an Iowa Non-Disclosure Agreement for Potential Investors, certain red flags may indicate potential issues. Look for vague definitions of confidential information, overly broad obligations, or clauses that seem unfairly restrictive. Additionally, be cautious of NDAs that do not specify the duration of confidentiality or include provisions that might limit your future business opportunities.

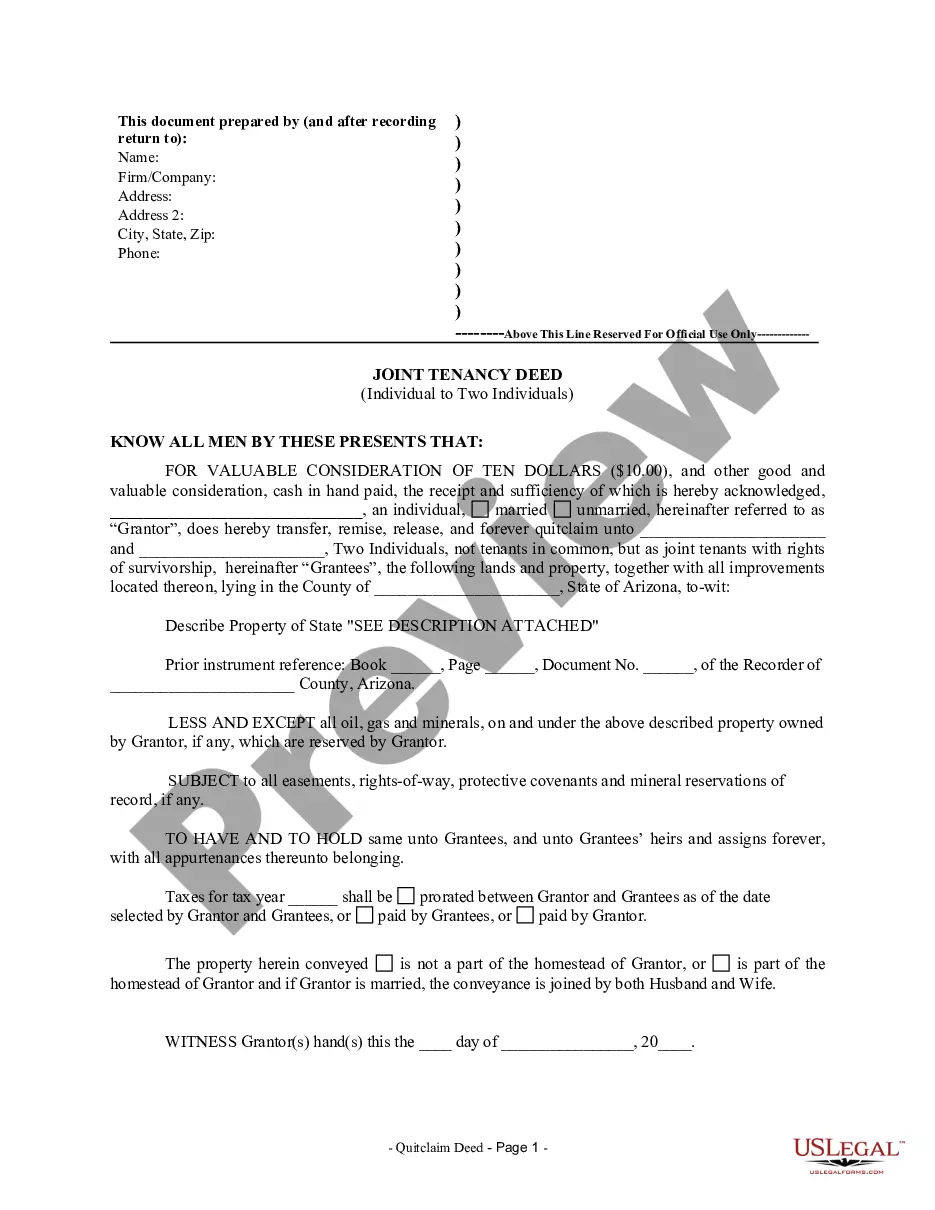

Filling out an Iowa Non-Disclosure Agreement for Potential Investors involves several key steps. First, identify and describe the parties involved in the agreement. Next, clearly outline what information is considered confidential, including specifics about the business idea, financial details, or trade secrets. Lastly, both parties should sign the document to make it legally binding, ensuring mutual understanding and commitment.

The primary difference between a mutual NDA and a one-way NDA lies in how information is shared. A one-way NDA involves one party disclosing confidential information to another party, requiring the latter to keep it safe. In contrast, a mutual NDA allows both parties to share information with a commitment to confidentiality. Choosing the right type is essential for establishing trust in any investment situation, especially when dealing with the Iowa Non-Disclosure Agreement for Potential Investors.