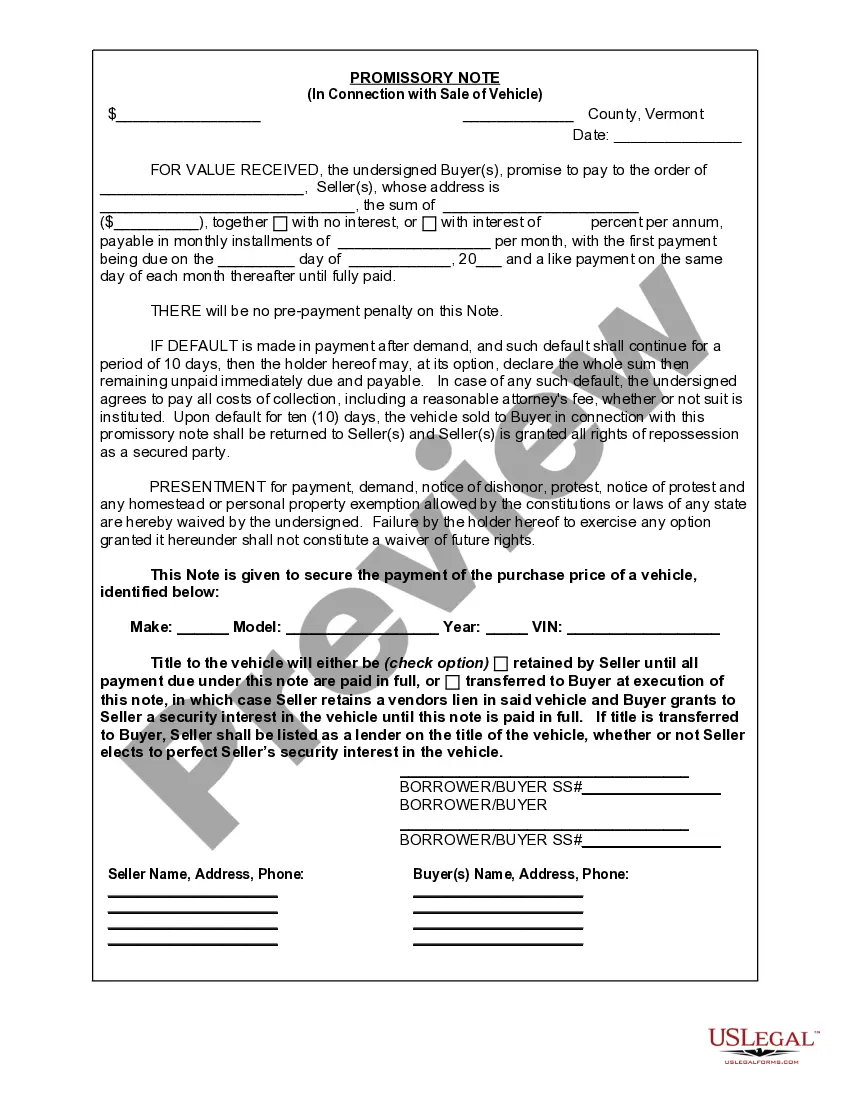

A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

Iowa Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note

Description

How to fill out Letter Tendering Full Payment Of Existing Balance Of Promissory Note Due To Acceleration Or Prepayment Of Note?

Selecting the appropriate legal document template can be quite challenging. Clearly, there is an array of designs available online, but how can you find the legal form you require? Utilize the US Legal Forms website.

The service offers thousands of designs, including the Iowa Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note, which you can use for business and personal purposes. All of the documents are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the Iowa Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note. Use your account to browse the legal documents you have previously purchased. Go to the My documents tab of your account and get another copy of the document you need.

Complete, modify, print, and sign the obtained Iowa Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note. US Legal Forms is the largest repository of legal forms where you can find numerous document templates. Use the service to acquire professionally crafted documents that comply with state requirements.

- If you are a new user of US Legal Forms, follow these simple instructions.

- First, ensure you have chosen the correct form for your area/region. You can preview the form using the Preview button and read the form description to confirm this is the correct one for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- When you are confident the form is suitable, click the Purchase now button to obtain the form.

- Select the pricing plan you want and enter the required information. Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

To accelerate a promissory note, the lender typically invokes an acceleration clause, which allows them to demand full repayment of the remaining balance. This action often occurs when the borrower fails to meet payment obligations or secures a prepayment option. A crucial part of this process is sending an Iowa Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note, which formally indicates the borrower's intent to settle the debt. Understanding these steps can help both parties manage their responsibilities effectively.

The acceleration of a promissory note refers to the lender's right to demand full payment once certain conditions are met, like a breach or default by the borrower. This process often involves issuing the Iowa Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note, which outlines the total owed. Understanding this concept is vital for both lenders and borrowers to navigate their financial agreements effectively.

To accelerate a promissory note, you must follow the conditions set forth in the document, usually involving a default. Notify the borrower in writing about the acceleration, referencing the Iowa Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note. This process helps to formalize your request for full payment and protect your rights as a lender.

Yes, you can demand a promissory note based on the terms outlined within the document. If the borrower defaults or the acceleration clause is invoked, you can request full payment. Utilizing the Iowa Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note is effective in communicating this demand.

An acceleration clause in a promissory note allows the lender to demand full repayment if specific conditions arise, such as missed payments. When this clause is enforced, it triggers the Iowa Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note. This essential feature protects the lender's interests, ensuring they can act swiftly in a default situation.

To legally enforce a promissory note, you must first review its terms to ensure compliance. Gather any necessary documentation, including the Iowa Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note, if applicable. Next, contact the borrower to discuss repayment options, and if necessary, consider taking legal action to recover the debt.

To make a promissory note enforceable, ensure it is clear, written, signed, and contains essential terms like the interest rate and payment schedule. It's also advisable to have it witnessed or notarized to enhance its validity. For a comprehensive understanding, exploring the Iowa Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note through Uslegalforms can be very helpful.

To correct a promissory note, both parties should agree on the changes and sign a new version reflecting the updated terms. It is essential to ensure that changes do not alter the original contract's core intentions. Familiarizing yourself with the Iowa Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note can help streamline this process.

Yes, you can sue someone based on a promissory note if they fail to uphold their end of the agreement. To initiate a lawsuit, you will need to provide a copy of the note and demonstrate that the terms have not been fulfilled. The Iowa Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note can guide you through the necessary steps when pursuing legal action.

A notarized promissory note generally holds significant weight in court. Notarization provides added authenticity and proves that both parties willingly signed the document. However, various factors can affect its enforceability, making knowledge of the Iowa Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note essential for your legal protection.