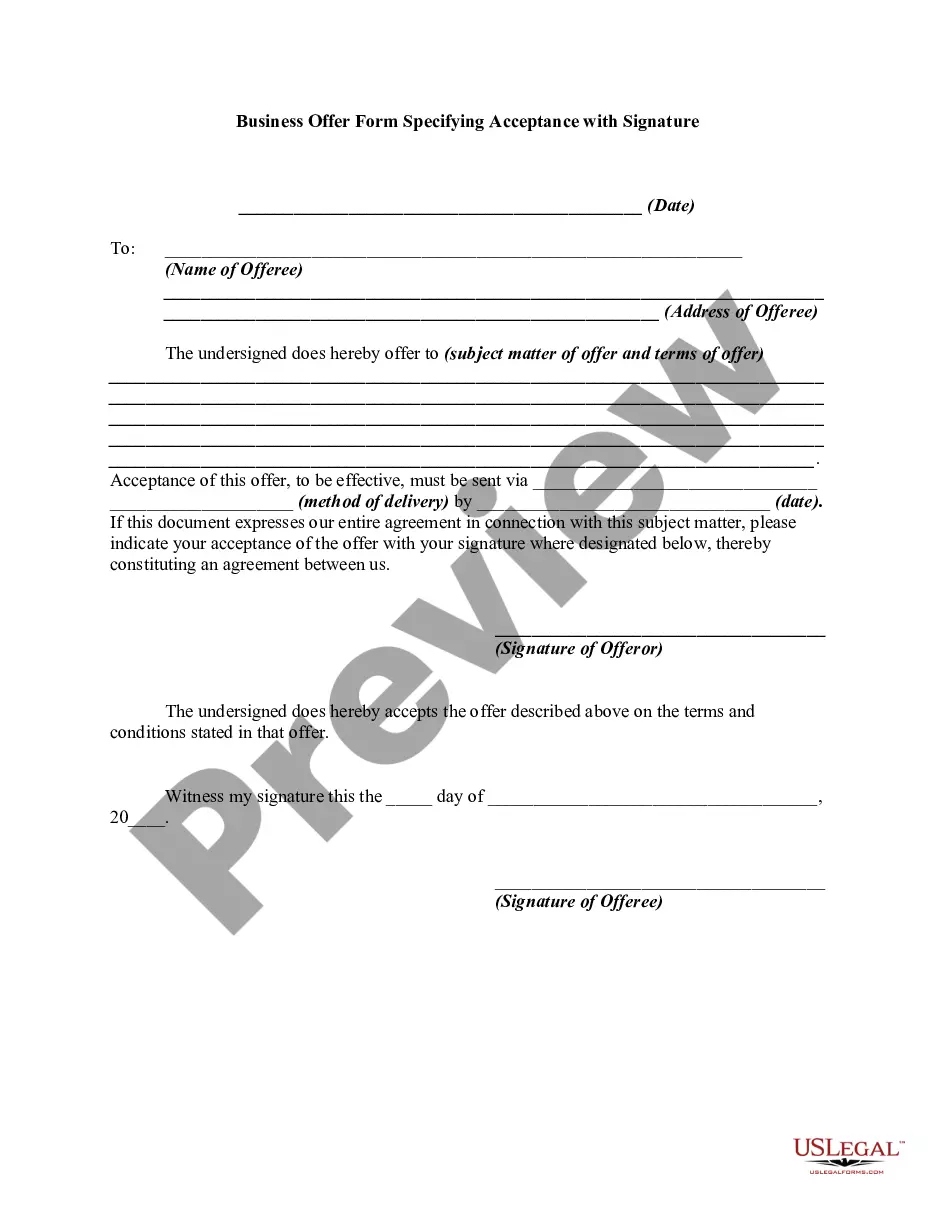

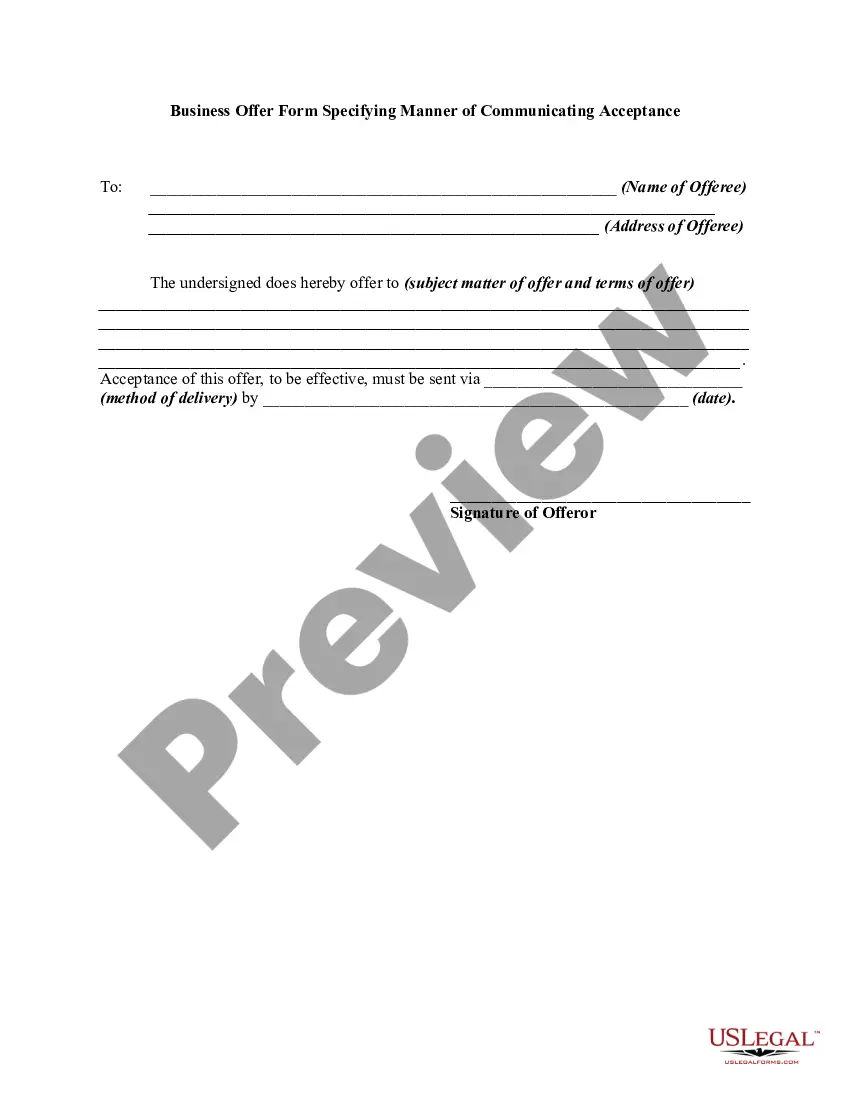

The elements of a contract are: an agreement; between competent parties; based upon the genuine assent of the parties; supported by consideration; made for a lawful objective; and in the form required by law. A contract is based upon an agreement. An agreement arises when one person, the offeror, makes an offer and the person to whom is made, the offeree, accepts. There must be both an offer and an acceptance. If either is not present, there is no contract.

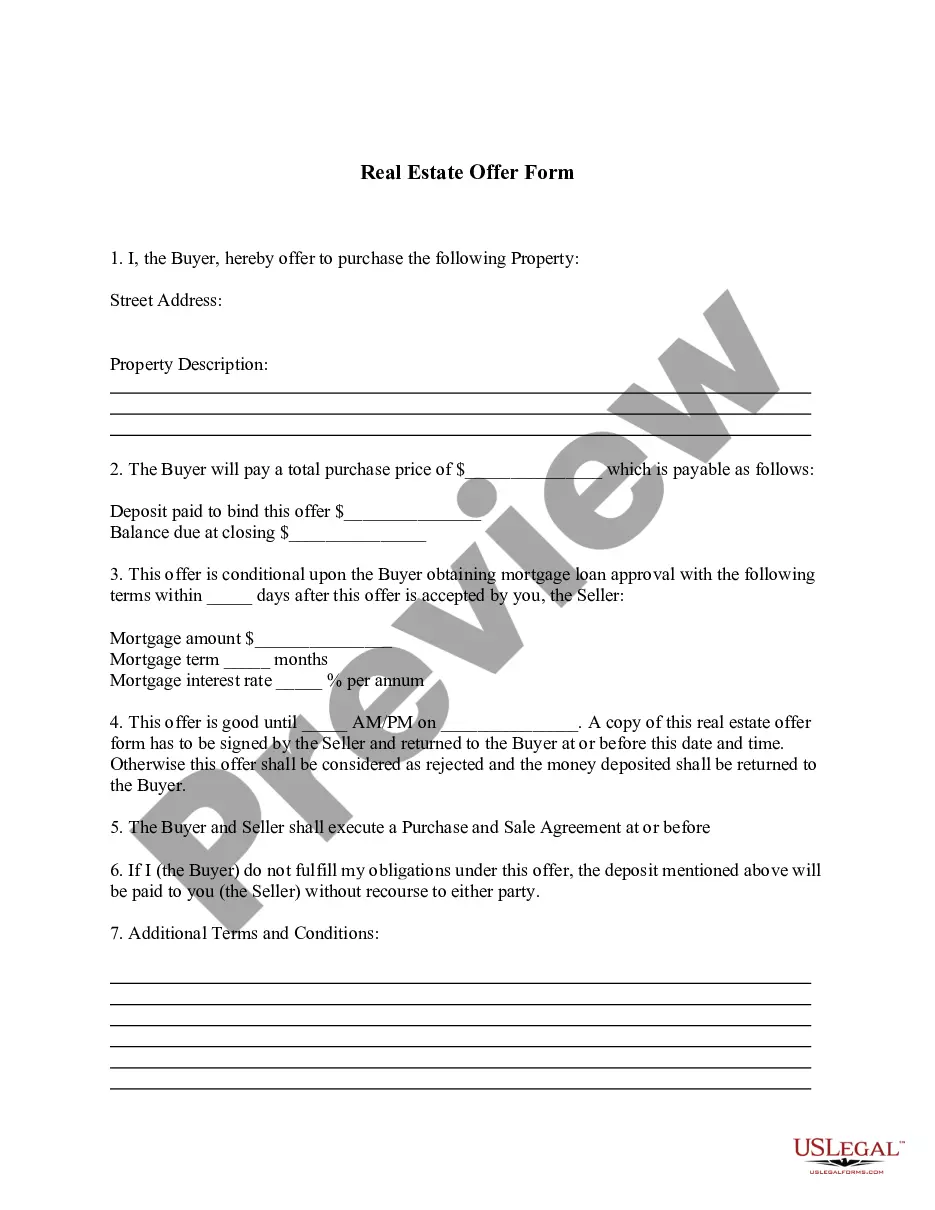

This form is an offer which specifies that acceptance of the offer should be communicated by the offeree signing where indicated.