Iowa Shareholder and Corporation agreement to issue additional stock to a third party to raise capital

Description

How to fill out Shareholder And Corporation Agreement To Issue Additional Stock To A Third Party To Raise Capital?

If you wish to be thorough, download, or print officially sanctioned document templates, utilize US Legal Forms, the premier collection of legal forms available online. Take advantage of the site's straightforward and user-friendly search to find the documents you need.

Numerous templates for business and personal use are categorized by types and states, or keywords. Use US Legal Forms to acquire the Iowa Shareholder and Corporation agreement to issue additional stock to a third party to secure funding in just a few clicks.

If you are already a customer of US Legal Forms, sign in to your account and click the Acquire button to obtain the Iowa Shareholder and Corporation agreement for issuing additional stock to a third party for capital raise. You can also access forms you've previously downloaded in the My documents section of your account.

Every legal document template you acquire is yours indefinitely. You have access to every form you have downloaded in your account. Click on the My documents section and select a form to print or download again.

Compete and download, and print the Iowa Shareholder and Corporation agreement to issue additional stock to a third party for capital raise with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal requirements.

- Step 1. Ensure you have chosen the form for the correct region/country.

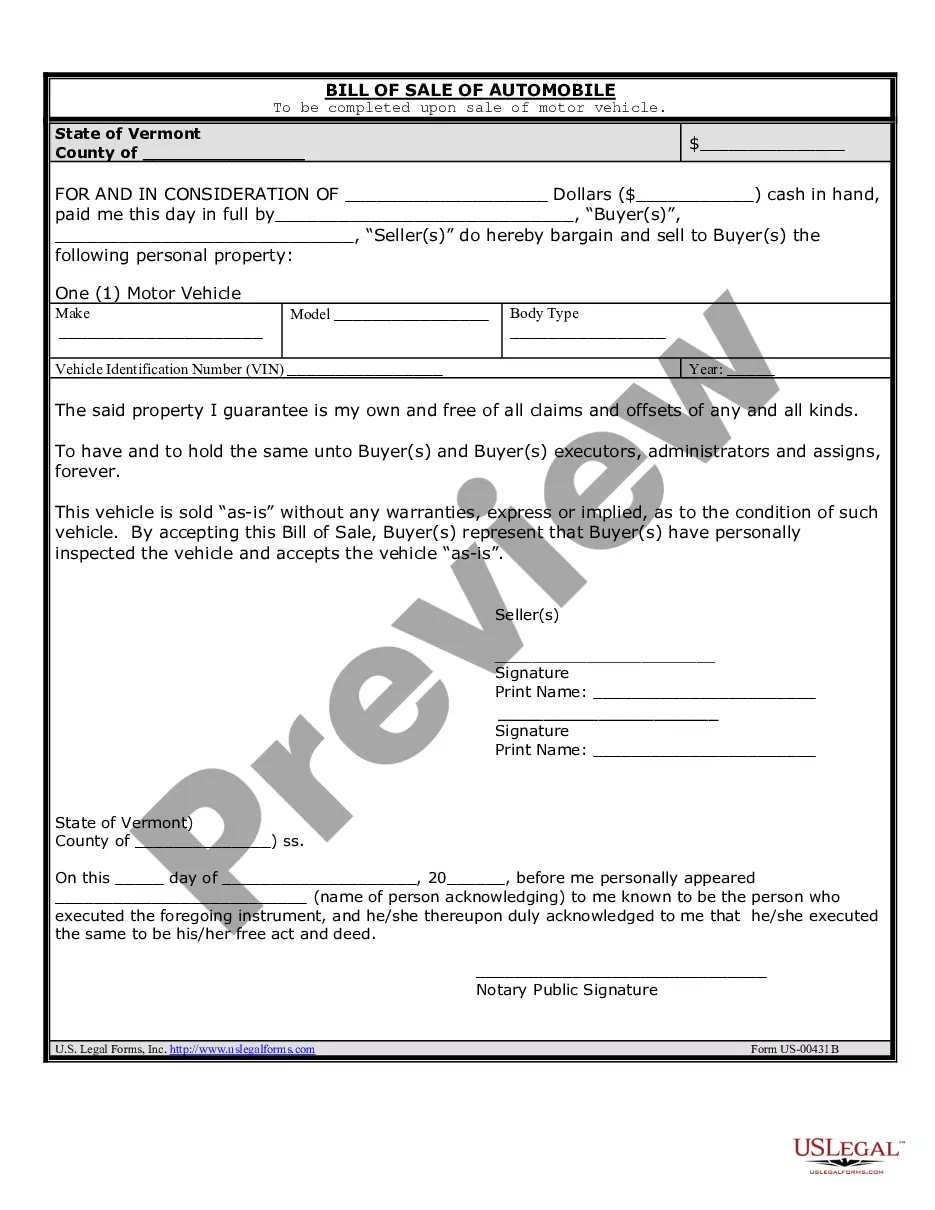

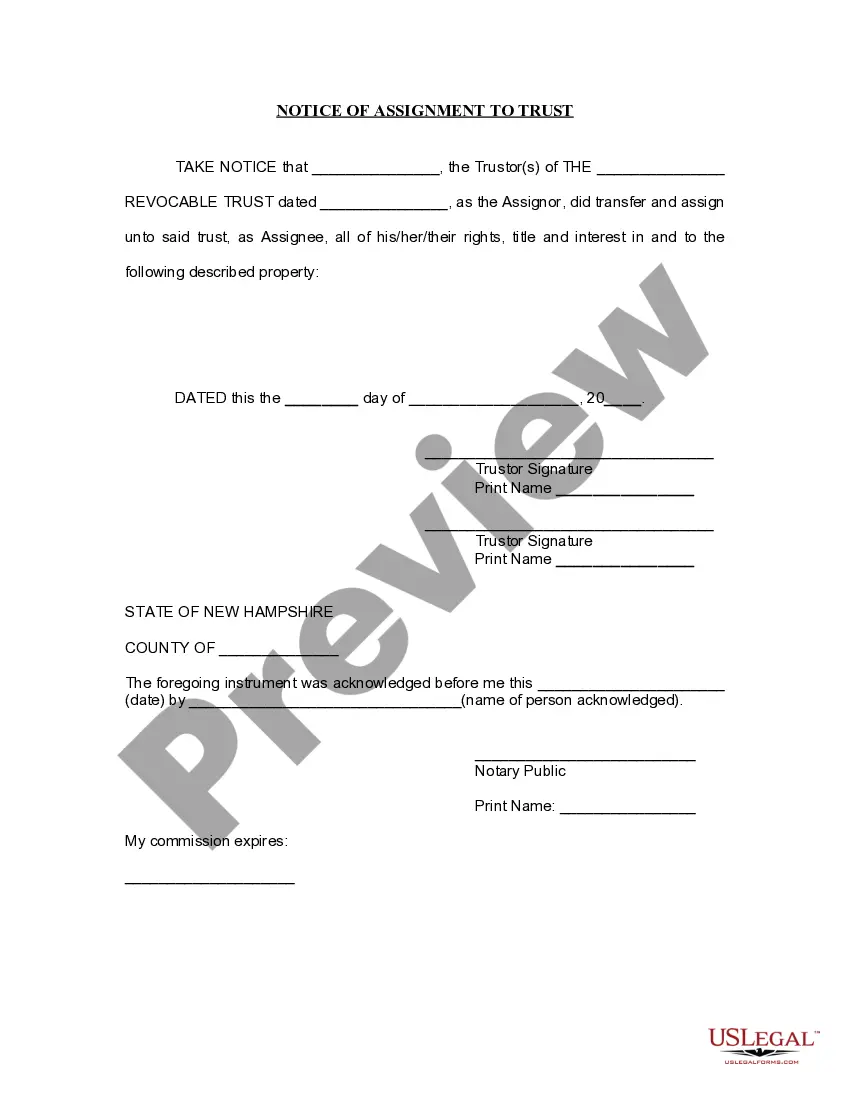

- Step 2. Utilize the Preview feature to review the form’s contents. Don’t forget to check the details.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the page to find other versions of the legal document template.

- Step 4. Once you have located the form you need, click the Acquire now button. Select your preferred pricing plan and enter your credentials to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Iowa Shareholder and Corporation agreement to issue additional stock to a third party for capital raise.

Form popularity

FAQ

A unanimous shareholder agreement ("USA") is a specific type of shareholder agreement that (i) is signed by all shareholders at the time it is first signed; (ii) binds future shareholders whether or not they sign; and (iii) removes, in whole or in part, the duties and powers from the directors of the corporation to the

The answer is b. The stockholders, themselves, do not have the right to declare dividends to be paid to the...

If you know the number of shares issued and unissued, or those authorized but not sold to shareholders, you can calculate authorized shares: shares authorized = shares issued + shares unissued.

Unless you indicate differently in your articles of incorporation or by-laws, your corporation's board of directors can generally issue shares whenever it wishes, to whomever it chooses, and for whatever value it decides.

The authorized share structure refers to the kinds, classes and series of shares that a company is authorized to issue. There must be at least one class of shares. A class of shares can include one or more series of shares if the special rights and restrictions attached to the class provide for this inclusion.

Corporate StockholdersWhoever owns any of the outstanding stock of a company is legally an owner. A C corporation can have an unlimited number of owners, and publicly traded corporations such as Apple, IBM or Wal-Mart have many thousands of shareholder owners.

In private companies with more than one class of share and public companies, the directors need authority to issue shares. This authority can either be given in the articles or by an ordinary resolution of the shareholders.

The term authorized, issued and outstanding refers to shares in a company that have been sold publicly. They are authorized because they fall within the maximum number of shares a company can sell according to its corporate charter. They are issued because they have been sold.

The Companies Act of 1993 and the company's own constitution govern the company's right to issue shares. Depending on the guidelines in the constitution, or in the Companies Act, the organization's board may issue as many of the authorized shares as they desire.

In some cases, a company will own stock in itself. These shares are known as treasury stock. Unlike typical shares, treasury stock does not grant voting rights or the ability to receive dividends. If a company decides to sell treasury stock, those shares will convert to outstanding shares.