Iowa Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee

Definition and meaning

The Iowa Warranty Deed from Limited Partnership or LLC serves as a legal document that allows a limited partnership or limited liability company to transfer property ownership to another party. This deed provides a guarantee from the grantor regarding the property's title. Specifically, it ensures that the title is free from encumbrances unless otherwise noted. Users can utilize this deed when formalizing the transfer of real estate between parties wherein either a limited partnership or LLC is involved in the transaction.

Who should use this form

This form is ideal for individuals or entities engaging in real estate transactions where a limited partnership or limited liability company either grants or receives property. It is particularly useful for:

- Members of a limited partnership or LLC transferring property ownership.

- Individuals or entities acquiring property from a limited partnership or LLC.

- Legal representatives assisting in property transactions involving LLCs or limited partnerships.

How to complete a form

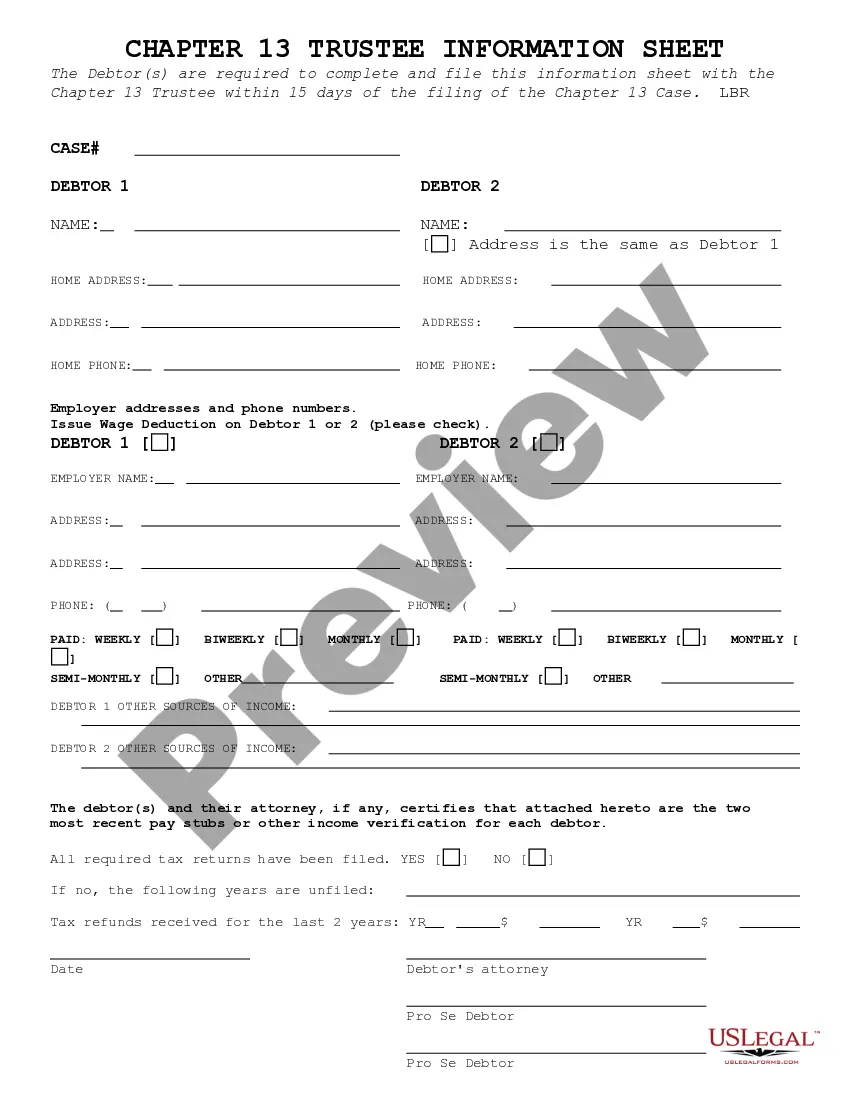

Completing the Iowa Warranty Deed from Limited Partnership or LLC involves several distinct steps:

- Identify the parties involved: Enter the names of the grantor (limited partnership or LLC) and the grantee (new owner).

- Provide property details: Include a full legal description of the property being transferred, which can often be found in previous deeds.

- Set terms: Indicate any specific conditions related to the transfer, such as whether the property is part of the grantor's homestead.

- Sign and date: Ensure all parties sign the document and date it appropriately.

- Notarization: Have the document notarized to validate the transfer according to Iowa state requirements.

Be sure to keep a copy of the completed form for personal records.

Key components of the form

The Iowa Warranty Deed from Limited Partnership or LLC is structured to include several critical components:

- Grantor Information: Details of the limited partnership or LLC granting property.

- Grantee Information: Details of the individual or entity receiving property.

- Legal Description: A comprehensive description of the property’s boundaries.

- Consideration Statement: Acknowledgment of the payment made for the property.

- Covenants: Assurances made by the grantor regarding the title.

State-specific requirements

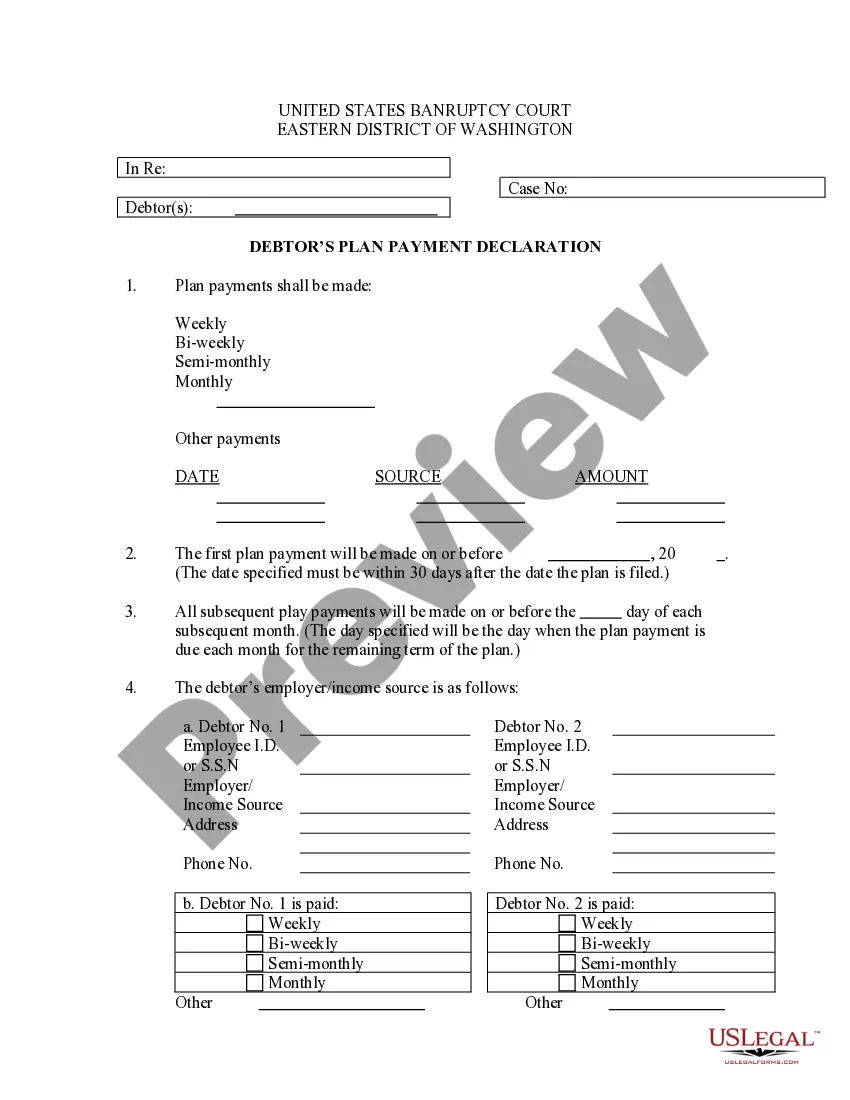

When using the Iowa Warranty Deed from Limited Partnership or LLC, several specific requirements must be observed in Iowa:

- All property transfer documents must be accompanied by a Declaration of Value form.

- A Groundwater Hazard Statement must also be filed with the local county clerk.

- Ensure the legal description used is complete and accurate as per the county records.

Failure to meet these conditions can impede the processing of the deed.

Benefits of using this form online

Utilizing the Iowa Warranty Deed from Limited Partnership or LLC online offers several advantages:

- Convenience: Access and complete the form from any location at any time.

- Time-saving: Instant availability allows for faster processing compared to obtaining a physical form.

- Accuracy: Digital forms often have built-in checks to reduce errors in completion.

- Secure storage: Save and back up your completed forms securely online.

Common mistakes to avoid when using this form

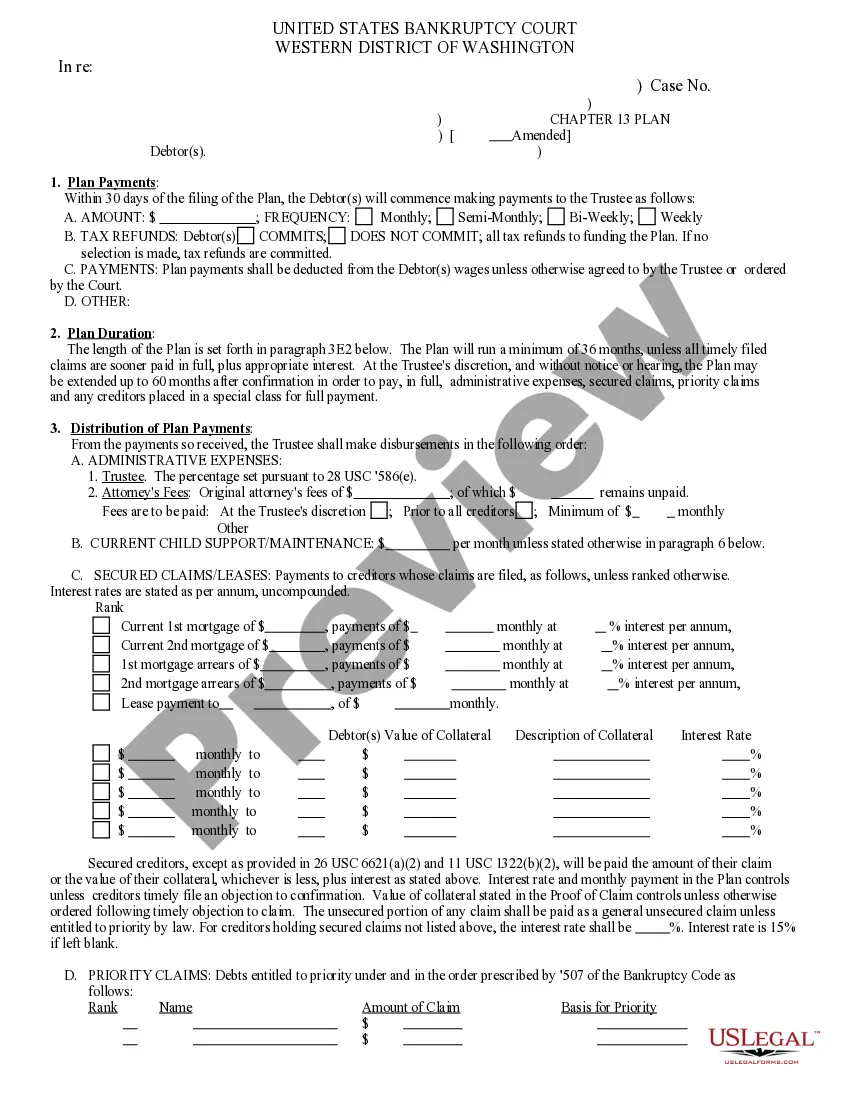

When completing the Iowa Warranty Deed, it's critical to avoid the following common pitfalls:

- Using an abbreviated legal description instead of the full one.

- Failing to include all necessary signatures or notarization.

- Leaving form fields blank, particularly regarding key legal details.

- Not accompanying the deed with the required Declaration of Value and Groundwater Hazard Statement.

By being mindful of these mistakes, users can ensure a smooth property transfer process.

Form popularity

FAQ

The owner of the property is the grantee, the individual or entity receiving the property through the warranty deed. The grantor is the current owner who is transferring their ownership rights to the grantee. Understanding this distinction is important when dealing with property rights and transactions.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Grantor's signature: The grantor must sign the deed for it to be valid. Usually, if more than one person owns a property, all the owners must sign. In some states a husband or wife who own property by themselves may have to have the spouse also sign the deed even though the spouse does not have title to the property.

No, California does not require that the Grantee sign a warranty deed. However, some states and counties require that the deed be signed by the Grantee in addition to the Grantor.

Special warranties allow the transfer of property title between seller and buyer. The purchase of title insurance can mitigate the risk of prior claims to the special warranty deed.

In a Warranty Deed, the grantee is the person who the interest in a property is being transferred to. For example, if you are buying a property from someone else, you are the grantee, and the person selling it is the grantor.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

No, in most states, the Grantee is not required to sign the Quitclaim Deed. However, some counties do require that the Quitclaim Deed be signed by the Grantee in addition to the Grantor.