Every employer of workers with disabilities under special minimum wage certificates authorized by the Fair Labor Standards Act, the McNamara-O'Hara Service Contract Act, and/or the Walsh-Healey Public Contracts Act shall display a poster prescribed by the Wage and Hour Division explaining the conditions under which special minimum wages may be paid. The poster shall be posted in a conspicuous place on the employer's premises where employees and the parents or guardians of workers with disabilities can readily see it.

Hawaii Notice to Workers with Disabilities Paid at Special Minimum Wages

Description

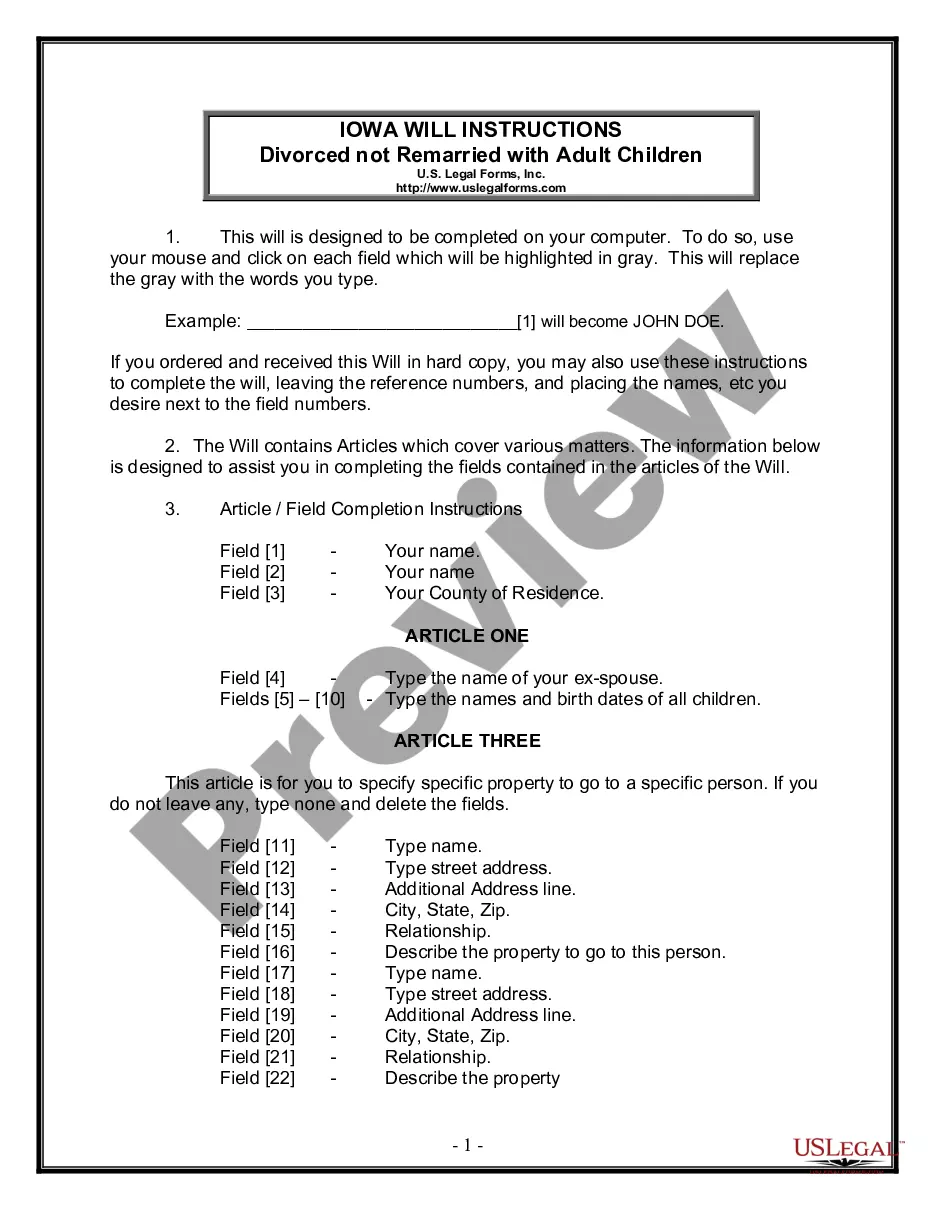

How to fill out Notice To Workers With Disabilities Paid At Special Minimum Wages?

Are you in a circumstance where you will require documents for either business or personal reasons almost every day.

There is a multitude of legal document templates accessible online, but finding reliable versions isn't easy.

US Legal Forms offers a vast collection of form templates, such as the Hawaii Notice to Workers with Disabilities Paid at Special Minimum Wages, which are designed to comply with federal and state regulations.

Utilize US Legal Forms, the most comprehensive selection of legal templates, to save time and avoid mistakes.

The service provides expertly crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Hawaii Notice to Workers with Disabilities Paid at Special Minimum Wages template.

- If you do not have an account and want to begin using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Use the Review button to verify the form.

- Read the information to confirm that you have selected the correct form.

- If the form isn't what you are looking for, use the Search area to find the form that meets your needs and specifications.

- Once you find the correct form, click Get now.

- Choose the pricing plan you want, complete the necessary information to create your account, and pay for your order using your PayPal or credit card.

- Select a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Hawaii Notice to Workers with Disabilities Paid at Special Minimum Wages anytime, if needed. Just open the necessary form to download or print the document template.

Form popularity

FAQ

Wrongful termination in Hawaii occurs when an employee is fired in violation of employment laws or contractual agreements. This includes dismissals based on discrimination or retaliation. Understanding your rights is crucial, especially if you are an employee under the Hawaii Notice to Workers with Disabilities Paid at Special Minimum Wages, as this law aims to protect vulnerable workers.

The minimum salary for exempt employees in Hawaii is currently set at $2,000 per month. This figure is important for employers who want to classify their workers correctly under state laws. Knowing these regulations, including those related to the Hawaii Notice to Workers with Disabilities Paid at Special Minimum Wages, helps maintain compliance and ensures fair treatment.

In Hawaii, third degree assault is classified as a misdemeanor, which can lead to up to one year in jail. Understanding the legal ramifications of such charges is vital for anyone facing these allegations. It is advisable to seek legal counsel to navigate the complexities of the law, especially if your case intersects with employment issues like the Hawaii Notice to Workers with Disabilities Paid at Special Minimum Wages.

388 7 3 of the Hawaii Revised Statutes specifically addresses the payment of workers with disabilities at special minimum wage rates. This law provides a framework for employers to hire individuals with disabilities while ensuring compliance with wage laws. Knowing this information is essential for both employers and employees to foster an inclusive workforce.

In Hawaii, certain individuals may be exempt from workers' compensation, including domestic workers and casual laborers. Understanding these exemptions can help employers navigate their responsibilities. If you have questions about specific situations, consider consulting the Hawaii Notice to Workers with Disabilities Paid at Special Minimum Wages for more guidance.

Section 388 7 3 of the Hawaii Revised Statutes outlines the provisions for workers with disabilities who are paid at special minimum wages. This section ensures that employers comply with wage regulations while providing opportunities for individuals with disabilities. It is crucial for both employers and employees to understand these provisions to promote a fair working environment.

The National Minimum Wage This is the minimum pay rate provided by the Fair Work Act 2009 and is reviewed each year. As of 1 July 2021 the National Minimum Wage is $20.33 per hour or $772.60 per week.

Minimum wages have been defined as the minimum amount of remuneration that an employer is required to pay wage earners for the work performed during a given period, which cannot be reduced by collective agreement or an individual contract.

Hawaii's state minimum wage rate is $10.10 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

Hawaii's minimum wage has been stuck at $10.10 for four years. If a bill moving through the state Legislature is passed, the minimum wage would increase to $12 in October, $15 in 2024, and finally $18 in 2026.